First of all, Happy New Year and it is great to be back after a good break. Unfortunately, the first weekly newsletter of the year is an altcoin bloodbath since people think the cycle seems to be over.

There’s a lot of Bitcoin FUD going on due to the DOJ being cleared to sell the confiscated Bitcoin the U.S. is holding. However, they have roughly two weeks to do this before Trump gets in. Survive and cool off the leverage.

Remember that the market bottoms on bad news and tops on good news.

Market Digest

DOJ gets “clearance” to sell $6.5B Bitcoin (this lacks nuance but a headline is a headline)

Do Kwon pleads not guilty to U.S. charges

Unipcs thread about developing conviction

Resdegen thread about portfolio management

Czech National Bank Governor considers BTC as part of future reserve strategy

Bug on Bittensor EVM

Dolomite announces DOLO and Berachain launch

Strive files to launch Bitcoin bond ETF

Gearbox shares 2025 vision

Cryptocred thread on lowering your IQ

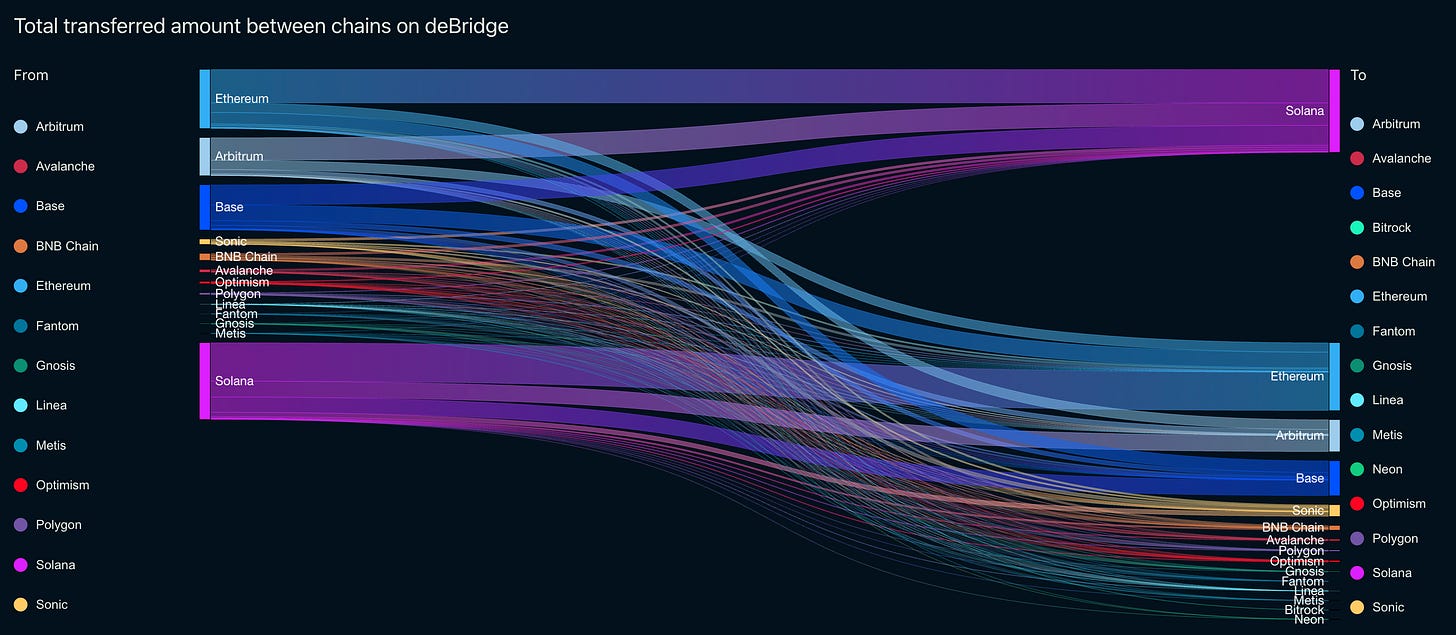

Bridge Flow

Capital has continued to be sucked to Solana throughout this whole bull cycle, it only tends to slow down when people are uncertain and want safety which has happened in the last 48 hours with capital migrating back to Ethereum again.

Despite Sonic being a new chain they have struggled to capture any significant amount of capital so far.

