It’s a customary crypto tradition to go from “it’s so over” to “we are so back” very swiftly which we experienced this weekend and I do hope you didn’t capitulate your bags.

Since we went through that stage, we have had tons of positive news concerning Trump’s crypto policies, and the general feeling is that the future is positive for Crypto. Best believe you are in the right place at the right time, and the election did matter.

We remain in an AI bull market, and it is no surprise that the market sector bounced the hardest after the market slump. The cycle theme has remained to be memes and AI, and it will likely continue that way for the foreseeable future unless we get a catalyst that changes that significantly.

Be water.

Market Digest

Trump will revamp crypto policy and pause current enforcement

Senator Lumins says “things are about to get crazy”

The U.S. government says seized bitcoin from the 2016 Bitfinex hack should be returned in-kind

Tether group will relocate to El Salvador

XRP surpasses $3

AIaccelerate DAO launch drama with influencers dumping

MicroStrategy buys another $243M worth of BTC

Virtuals announces buyback and burn for agents from tax generated

Plume airdrop checker

Speculation about a US-based altcoin reserve (source dodgy)

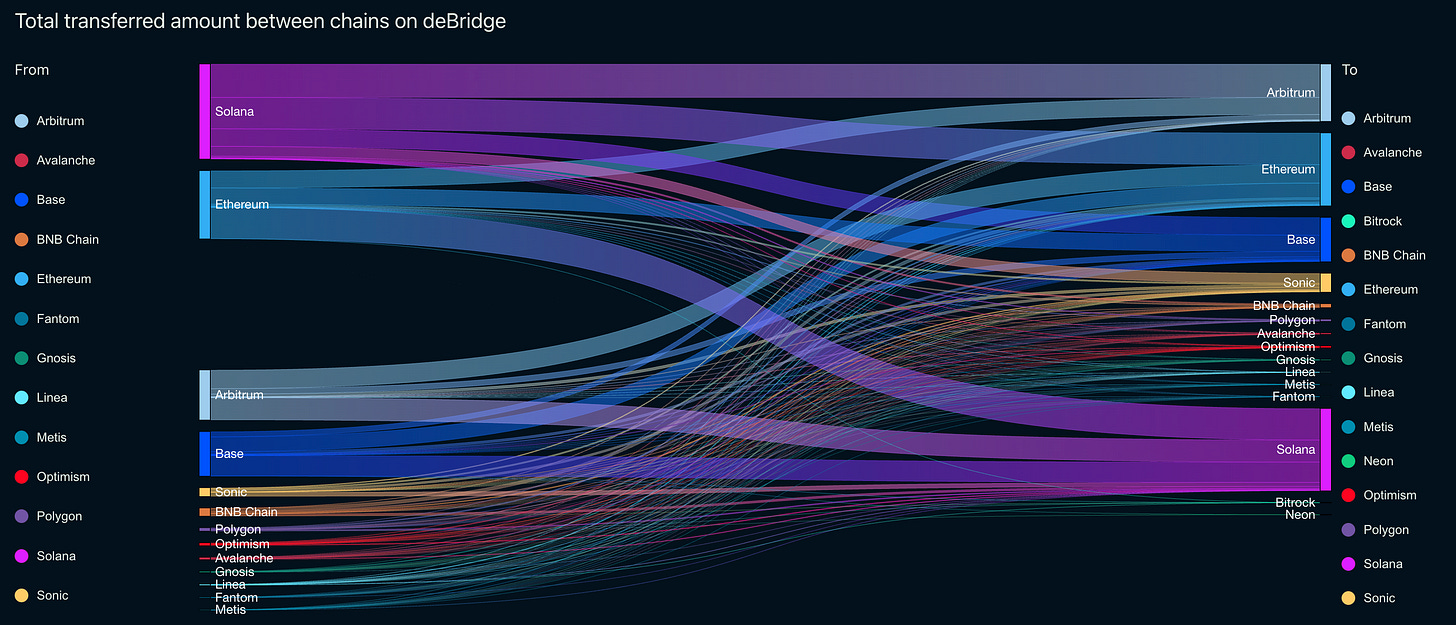

Bridge Flow

Outflows have continued from Solana surprisingly with it flowing to Arbitrum. However, when you look at it more closely it is likely because people have bridged that capital over to HyperLiquid. This is the first time in a very long time that it is on top of the charts. Don’t be lazy and check out the Hyperliquid ecosystem.

Otherwise, a lot of capital has flowed to both Ethereum and Base which is worth keeping an eye on. Still, there are still more variables in play with more bridges and Solana inflows are still relatively okay. I would like to see an aggregator check flows to XRP though as it likely is accelerating now.

