Over the past week, there has been some deleveraging as people bulled up with excessive leverage, thinking that breaking over 100K BTC would be easy. Anybody holding spot positions is unphased, while it has been painful for people overleveraged on perps positions.

There is a reason why long-term holders outperform over time and being able to hold spot positions with your portfolio is a blessing if you are content with your current situation.

Bull market doesn’t mean that you can get away with being reckless which is why the HODL mantra in crypto is so strong. Hold onto your conviction positions and you will be rewarded.

Unless you are a skilled perps trader, if you screw around with leverage you are about to fuck around and find out as we saw over 1B in liquidations over the last few days.

Market Digest

Kaito AI launches Yap-Points which is a potential future airdrop

Magic Eden’s launches their ME token

Thread about MSTR’s business model and convertible bonds

Seraphnet cancels public sale after being called out as bad actors

Market thoughts by 0xGeeGee

Trump names David Sacks as Crypto Czar

A16z article about what they are excited about in 2025

Synapse protocol proposal about $3.5m buyback and emission reductions

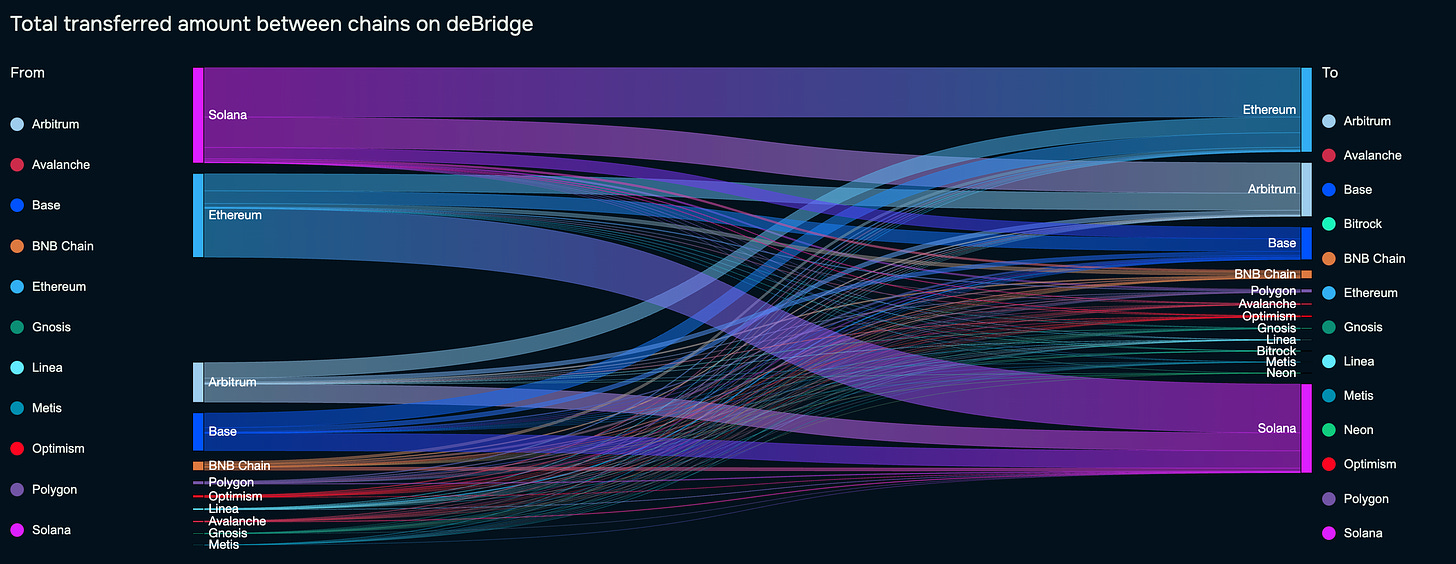

Bridge Flow

For the first time in a long time, more capital has flowed from Solana to Ethereum over the past week. Likely due to people being very risk-averse and cautious over the past week while there was a lot of volatility in the market. As the AI memecoins are starting to gap up again, it wouldn’t surprise me to see this reverse again for next week, but let’s see. Time will tell.

