This Week On-Chain #90 - Turned Tides, TAO and AI hype

In the midst of it's so over, I found that we are so back.

As people de-risked going into rate cuts due to the fear of recession markets gave them a sucker punch and rallied. As by design. We’ve seen BTC be strong over the past week while AI has been leading the rally with TAO performing exceptionally well.

AI is one of the few market sectors in this industry with no speculative ceiling that remains nascent. A lot of cool things are being built here so don’t let the doomers get to you and accept that it is likely to be one of the main narratives this cycle.

It will likely come and go in a similar type to the Metaverse wave in 2021 but is something that is too big to ignore at this stage.

With that said, let’s see what has happened over the past week.

Market Digest

Drift announces $25m series B led by Multicoin capital

Celestia foundation raises $100M

TerraForm Labs wind down after settling with the SEC

BingX hacked for $26.8M

Societe Generale plans to bring EURCV stablecoin to Solana

Microstrategy bought $458m worth of BTC between Sept 13-19

SEC labels crypto airdrops as securities (LOL)

Unclaimed ZRO tokens from the airdrop were redistributed to wallets that claimed (check your wallets for a 2nd airdrop)

SEC postpones decision on options on Blackrock’s spot BTC ETF

LOGX airdrop checker is live

Most successful crypto app this year Polymarket are considering token launch

Telegram will share user data with authorities upon valid legal requests

USDR drama

99% of TUSD reserves were invested in a speculative offshore fund

Banana Bot incident recap

Caroline Ellison senteced to two years in prison

P Diddy shares the same prison cell as Sam Bankman Fried

Man that was a lot of news, big week to say the least. Data time.