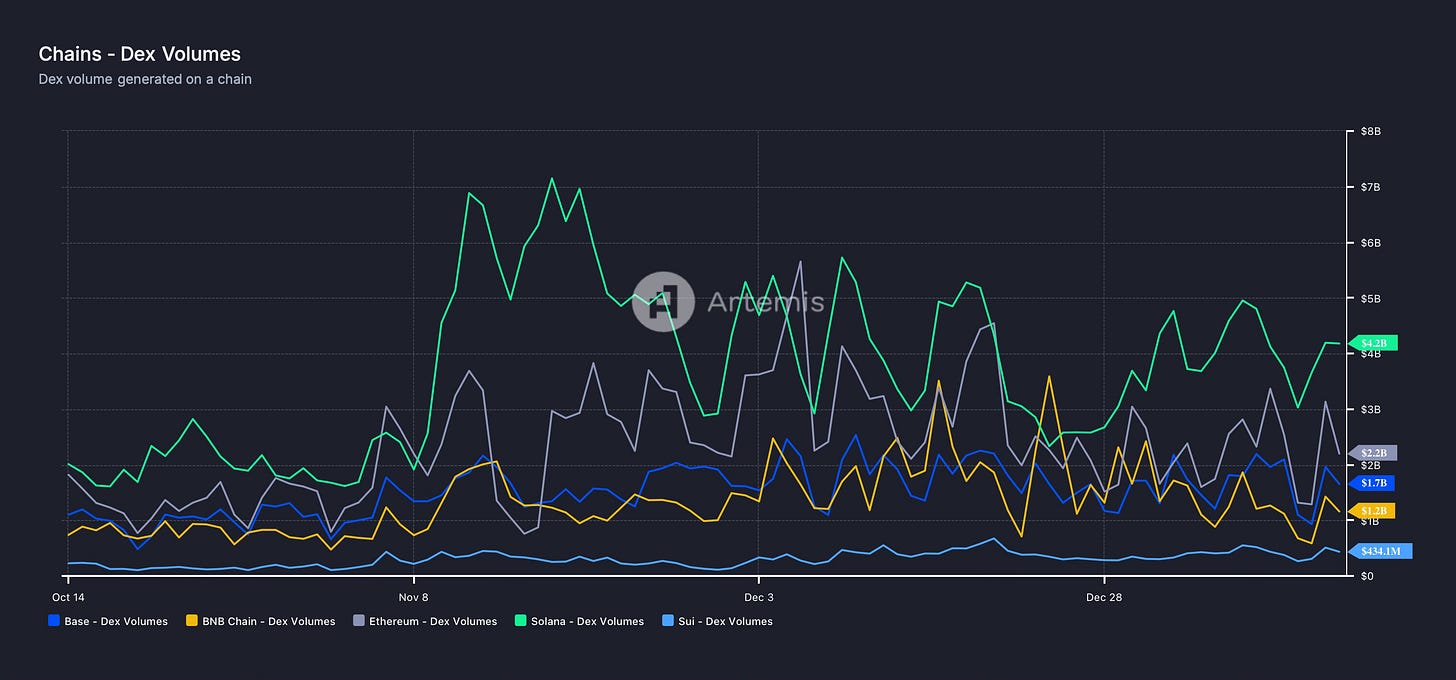

DEX Volumes

No chain comes close to Solana regarding onchain volume, which is why all the price action is much more aggressive on the chain. Tokens multiply in value and experience 70% corrections daily. For the onchain degen, it’s perfect, but for the slower-paced individual, it can be exhausting, which is why chains like Base exist with a slower pace. Pick your poison.

