This Week On-Chain #100 - 100K BTC Finally, South Korea FUD & XRP

Can't believe I have made 100 of these.

We’ve come a long way since I launched these articles toward the tail end ofthe bear market. To the people w 2022 as we were heading out of ho have continued to read and have been here since then, I want to begin with a sincere thank you for continuing to support this.

I have no intention of slowing down any time soon.

There is no way I begin with anything other than BTC going above 100K, history has been made and it’s a great moment to share with all of you guys.

XRP has been soaring, which has been causing a lot of pain for people who feel like they have been holding the wrong coins while being outperformed by those who blindly accumulated XRP throughout the bear. This is the wrong way to look at it, XRP is a necessary precursor for the true alt season which is coiling. The higher XRP goes the more eyes it raises and it raises the targets of the rest of the tokens as well.

Stay patient and stick to your bags, your time will come.

Let’s dive into what the last week has given us.

Market Digest

South Korea announces Martial Law causing a lot of fear in the markets

MARA buys $615M worth of Bitcoin

Celsius to distribute $127 million to creditors in second bankruptcy payout

Wisdom Tree Funds files for XRP ETF

BlackRock taps into DeFi through Curve and Elixir partnerships

Putin signs digital currency taxation law

US courts rule that sanctions against Tornado Cash are unlawful

GMX proposal to increase buyback and distribute fee coverage to 90%

HyperLiquid launches their HYPE token

Good thread on “smart followers”

Bridge Flow

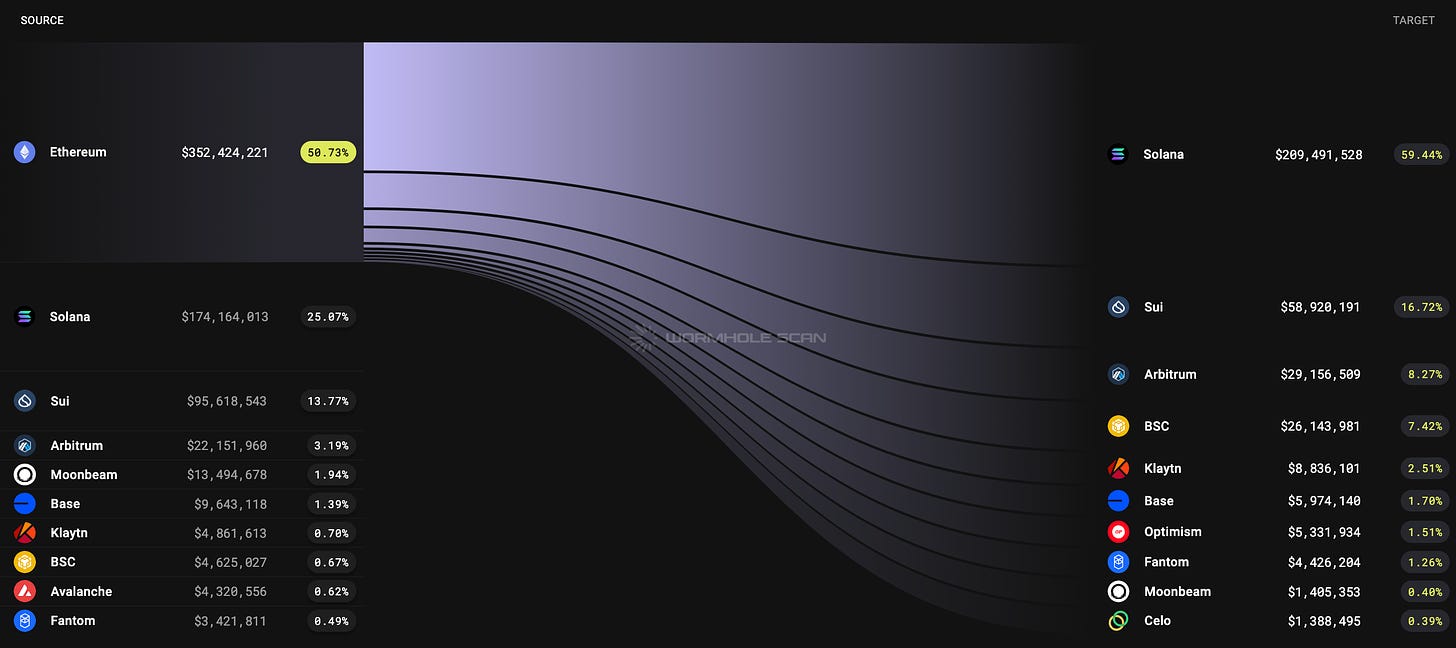

Capital continues to flow to Solana while Sui has started to wake up again. However, what stands out for once is the capital that has flowed to Arbitrum, but when you dive deeper, it is clear that it is capital that has been bridged to Arbitrum to bridge to the current HyperLiquid L3 that eventually will turn into its own L1 ecosystem.

While small amounts have flowed to Fantom so far, it is one to keep your eyes on with the launch of Sonic.

