Shakeouts are designed to get the tourists out of the ride so the pretenders are out of the way. This is a scenario we have been experiencing right now as people's portfolios are bleeding while BTC remains above 100K. It continues to be a BTC cycle with continuous alt dispersion as the demand can’t keep up with the number of tokens generated every day. If you’re going to hold an alt you better make sure that you believe it will outperform BTC. However, I don’t believe BTC has topped yet but some volatility was what the doctor ordered.

People like to blame DeepSeek, the model a Chinese AI company built for the sell-off but the market was already exhausted and needed any reason to sell off. This was it. The reaction is more important than the news itself.

While DeepSeek took the world by storm, a new AI mode, Qwen, is already claimed to outperform it. The pace of AI development is accelerating.

While LTF traders were watching every minute of the FOMC, it was a nothing burger as usual. Stick to the plan.

Market Digest

China has 10 labs comparable to OpenAI, according to Indian Amazon worker

Uniswap to begin v4 deployments

XRP and SOL futures added to CME

Vine founder launches memecoin

Thorchain insolvency warning

Donald Trump signs executive order for Digital Asset Stockpile

Virtuals expanding to Solana

Jupiter Exchange acquires majority stake in Moonshot

OpenSea takes snapshot announces OpenSea 2 private beta

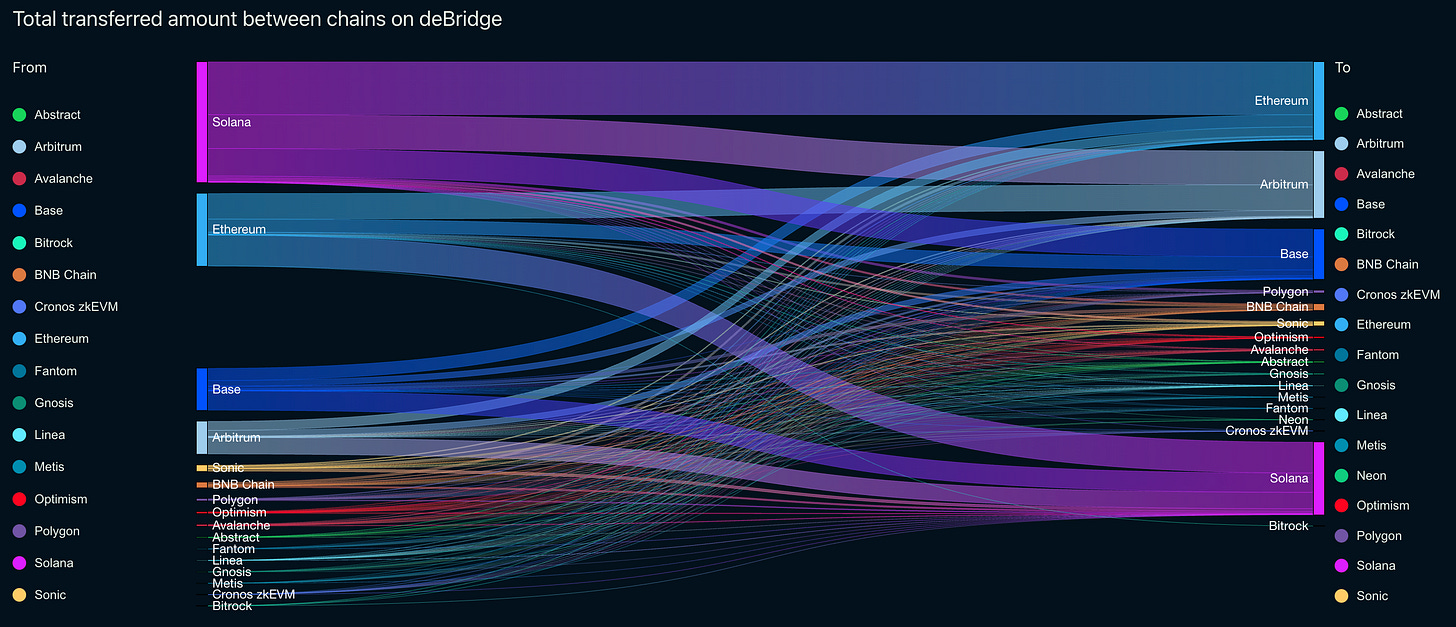

Bridge Flow

It’s almost standard during market uncertainty at this stage that people port their capital over to Ethereum from Solana as people view it as a safer venue. Meanwhile, when the risk appetite increases, it accelerates in the other direction. Capital has been flowing mainly to Ethereum and HyperLiquid (Arbitrum just acts as the intermittent bridge between the chains).