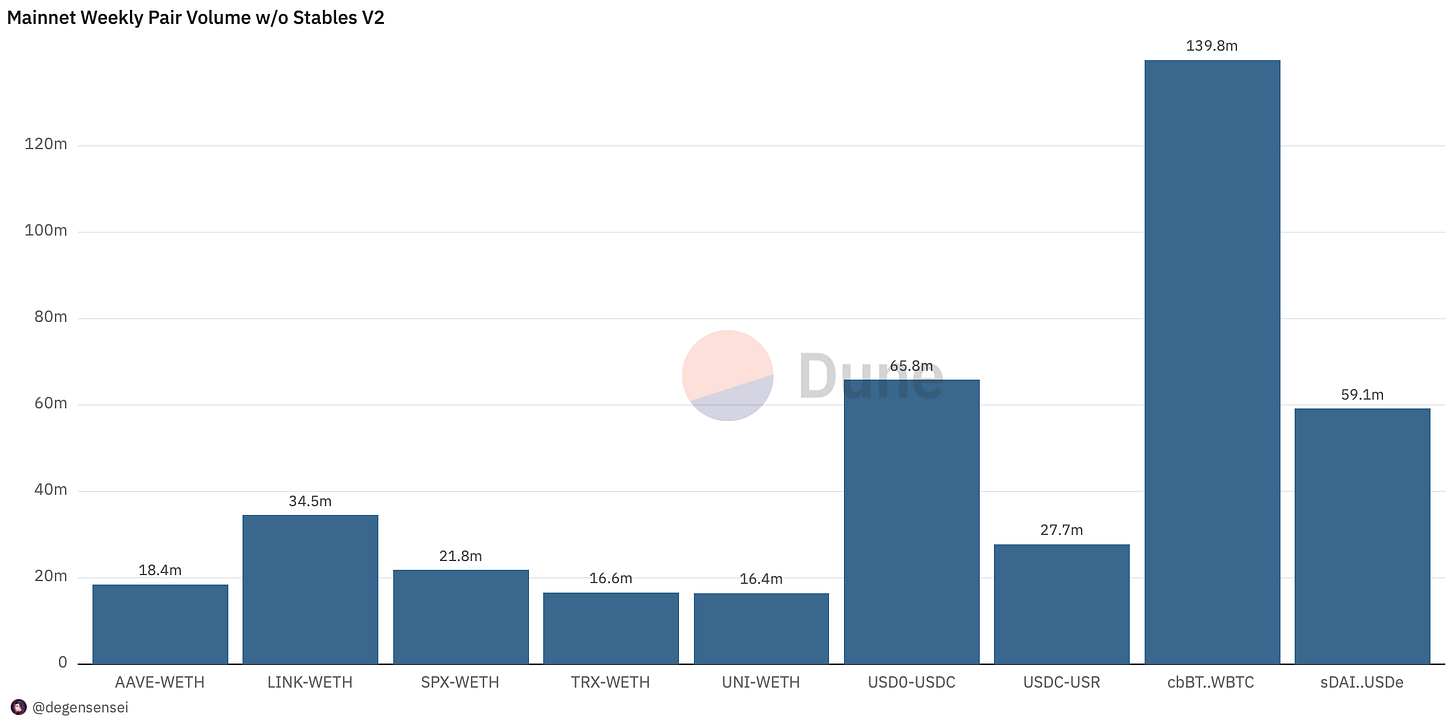

Pair Volumes

The large caps are where the attention is at on Ethereum as AAVE, LINK and UNI are leading onchain volumes outside of SPX which is emerging as one of the cycle winners and shouldn’t be disregarded at this stage. TRX is preparing plans for USDD 2.0 and is doing a lot of volume as well.

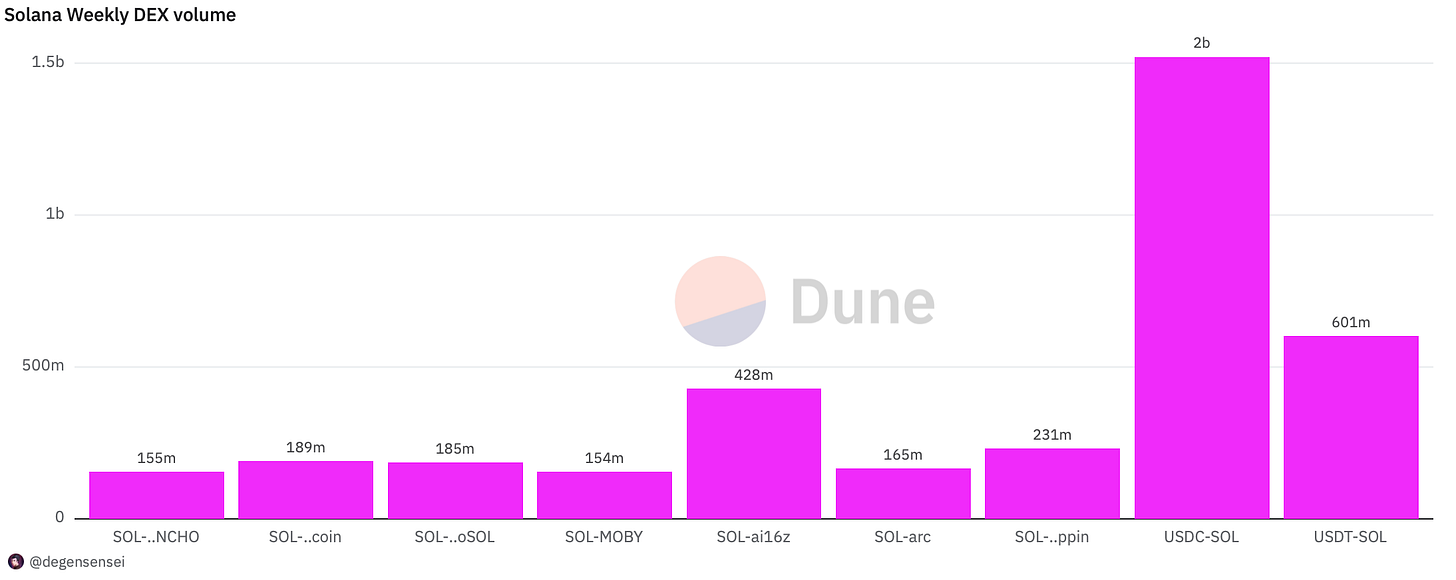

Ai16z dominates the volume this week after the founder was involved in the Aiccelarate drama and then had a crash out moment on Twitter which added to the volatile week we have had. Apart from that, we have seen strong coins emerge such as ARC, Pippin, Concho, and Fartcoin that have emerged even more robust after the sell-off.