Dex Volumes

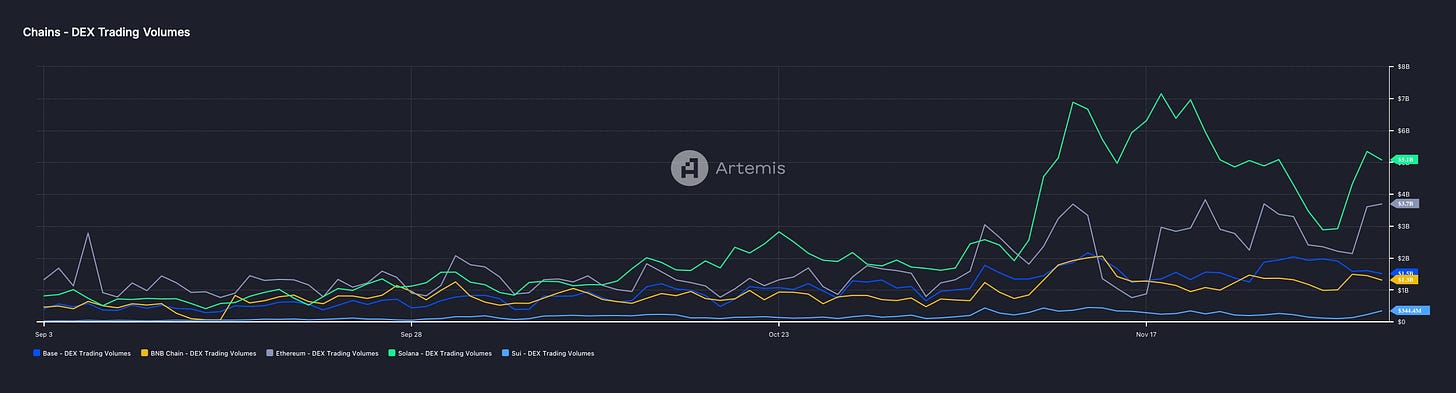

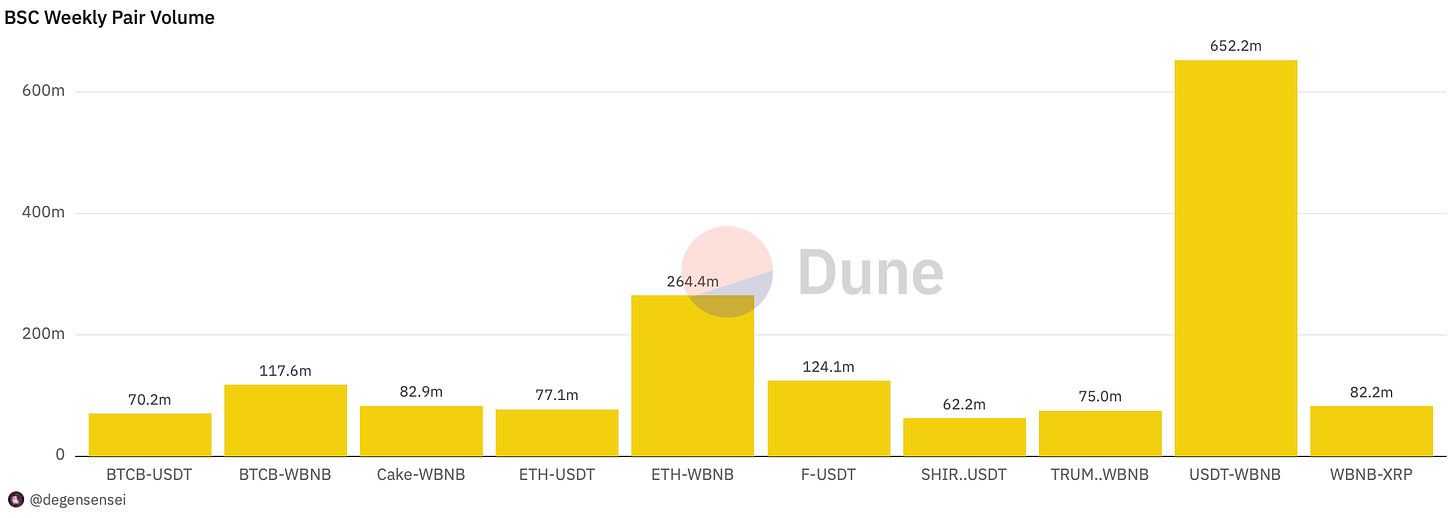

Solana going back to its standard high dex volumes while Ethereum is attempting to pick up. For this week I have decided to include BNB which I mentioned last week and it is very timely considering it just made a new all time high. The volumes on BSC are on par with the volumes on Base which is interesting considering it is not talked about at all and is flying under the radar. You will likely find good opportunities there if you dig deeper.