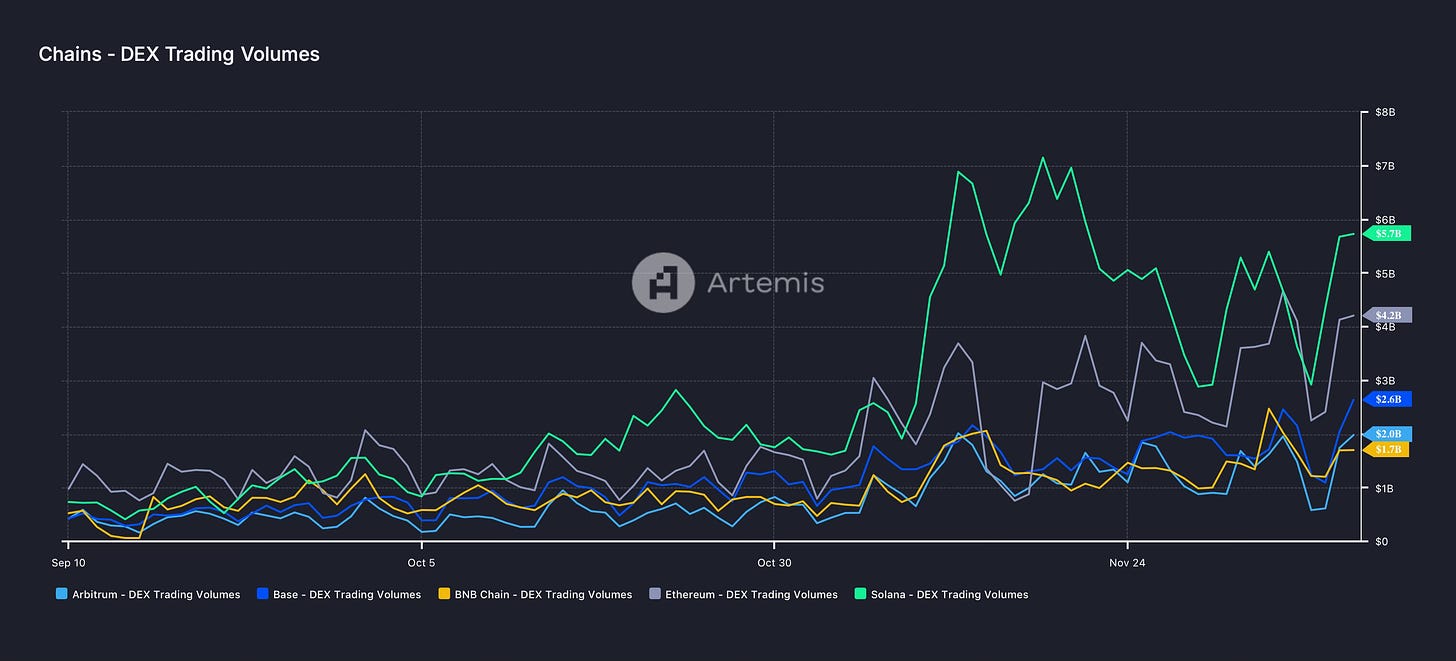

Dex Volumes

Shakeouts are nothing to worry about for now, we are in a bull market and they will continue to be good opportunities with volume continuing to trend up and to the right. All chain activity is up across the board with Solana and Ethereum mainnet leading the way. Arbitrum is creeping up above BnB which is interesting.