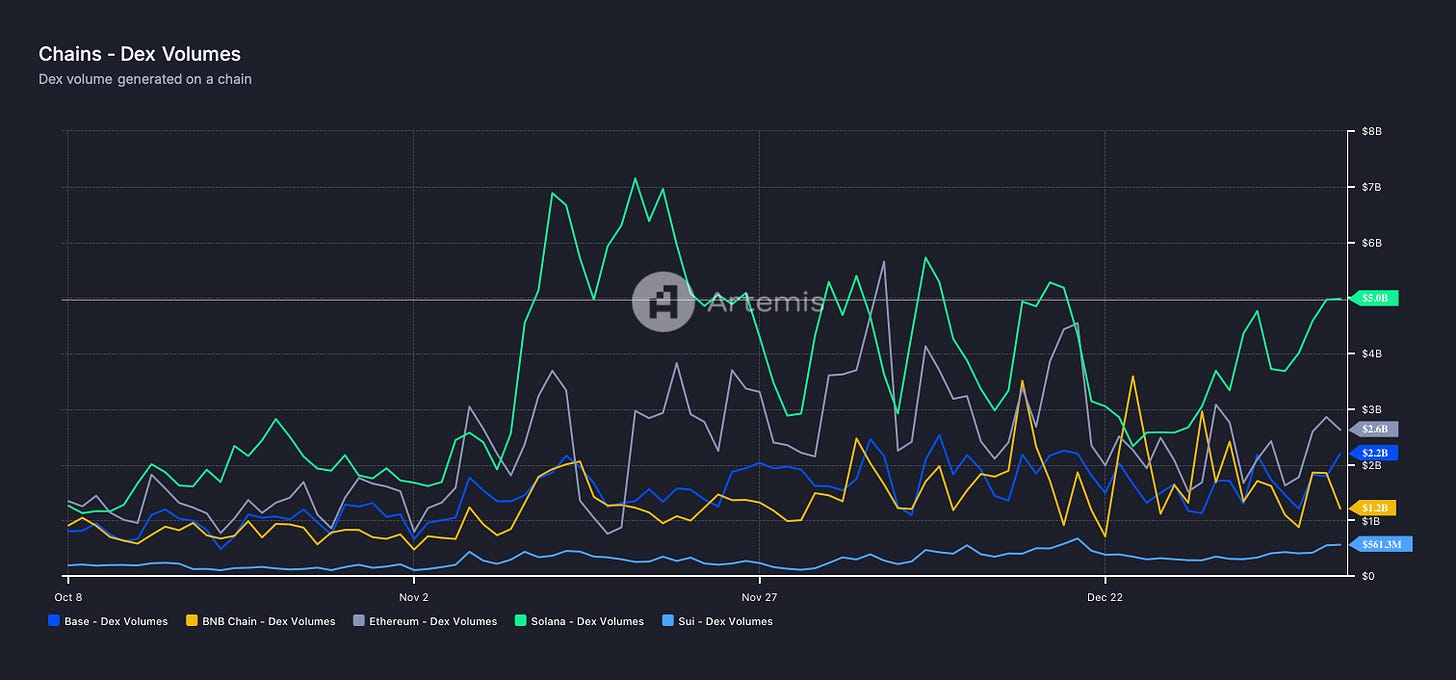

DEX Volumes

Dex volumes were at their highest post-election in November but have remained around the highs throughout this time. Right now, they are not showing any signs of slowing down, and I will sound the alarm when they do.

