Christmas is upon us, and I look forward to taking a Christmas break soon. A reminder that the weekly articles will take a two-week break after 102 weeks of consistency. Still, even if Christmas is close we operate in a 24/7 market that never sleeps and there are always tons of things going on.

TradFi can’t get enough of Fartcoin. The public talks about shorting it and vitriol about its rise as it acts as the poster boy for the absurdity they view crypto as. The marketing flywheel is in full effect, which can be seen in the price action of Fartcoin.

Additionally, people were eagerly awaiting the FOMC event that led to the Fed cutting 25 bps while remaining hawkish as they intend to keep rates higher for longer. And despite this, to people’s detriment, Fartcoin continues to rip hard as it has become the de facto crypto tradFi joke. The funniest outcome continues to be the most likely.

Market Digest

Pendle introduces PendleSwap

Sonic mainnet goes live

Avalanche raises $250m from Galaxy Digital and others

Frax Finance introduces frxUSD and renames FXS to FRAX

Bitwise 10 crypto predictions for 2025

Odos DAO announces ODOS airdrop and airdrop checker

deBridge now supports bridging to HyperLiquid

Binance lists Velodrome

Daniele Sesta explains the new AI product “heyanon AI”

Zerebro launches zerepy

Kabosumama granted ownthedoge DAO the Neiro IP

Bybit to remove services from French users

FTX announces effective date and record date of January 3 for Reorganisation

Binance introduces Binance Alpha

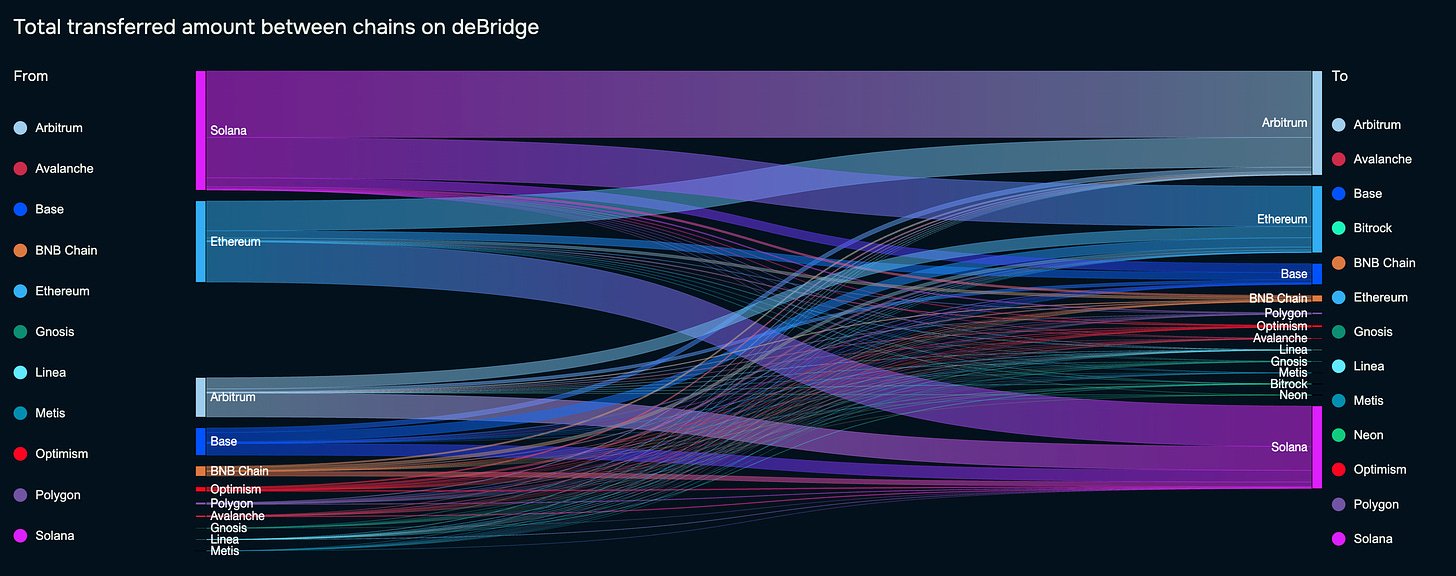

Bridge Flow

To many people’s surprise, tons of capital has been flowing from Solana to Arbitrum. However, this capital has not stayed in the Arbitrum ecosystem but has continued to flow over to the HyperLiquid ecosystem which currently operates as an Arbitrum L3 before they launch their own HypeEVM L1. So much capital has flowed to HyperLiquid that it is close to flipping Arbitrum in TVL.

It’s clear where the opportunities lie at the moment, check out the HyperLiquid ecosystem and protocols planning on deploying there.