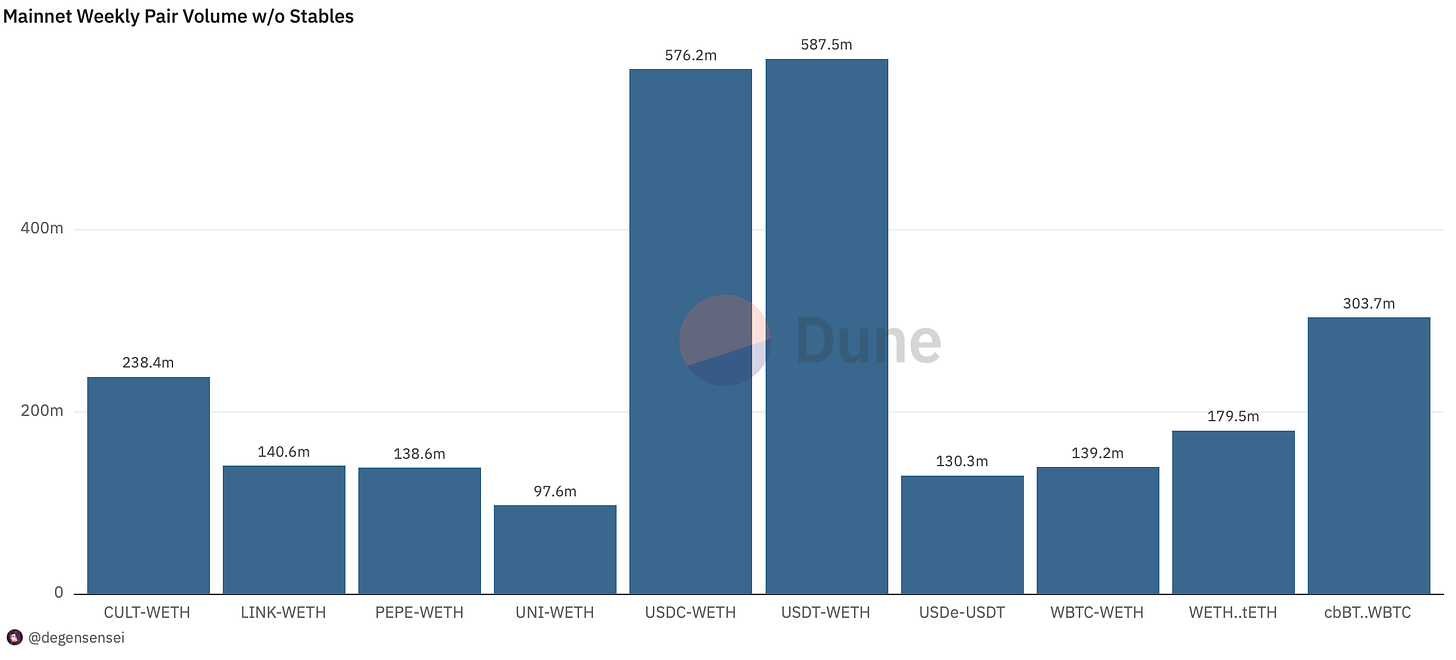

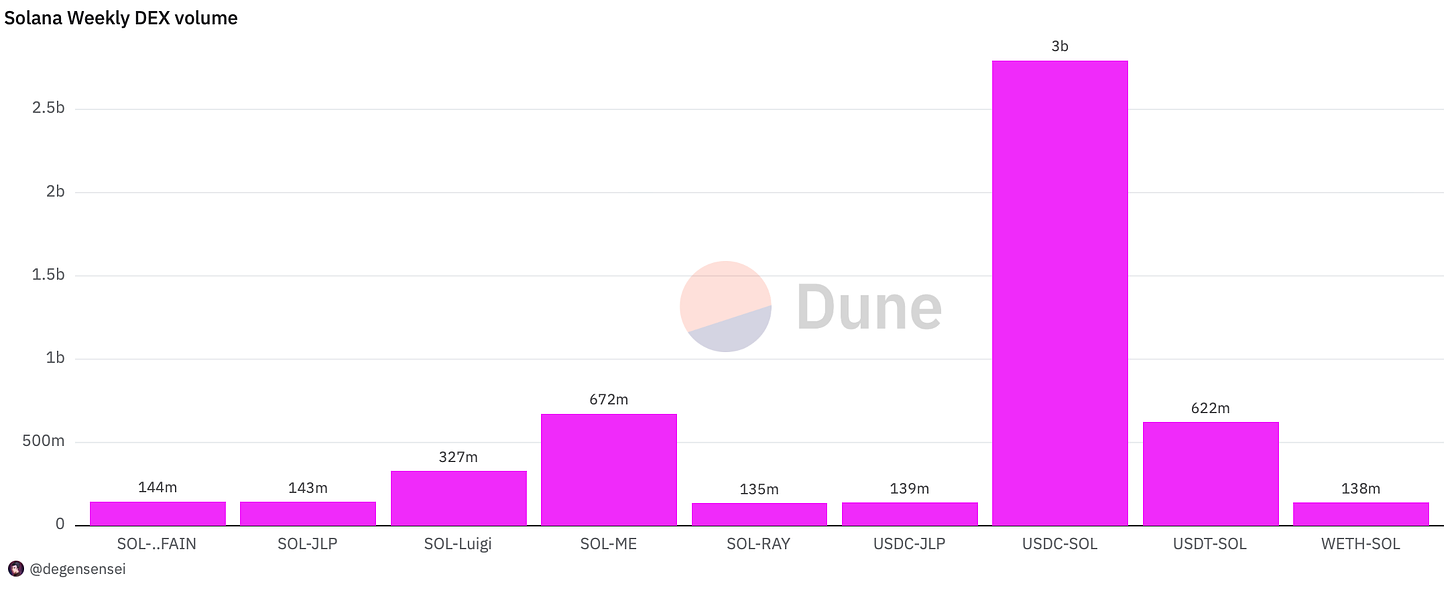

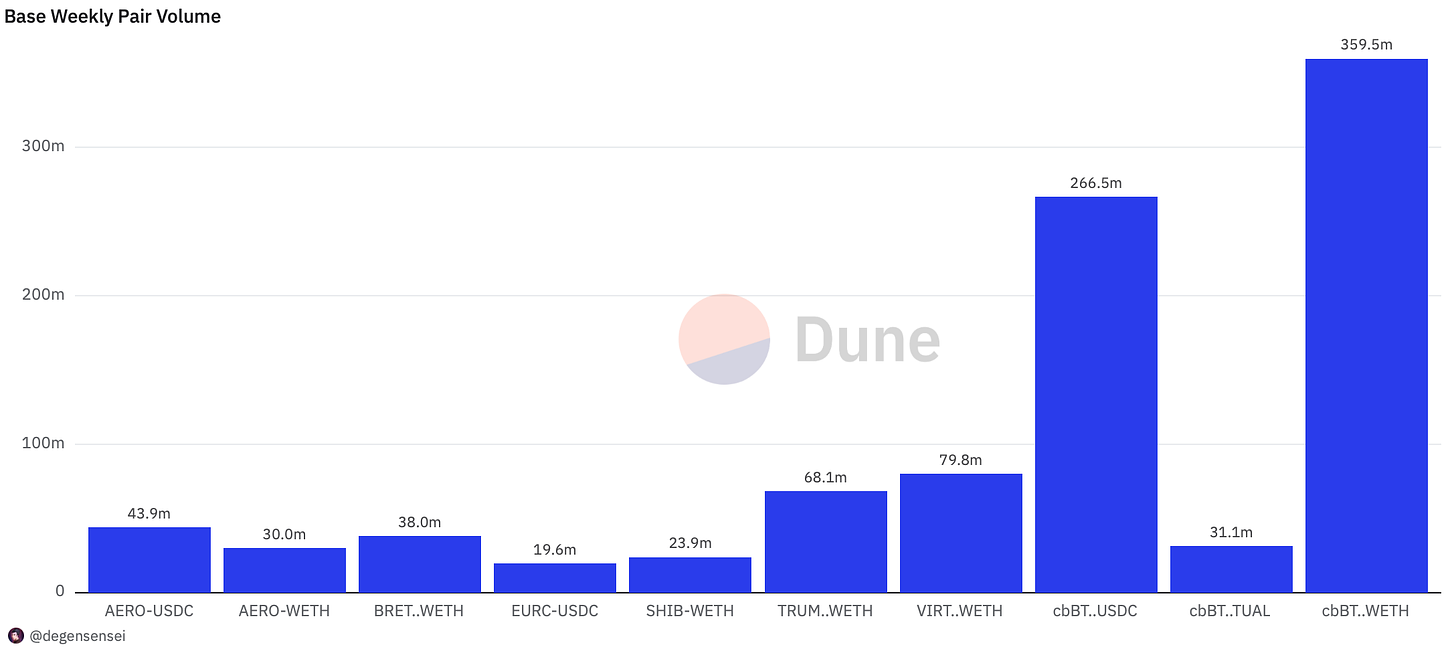

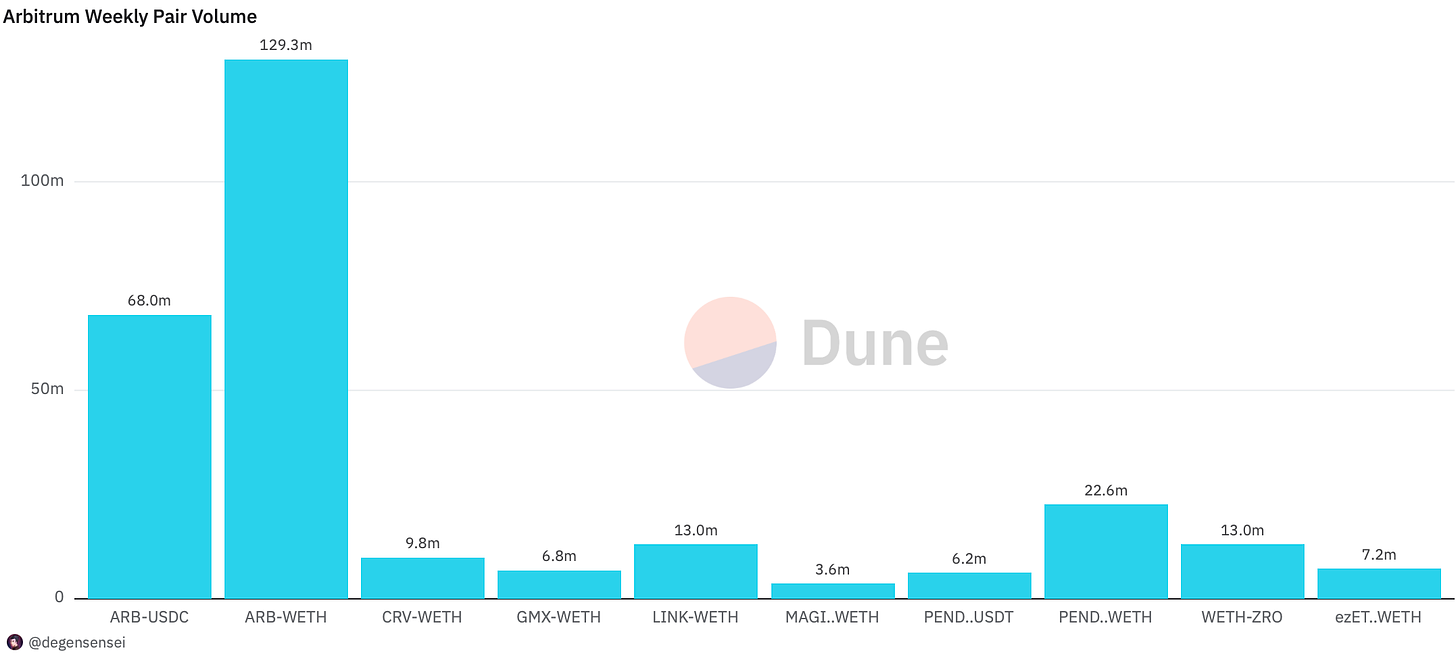

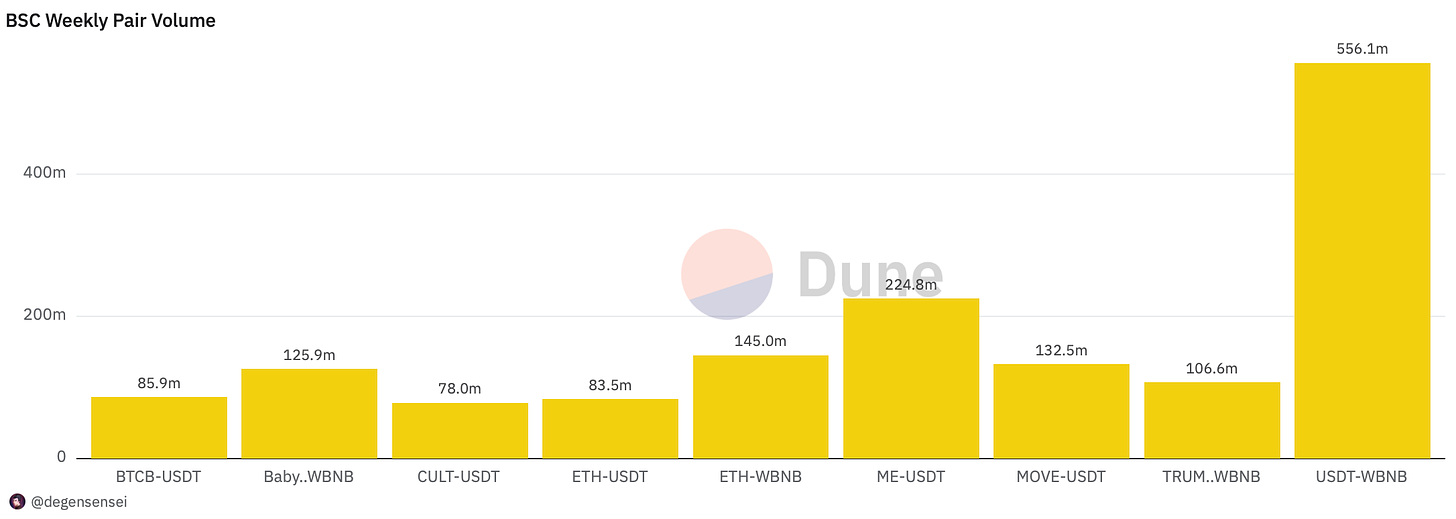

Pair Volumes

CULT is unsurprisingly leading the alt volume on this list as it was a long-anticipated airdrop for the Remilia community that has been months in the waiting and is very lucrative for Milady, Remilio, and Yayo holders. Aside from that large caps have gotten the lion’s share of volume as LINK, PEPE, and UNI have been the prime candidates for on-chain degens over the past week.

Similar on the Solana side, ME is doing the majority of the volume due to a large anticipated airdrop that featured the worst claim process in a long time. Either way, thanks for the tokens, Magic Eden. Most of you haven’t missed the Luigi incident as he finally was arrested and no surprise that there was a token for it. GRIFFAIN is