Pair Volumes

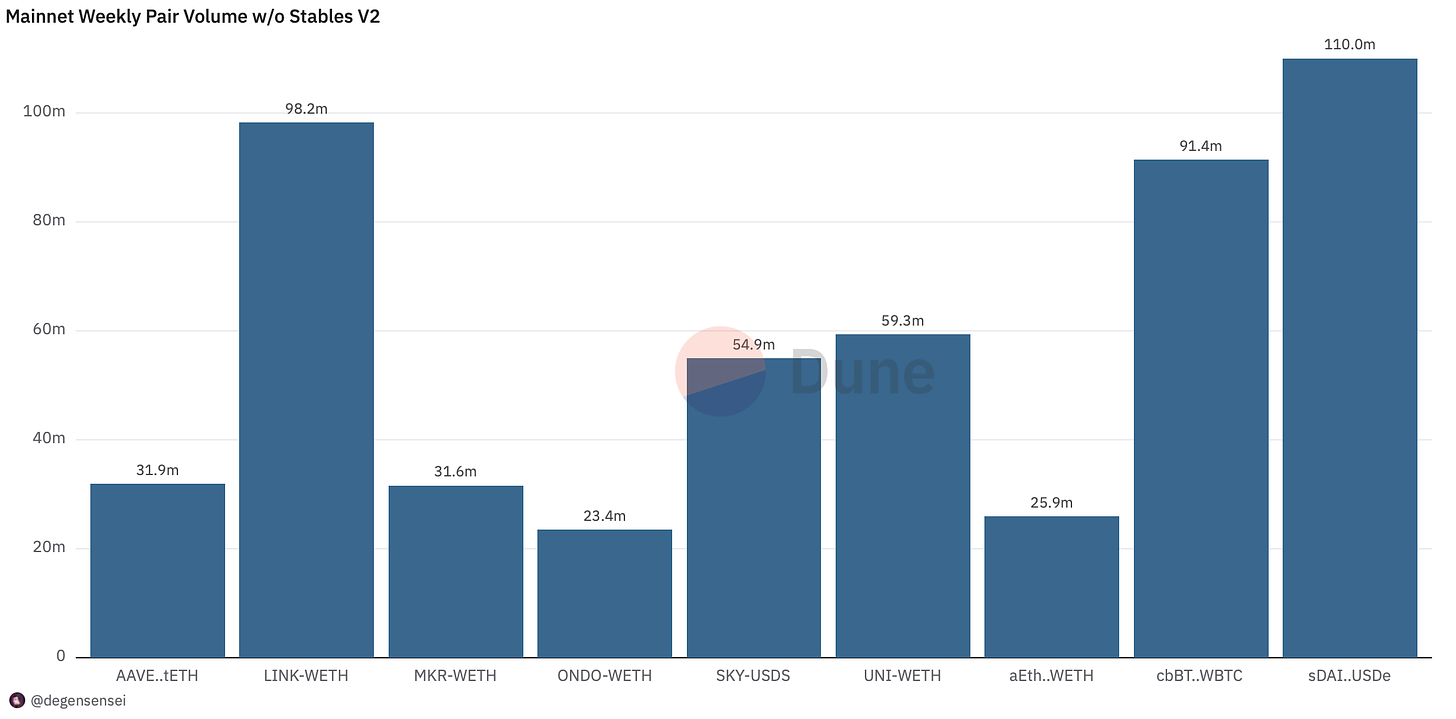

DeFi is coming back with a vengeance with both AAVE and LINK being poised for institutional bids alongside ONDO and UNI. They have been dominating the on-chain volumes as people aggressively have been buying up the DeFi tokens over the past week.

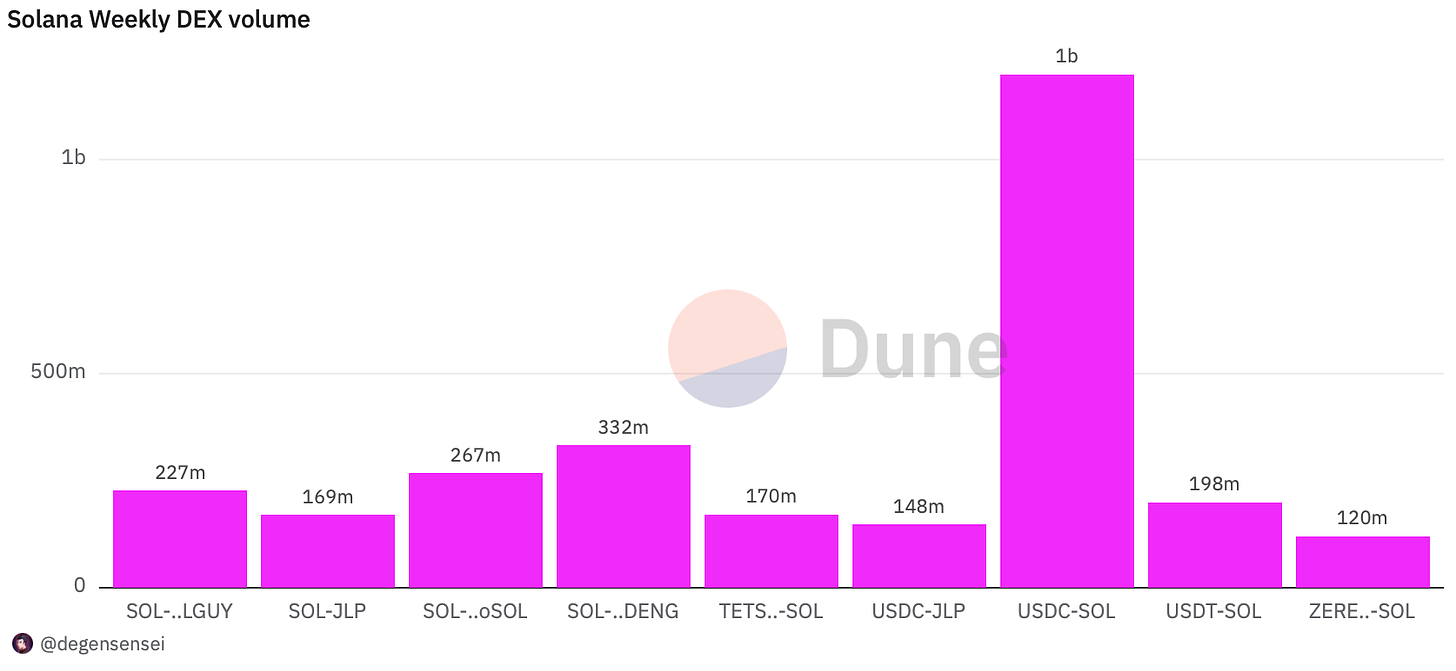

Solana continues to be meme focused even though they have been underperforming other market sectors over the last few weeks barring a few outliers. ChillGuy has been performing very well while Moo Deng got listed on Coinbase which took many people by surprise due to how fast that has happened. Considering the volatile markets we have experienced over the past week, JLP has emerged as a hedge.