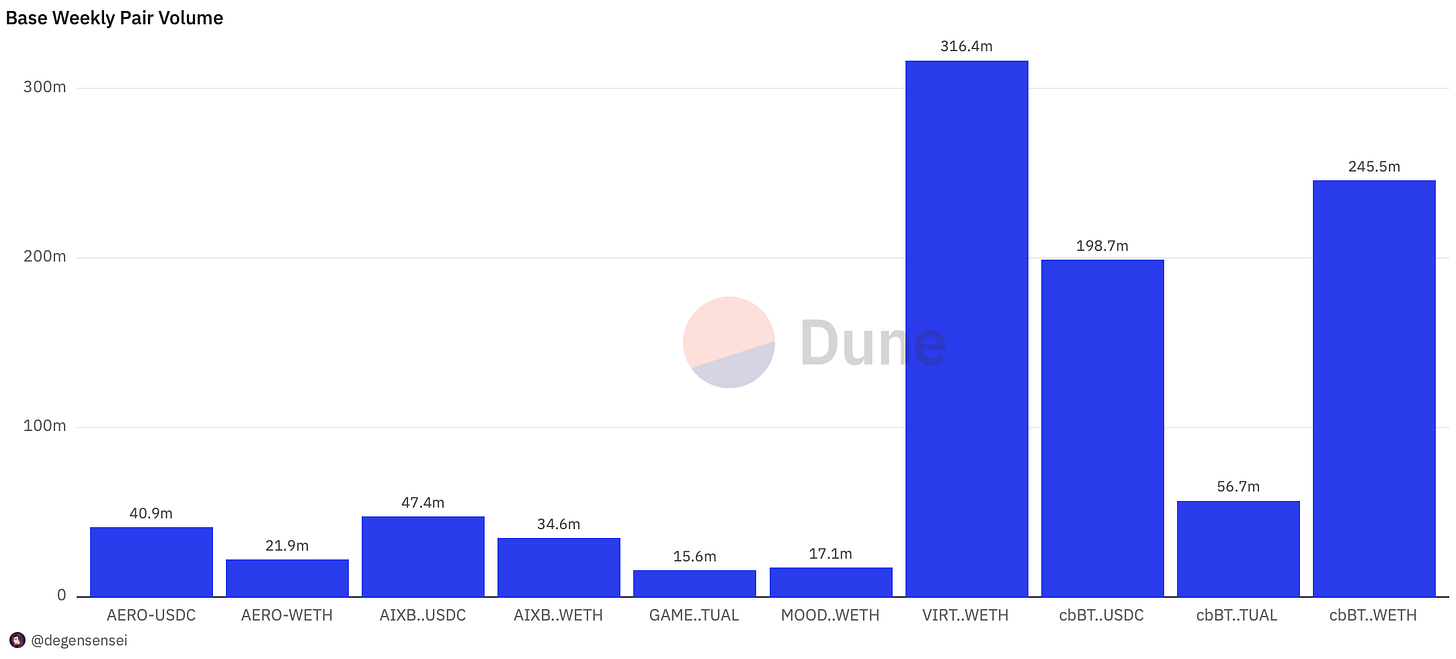

Base sold off before Solana but is recovering very strongly now, with Virtuals doing the smart move of bootstrapping its whole ecosystem. AIXBT, which is the #1 KOL on Twitter has gone from strength to strength by pushing for all-time highs as well. While many of the other bots are following accordingly, such as GAME.