an AI protocol supported by the Solana Foundation (or the co-founder to be specific) that has soared in value over the past week after that endorsement.

AERO and VIRTUAL continue to dominate the trading volume and price action on Base as the two unicorns of the ecosystem. BRETT is following them accordingly which is a good signal for the rest of the ecosystem that it is go-time.

Arbitrum is finally starting to have some consistent volume that doesn’t disappear every other week. PENDLE continues to be strong with ZRO following suit accordingly. Meanwhile, it looks like MAGIC has risen from the dead with gaming finally starting to receive some time in the light as well. While GMX keeps chugging along as an old-time bear market favorite.

The one that stands out on this list is none other than BabyDoge as the BNB native dog coin that continues to fly under the radar but has performed very strongly over the past month and is sitting at an 870m market cap at the time of writing.

NFT Trading

Pudgy Penguins and Lil Pudgys have been soaring over the past week as the winners continue to establish themselves. They also announced an upcoming token for their token holders in a similar mold to the CULT token for Remilia assets. Speaking of Remilia assets, the NFTs sold off after the airdrop as the drop was worth more than the value of most of the NFTs which gave people the opportunity to free-roll them.

People expected the ME airdrop value to flow back to NFTs, but clearly, that has not been the case.

Interesting mints

We finally have an interesting mint after a long time:

Bomefers - Minted as a pre-sale for the Panana token where bomefer holders would be airdropped the token. The Panana token is now live and is sitting at a 4m market cap with a deep LP consisting of 4.5m in liquidity which is rare for a low cap. Let’s see how the market treats it.