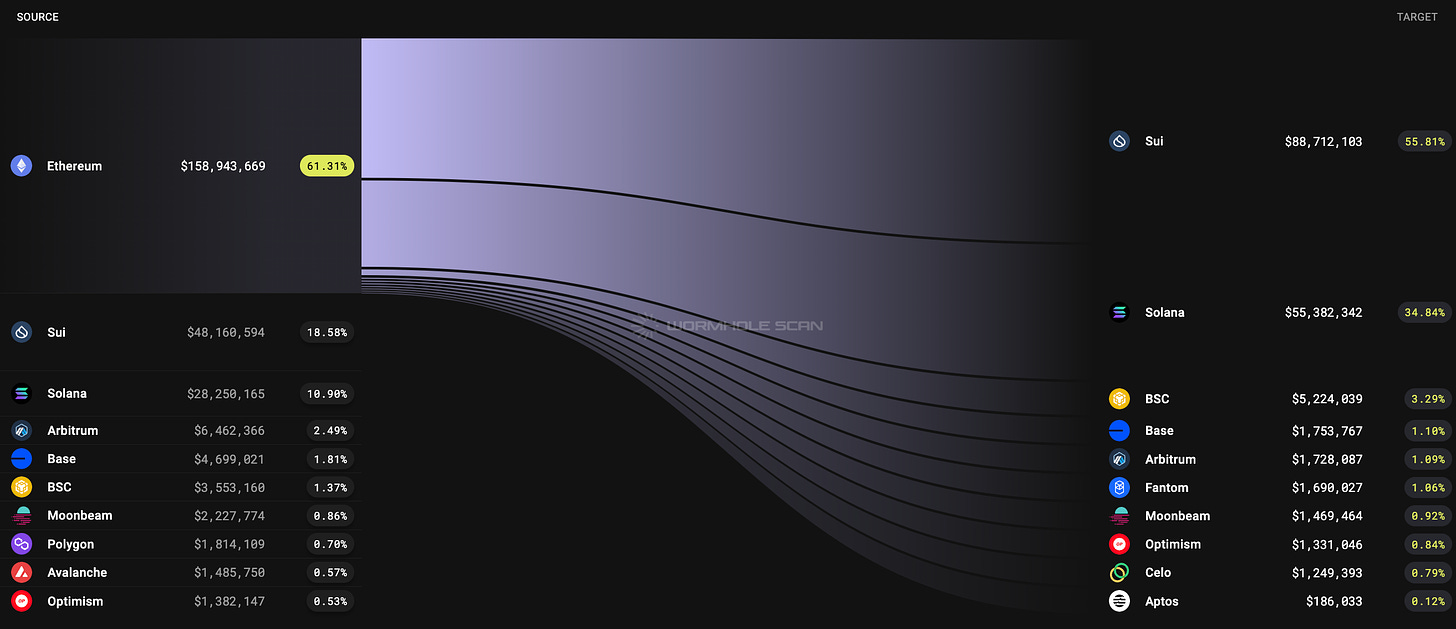

Bridge Flow

Sui continues to suck liquidity from other ecosystems and has the biggest net flow of capital outside of other chains and the price action is reflecting it. The bonus on Sui right now is that the serial ruggers and snipers don’t know how to use the VM yet which sets up early participants for success.

Solana is also gaining steam again with increasing amount of flow going in that direction.

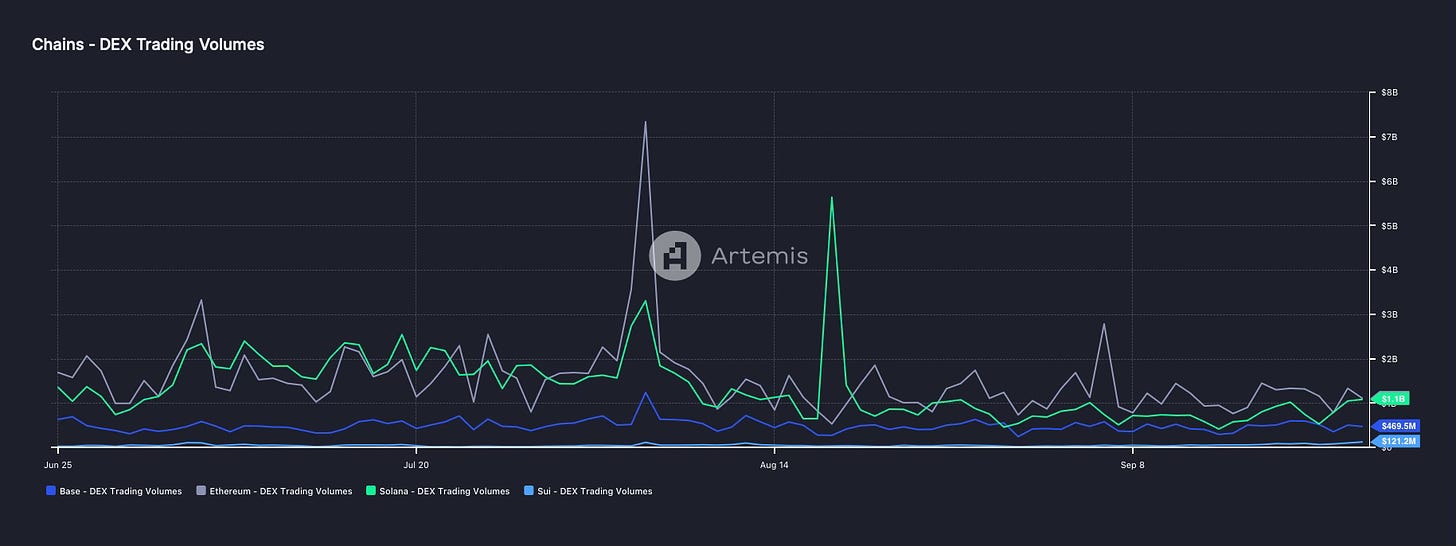

DEX Volumes

While activity is starting to increase it really isn’t much larger than we have been seing over the past month. The difference is that there has been selected outperformance over a few asset. It is more the last 4 days that we are seeing an uptick in on-chain activity which remain to be seen if it can be sustained.

