This Week On-Chain #107 -Liquidation Event & Berachain

Largest liquidation event since May 2021.

The day after dawn. The weekend was sobering for most heavily leveraged people, and many well-known people in the industry were wiped out in the process. If you are still standing, you should be proud of yourself for surviving. Anyone who played defense going into it would be happy if they had stablecoins available during the process.

Make sure to protect your capital.

Meanwhile, Trump is starting a trade war with the whole world to try to force his will through, and China retaliated accordingly. It’s been a strange weekend, but I’m not going anywhere, so let’s dig into it.

Market Digest

FTX to start creditor repayments on Feb. 18

Trump launches Sovereign Wealth Fund

Tariff Wars begin

Ondo Finance unveils tokenization platform to bring stocks, bonds and ETFs onchain

Autonolas introduces Agent App

Frax Finance introduces Borrow Automated Market Maker (BAMM)

Enron scam

MegaETH NFT mint checker

Freysa AI thesis

ThorChains plan to tackle debt crisis

Berachain is live

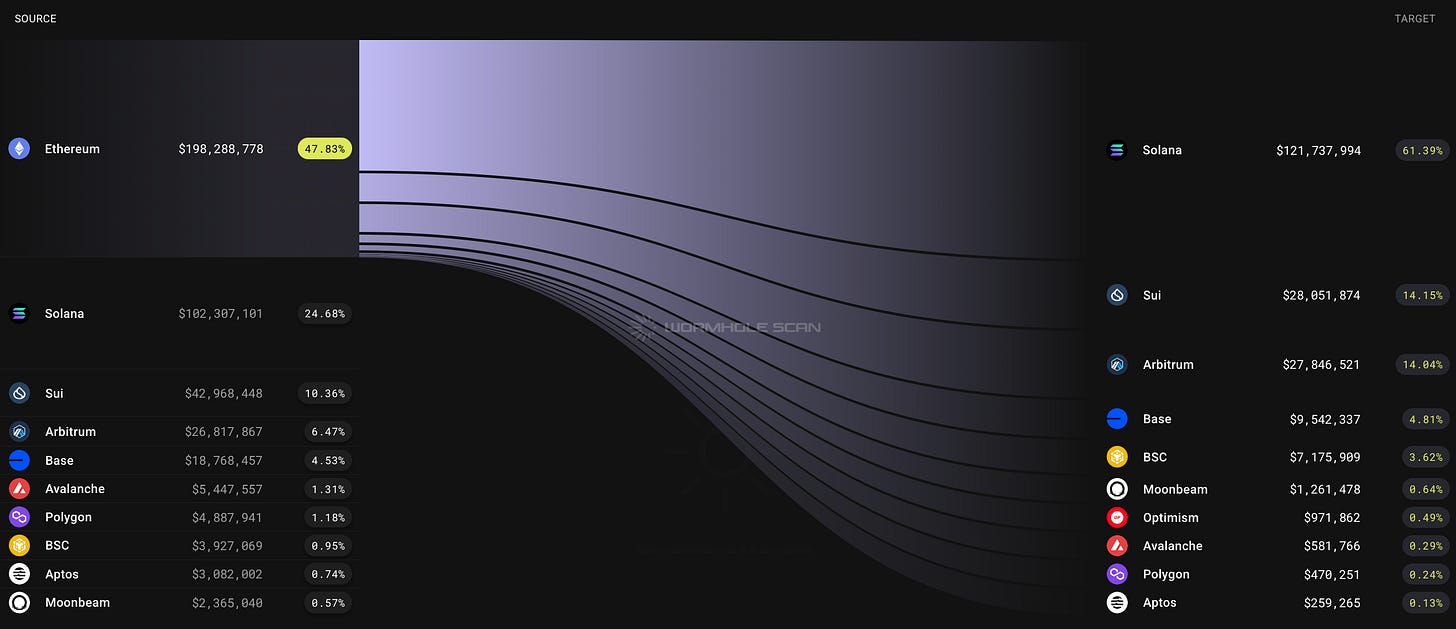

Bridge Flow

Ethereum ecosystem is not acting as a safe haven for capital flight during uncertainty anymore as more capital has migrated to Solana over the past week than vice versa. This likely stems from the fact that people are fed up with Ethereum’s underperformance over the past 3 years. Took them long enough.