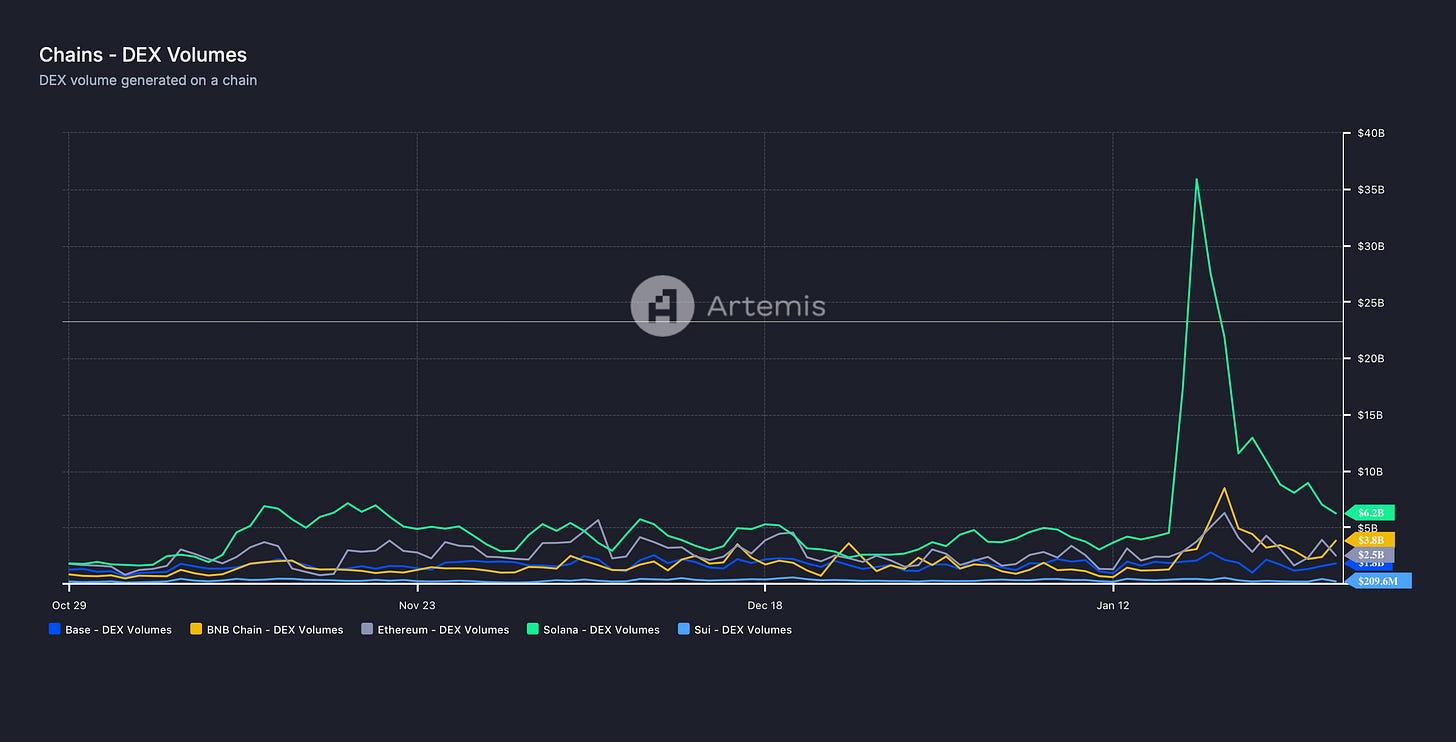

DEX Volumes

DEX volumes since the Trump and Melania launch has fallen off a cliff on Solana as it acted as a significant liquidity drain. Considering majority of people that “onboarded” to buy TRUMP on the day hasn’t made any other transactions, it wasn’t good for the onchain casino evidently. However, Base and BNB has continued to be very strong for their volume levels which is worth keeping an eye on.

