Stablecoinization of the DeFi Space

Stablecoins are the new black

Welcome, Anon! Since everybody is creating stablecoins left right and center in the crypto industry, we’re diving into why that’s the case in this piece.

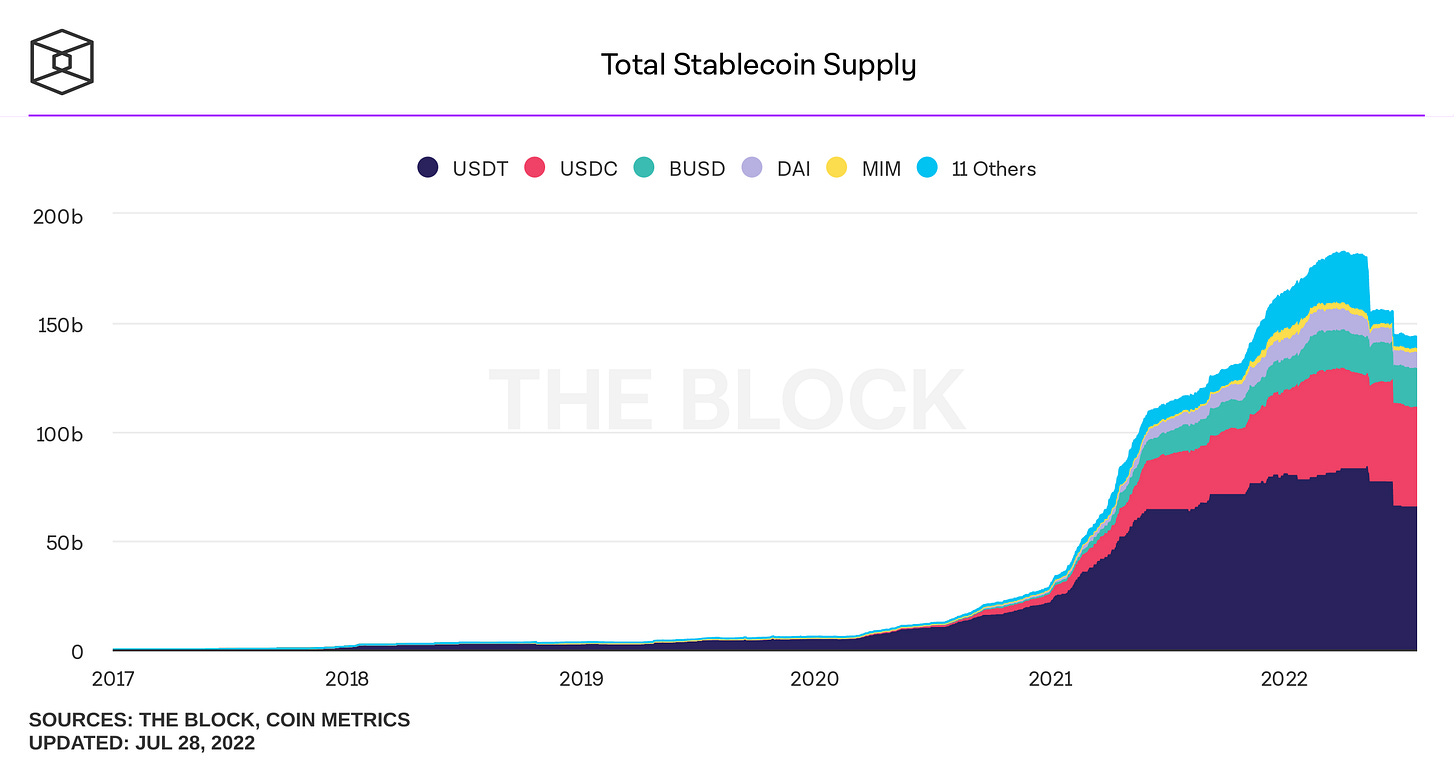

If you have been paying attention for the past months in the DeFi industry you might have noticed that an increasing amount of protocols are planning on releasing their own stablecoin. While USDC, USDT, DAI, and FXS are the leading forces for stablecoin liquidity in DeFi, there seems to be an ever-expanding list of stablecoins that are entering the space.

Stablecoins are arguably the next trillion-dollar opportunity and it is no surprise that everybody is looking in that direction.

Just from the top of my head, there are 6 large protocols that plan to release their own stablecoin in the intermediate future. Among these are:

Curve has been a battlefield of what we notoriously call the Curve Wars nowadays. Even my wife’s boyfriend knows about the Curve Wars so I’m not going through that in this piece. However, it seems like the kingdom got tired of watching other plebs fighting over liquidity. Why watch when you can enter the fight yourself?