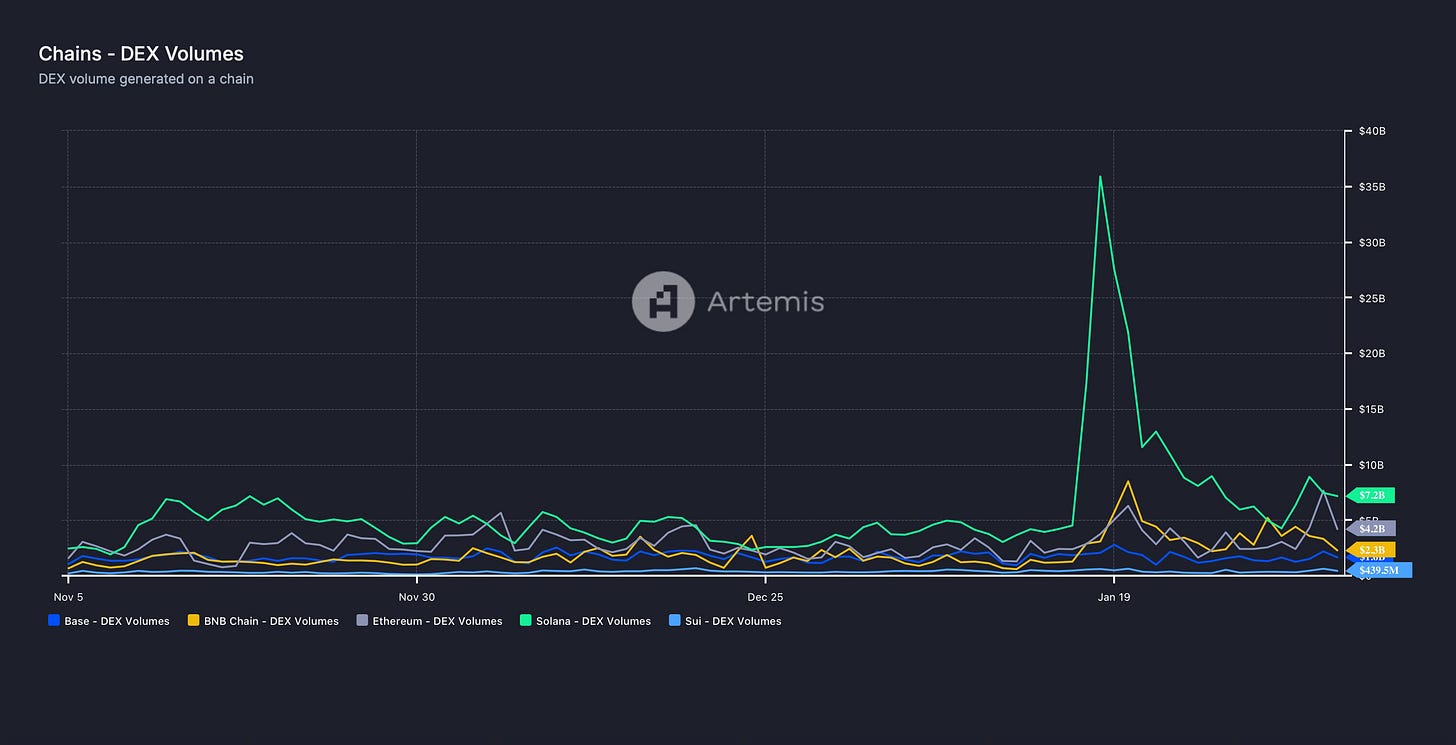

DEX Volumes

DEX volume reached an intergalactic peak on the TRUMP launch while it had a significant bump during the weekend liquidation event. However, it is slowly dying out as volatility is fading and likely will for the foreseeable future until we get a catalyst.