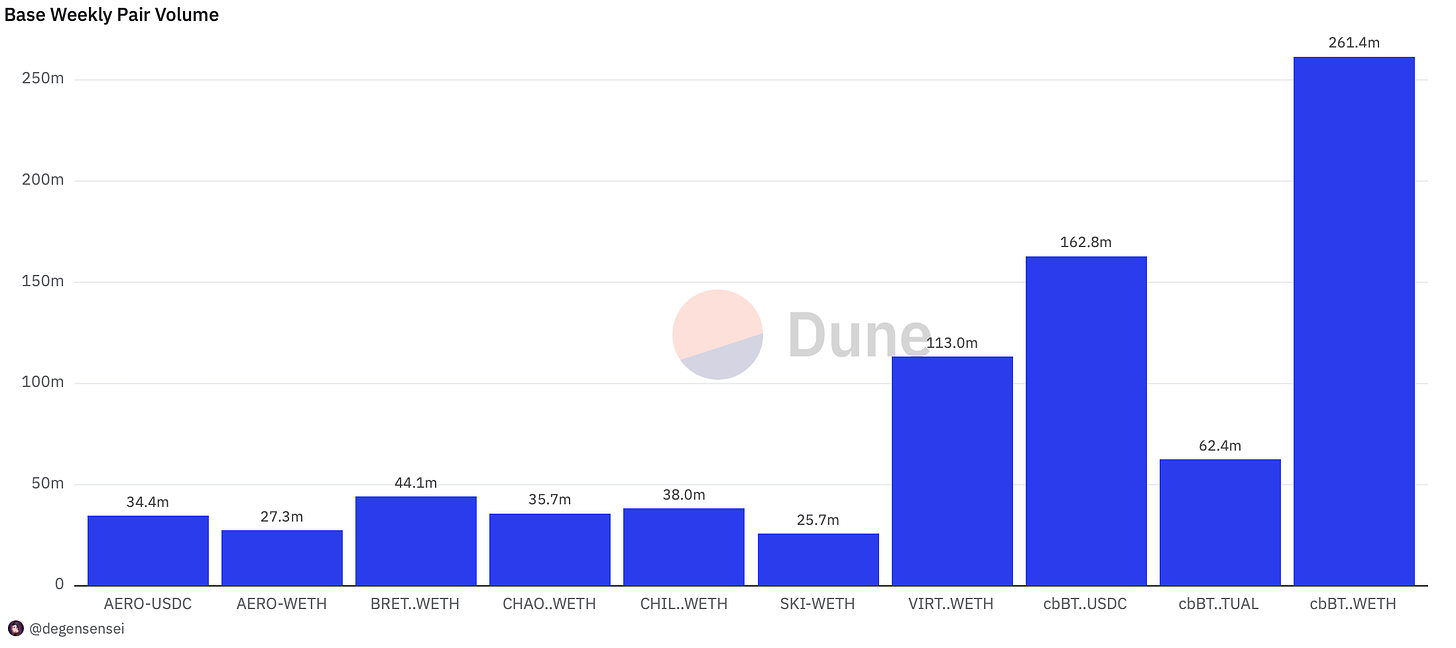

Base is continuing to heat up with Virtual completely dominating the on-chain volume while SKI has 10xed over the past week. Tons of opportunities there right now, get in.