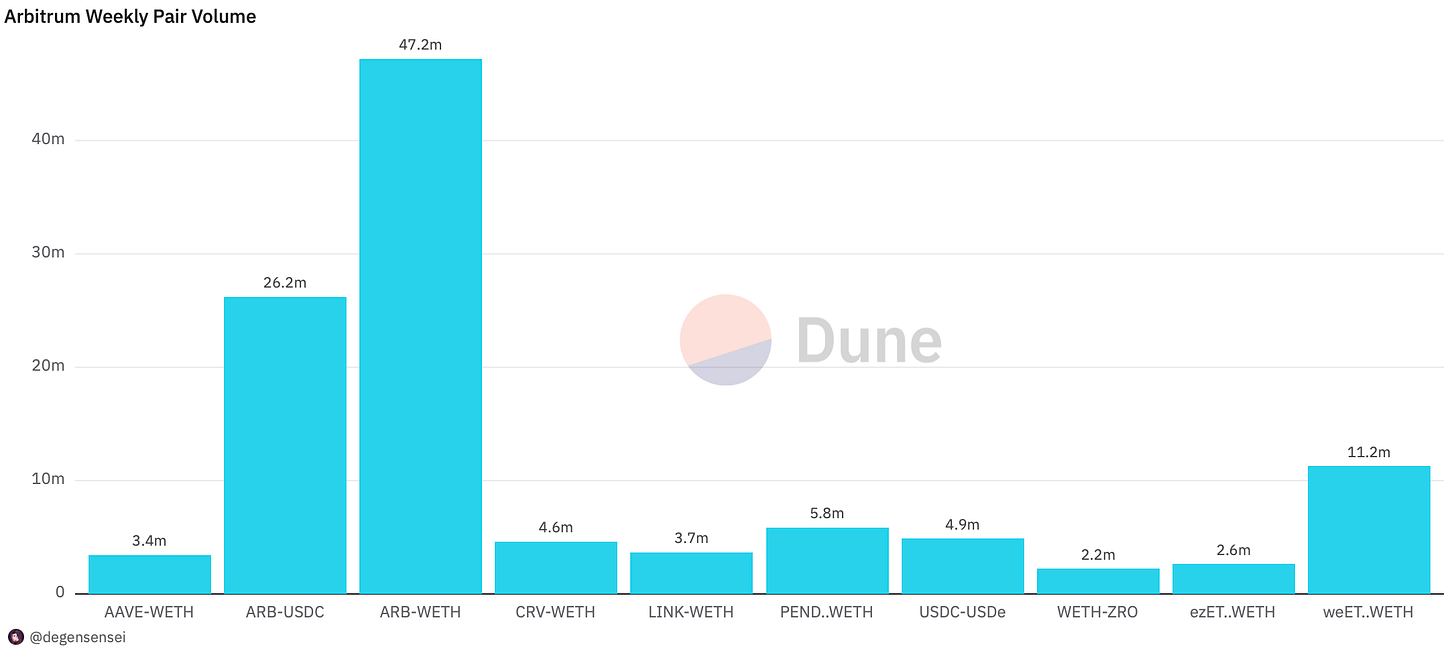

The less said about this ecosystem the better, for now, tragic volume outside of ARB and Pendle. However, I will give them that they are making an actual effort to make DeFAI (DeFi AI) a reality there.

NFT Trading

Azuki has been one of the strongest-performing collections over the past week, and with the release of the ANIME token, 50% of the supply will go to Azuki token holders. CryptoPunks are making a strong comeback to separate themselves from the rest of the pack, as Pudgy Penguin was edging closer to them in floor price.

Seems like provenance does matter.