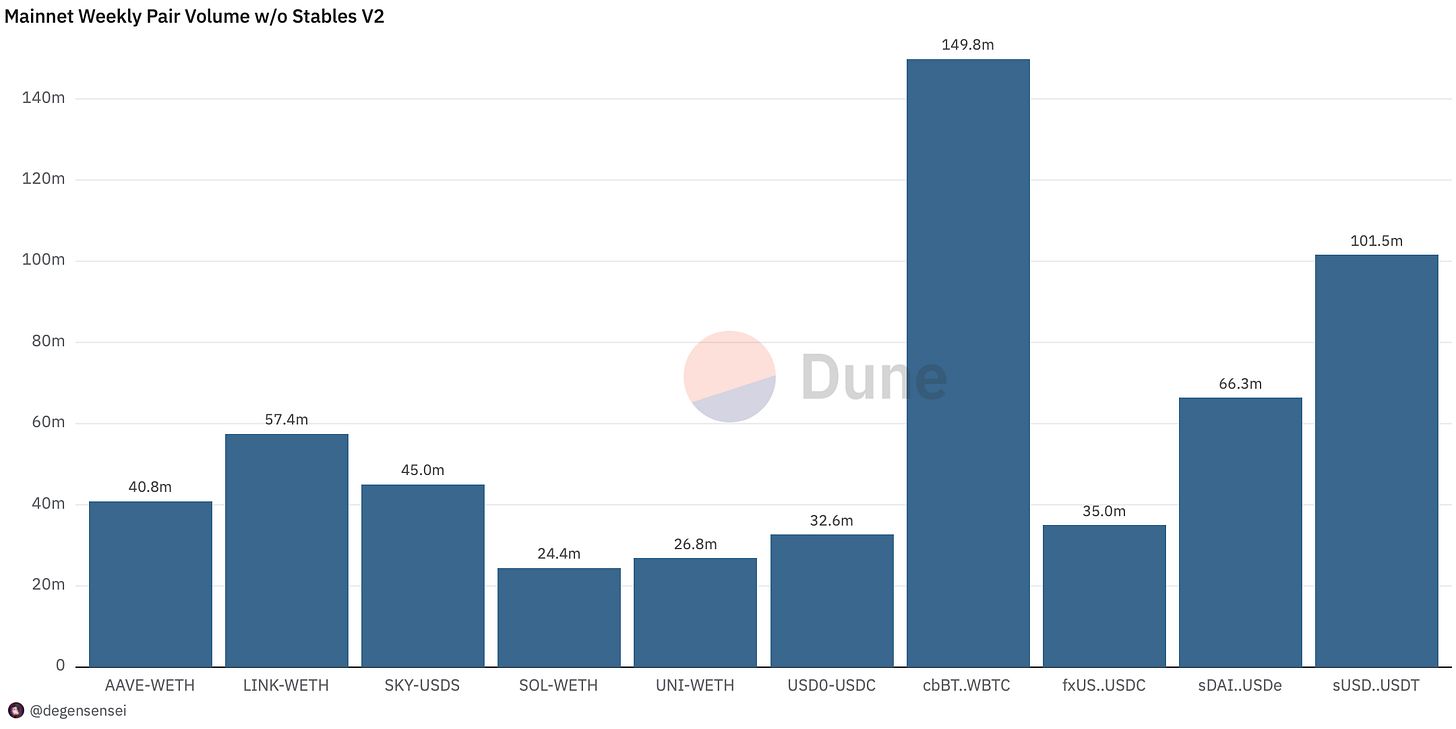

Pair Volumes

The people on the mainnet are sticking to blue chips assets that are being accumulated such as LINK, AAVE, SKY and UNI while the rest of the onchain market is bleeding out at the moment. These are the few protocols with actual PMF in crypto so with that in mind it isn’t that surprising when the tide turns.