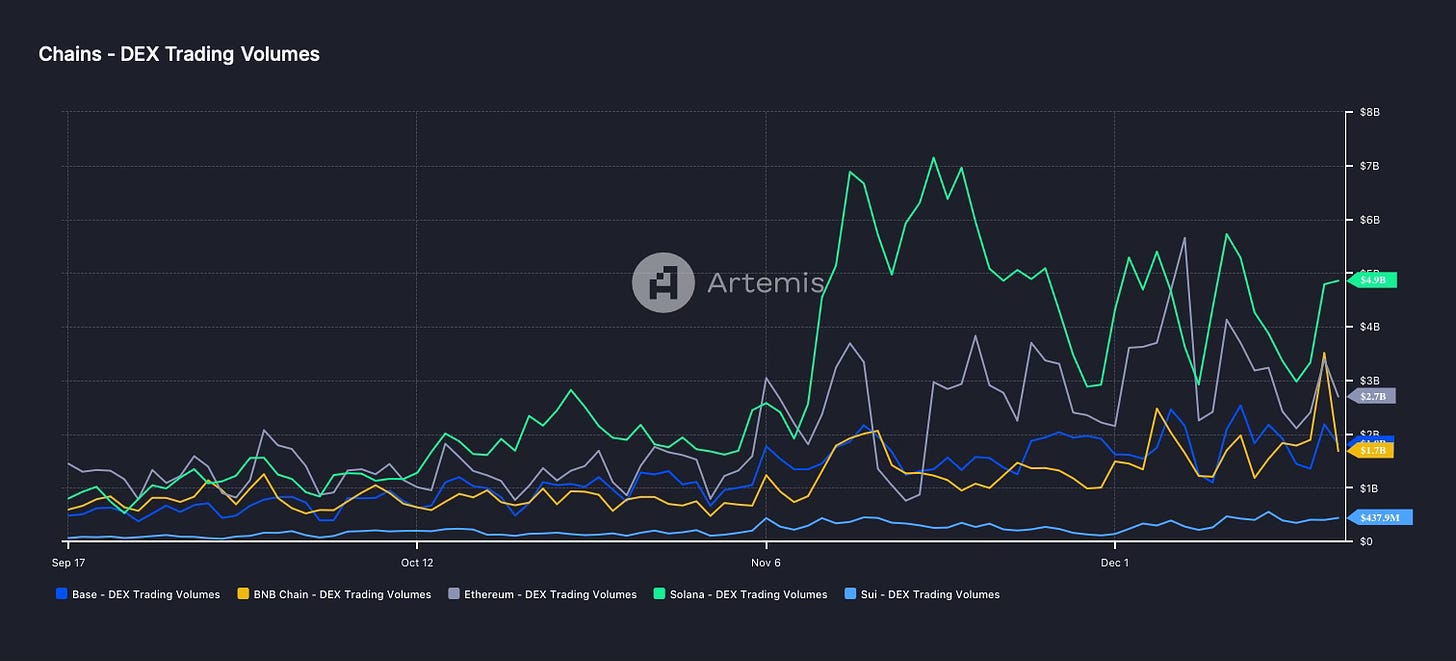

DEX Volumes

On-chain volume continues to remain high and there has been a lot of exchanging of hands over the last week as alts have kept bleeding while we have been limited to select outperformance of a few alts. Still, we are in a raging bull market, and “retail” which is a word I hate but they are well and truly here no matter what anyone else tells you. Make the most out of it while it lasts.

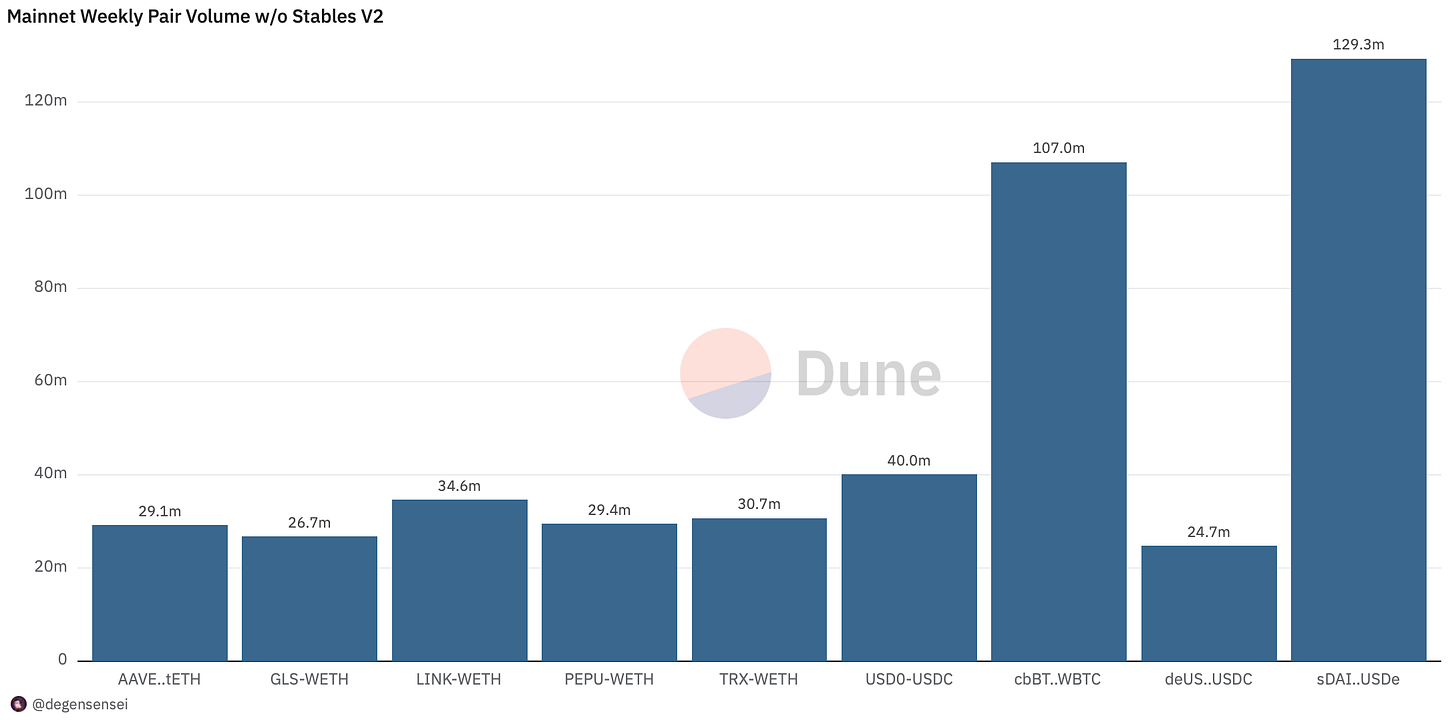

Pair Volumes

No surprise to see AAVE and LINK here after World Liberty Finance bought them last week. GLS is the latest AI infrastructure launch that had its TGE yesterday which has done very well and can be seen by market interest based on volume. The TRX recently was deployed on Ethereum which is why it is showing up in the volume charts as it recently made a new all-time high. Dino coins continue to be strong.