What do we know of Curve’s stablecoin so far? It will be an overcollateralized stablecoin that can be minted against liquidity providers’ LP positions. This will most likely work in a similar mold to MakerDAOs CDP (Collateralized Debt Position). If you’re not familiar with that it essentially refers to collateral needing to always exceed 150% of the stablecoin (in Maker’s case DAI) that was minted. If the collateral falls below that value, it automatically gets sold by the smart contract to repay the protocol for the debt issued.

Thus, this provides the protocol with the ability to collect additional revenue from liquidations along with an additional revenue generator through borrow interest rates.

Aave with GHO (should have been USa - a missed opportunity that would have led to burgers championing it)

GHO will be an over-collateralized decentralized stablecoin. It will be backed by a basket of yield-bearing assets that ensures that it remains its peg. The tokens will be minted by facilitators in a trustless manner. These facilitators are other entities (such as external protocols) that require whitelisting by Aave governance and have a limit on how many GHO tokens they can issue.

The $stkAave holders in the Aave ecosystem can mint GHO at a discount getting a more generous interest rate —> incentive to stake Aave for good lending terms. The protocol will set a specific amount of GHO at a discount per $stkAave that is dependent on governance.

When borrowers either repay their debt or get liquidated, the protocol burns the user’s tokens. However, 100% of the revenue generated from the interest payments of the GHO token will be distributed to the DAO.

Challenges: Integrating it into the DeFi ecosystem and generating token pairs that make it easy to trade against. The protocol has identified L2s for initial widespread adoption.

Dopex with dpxUSD

It is no secret that the tokenomics of the 2nd token of the Dopex ecosystem is subject to a rapid change that will make it deflationary. RDPX v2 is been long-awaited by a strong Dopex community and is rumored to be released in the coming months (wen v2?). I won’t go into deep detail on this one as it has been widely covered in a two-part series by me in part 1 and Average Joe’s Crypto in part 2. Nonetheless, it makes a lot of people excited about Rdpx which has been among the pumpiest coins on Arbitrum (the volatility is not for the weak). Since its fundamentals will rapidly change from being an inflationary rebate token with no supply to being used for dpxUSD minting.

Considering veDPX has been released already, the veDPX holders will get the first opportunity to arb dpxUSD and buy it at a discount for USDC when it’s below its peg. It will also be used as collateral to borrow dpxUSD.

While the main challenge would be getting liquidity for other stable pairs against dpxUSD, the protocol has Tetranode on their side that will use his CVX to drive curve emissions to the Curve pool that will be launched by Dopex. Notwithstanding the 500k CVX the protocol possesses.

Redacted Cartel with Dinero

What we know of Redacted Cartel’s stablecoin thus far is that according to 0xSami_ they have the capability to create a very liquid through the CVX, TOKE, and FXS that the protocol currently holds enabling them to drive valuable emissions through Curve.

It will be an overcollateralized stablecoin that is backed by custom material block space. I don’t even know what this means to be honest. What we do know is that ETH will be deployed in a CDP system —> that ETH is used to set up [REDACTED] validator —> Stablecoin depends on EIP-721 (the NFT standard) —> stablecoins used for meta transactions as an alternative to ETH.

Note: Meta transactions are transactions that are passed on to a secondary network that acts as a relayer, this relayer then wraps the request into an actual transaction and broadcasts it to the main network.

While they have briefly mentioned creating their own stablecoin, nothing concrete has been released yet. (I will update this section when more information is out there)

Tangible with USDR

Tangible is going for a novel untested approach with their stablecoin so far. While it entails higher risk, it is exciting nonetheless. It is an overcollateralized stablecoin that will be yield generating through tokenized real estate.

USDR is minted through DAI; consequently, a portion of that DAI is spent on tokenized real estate in the Tangible marketplace. The stablecoins claims to generate a 5-10% yield from rental revenue on the underlying real estate. Stakers of USDR receive a daily rebase to prevent the asset from losing value against inflation.

The protocol has not released its stablecoin yet but is an attempt to drive the Real World Asset movement forward (and give DeFi and tokenization tangible use cases) which I will cover in a future substack post.

Cytus with USDY

Continuing on the Real World Asset narrative, Cytus is another protocol that aims to tie its stablecoin to the real world. Users deposit USDC and receive USDY in return. The deposited USDC is lent out to borrowers in traditional finance. Cytus operates through a fractional reserve banking model which implies that they don’t loan out 100% of the assets you deposit but keep 10% of it as a necessary reserve in case people want to cash out.

The stablecoin is algorithmically pegged through a transmuter that directs harvested yield to it at a constant basis to ensure it remains stable. The strength of the stablecoin lies in that it is fully collateralized by loans from real-world usage.