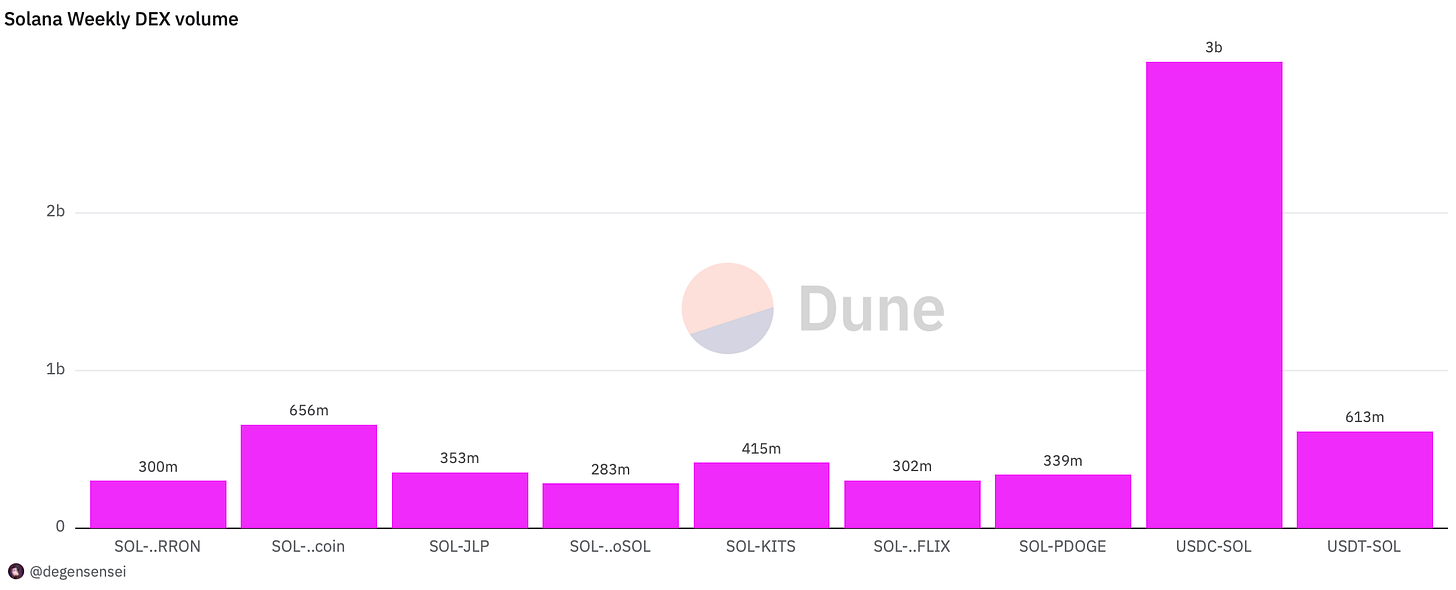

Risk appetite falling off a cliff in the casino as people have been fleeing to USDC as you can see the volume dwarfing anything else. We’re in risk off season where protecting your capital is more important than anything else. Fartcoin is the highest volume token throughout these period while a lot of people are finding safety in JLP as well.