Net Inflow

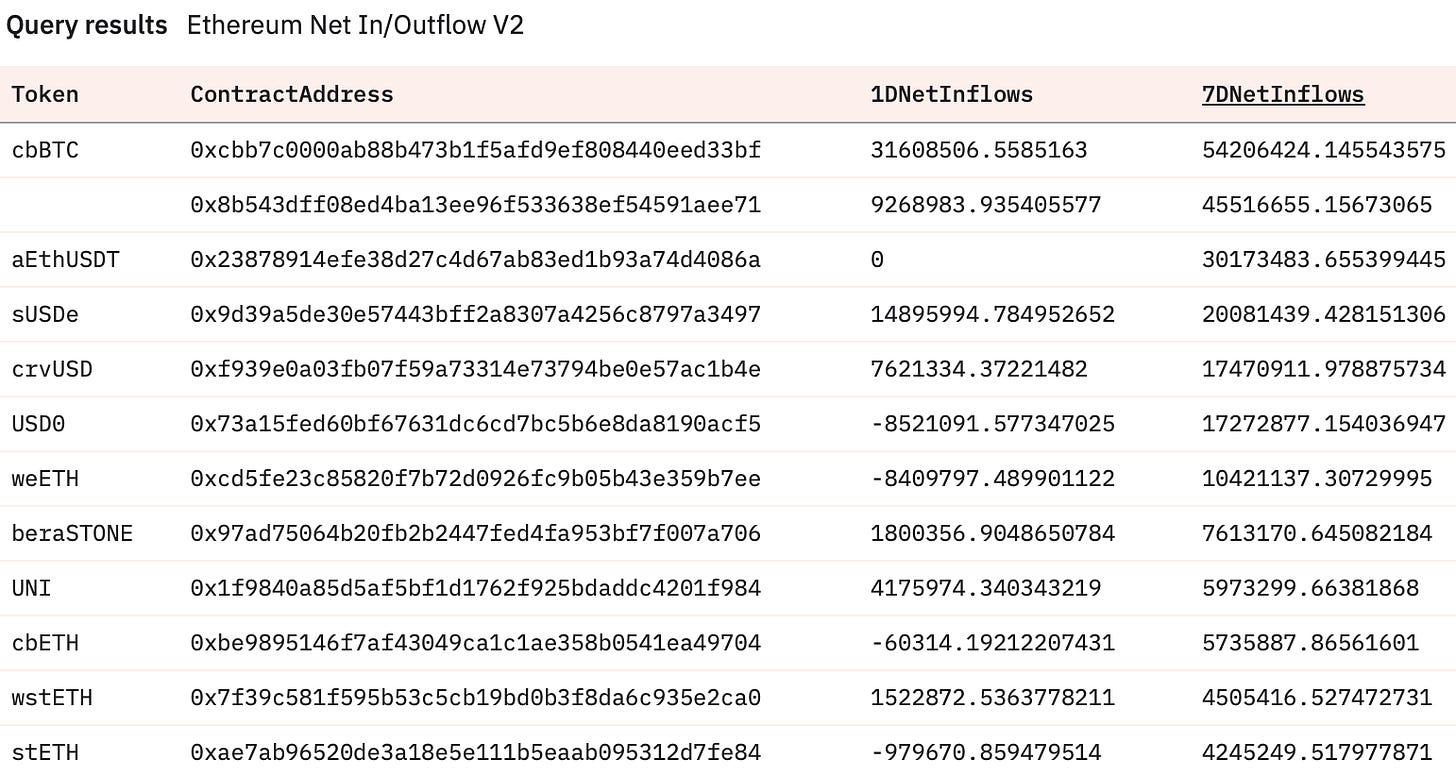

Ethereum mainnet onchain activity moves slower than the rest of the ecosystems likely because there’s big money here that is relatively risk averse. The only significant alt these people have bought with size over the last week is UNI. Thus, if you are someone who is trying to grow your portfolio that might be smaller, this is not the place to do it.

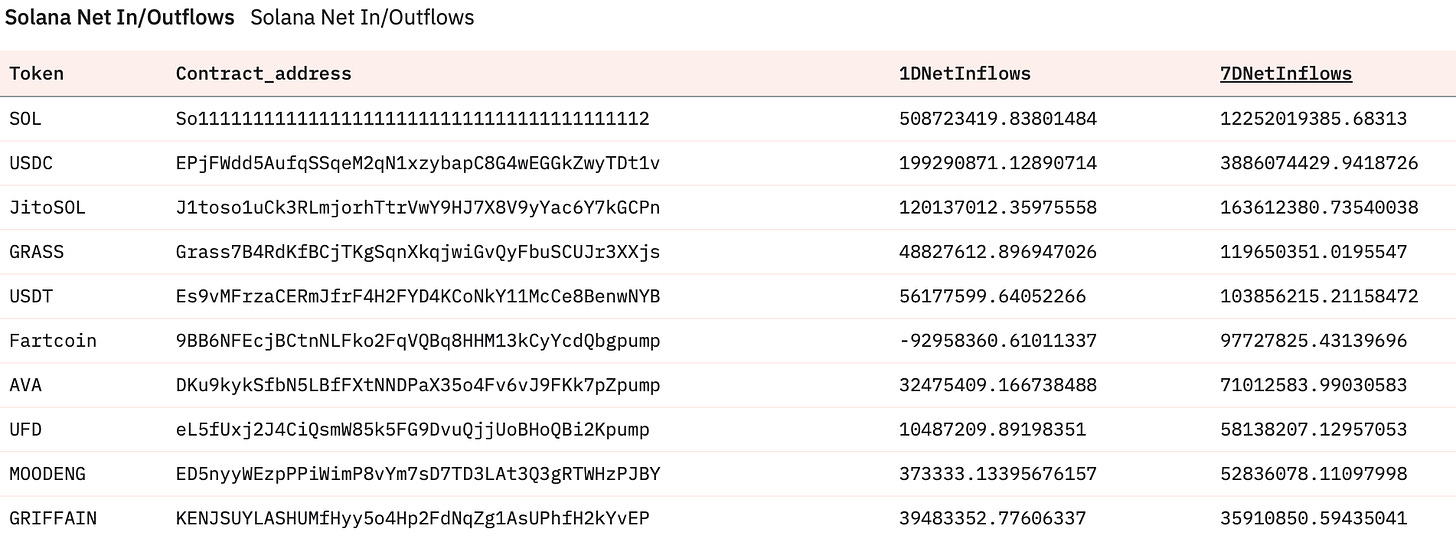

As you can see, Solana's risk appetite is completely different. They continued to accumulate what they perceived to be strong tokens throughout the market turndown. SOL, GRASS, Fartcoin, AVA, UFD, MOODENG, and GRIFFAIN were the degens' choices, and millions worth of tokens changed hands and were accumulated over the past week.