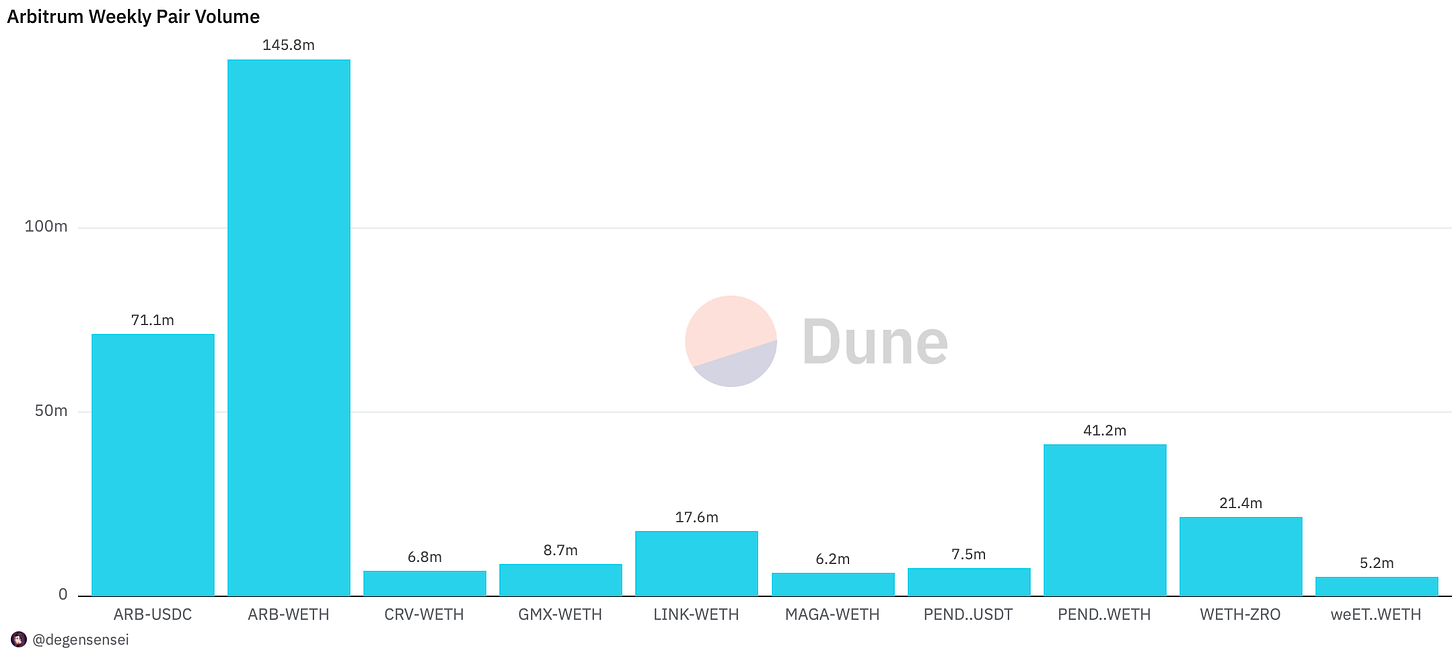

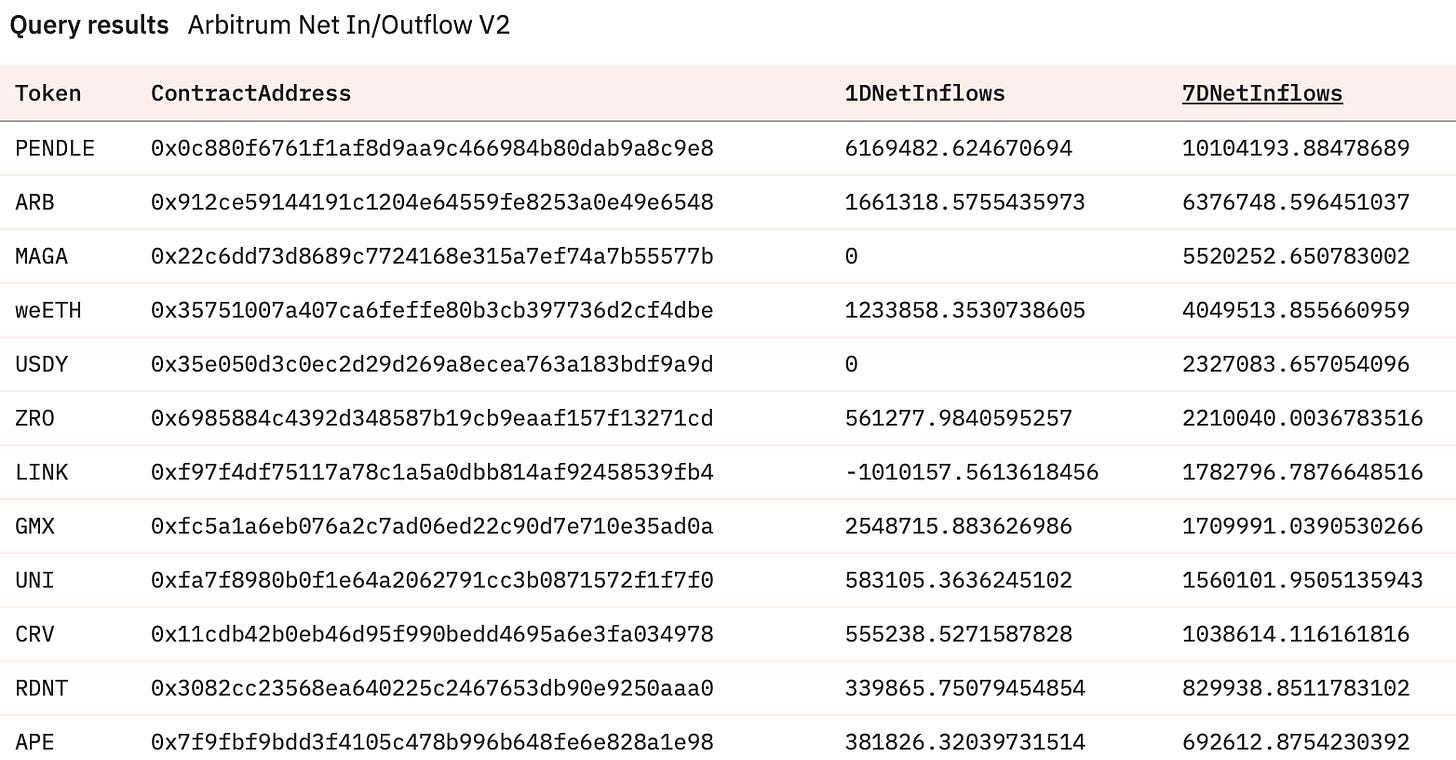

ZRO and PENDLE are the Arbitrum native token that have decided to wake up out of a long slumber with both breaking out and putting on significant price moves. GMX is starting to move as well after the latest proposal to increase buybacks which is interesting. While CRV isn’t Arbitrum native, it has performed so well over the past weeks (up over 300%) that it is making its way into this chart.

Time to include some BNB data here as well, outside of the Bitcoin derivative pair I would argue that it is the CAKE pair that stands out as it tends to move highly correlated to the BNB price and is poised to benefit from the new activity the chain attracts due to being the main dex.

NFT Trading

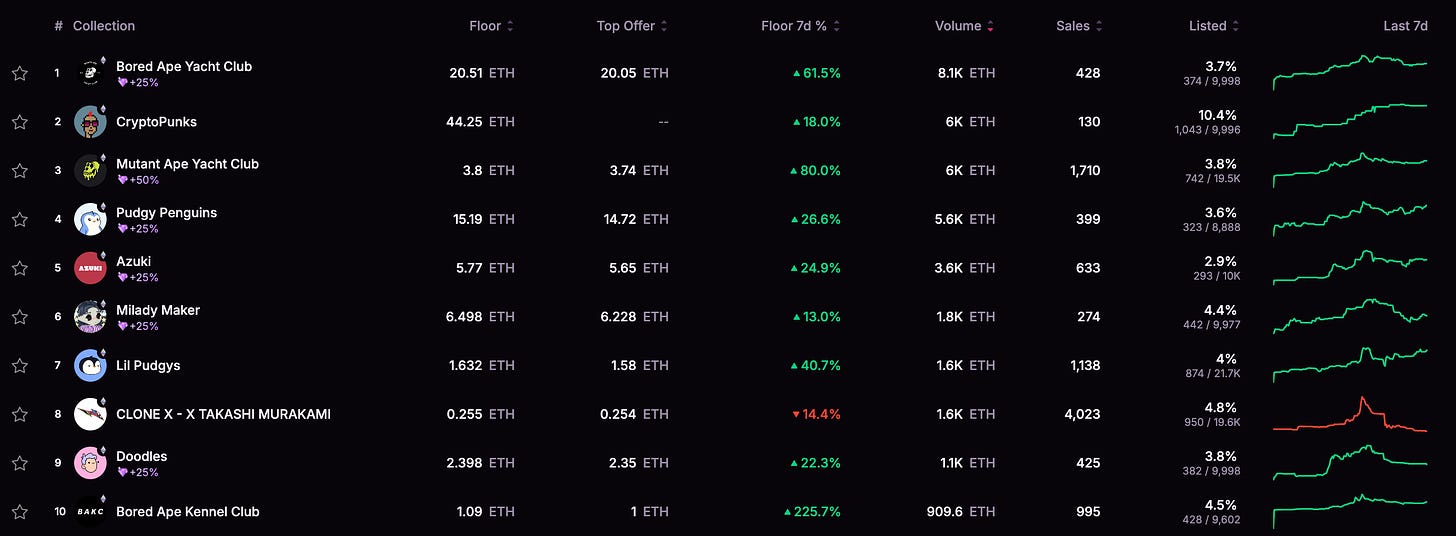

NFTs continue to move aggressively with both BAYC and CryptoPunks putting on significant moves as they are well and truly back.