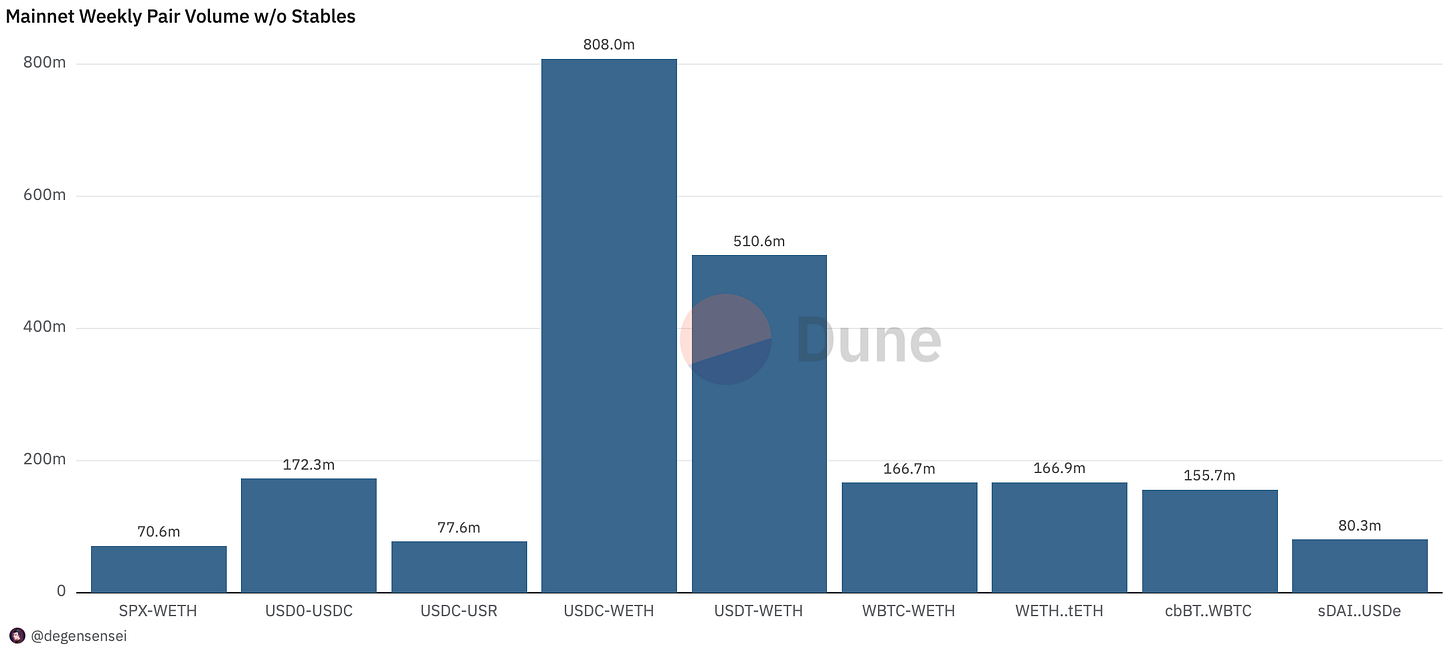

Pair Volumes

Other than SPX waking up from a long consolidation period and pumping to new all-time highs again, there is not much to see on the Ethereum mainnet as people are very stablecoin-heavy at the moment.