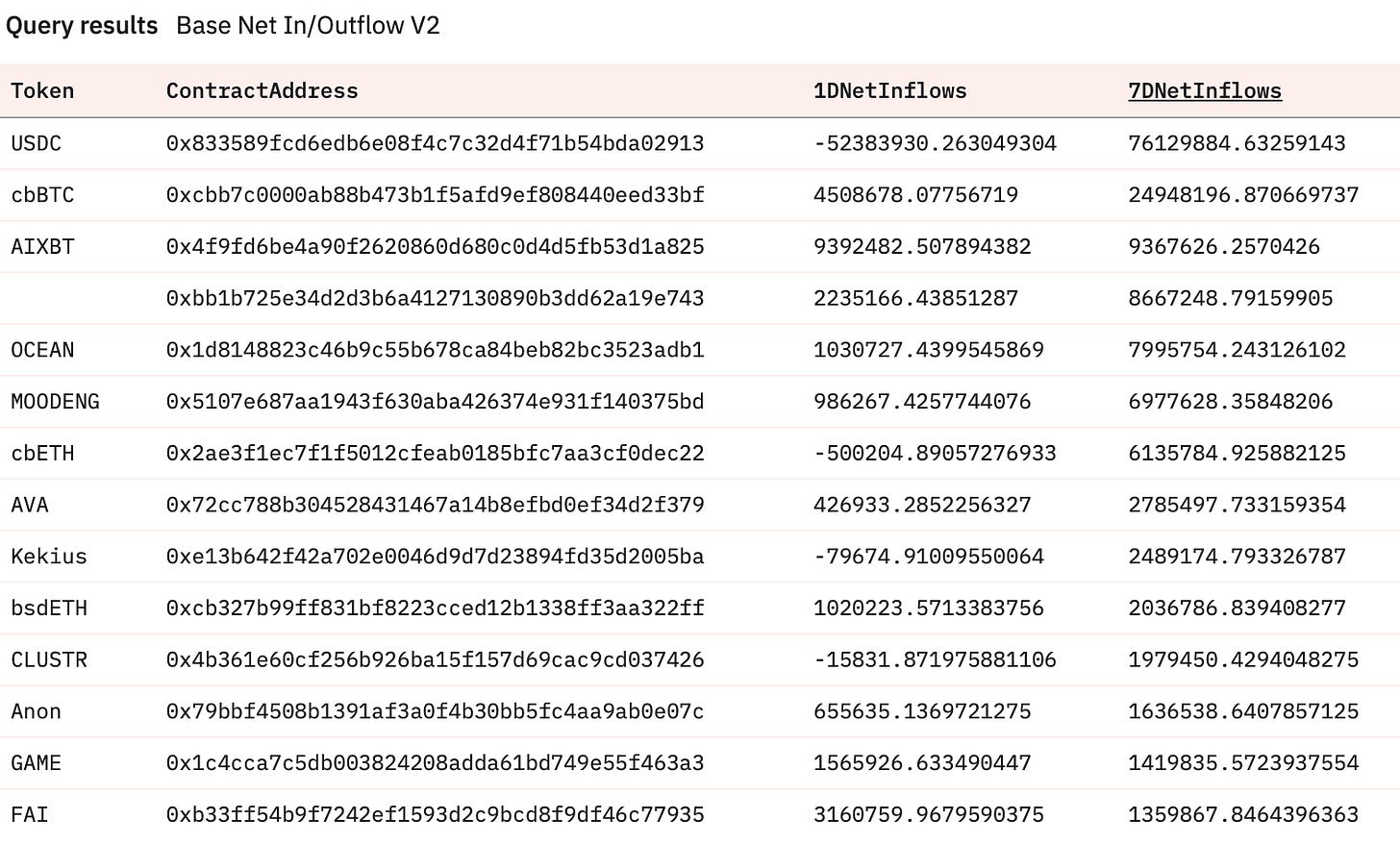

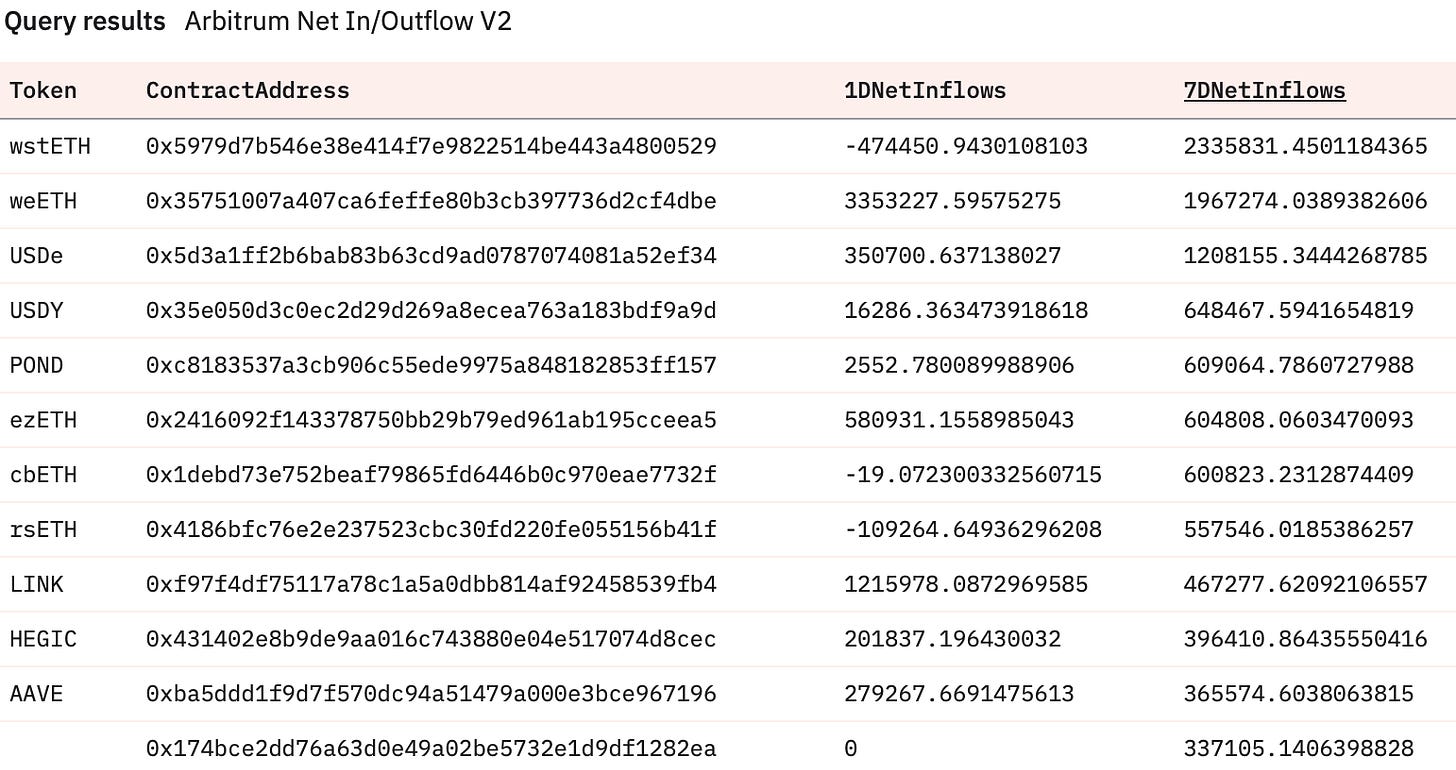

Base is also an ecosystem worth spending more time on, even if the top accumulated token over the past week was USDC. As you see, AIXBT is leading the flows (it also helps that it got a Binance listing), and CLUSTR, GAME, and FAI are all making the list.

I prefer to not speak, if Arbitrum doesn’t pick up I’ll likely exclude it going forward as it continues to be a waste of time.

Sleuthing

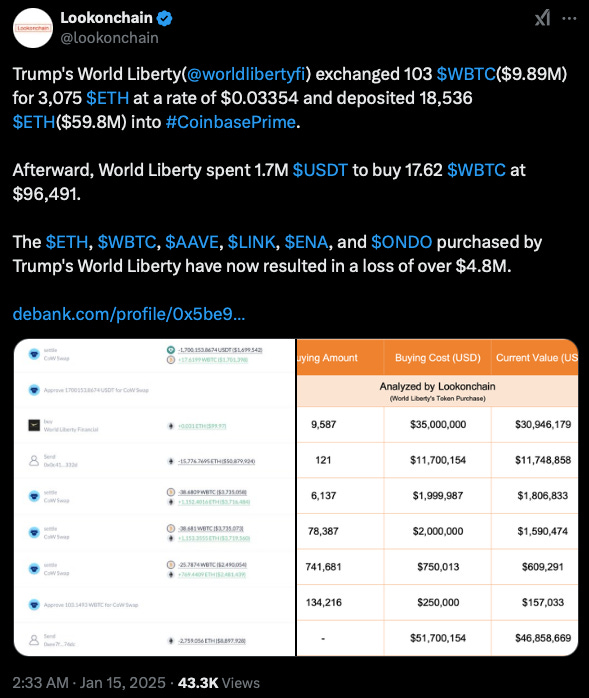

Is there hope for Ethereum holders?

Time will tell.

Token Unlocks

PRIME - 1.42% of supply worth $11.53m on Jan 17th

ASTR - 0.13% of supply worth $599.33k on Jan 17th

MOCA - 0.15% of supply worth $514.86k on Jan 17th

1INCH - 0.03% of supply worth $139.05k on Jan 17th

APE - 2.16% of supply worth $17.32m on Jan 17th

ONDO - 134.21% of supply worth $2.39b on Jan 18th

QAI - 4.79% of supply worth $20.65m on Jan 18th

MANTA - 0.06% of supply worth $169.26k on Jan 18th

FTN - 4.67% of supply worth 77.00m on Jan 21st

EIGEN - 0.55% of supply worth $4.22m on Jan 21st

That ONDO unlock stands out and has been talked about for around 6 months. The price action of the ONDO token as it unlocks will likely tell a story of how to navigate around unlocks going forward. If it ends up not being a big deal then it can be disregarded going forward as we are in a bull market. If not, then a good lesson will be learned. Exciting times.

Expect some volatility going into the Trump inauguration but don’t fret even if alts go up and down violently over the coming days. Good times are ahead of us.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.