The cherry on top is the incoming Magic Eden airdrop that is scheduled for next week and will benefit NFT traders who have been using the platform based on the amount of diamonds they are holding.

Net Inflow

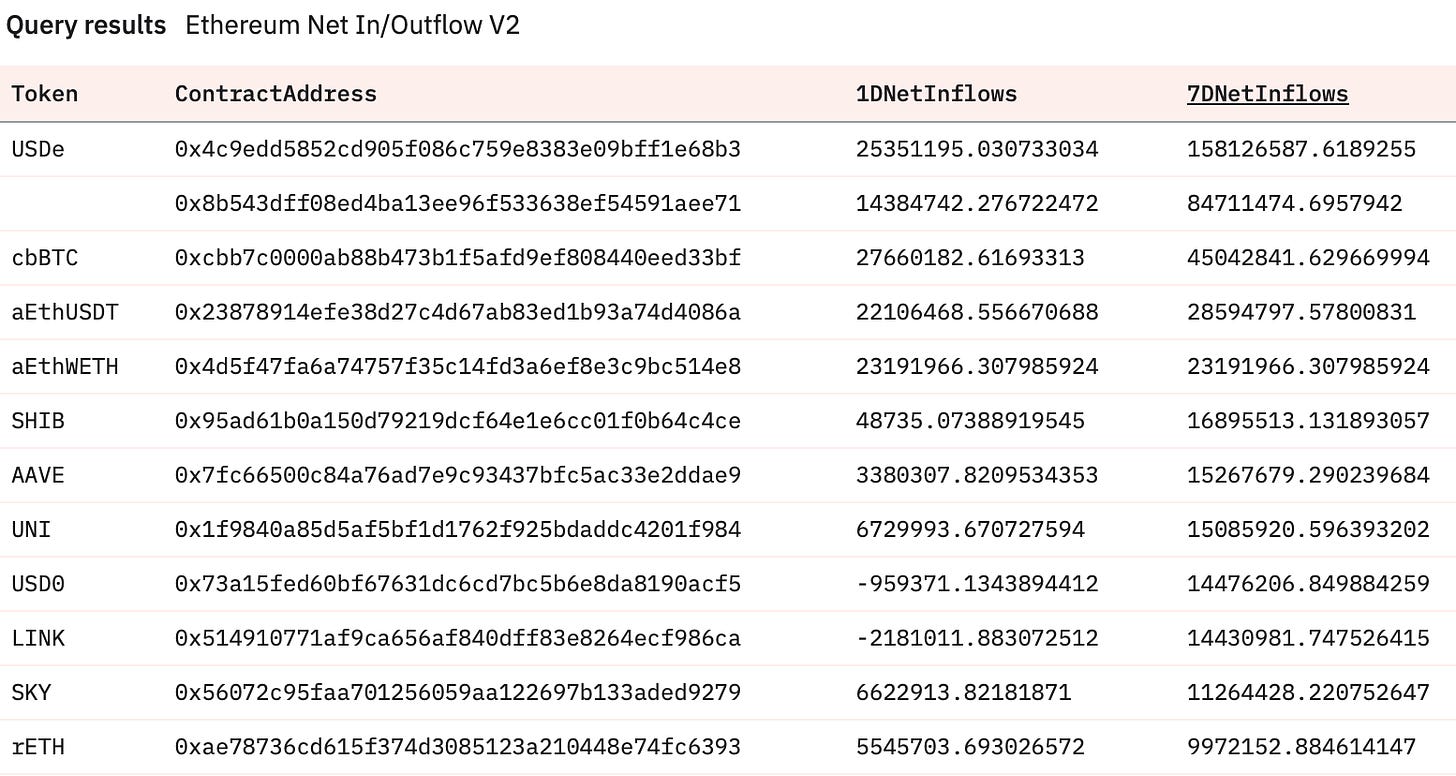

Ethena’s USDe continues to dominate stablecoin flow and is getting tons of flows as people want that juicy stablecoin yield. Old money is where the capital is flowing right now with SHIB, AAVE, and UNI being the most accumulated alts on Ethereum over the past week with LINK following accordingly.