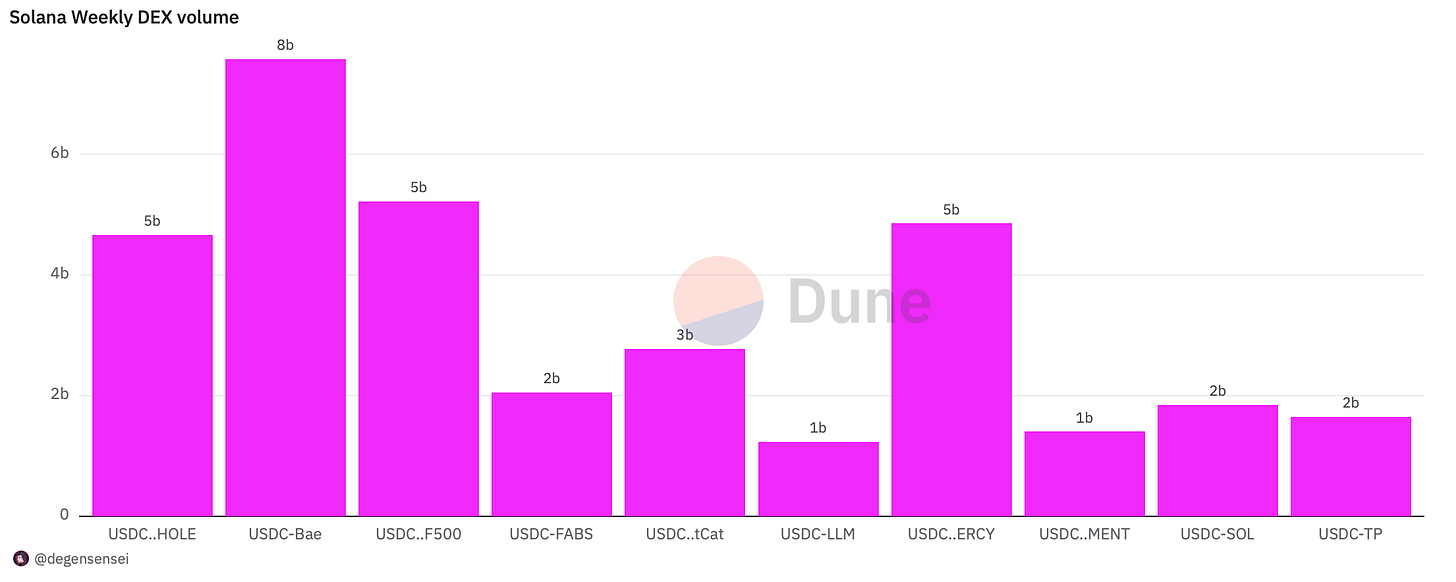

With there being an evident saturation in AI coins, meme derivatives of AI16z and Fartcoin are taking the centerpiece on Solana, with tokens such as Butthole, and LLM dominating volumes over there (yes, seriously).

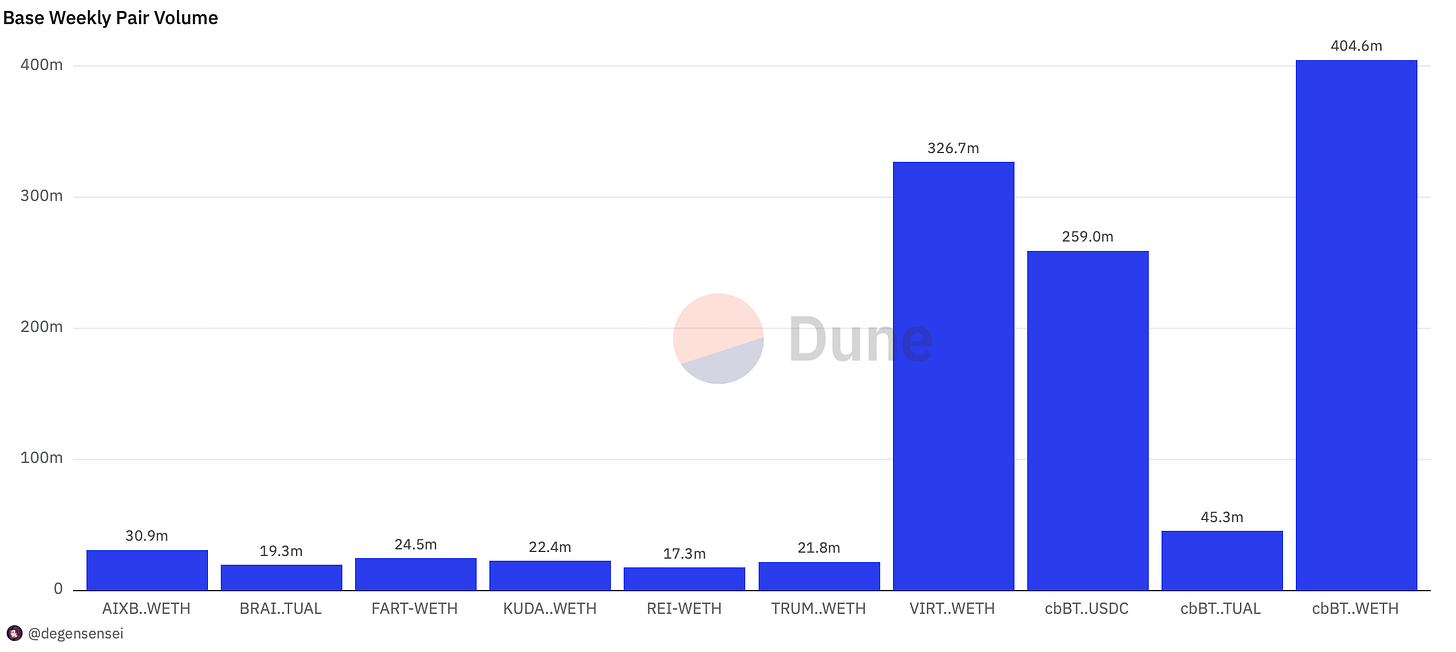

Volume is more spread out on Base with Virtual still dominating the flows despite being in a clear downtrend now, volume is volume and the flywheel still runs through the VIRTUAL token. AIXBT continues to be the leading agent while REI has continued to perform very well. Kudai is the latest DeFi AI Agent that launched through the GMX blueberry club.