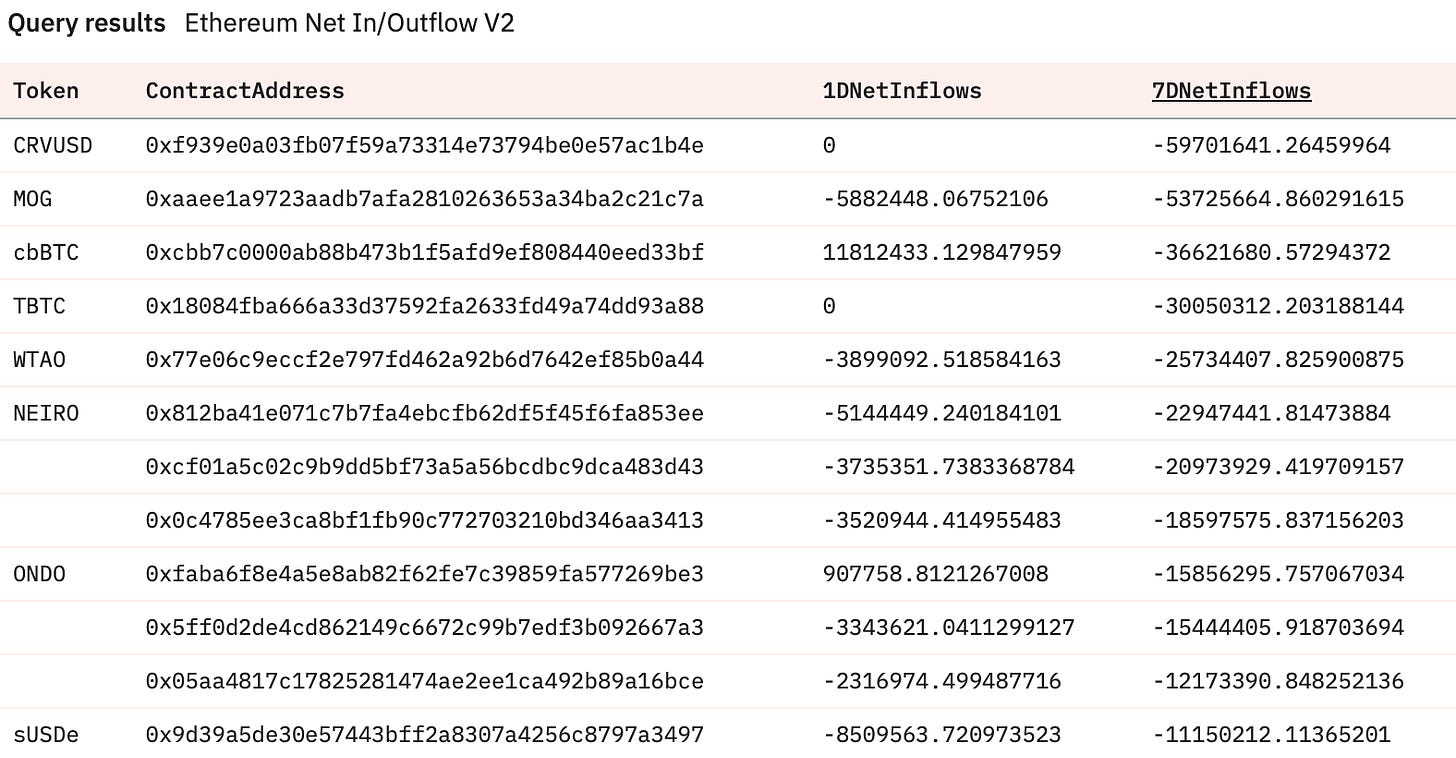

Net Inflow

Since we just had a deleveraging event, it is more insightful to look at what people have been bidding over the past day instead of weekly. MOG, TAO, NEIRO and ONDO have been leading the way for on-chain accumulators that want their hand on good tokens on Ethereum.