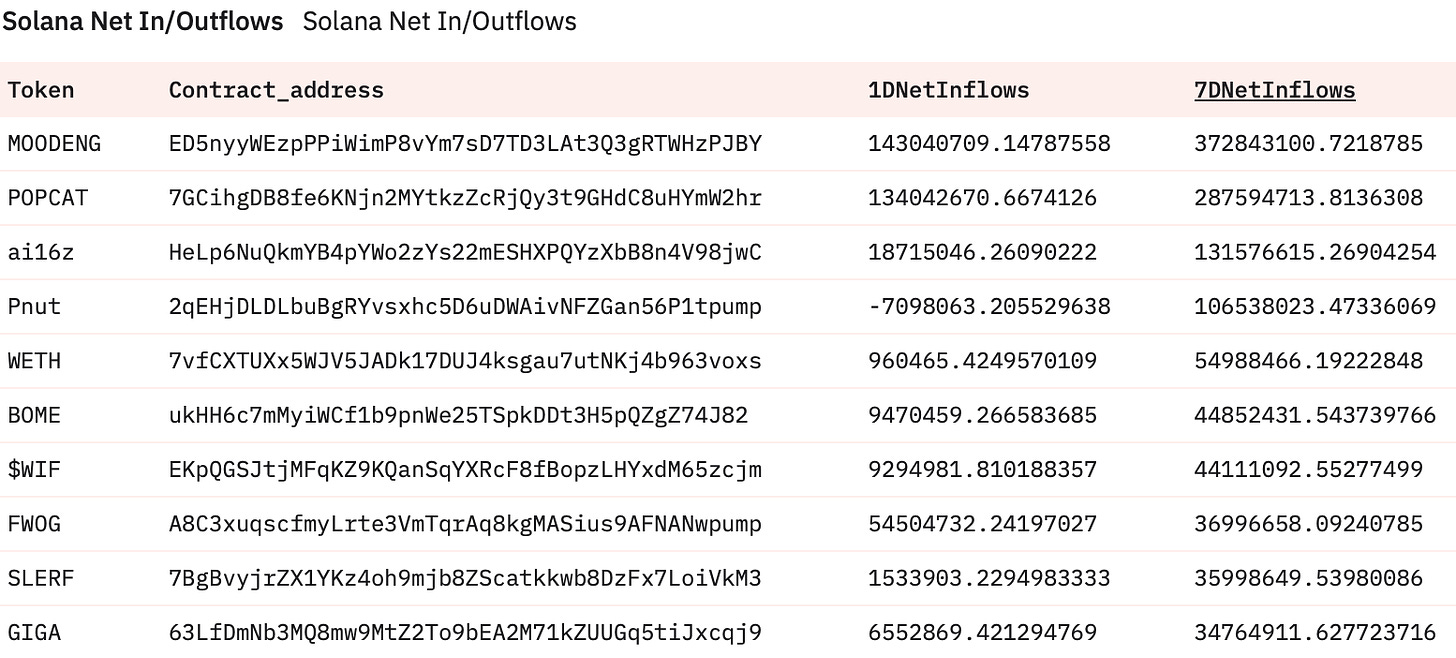

On Solana, the focus continues to be on memecoins solely as MOODENG is leading the accumulation race due to its latest Coinbase listing and I would never fade the Hippo. POPCAT has been frustrating holders for a while but seems to have garnered a lot of interest over the past week. The AI16z fud events seem to be over and the framework looks to be too valuable to be disregarded by emotional people on Twitter. Meanwhile, PNUT has garnered interest again after speculations about another Coinbase listing.

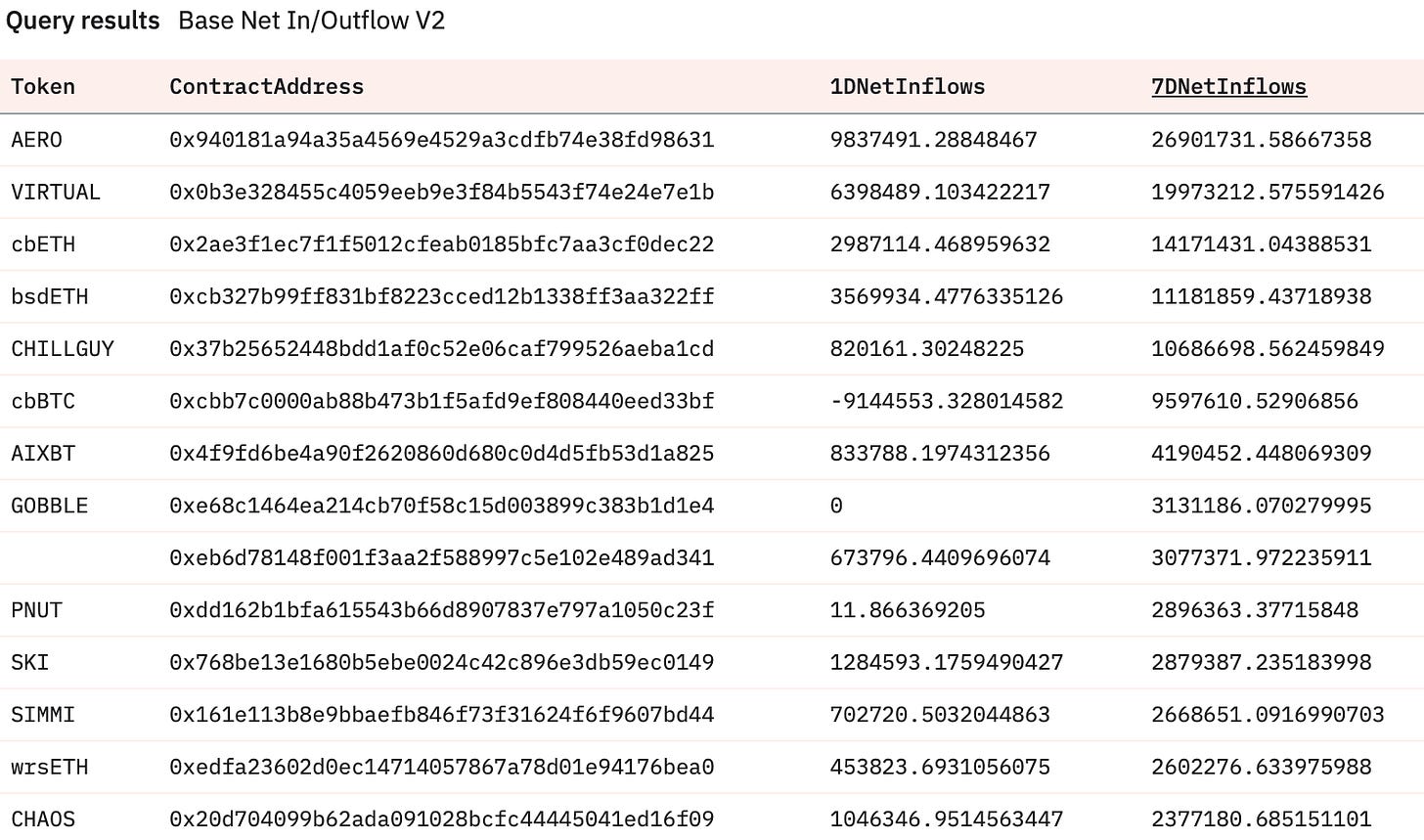

AERO and VIRTUAL are leading the way on Base as the two unicorns of the ecosystem that is trading at over $1B market cap. Meanwhile, AIXBT has become the most popular AI agent and is continuously tagged and featured in multiple Twitter posts as it can spew alpha better than most KOLs. Their business is in trouble. Additionally, there is only one word for SKI: Monster. Chaos is the token that was created by AIXBT and is burned whenever it is tagged.