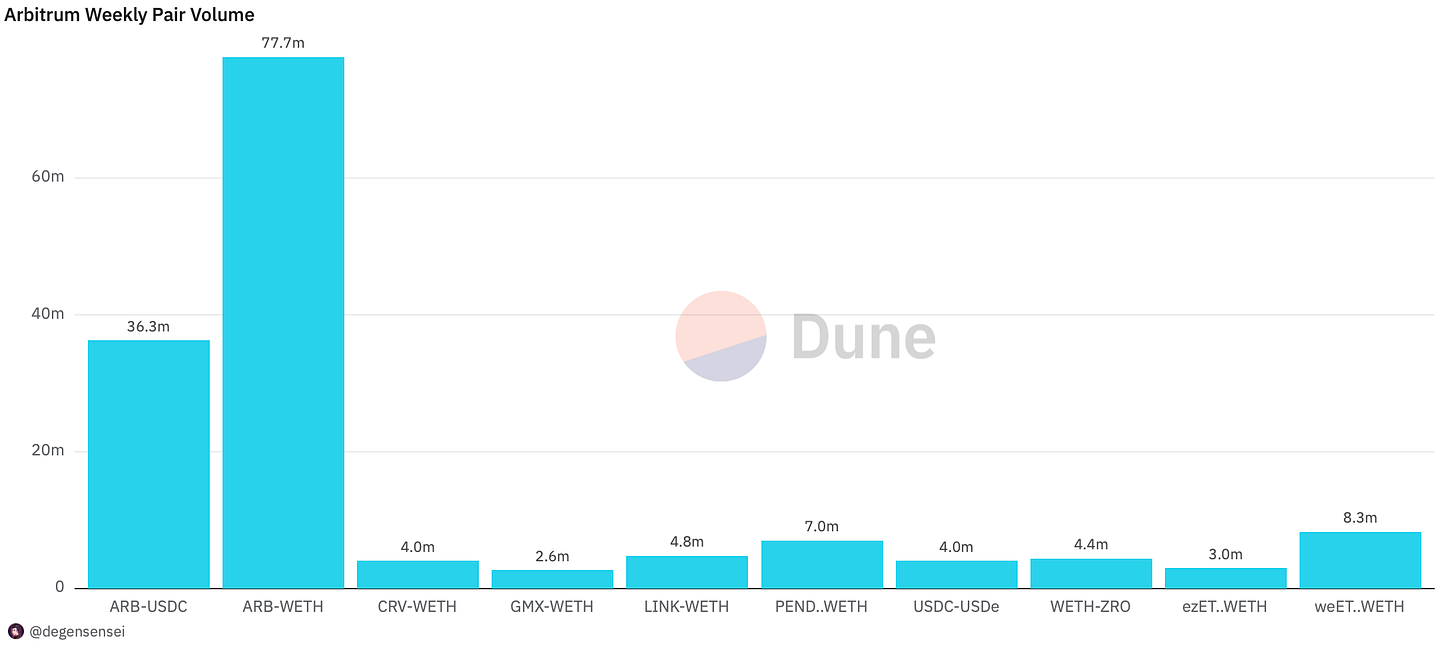

A few tokens doing small amounts of volume such as PENDLE, ZRO and GMX are all Arbitrum native. Outside of that, not really much to see here for now.

NFT Trading

Unless you are holding a Pudgy penguin there has been no escaping from the latest bloodbath. The Pudgies are likely doing well as they are poised to receive an airdrop when Abstract chain launches.

Interesting new mints?

Let’s not talk about that.

