Welcome fellow Degen! First of all welcome to my new substack. In this post, I will cover a protocol that opens up the door for other DAOs to bootstrap their treasury. Also, remember that you are reading the opinions of a random degenerate sensei on the internet and this is not financial advice.

There have been constant talks about wars in the past few weeks. Understandably so as the DeFi industry is ramping up in the spring for what could look like some exciting months ahead. However, one thing is flying under the radar despite the Curve wars being worth paying attention to with new entrants entering the fold.

People navigating through the depths of DeFi are always looking for the best yield farming strategies and there is one that is just in front of their eyes. That is the importance of the GLP token as a treasury strategy for DAOs.

To provide the proper context in this piece, perpetual futures have to be explored first before diving into GMX and GLP.

What are Perpetuals? (If you are familiar with derivates you can skip this section)

Perpetual futures contracts (perps) are a subset of what we call derivatives. A derivative is a contract that bases its value on an underlying financial asset or index. The typical example of derivative instruments are options, futures, swaps, and forward contracts. The most common of these would be a futures contract which is a contract to buy a financial instrument or physical commodity for future delivery at an agreed price. There are certain standardized features of futures contracts that you do not find in forward contracts for instance. They are bilateral contracts that involve counterparty risk.

Futures contract:

The perfect example to use in the current climate would be the example of Oil prices. If you were an airline company that bought an oil futures contract while Crude Oil was trading around $60 with a delivery date about 1 year out. This would protect you against future price rises (essentially a hedge). Considering the current climate in the last months with the oil prices exceeding $100, the airline companies that are being delivered oil based on futures contract that has an agreed price of $60 are benefitting heavily. Although it worked in this case, it can also move against you as well. However, it puts a business at less risk if utilized correctly.

This is why futures are such an important part of the market, the ability to hedge yourself is fundamental for large players to participate. It is important if you are an institution that wants to practice responsible risk management. However, as much as it is beneficial for situations like this, it also contributes to a large part of speculation in the market. This is what people refer to as Open interest which is the total number of outstanding derivatives contracts that have not been settled for an asset.

Another interesting part about futures contracts is that you do not have to own the full value of the contract to get access to it. By depositing a small amount e.g. 10% of the contract value, you can get access to the full contract and take on leverage. This is of course a speculator’s dream and leads to more capital efficiency despite the possibility of being wiped out due to liquidation.

This development in the traditional market has made its way to our exciting crypto markets. This brings us to perpetual swaps. Perpetual Swaps are a product invented by BitMex. They are similar to a futures contract with a few differences:

There is no expiry or settlement

Perpetual Contracts mimic a margin-based spot market and hence trade close to the underlying reference Index Price.

Each perpetual contract has its own details which can be found in its Contract Specifications. These details include:

- Maximum Leverage

- Funding Rate

- Reference Index (the price it follows)

Perpetual contracts do not require you to post 100% collateral as margin, essentially allowing you to take on 100x leverage (a degens dream). These perps allow you to buy and sell the value of a cryptocurrency like BTC without having to hold any BTC. Through these perps, you can either open long positions (a bet on the price going up) or a short position (a bet on the price going down). If you are long you need access to more *USD and pay interest on the capital you are using. The people that take a short position get paid interest since they are lending out their USD instead.

Perpetual swaps offer access to cheap leverage and are one of the most liquid products related to Bitcoin. The largest players in this industry related to crypto are currently FTX and Binance where people love to gamble for fun.

*USD for this example to make it intuitive

Note: I also want to make this clear, despite the possibility of using leverage in platforms like this. I am not comfortable recommending that anybody use leverage if you don’t have a professional background in derivatives. Even so, it should only be a small amount that you are willing to lose. Don’t bet your rent money despite how degen you might be, please.

If you are interested in learning more about Perpetual Contracts, BitMex has a guide here.

That should cover a high-level view of perps, any further questions are gladly answered in the comments. This brings us to the protocol this concerns which is GMX.

What is GMX?

Gmx is a decentralized spot and perpetual futures exchange that resides on the Ethereum layer two solution Arbitrum and Avalanche. It is a platform that prides itself on providing zero impact price swaps in comparison to other DEXs (Decentralized Exchanges). Most DEXs use an AMM (Automated Market Maker) model that provides low slippage. While this AMM model is more or less the industry standard in regards to DEXs, with high volume swaps, it impacts the slippage significantly. This is to the detriment of the user despite being a fine piece of innovation. GMX has taken another approach and uses a different model that is based on OTC (over-the-counter) trades, which leads to less impact on price and to the benefit of the user performing the swap.

We have all seen stories like this, don’t be this guy @BowTiedIguana refers to:

Since liquidity is the be-all and end-all of exchanges, it is fundamental that this can be provided in a reliable manner by GMX. So how does the protocol acquire its liquidity? By letting people deposit assets in exchange for one of their tokens. This brings us to tokenomics.

Tokenomics

The tokenomics of GMX is based on a two-token system. These tokens include GMX (and an escrowed version of GMX) and GLP. Let’s start with the first native token.

GMX

The native token GMX is the governance token of the protocol. The current supply is 7,532,399 GMX with a forecasted max supply of 13,250,000 GMX. I mentioned “forecasted” which might raise an eyebrow. The max supply depends on how much that gets vested and the amount that gets used for marketing and sponsorships. Going beyond this supply will only happen if liquidity mining is needed and more products are launched. Moreover, it’s controlled by a 28-day timelock.