No surprise to see PENDLE at the top of this list as it will undoubtedly become another unicorn soon that passes the 1B market cap and it could not be deserved more. Congratulations to the people who read this article in the depths of the bear market when it was trading at a 50m market cap and won.

Other tokens like ARB, ZRO, and GMX have been receiving some flows but they are all dwarfed by PENDLE although they shouldn’t be underestimated.

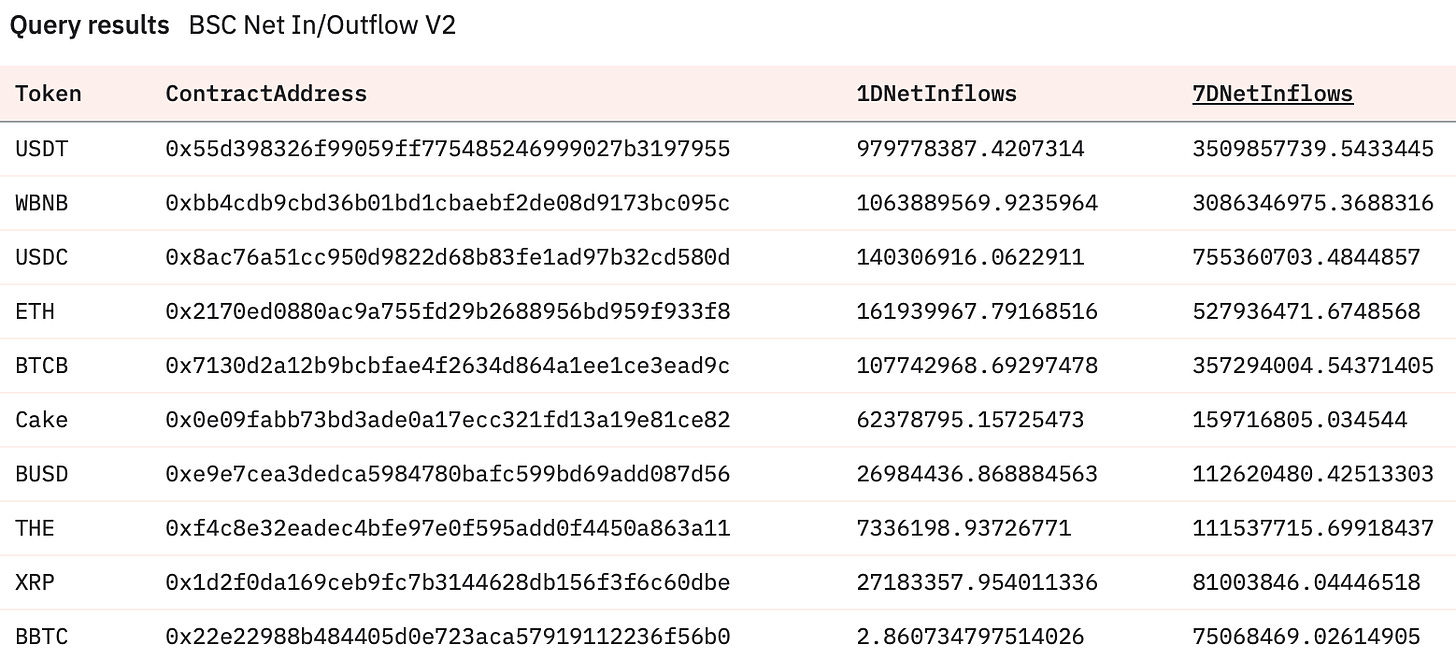

For the first time on this stack, the BSC data shows clear winners: CAKE and THE (Thena). The people want BNB beta with deep liquidity, so don’t complicate it, as the flows here have been crazy.

Sleuthing

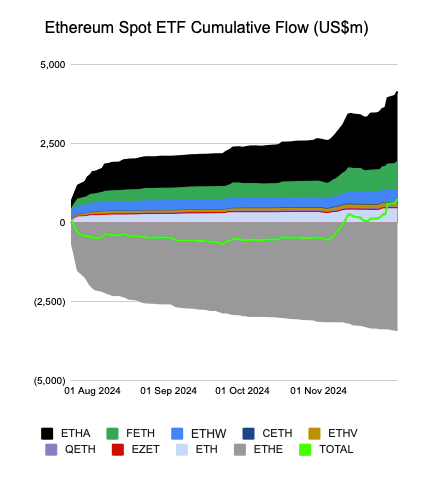

Ethereum holders that believed in the ETF are finally getting rewarded, people forget how reflexive an asset like ETH can be and considering it is a smaller asset than BTC it will move more violently when things start to take off (and when the music ends). Enjoy it while it lasts, you deserve it.

Token Unlocks

ADA - 0.05% of supply worth $22.05m on Dec 6th

JTO - 102.97% of supply worth $$500.79m on Dec 7th

BGB - 0.38% of supply worth $9.46m on Dec 10th

EIGEN - 0.11% of supply worth $5.33m on Dec 10th

ENA - 0.44% of supply worth $11.96m on Dec 11th

IO - 1.68% of supply worth $7.29m on Dec 11th

APT - 2.11% of supply worth $164.22m on Dec 11th

We are in a roaring bull market and I hope everyone is printing, it’s been a long wait but it is sure worth it. Enjoy those green candles and thanks for reading the 100th weekly newsletter.

FYI, I have intentionally made the paid newsletter affordable to not price anyone out at $7.99 per month which is the price of a beer a month to feed you deep insights and quality research. As some readers have been very nice to me, they have insisted on me raising the price for my work so I will increase it to $9.99 when after the turn of the year. However, you can still lock in a yearly subscription for cheaper until then, so don’t fret.

It helps me stay motivated and makes me feel like I am getting rewarded for my work. I hope this doesn’t cause too much pain for anyone.

Also, I have an interesting protocol deep dive coming up on Sunday for the upgraded substack, make sure you don’t miss it after the performance of the latest deep dive which was GammaSwap and the GS token which is up 13x since then.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.