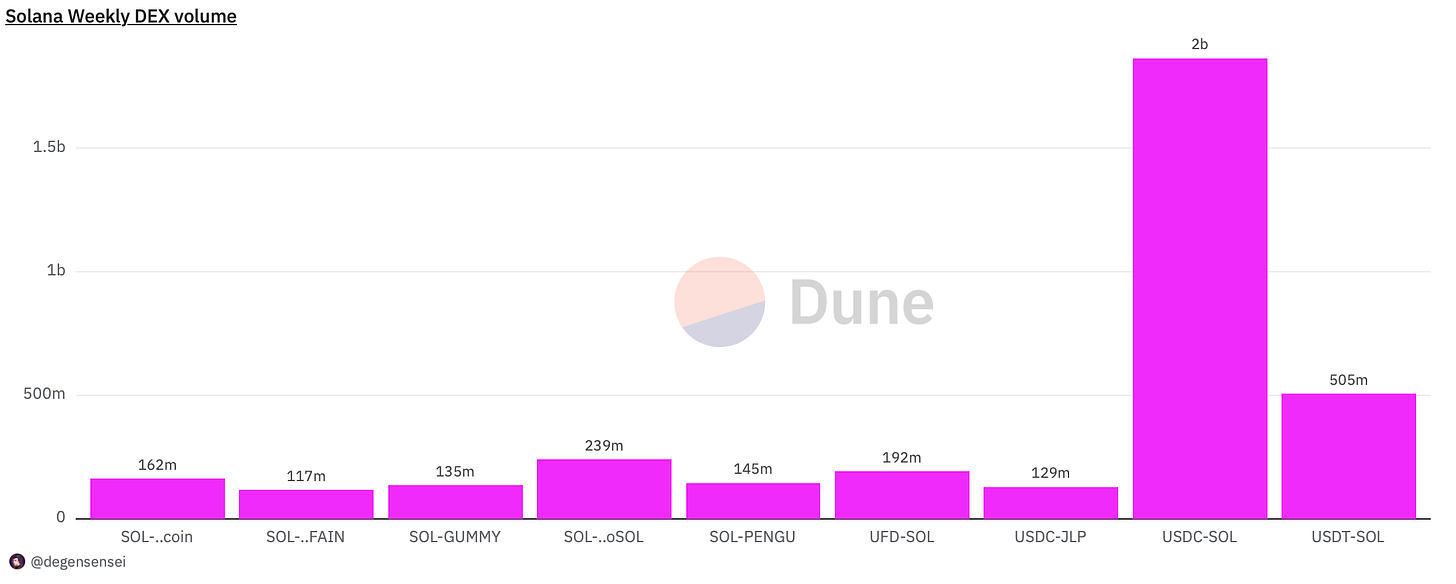

Solana volume continues to skyrocket and recently made an all-time high again which can be seen in the USDC-SOL pool. New launches such as PENGU were the center of attention for a few hours before Fartcoin took over again. UFD is a new memecoin (Unicorn Fart Dust) that was created by a boomer that is gaining increasing popularity as well. While Griffain continues its imperious performance over the past week.