Net Inflow

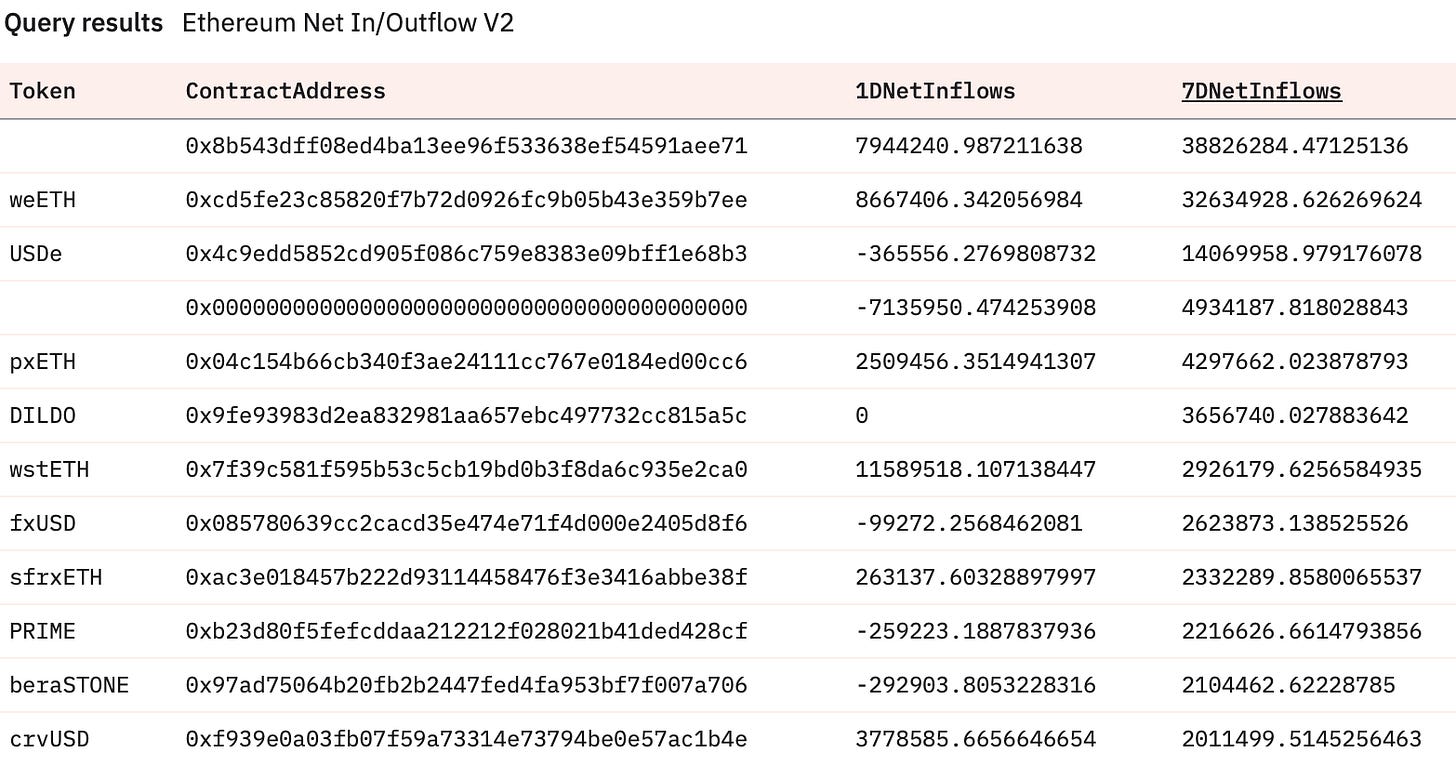

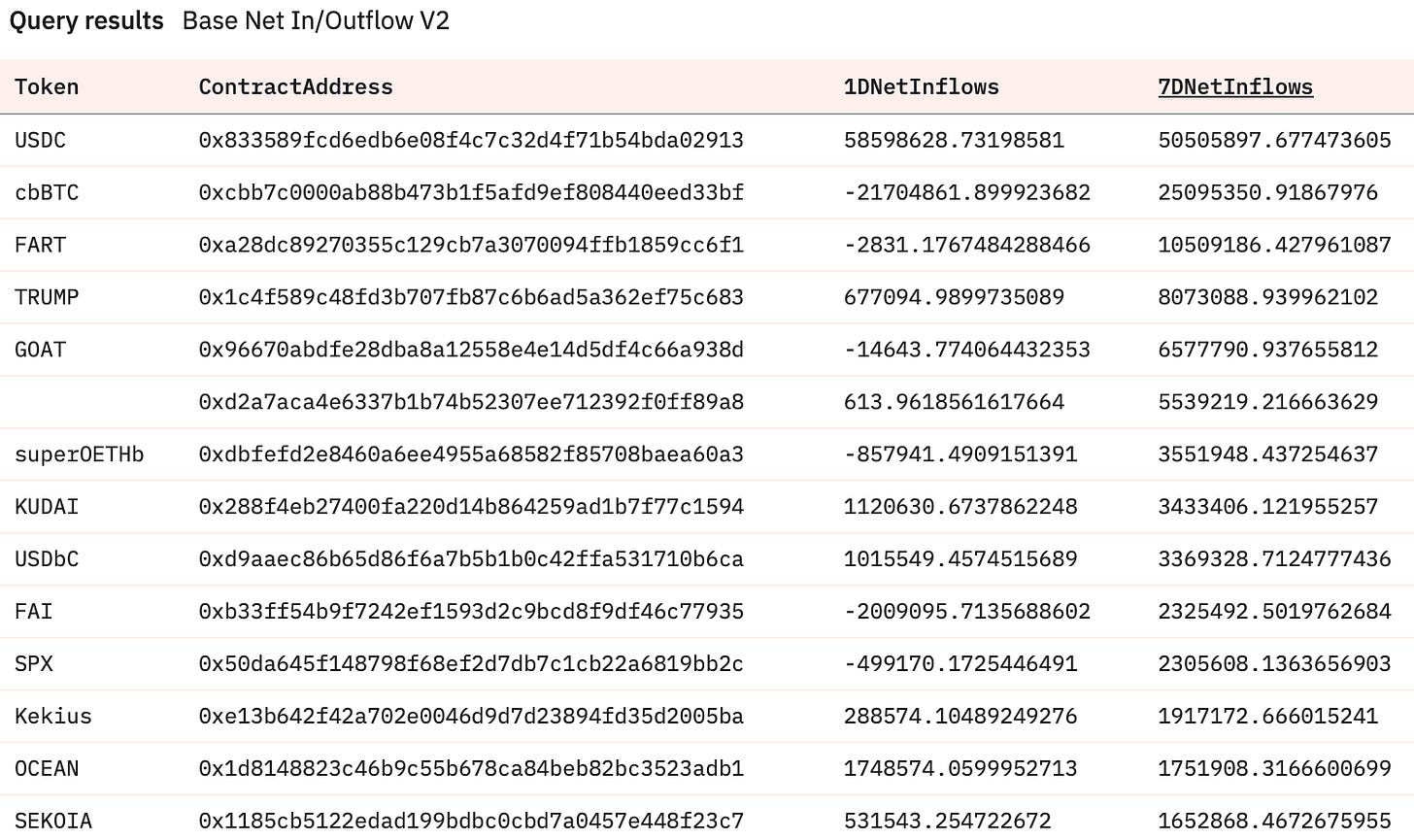

Not a lot of risk taking going on here, understandibly so with it mainly being farming of ETH that is taking place on mainnet. The main outlier here is PRIME that has been heavily accumulated over the week with 2.2M inflows going into the AI Wayfounder launch.