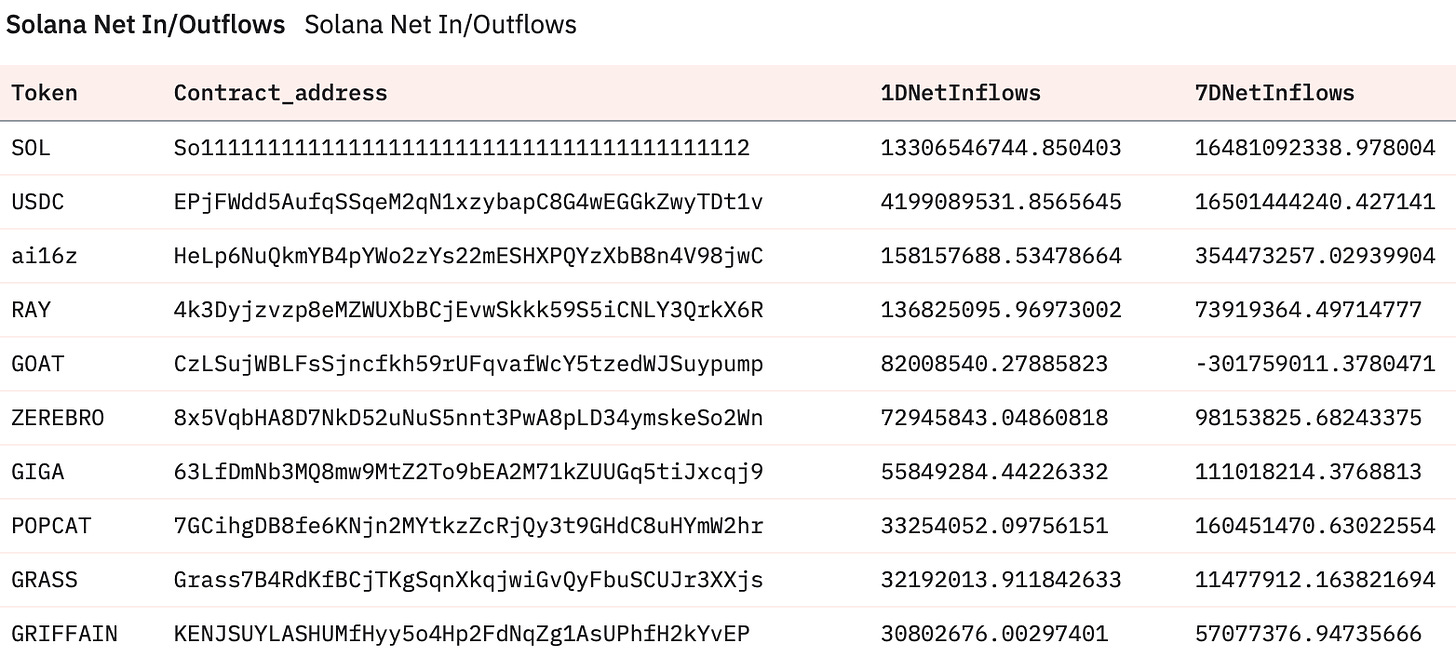

On Solana, the SOL token has been leading accumulation as people saw it as a great opportunity to accumulate. Otherwise, ai16z, which has managed to flip GOAT, has led the way while RAY, GOAT, Zerebro, and GIGA have followed accordingly. POPCAT, GRASS, and GRIFFAIN make up the last cohort of this list, and you will notice that people are much more aggressive in buying up the dips on Solana with ferocious volume in comparison to Ethereum.

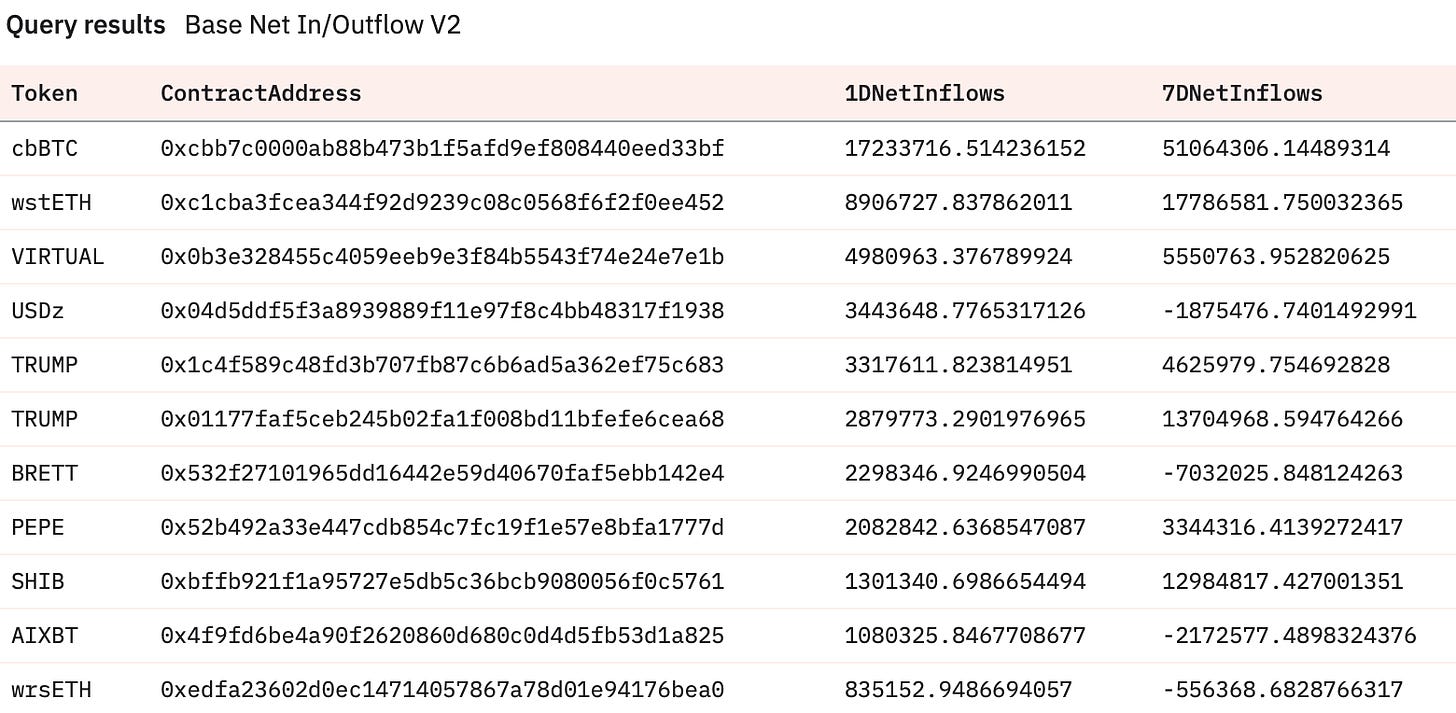

On Base people have been buying more cbBTC than ETH which is interesting on an Ethereum-based network, we are truly in a Bitcoin-led cycle for now even if ETH is starting to wake up. VIRTUAL, BRETT, and AIXBT remain the Base native tokens that have been accumulated aggressively during the latest dip.

(The net inflows for BNB provided zero insights so excluding it for this week).