The main challenge here is that people have PTSD after LUNA and despite USDY being able to be used in DeFi protocols, it isn’t widely integrated which limits its usage despite being a yield-bearing token. The strongest DeFi usage is yield farming it in a USDC/USDY peg that shouldn’t incur wide impermanent losses that reward you in CTS tokens.

A question that remains from my side concerning Cytus is: Considering the loans are backed by real-world lenders, who are determining that they are credit-worthy and able to repay the loans? The risk of RWA is the willingness to find RWL(Real World Lenders). Therefore, leads to clients with lower creditworthiness than a bank with high demand that can cherry-pick their clients. It is documented that a lot of lenders use land as collateral, however, I wonder if it stops there.

Nonetheless, innovation is welcome and despite there being some questions, it will be exciting to see where Cytus goes with this product as they aspire to eventually further back the stablecoin by AAA corporate bonds and treasury bills.

With that said, It wouldn’t surprise me if I have left out an obvious stablecoin.

Along with these novel products, we have projects that focus solely on stablecoins such as FXS (although Frax Lend is launching soon), FEI, and RAI to name a few. The real question one might ask is why everybody wants a stablecoin instead of using existing ones already.

Why does everybody want a stablecoin?

Frax’s Sam Kazemian has previously stated that the stablecoin market is not a zero-sum game and that stablecoin projects should seek to collaborate. However, what makes these protocols create their stablecoins instead of using or collaborating with existing protocols? When you look into the weeds, you see that there are a lot of financial incentives that are beneficial for protocols with native stablecoins. While they dilute each other, it’s an attractive pie slice everybody wants.

The first clear benefit is that it leads to an added utility for their token. The more utility you create for your token, the higher chance it has of long-term survival as it creates a necessary demand for it. One of the main utilities that people love in the degeneracy we currently find ourselves in is leverage. Being able to use LP positions, native tokens as collateral will always be attractive to degens (Aave and Curve).

Burning native tokens to mint the stablecoin also allows further utility as the token can be used as a sink (á la rdpx v2) reducing the supply and making it more scarce.

Internalizing fees is a small value savor but can amount to a lot in the long run as the small AMM cost that is prevalent during swaps can be kept internally by the protocol as users want to swap between their tokens and stablecoin. It also keeps capital in-house instead of letting it flow into other parts of the DeFi ecosystem. Considering liquidity is the name of the game, creating your own stablecoin leaves users another reason why they should keep their capital within your protocol when they want to reduce their risk.

It also allows for slippage minimization from minting a protocol native stablecoin instead of trading it on the open market where AMMs are susceptible to slippage.

Capital efficiency goes without saying as I’ve already touched upon leverage. However, being able to borrow against your asset means that you don’t have to sell them and implies no capital gains tax as well. However, this is without a doubt very risky considering the volatile nature of these assets which brings us to the next point.

Liquidation revenue is a very profitable business for protocols. Especially for overcollateralized stablecoins that make you a forced seller when your assets fall below the minimum collateral ratio. The protocol can feed on your tears cheaply and resell liquidated assets at a higher price.

Borrow Interest rates are an additional way for the protocols to increase their revenues if you manage your risk well enough to not get liquidated. While protocols such as Aave will allow stakers to get a discount on the interest rates, it will not be the case for everybody that wants to make a degen bet with their current portfolio. Larger loans will lead to higher fees generated from the protocol.

Arbitrage opportunities as the protocol native stablecoin most likely will range between 0.99-1.01 if it maintains a stable peg. Arbitrage hunters (and bots) will eye it as a potential for arbitrage leading to higher trading volume for the protocol. Especially if it manages to generate strong liquidity through Curve and can be paired against other stablecoins with deep liquidity. It allows these arbitragers to mint cheaply and then sell it for another stablecoin or go through the backdoor. However, the backdoor exit is dependent on the redeeming mechanism of the protocols and it all widely differs among the stablecoins covered in this piece.

Conclusion

Implementing protocol native stablecoins allow protocols to expand their product line. It has the potential to be a strong revenue generator in addition to the core value prospect these DeFi protocols already offer. While the functionalities of these stablecoins differ, leveraging your brand is a credible strategy as stablecoins are widely based on trust. Taking advantage of the strong reputation some of these DeFi protocols have built in this industry so far will lead to their loyal customers turning to them for stablecoin issuance as the protocol usage grows.

However, it has the potential to skyrocket the growth of the protocols or be the reason for their potential downfall. It is visible that stablecoins are an attractive pie that everybody wants a slice of as the competition heats up.

Do you see any potential winner among these protocols or how do you think the next phase of the stablecoin wars will pan out?

Well done if you managed to congest all that information, I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me, do not hesitate to subscribe. Thanks for taking the time!

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. I am just a random degenerate sensei sharing an opinion.