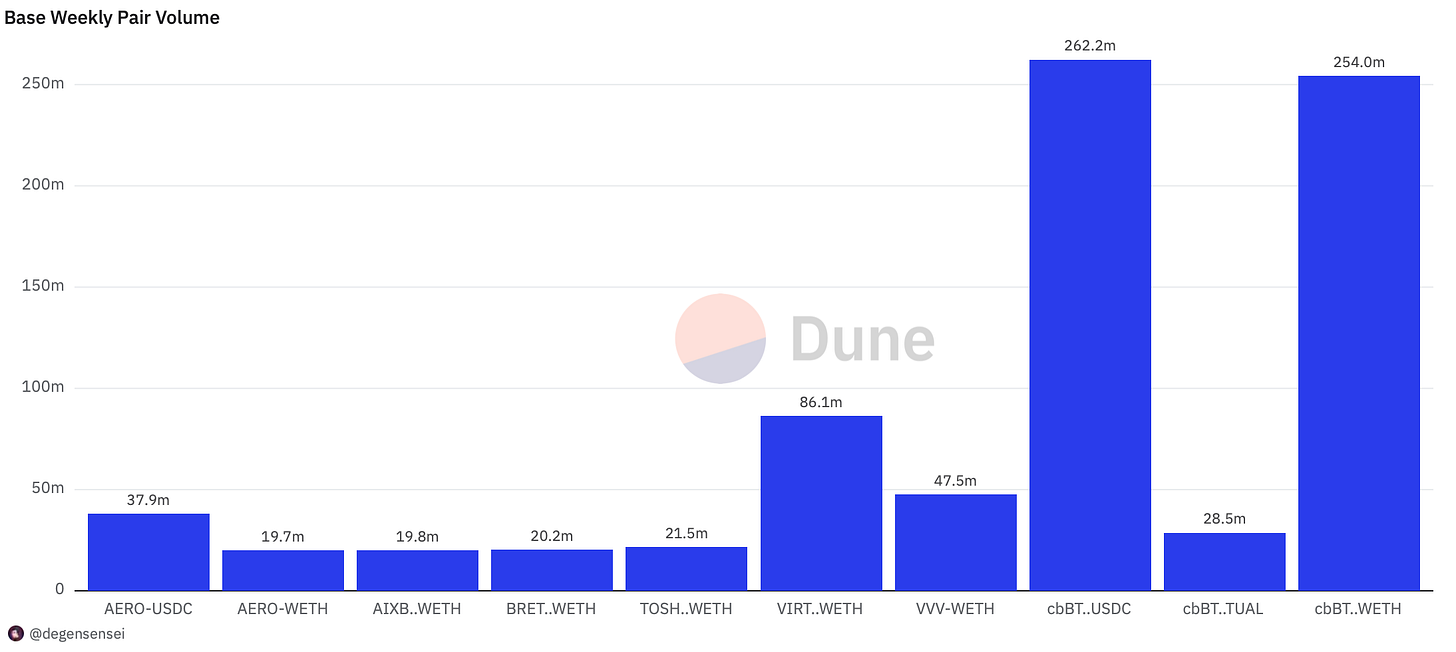

VVV is finally being tracked, which was a fiasco to say the least, that is reflecting very bad on Coinbase as a company. Otherwise, Virtual remains the most traded alts (likely due to all the Virtual pairs) while people have been fleeing to cbBTC during market uncertainty.