Sleuthing

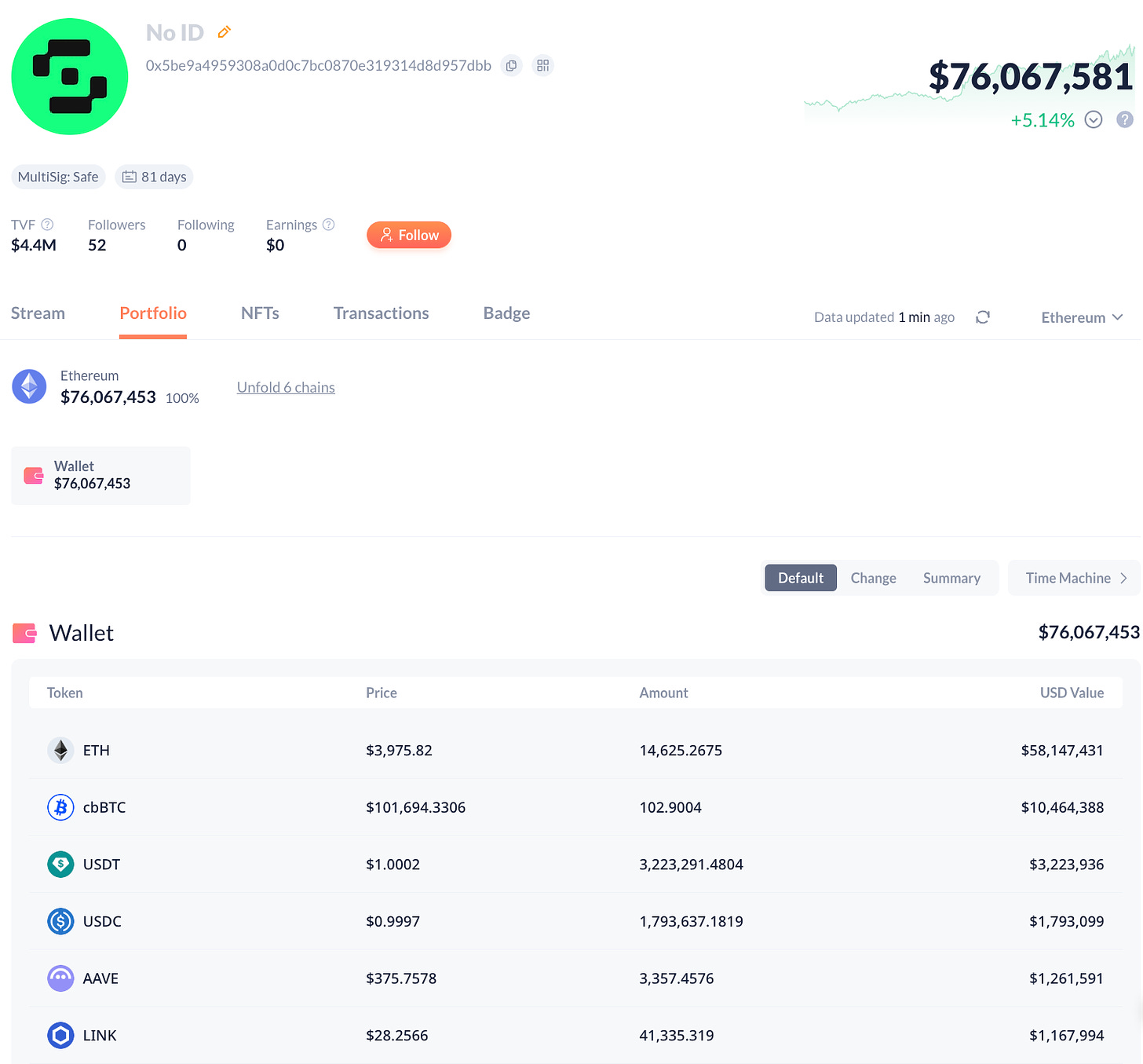

World Liberty Financial spearheaded by the Trump family buys $5m worth of ETH, $1m worth of AAVE, and $1M worth of LINK respectively.

Please feel free to check the address here to confirm. Don’t trust, verify.

Token Unlocks

AXS - 0.52% of supply worth $6.42m on Dec 13th

STRK - 2.83% of supply worth $41.58m on Dec 15th

SEI - 1.39% of supply worth $32.92m on Dec 15th

ADA - 0.05% of supply worth $20.05m on Dec 16th

ARB - 2.26% of supply worth $93.29m on Dec 16th

PRIME - 1.46% of supply worth $11.39m on Dec 17th

APE - 2.16% of supply worth $24.03m on Dec 17th

EIGEN - 0.61% of supply worth $6.48m on Dec 17th

QAI - 5.16% of supply worth $22.35m on Dec 18th

ENA - 0.44% of supply worth $12.88m on Dec 18th

That’s it for this week and it is the time to sit on your hands and not chase positions.

There will be a weekly article for next week and after that, there will be a 2 week hiatus for Christmas and New Year unless I manage to squeeze one in while I celebrate with the family.

See you in the next one.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.