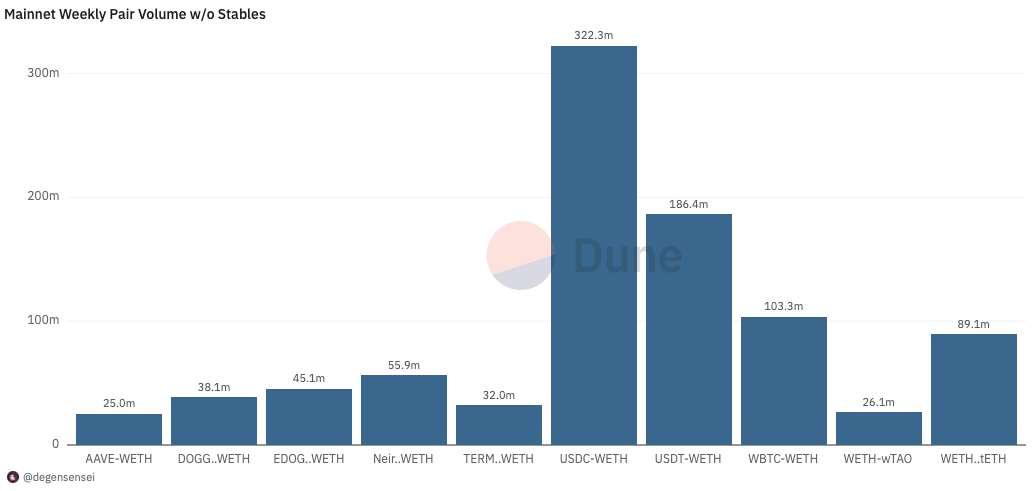

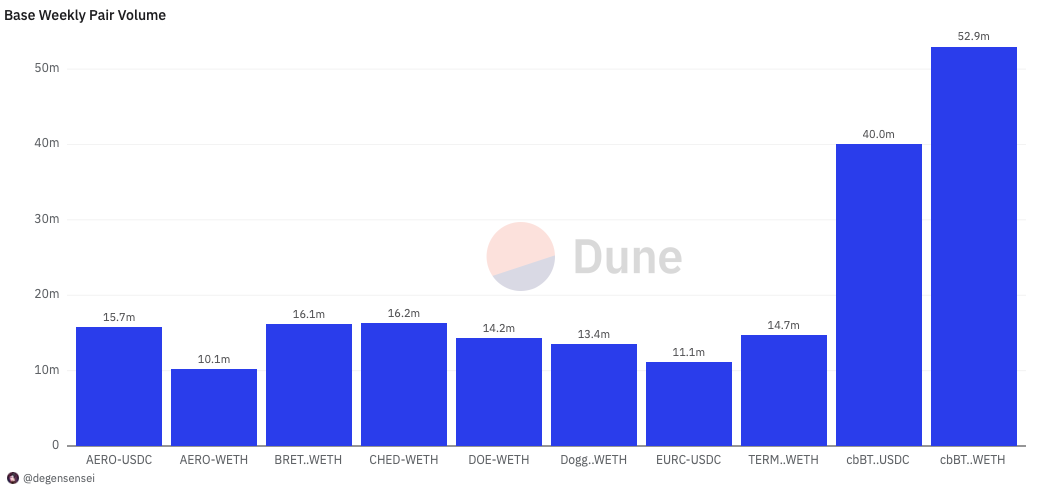

Pair Volumes

Ethereum on-chain is well and truly underway with NEIRO being the dominating alt unsurprisingly due to its incredible performance. EDOG which is the latest memecoin that has been performing strogly over the past week continues to garner interest in addition to strong performers such as AAVE and TAO with TAO undoubtedly standing out even if the majority of price action take place on centralized exchanges nowadays.

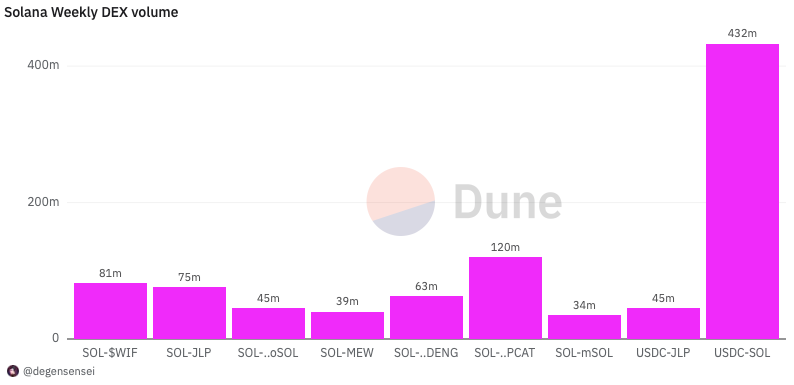

As I have been harping about POPCAT as the hottest token on Solana for a long time period, it has now made a new all time high and has been leading the memecoin resurgance on Solana. This is also reigniting WIF again which is worth paying attention to.