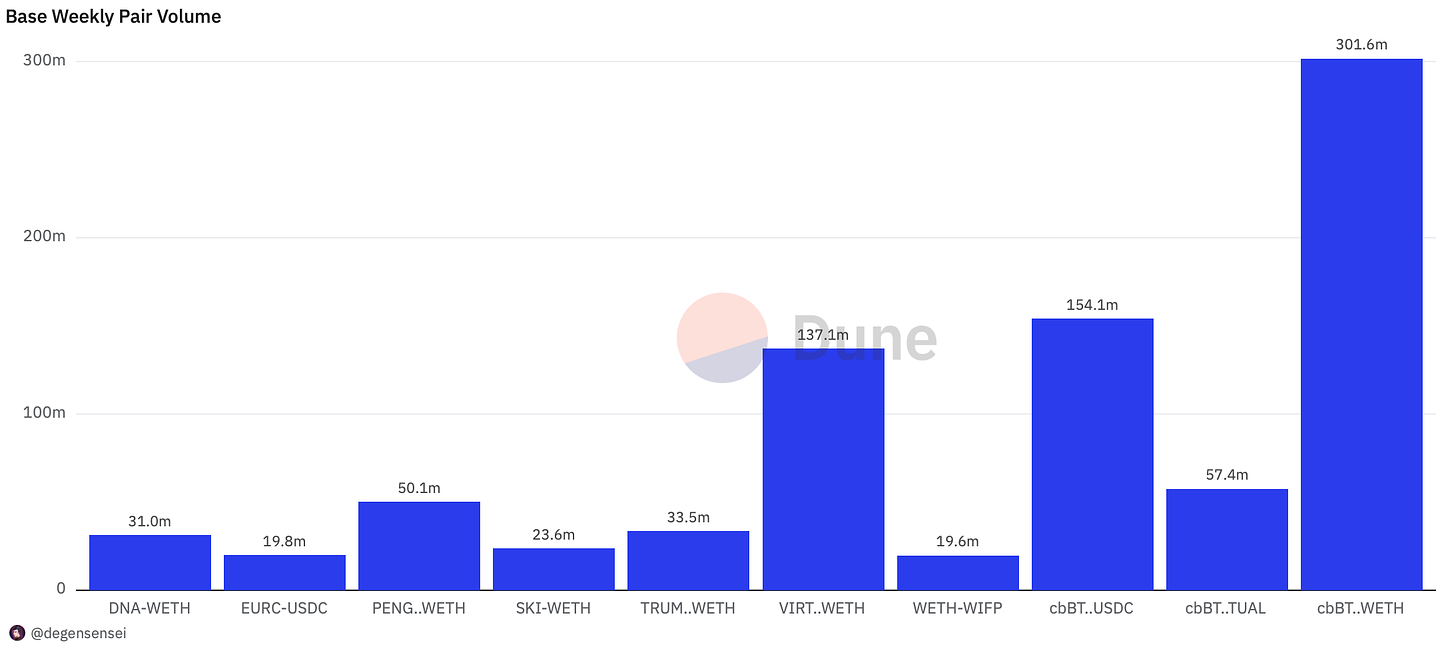

Base volumes continue to be strong although the activity remains more concentrated than Solana as the tokens that have generated trading volume and have performed well are mostly Virtual and SKI.

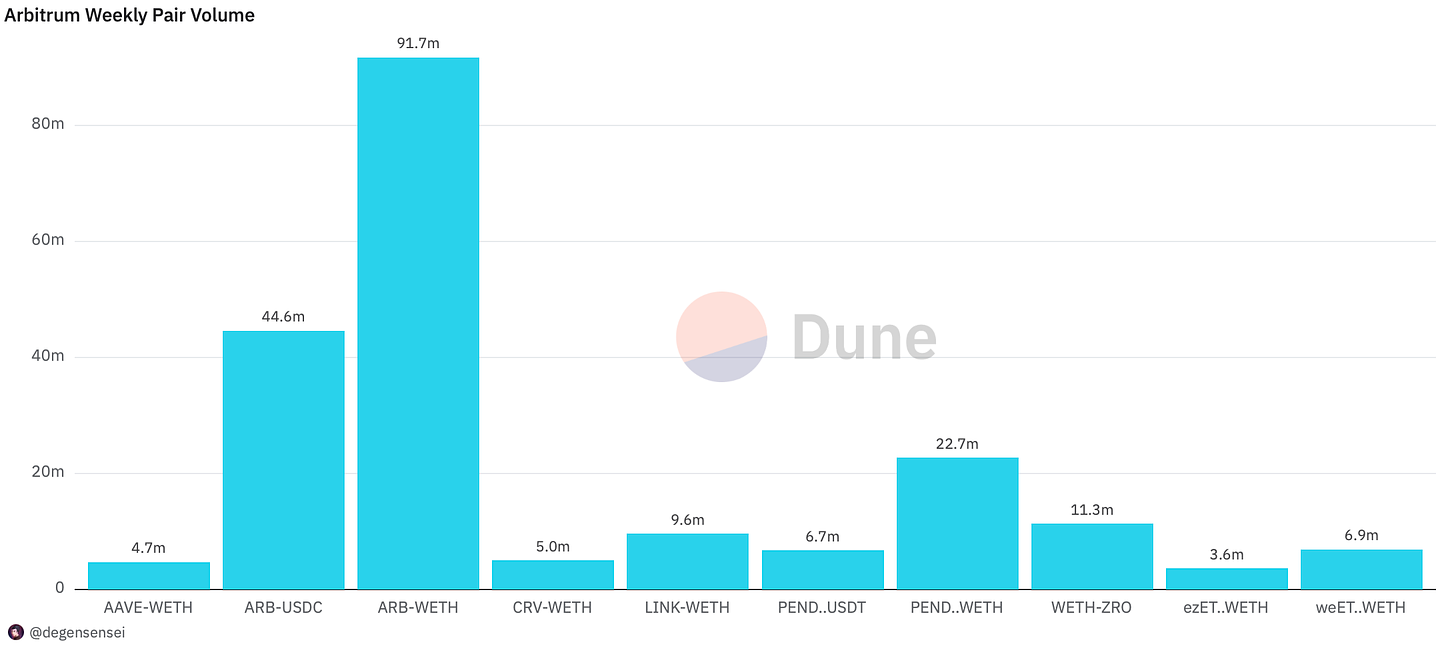

Arbitrum activity continues to be sporadic for Arbitrum native tokens with only ARB, PENDLE, and ZRO doing any significant kind of volume. However, it is worth paying attention to Y2K which piqued some interest due to their plans to deploy the new protocol (Fractality) on HyperLiquid.