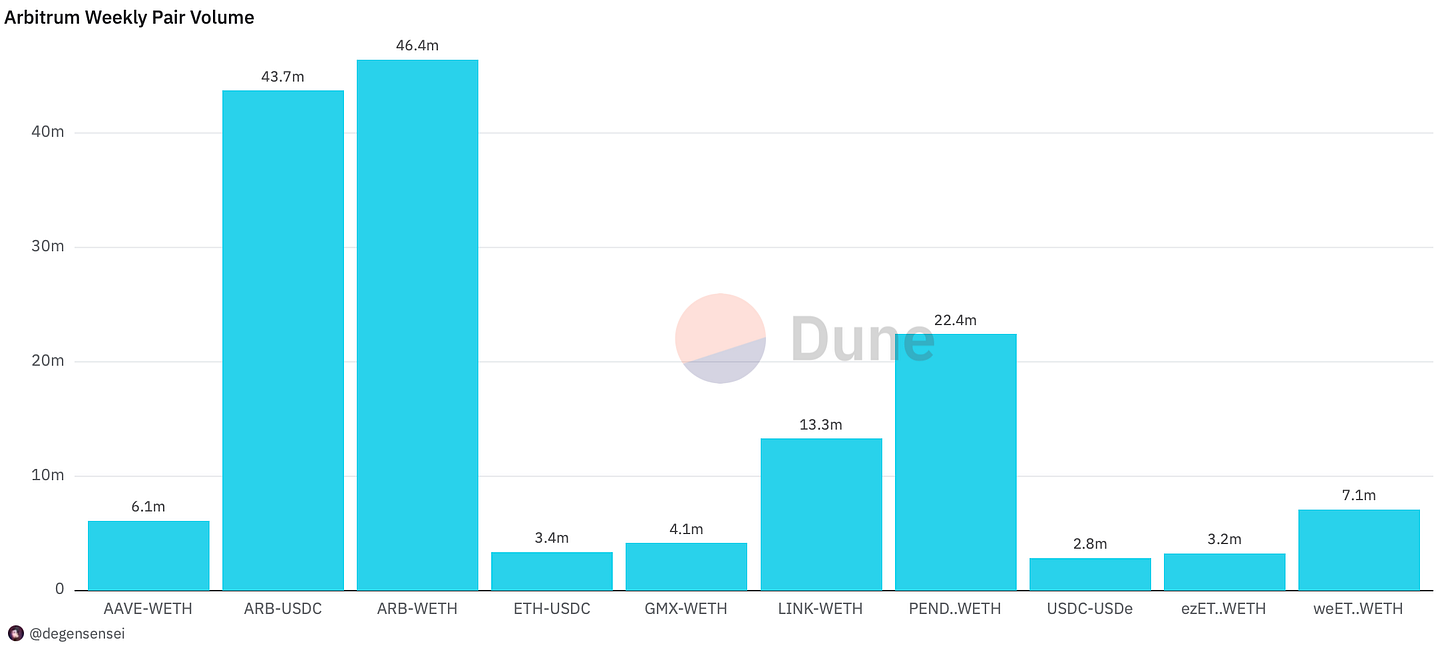

There is not much to see here except that LINK and PENDLE are the most actively traded tokens on the chain outside of ARB. When I get the queries together, I will likely exchange Arbitrum for Sonic in the coming articles, as that ecosystem is in an uptrend.

NFT Trading

With Berachain launching today it is no surprise to see the surge in the Berachain NFT volume and price over the past week as they are being handed many airdrops within the Berachain ecosystem.

You’re likely late if you’re trying to buy one now so keep that in mind.