Moo Deng which is the latest viral animal has been turned into a memecoin that has had an incredible rally as well.

Base is back and AERO has properly waken up. Memecoins are surging again as BRETT is back in the chart which is a good indicator for the rest of the ecosystem. Tons of memes in the ecosystem that has been consolidating for a long time that is starting their second run.

Don’t sleep.

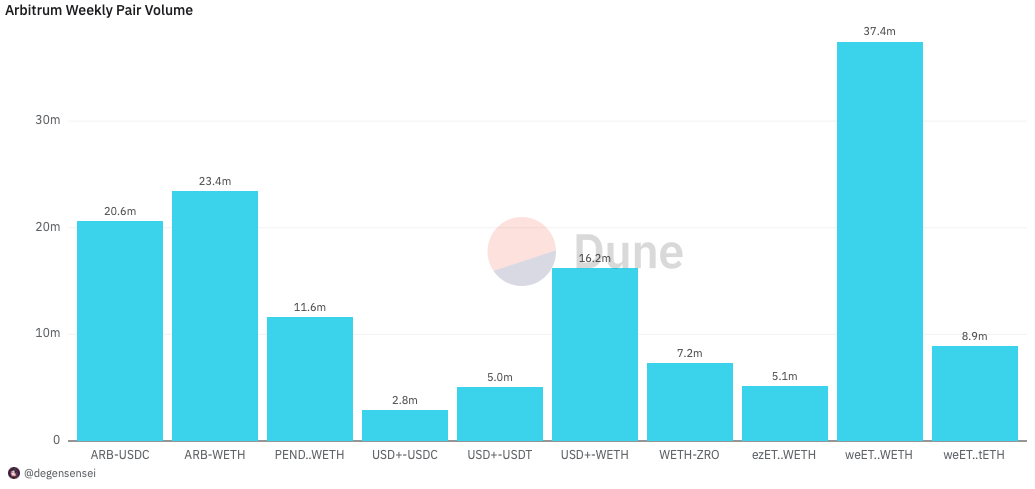

Majority of volume remains between ARB and PENDLE when it comes to altcoin trading while ZRO continues to garner interest as a breakout has been imminent.

Although there are small signs of the ecosystem wakig up with the performance of the mascot meme that is BOOP which isn’t being captured here as it produces lower volume.