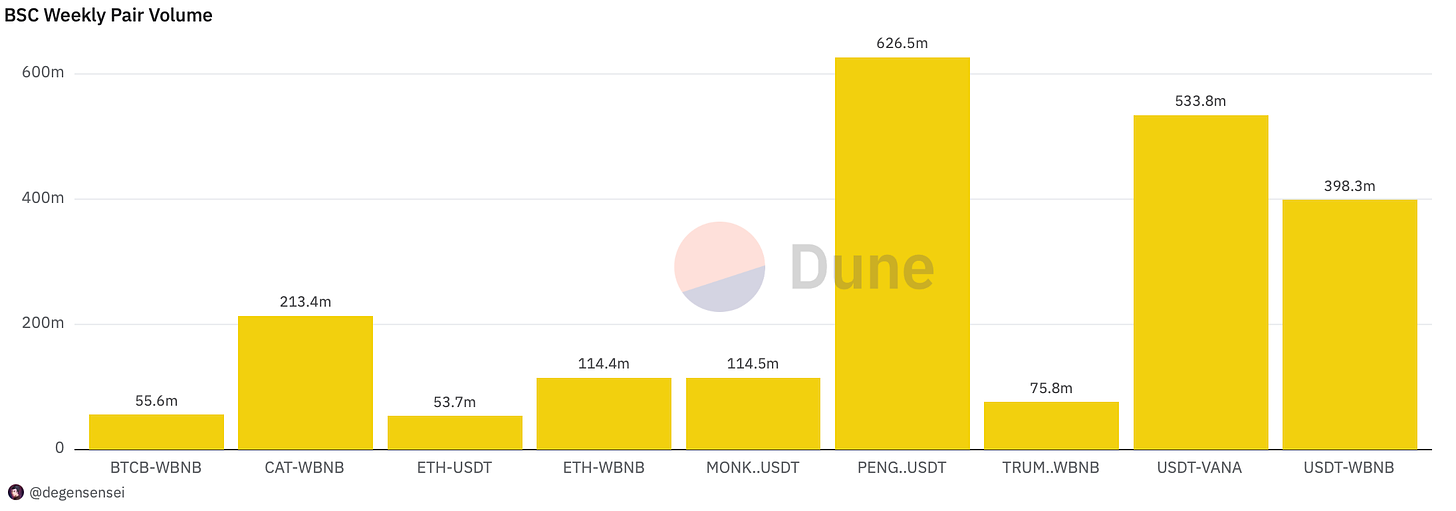

On BNB the only token worth paying attention to is CAT which recently got listed on Binance which is why it has done a significant amount of volume over the past week. The majority of the other tokens on this list are spoofed.

NFT Trading

With Pudgy Penguins launching the PENGU airdrop for Pudgies which at the time of the drop was worth $98K, people cashed in on their Penguins which led to a stark drop in NFT price. Aside from that Azukis continued to do well and flew under the radar as they are appearing as a dark horse of an NFT collection worth holding.