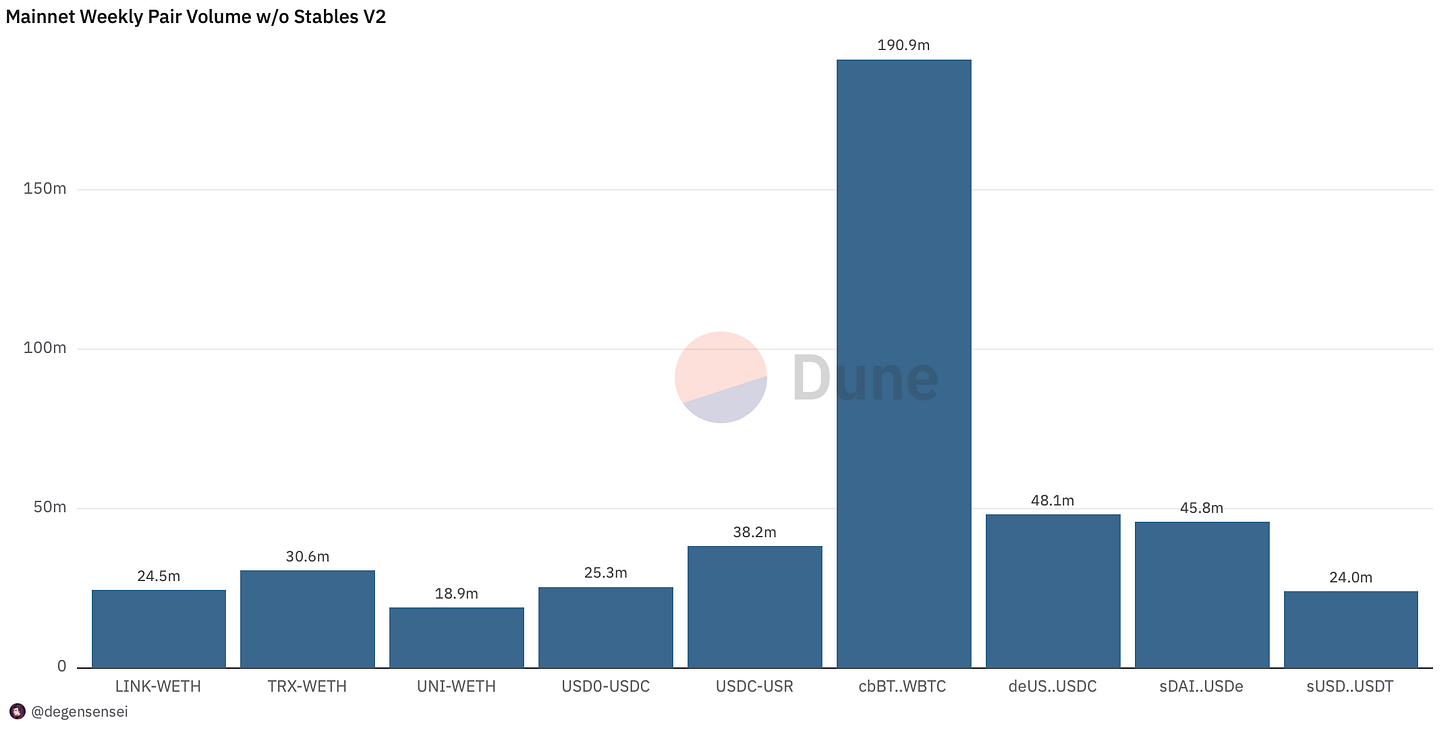

Pair Volumes

Not much going on at Ethereum which isn’t a surprise at this stage, the tokens people have been mainly trading over the past week have been LINK, TRX and UNI. UNI has been teasing that Uniswap v4 will be launching soon but has also ended up in controversy due to the founder Hayden Adams hinting that he wants the Ethereum Foundation to buy out Uniswap.