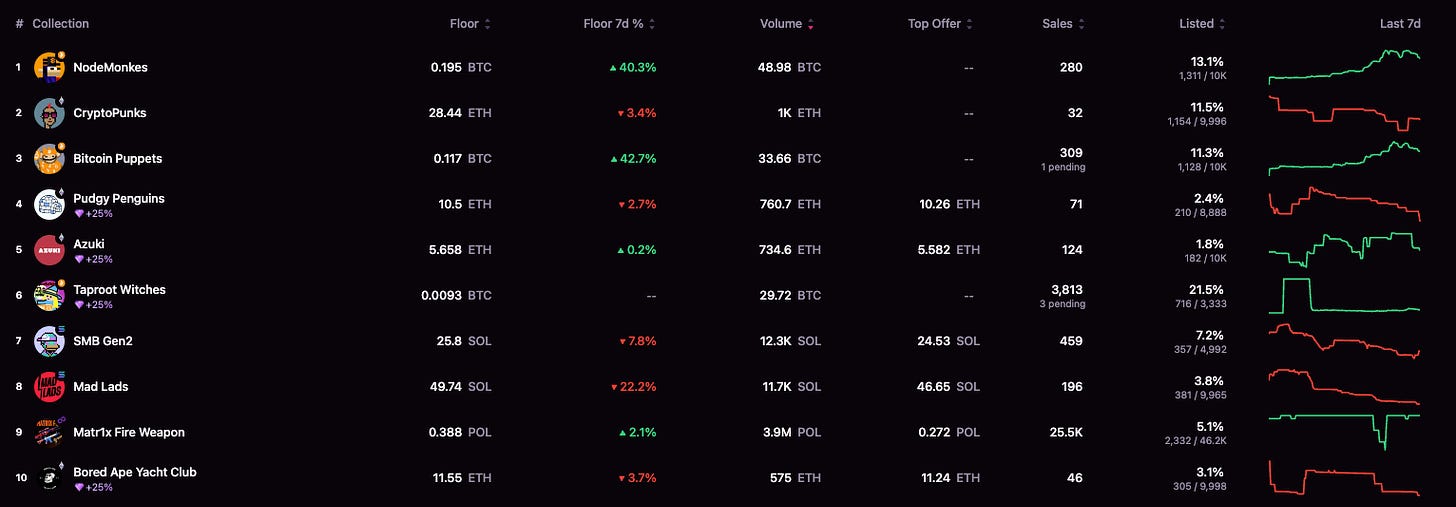

NFT Trading

Ordinals are starting to show some life again with both Nodemonkes and Bitcoin Puppets being up significantly. It still begs the question whether they can have as strong runs as the first time but anybody that got in at the lows should be happy with the recent performance. Apart from that not really much going on in the NFT landscape outside of Remilia ecosystem catching heat for the continous delays of the CULT token after raising $20m.

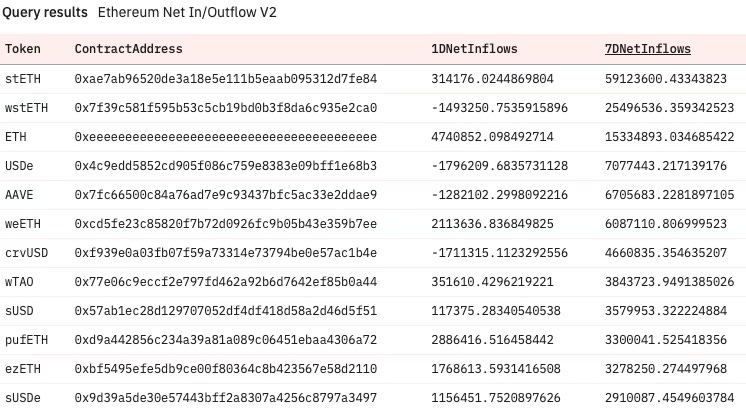

Net Inflow

A lot of ETH related in flows which probably stems from people becoming bullish and borrowing against it to buy more alts. Those alts over the past week seem to be mainly AAVE, and TAO as previously mentioned. Efforts amongst large caps has been concentrated due to the altcoin dispersion. Pick your spots carefully.

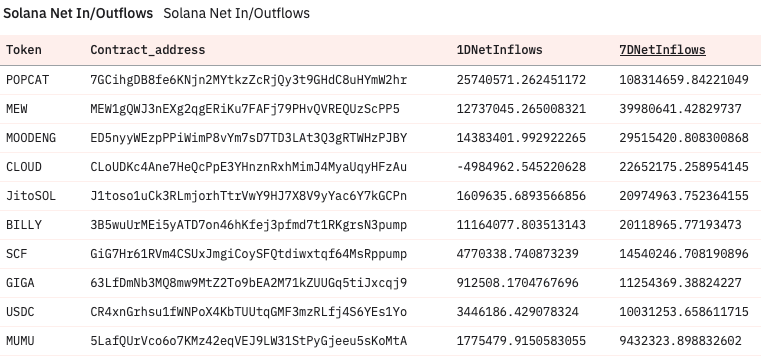

POPCAT is unsurprisngly the leading token when it comes to memecoins on Solana. As POPCAT is the leading cat token it leads to people buying other cat tokens as “beta plays” which is why MEW has seen heavy in flow in response to the people that missed POPCAT. MOODENG is the latest hot viral meme as mentioned previously and has had an insane rally. Outside of memes only CLOUD remains relatively strong. While BILLY and SCF continues the strength although amongst low cap memes instead.