Net Inflow

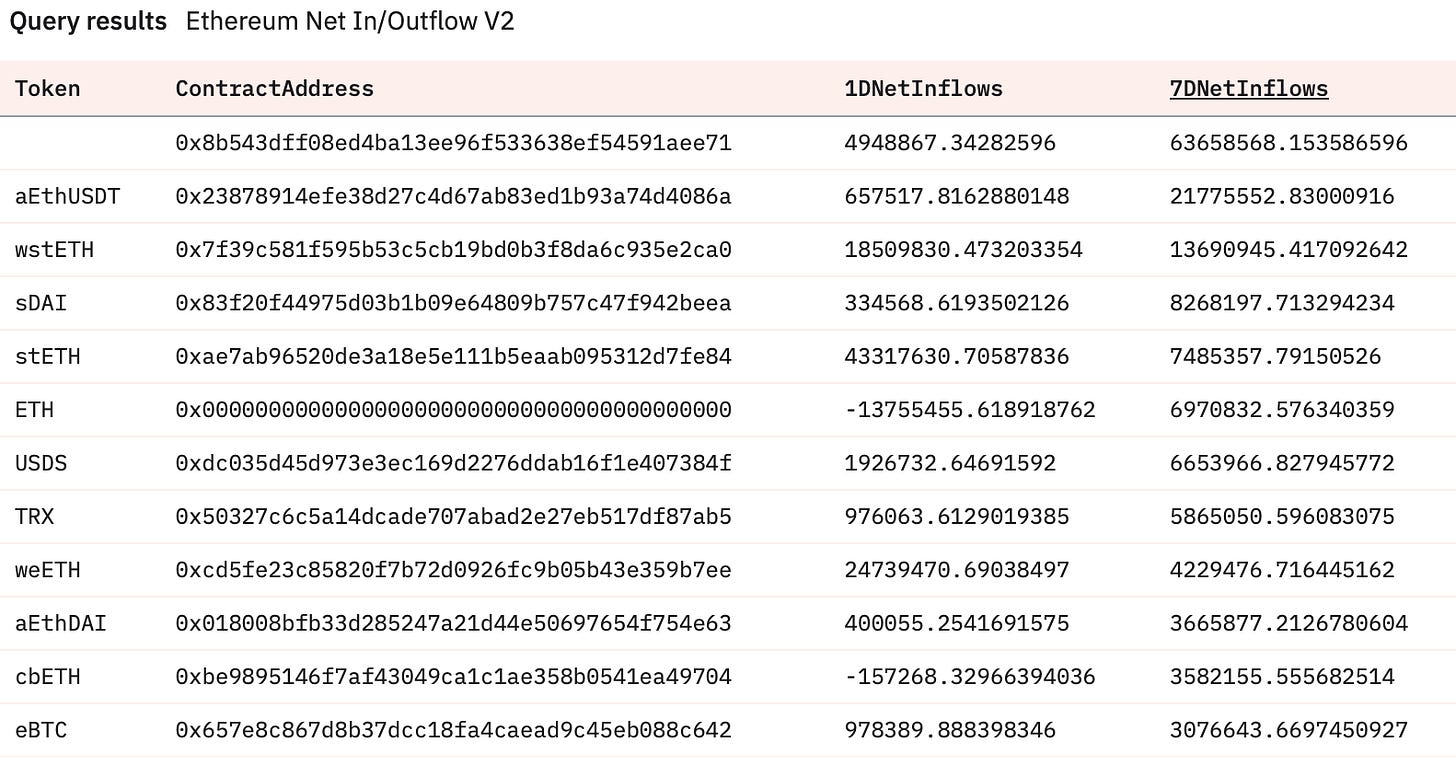

It’s farming season on Ethereum as no one is basically bidding any alts whatsoever. The only one that has been remotely accumulated over the past 7 days is TRX. Save yourselves the trouble for now.

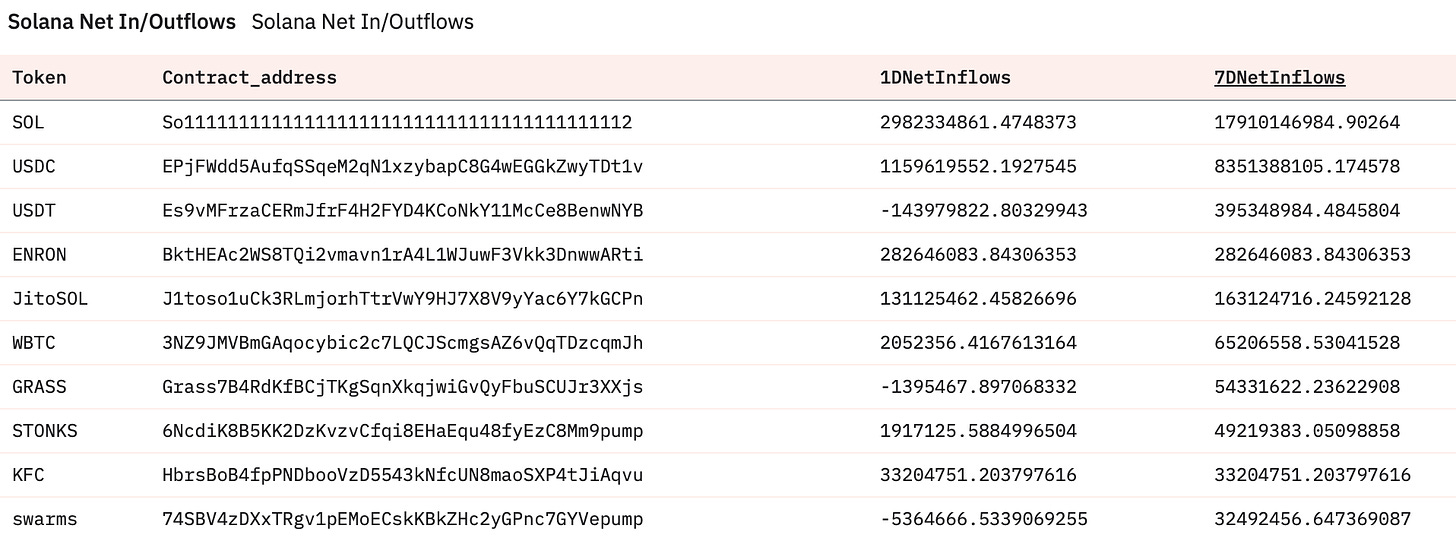

It’s the first time both USDC and USDT are in the top three indicating a clear risk off envirionment. Additionally, ENRON absorbing 28m of inflows while majority lost money due to the team dumping tokens is not a good look for onchain as that is additional liquidity gone. Aping ENRON without expecting to lose it all would only end one way.