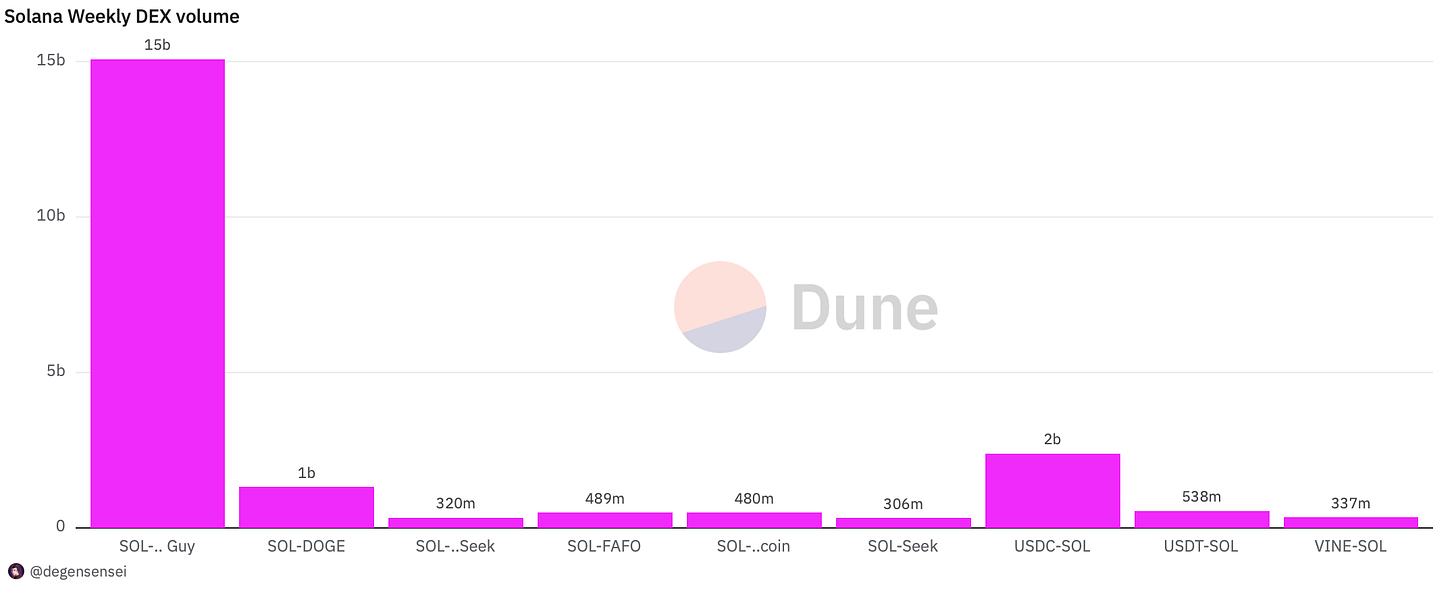

The first purple bar in this chart is spoofed and with that in mind it is clear to see that onchain volume on Solana has significantly decreased over the past week due to the liquidity drain the ecosystem has experienced. SOL paired with stablecoins continues to dominate volumes for a reason.