The GMX token also allows you to stake it to receive 30% of the fees generated by the platform. Considering the stark growth of GMX since its inception, it’s a valuable prospect.

GMX has accrued almost $32 million in fees since its inception, generating among the highest fees in DeFi. These staking rewards are paid out on native ETH (you heard that right) and esGMX which will be explained next.

esGMX

The escrowed version of GMX is called esGMX. You get paid out esGMX in staking rewards and can then subsequently choose to vest it which will convert it back to GMX. It will vest over 365 days and start being converted to GMX every second over the vesting period.

Explanation from official docs: “For example, if you staked 1000 GMX and earned 100 esGMX tokens, then to vest 100 esGMX tokens, 1000 GMX tokens will be reserved. To vest 50 esGMX, 500 GMX tokens will be reserved. Note that this is an example and the actual ratio depends on the average staked amount and rewards earned for your account.”

The last point regarding the GMX token, one important aspect to take into consideration is the power of passive income generated by the platform. For every GMX token, you have staked you earn multiplier points which further increases the yield you attain. If you have staked $100,000 worth of ETH with an APR of 10%, you would receive $10,000 in rewards. You could then potentially have an additional 10% in multiplier points from your initial amount that would boost your yield to an additional $1000. Thus, the total reward for the year would be $11,000. This is a great way for DAOs to bootstrap their treasury and we are just getting started.

GLP

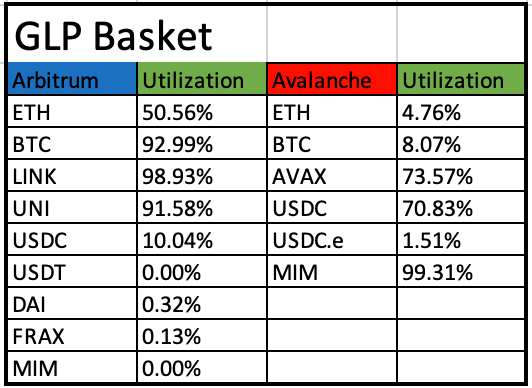

GLP is the platform's liquidity provider token. GLP consists of a basket of assets that are used for swaps and leverage trading. Depending on which chain you use (Arbitrum or Avalanche) this basket differs.

However, GLP is what incentivizes users to provide liquidity through their reliable and beneficial rewards. By staking GLP you earn 70% of the fees generated by the protocol (if you stake the esGMX rewards). More than 50% of these rewards are paid out in ETH while the rest is paid out in esGMX. If you decide to stake the earned esGMX for additional yield or vest it is down to you. However, there are trade-offs as the GMX token gives you governance rights and the same can’t be said for the GLP token.

GLP holders provide liquidity for leverage trading and act as “the house”. When the traders make a loss (degens love 30x leverage so it happens frequently) the GLP holders profit and when the leverage traders profit the GLP holders make a loss. The data from GMX analytics displays that the house wins more often than traders make a profit.

These rewards are chain specific depending on which blockchain you prefer to use. However, it enables you to optimize for the basket you prefer.

Treasury Strategy

This makes it a perfect strategy for protocols to utilize that want to bootstrap their treasury and generate yield for it. While CVX has been the most popular option and rightly so due to the Curve Wars, it doesn’t pay out rewards in native ETH.

Also, taking into consideration the potential of the perps market with Binance and FTX currently being the leaders, people are in need of a decentralized option (and degens love speculative gambling). The potential value capture for GMX is immense. The rapid growth of GMX on both Arbitrum and Avalanche is a testament to that and with the limited amount of asset available to take leverage against currently, there is a lot of potential as the protocol expands.

These lucrative fees will become an exciting prospect and it would not surprise me to see GMX become the go-to perps exchange and multiple DAOs develop a GLP strategy for their treasury.

Protocols like JonesDAO are already supporting GMX to enhance their treasury strategy and support them with management.

One of the downsides with yield farming for high yields is that it is paid in some native garbage token nobody wants. GLP solves this problem through their farming mechanism and enables you to choose if you want to get rewards in AVAX or ETH. While this treasury strategy is already being discussed by DAOs, it wouldn’t surprise me to see one act out on it soon.

Pitfall: GMX on Arbitrum compared to GMX on AVAX have different underlying assets. Problematic depending on where your protocol resides, however, it also gives you the option of choosing what basket you want exposure to as we are going more multichain. Also, GLP is not a risk-free treasury strategy as it assumes that traders will lose more than the house. If this would change significantly, the GLP holders will be disincentivized to hold the token since they would bleed out money.

Obviously, the house is in a strong position here since they also acquire fees from trading and interest as well. Nonetheless, it is an interesting point worth raising as there is no free lunch. Does CVX have a potential competitor as a lucrative treasury strategy? We are bound to find out.

If you managed to congest all that information you are a champion and I am duly grateful. . Don’t forget that you are more than welcome to leave feedback as well.

As GMX recently rolled out a referral program, feel free to use my code for a 10% trading discount as you are interacting with the platform here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me, do not hesitate to subscribe. Thank you very much for taking the time!

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. I am just a random degenerate sensei sharing an opinion.