Net Inflow

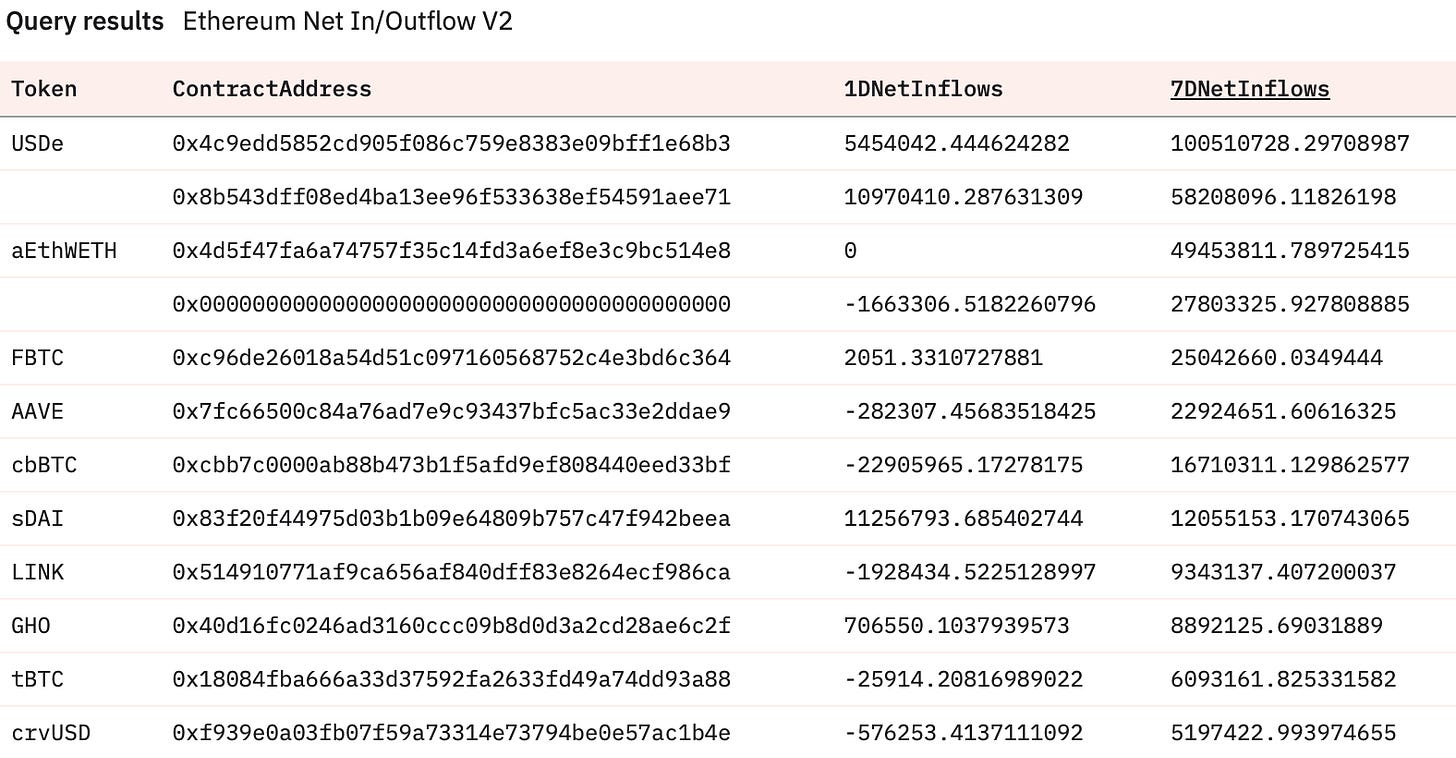

The flows for this week indicate that it is risk off season with Ethena’s USDe leading the way in inflows as people seek high-yielding stablecoin exposure instead of taking risks on alts. The only alts that have received any significant bids are fundamental alts such as AAVE and LINK.

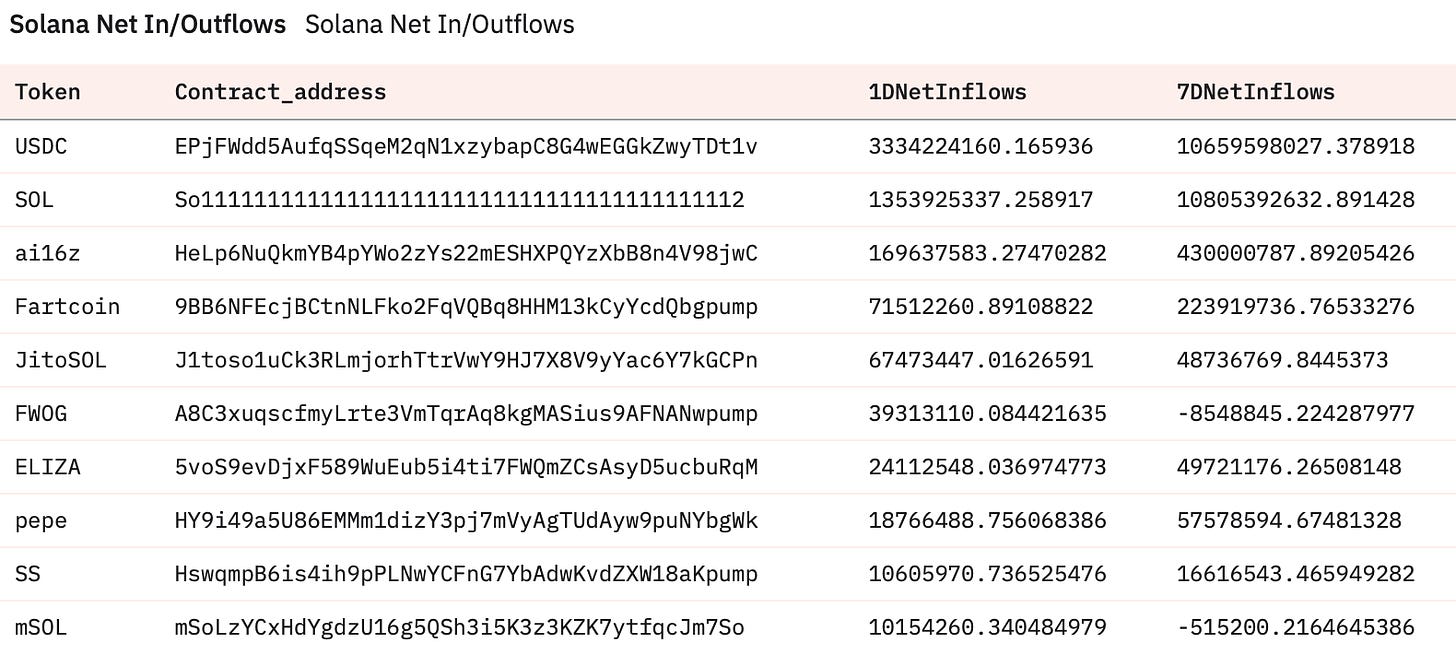

Even Solana is heavily risk off which is a rare sight to see with the leading token getting inflows is USDC. We don’t see this often as people have been heavily selling over the past few days which can be seen on the Solana meme charts except for a few outliers. Among those outliers, we find Fartcoin while the rest of Solana on-chain has been selling off rapidly. AI16Z, ELIZA, and FWOG are being accumulated though.

The good thing about these signals is that people generally react late and these things take place close to local alt bottoms.