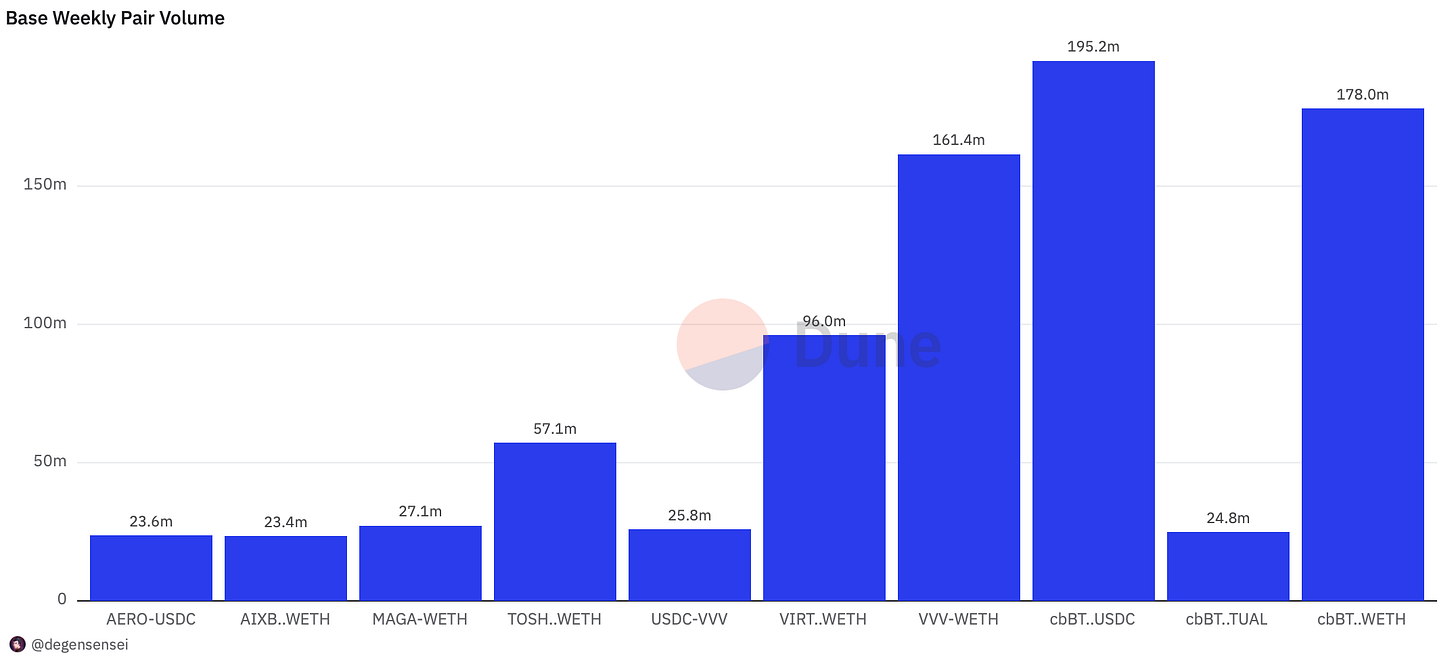

VVV dominates the volumes on Base over the week after being an AI launch that is built on top of DeepSeek by Erik Vorhees. Due to this it caught a lot of excitement unsurprisingly although some controversy was involved with Aerodrome team members insider trading the launch which led to suspension of 2 members. TOSHI also got listed on Base and surged which is why it has been producing so high volumes over the past week just trailing VVV and Virtual. Speaking of VIRTUAL the team has every right to be bummed out and launch on Solana as they continue to be neglected by Coinbase and the Base team.

No volume is standing out on either BNB or Arbitrum that is remotely interesting, whenever that changes I’ll include them in the weekly post but they will remain out until now to not bore anybody.

NFT Trading

The abstract launch was underwhelming and people holding Pudgy Penguins were expecting more until they realized that the token launch is still far out which led to a steep sell off of the Pudgy Penguin NFTs.

During low liquidity environments NFTs bleed out fast as people are seeking capital safety and want to remain liquid. NFTs pump hard but the door when you want to get out remains small. CryptoPunks really demonstrate its strength during times like these.

Net Inflow

So where is the capital going?