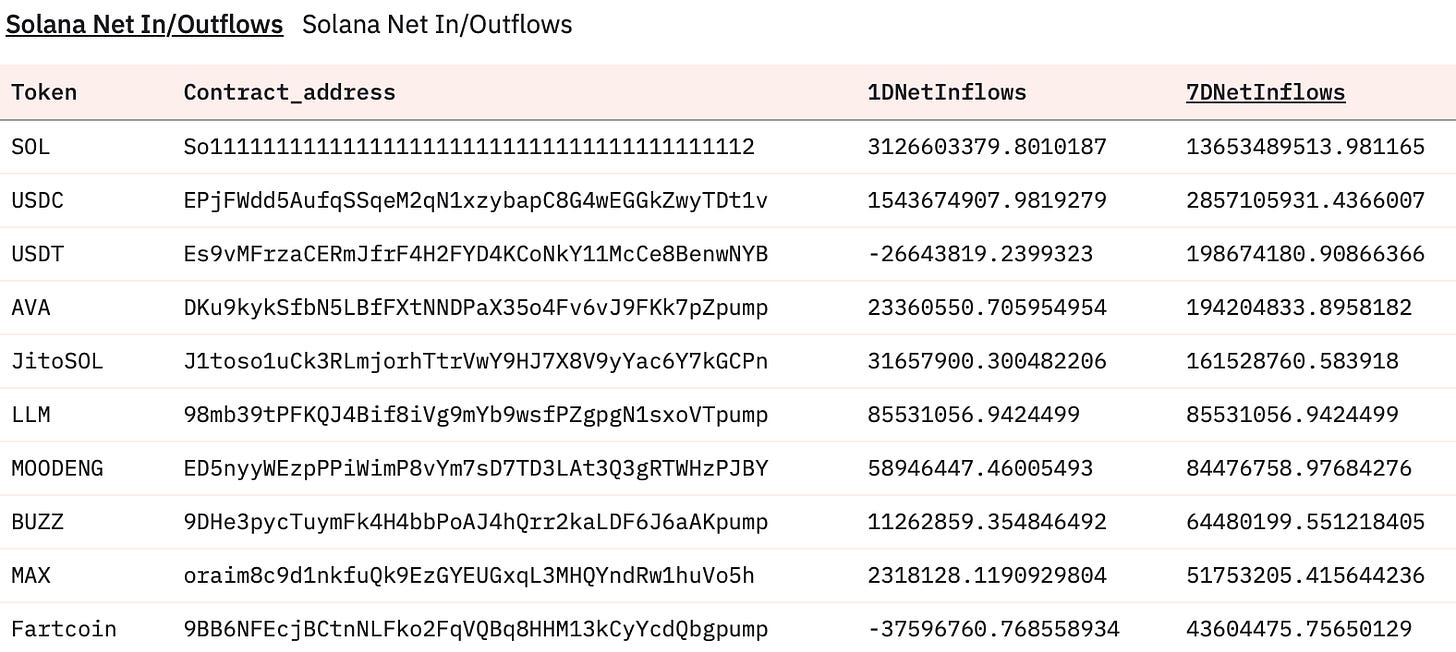

SOL has been the most “accumulated” token over the week which stems from people selling their altcoin positions into SOL and then a lot of that SOL being sold into stablecoins which you can see are the top three on this list. AVA has outperformed the whole market with incredible performance while LLM was the latest onchain runner of the week.

Base has also been a chain of derisking with selective outperformance as people have been venturing into USDC and cbBTC as safe havens. However, KUDAI launched and have performed very well during this turmoil (always respect teams that launch in bad market conditions). While Sekoia has been relatively unfazed as a AI investment fund.

Sleuthing

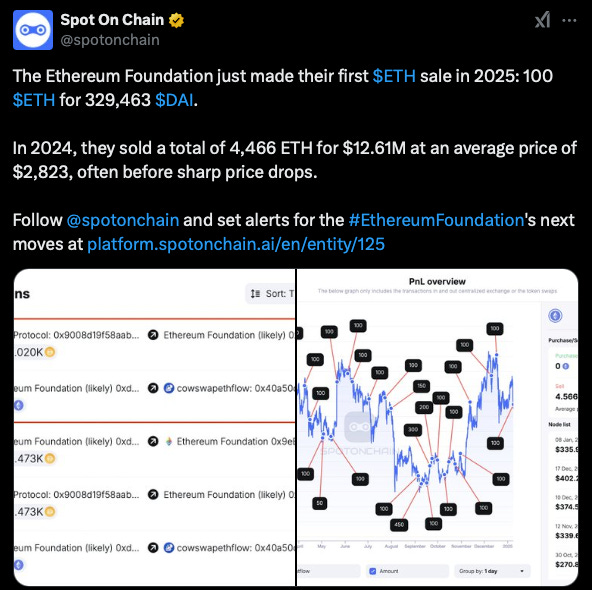

Ethereum foundation sold a small amount of ETH again which is frustrating people.

At this stage, it is time capitulation based on the reaction to a 100 ETH sale. Although I can understand it due to the underperformance of Ethereum this cycle.

Token Unlocks

OP - 0.33% of supply worth $8.05m today

MOCA - 0.15% of supply worth $571.46k on Jan 10th

APT - 0.15% of supply worth $99.53m on Jan 11th

IO - 2.50% of supply worth $9.81m on Jan 11th

RENDER - 0.10% of supply worth $571.46k on Jan 12th

AXS - 0.52% of supply worth $5.11m on Jan 12th

Don’t be scared and capitulate your bags. See the bigger picture and you’ll be fine.

It’s great to be back.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.

Interestingly, over last 7d, vols in and out of SOL are net flat..