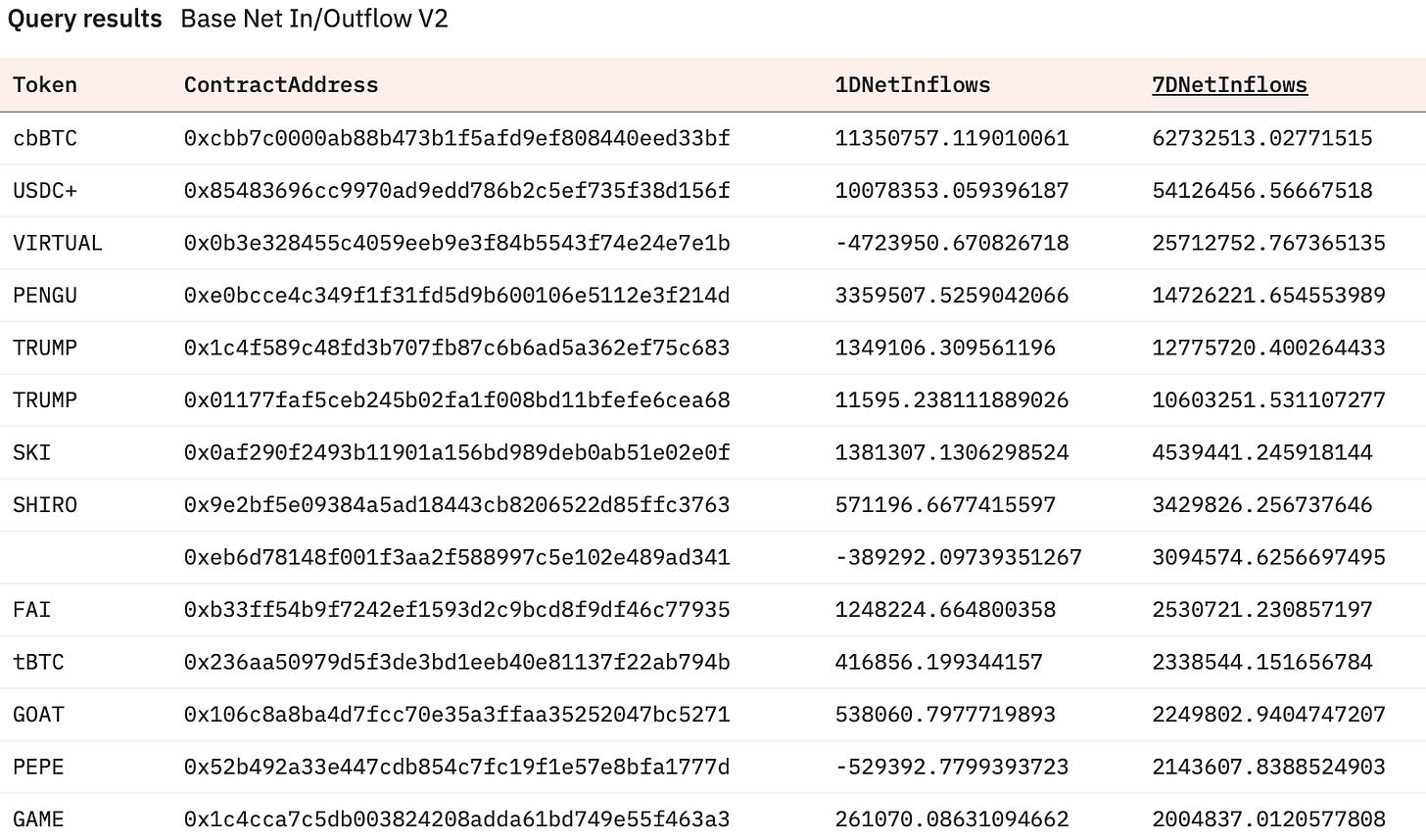

People are a little bit more liberal on Base as they are more interested in holding cbBTC instead of USDC+ which is a yield product. VIRTUAL has been accumulated heavily over the past week and had a crazy run which is taking a breather now which can be seen in the 1 day sells. FAI (Freysa AI) is the latest AI runner that has flown under the radar on Base. While the GAME framework on Virtuals finally is getting attention although it did take some time.