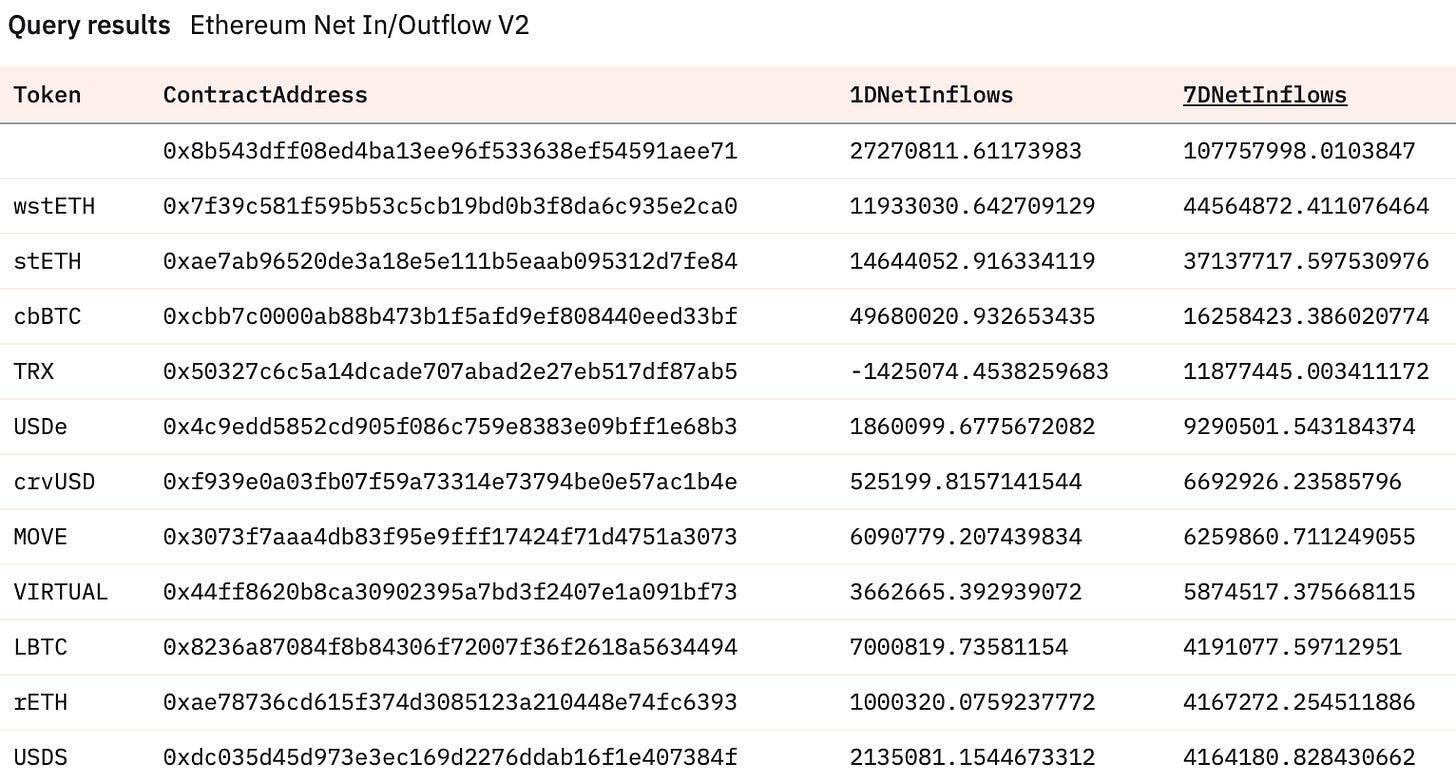

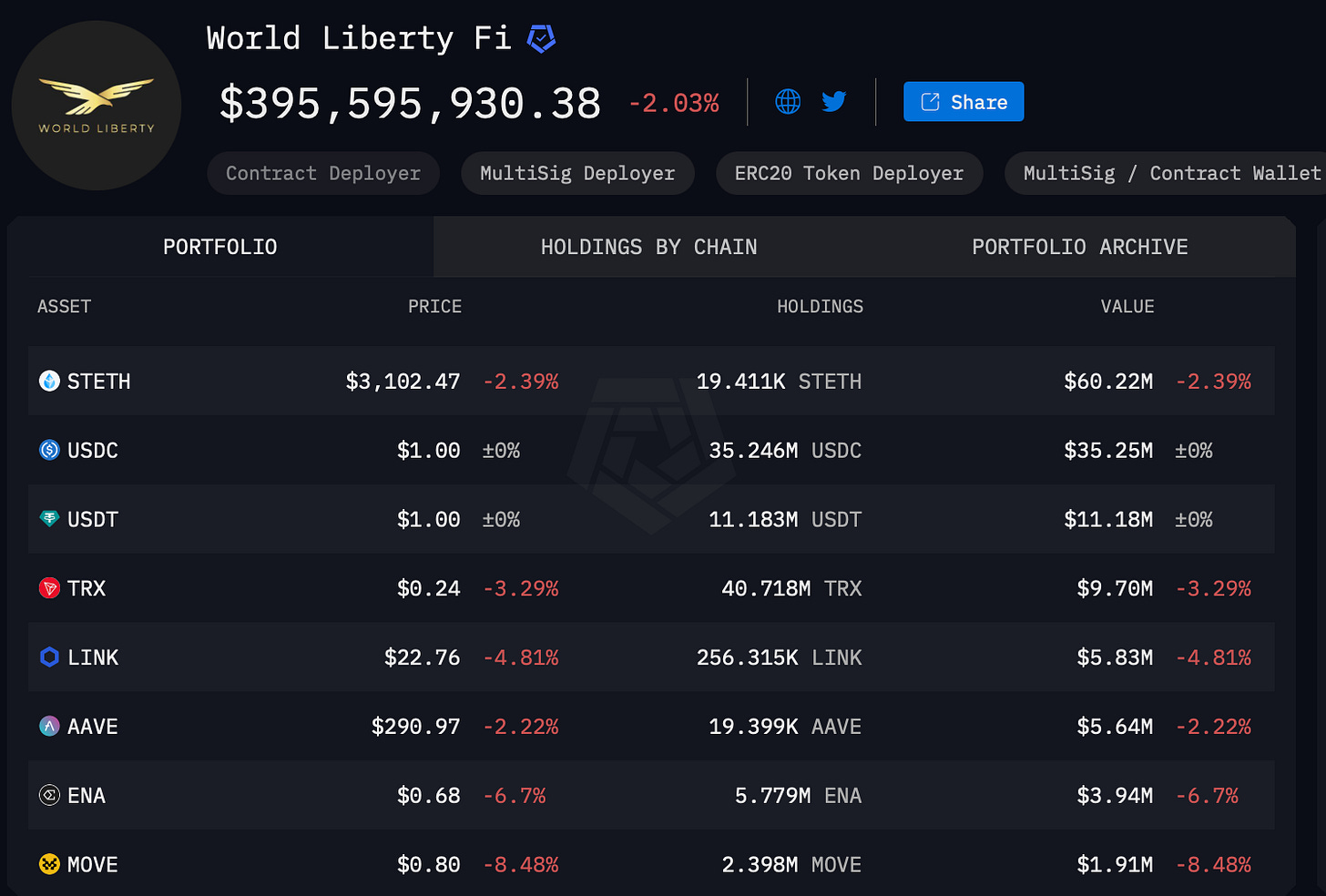

The Ethereum mainnet remains as risk averse as ever as they continue to keep their capital in farming opportunities such as wstETH or the safety of BTC. Meanwhile, both TRX and MOVE caught additional bids due to World Liberty Finance continuing to invest in both.