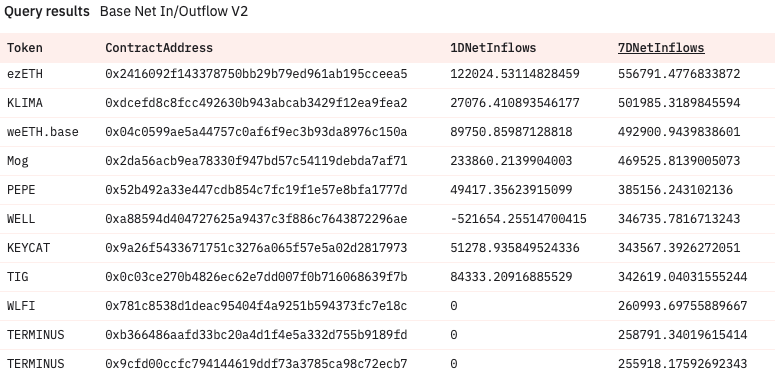

KLIMA has seen a lot of inflows again as RWA tokens are starting to pick up steam again after a long summer lull. Otherwise, native tokens like WELL has been performing strongly alongside the leading cat coin of the ecosystem which is KEYCAT. TIG is the latest AI token on Base that has caught a small amount of interest as well.

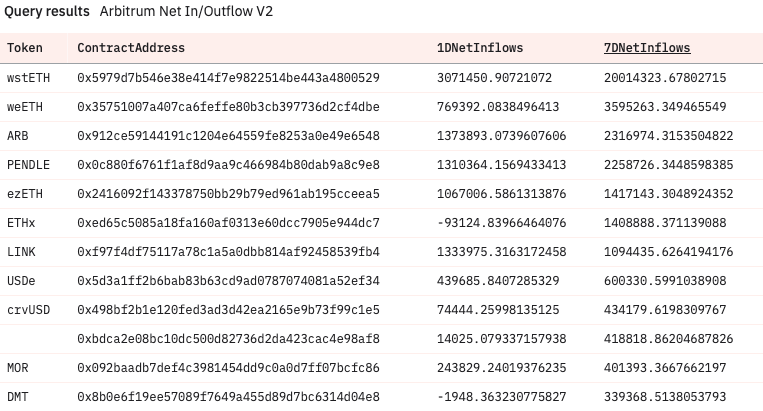

Been a while you saw so many different tokens on Arbitrum being bought (which still isn’t a lot) but the clear tokens of interest over the past week have been ARB, PENDLE, MOR and DMT which covers the majority of the hot market sectors that are residing on Arbitrum. The ZRO trading happens both on CEX and DEX.

Sleuthing

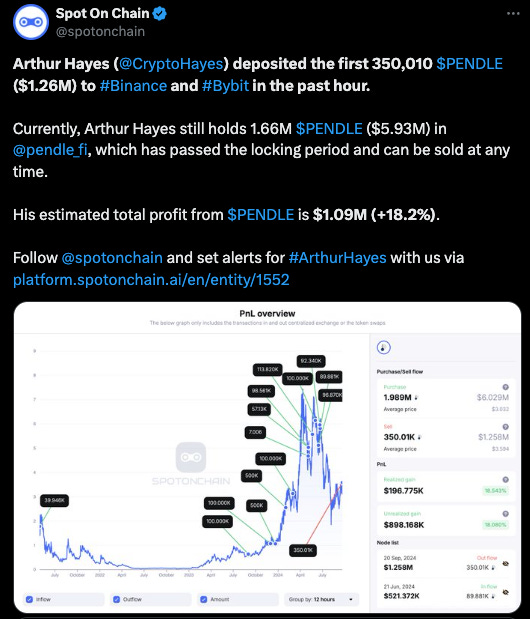

Arthur Hayes sold $1.26M of his PENDLE position, it immediately pumped afterward. People are taking countertrading him seriously nowadays.

You either die a hero, or live long enough to see yourself turn into a countertrading indicator.

Token Unlocks

ADA - 0.05% of supply worth $7.15m on Sep 27th

EUL - 0.23% of supply worth $184.79k on Sep 27th

YGG - 3.64% of supply worth $6.72m on Sep 27th

AGIX - 1.63% of supply worth $5.99m on Sep 28th

TORN - 2.41% of supply worth $238.33k on Sep 28th

ENA - 0.78% of supply worth $4.71m on Sep 29th

Q4 is poising up to be very interesting so far, don’t let it go to waste and enjoy it while it lasts.

FYI EIGEN will have its TGE on the 30th, pay attention.

Until next time, see you then.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.