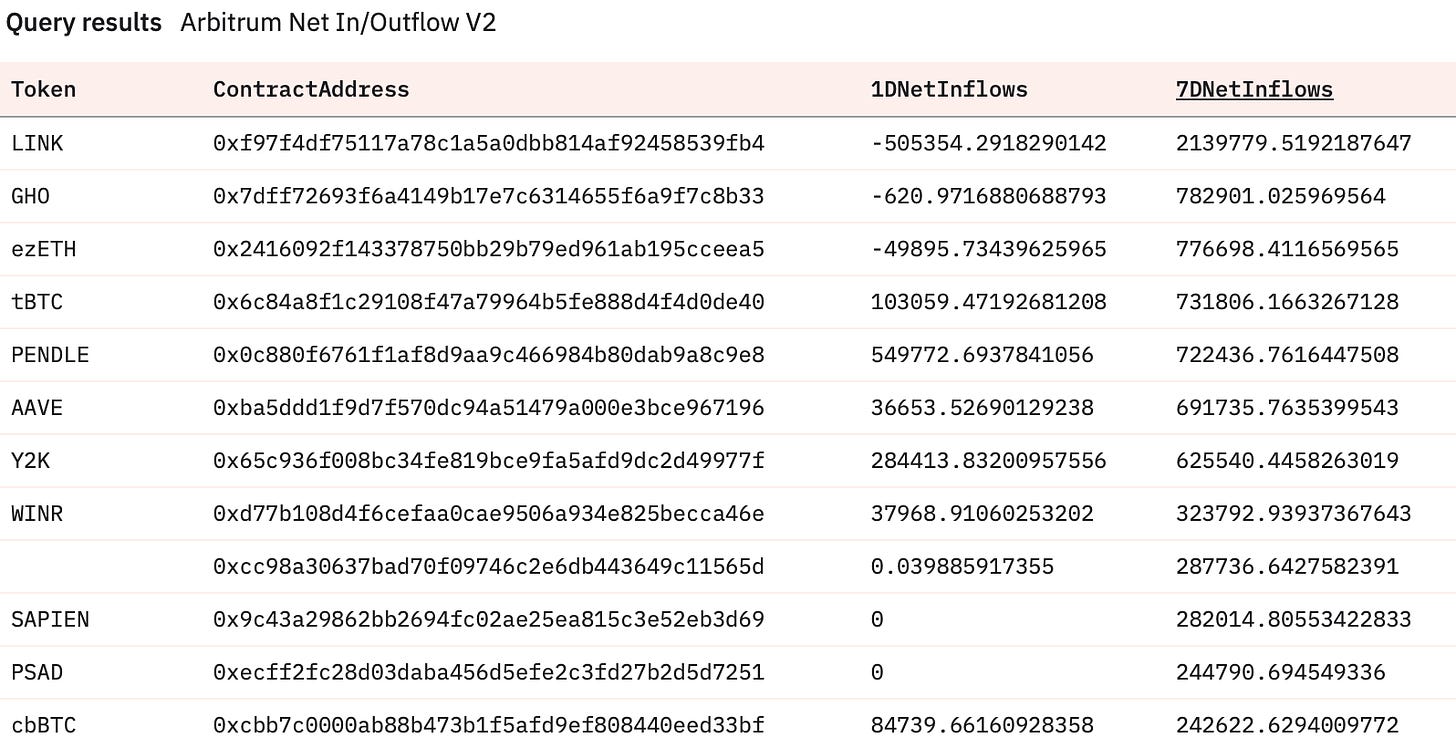

The Arbitrum native tokens that have received a lot of positive flows over the past week are PENDLE, Y2K, and WINR. Pendle for having a lot of BTCfi integrations planned. Y2K for planning on rebranding their token and launching Fractality on Hyperliquid. WINR announced new updates for the JustBet platform. Otherwise, not really much to see here.

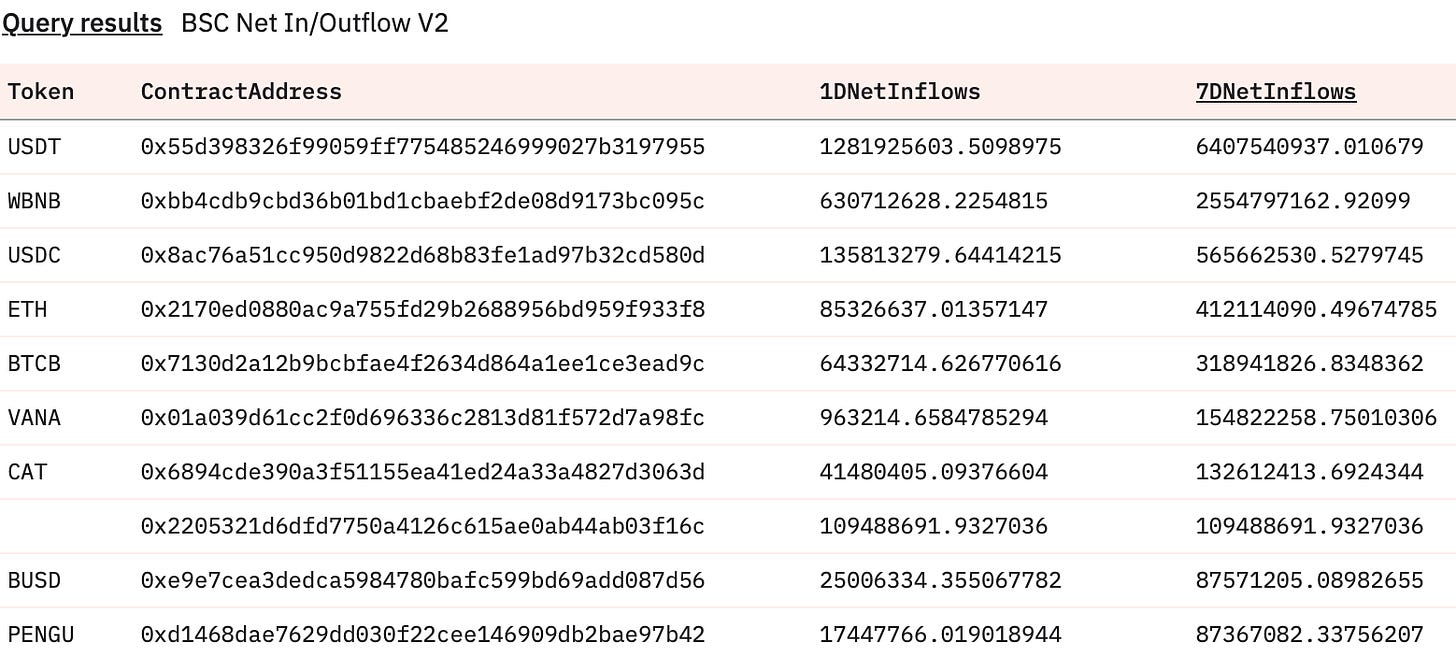

Same story on BNB with people being defensive,the only thing that stands out here is the inflows for CAT after it got listed on Binance. Otherwise, nothing interesting really.

Sleuthing

Some hopium for ETH holders. December 2020 all over again.

Token Unlocks

ADA - 0.05% of supply worth $17.50m on Dec 21st

MRS - 11.87% of supply worth $42.50m on Dec 23rd

EIGEN - 0.61% of supply worth $5.92m on Dec 24th

ENA - 0.44% of supply worth $13.69m on Dec 25th

IMX - 1.45% of supply worth $37.02m on Dec 27th

Don’t forget that there will be a 2-week break for the newsletter from today as I’m planning to enjoy the holidays with friends and family to take my mind off things (if I can).

Thanks for being a long-time reader of this newsletter. Merry Christmas and Happy Holidays to everyone. Hope you have a great time with your loved ones.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.

Happy holidays, you deserve a break :)

Have a great Christmas break! :)