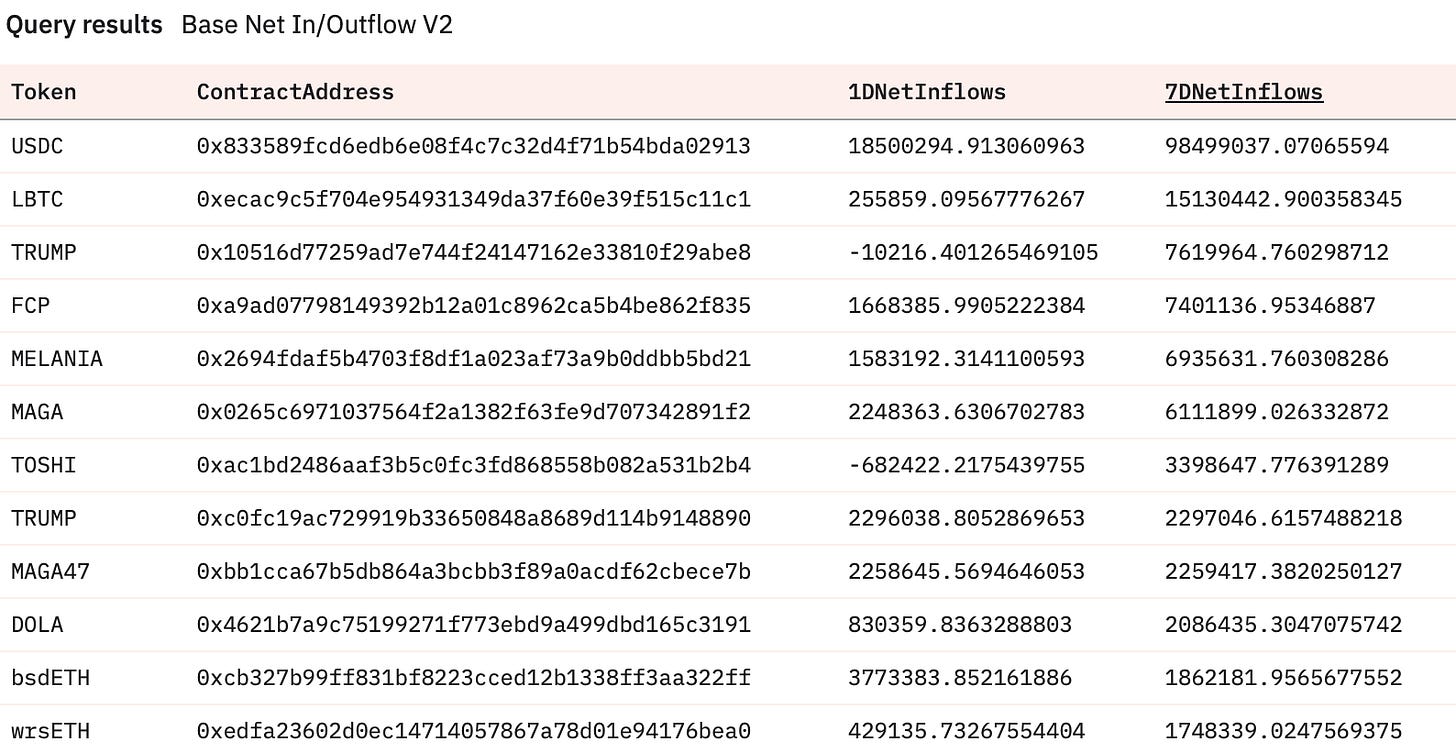

While the Solana ecosystem does take more risk than Ethereum it is a stark difference in comparison to previous week as it’s clear to see people have been rotating their capital to mainly SOL and USDC during market uncertainty. While VINE has been the main solo outperformer as it was launched by the old Vine founder.

Also, even if it doesn’t feature on this list, the 1 day flow into $WIF has been notable after announcing the sphere which many have been waiting for.

The only thing that has been picked up by Dune that is remotely interesting on Base is the flows going into TOSHI. However, considering it was listed on Coinbase majority of the flows is happening on the exchange and not onchain which is why the numbers are where they are. VVV that recently launched likely haven’t been picked up and recorded on Dune yet.

Sleuthing

World Liberty Fi adds MOVE to their token holdings from the proceeds they have raised from their sale so far.

This is based on speculation that Elon Musk had talked to the MOVE team about using their blockchain, although nothing tangible has emerged from this yet.

Token Unlocks

SUI - 2.13% of supply worth $234.95m on Feb 1st

ZETA - 6.98% of supply worth $18.32m on Feb 1st

dYdX - 1.15% of supply worth $8.30m on Feb 1st

EIGEN - 0.55% of supply worth $3.12m on Feb 4th

XDC - 5.36% of supply worth $88.67m on Feb 4th

KAS - 0.67% of supply worth $20.85m on Feb 4th

Turbulent times and during times like these unlocks seems scarier than they are. However, this is the time to stick to your own guns and not be affected by the timeline no matter where you stand on where we are in the cycle.

A fun fact is that I lost followers because I was bullish while people were hurting, it’s an example of how riduculous things can get and a reminder to not get swayed by others.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.