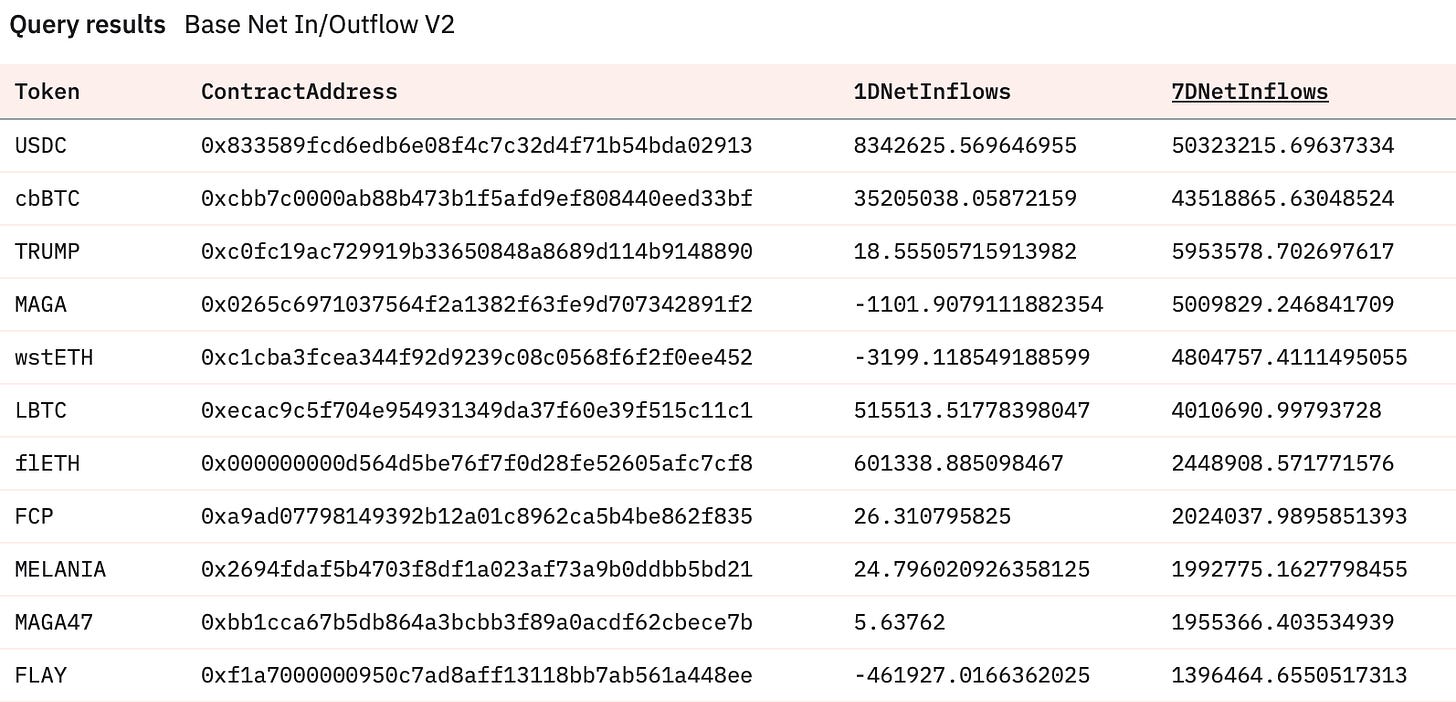

Same thing is prevalent on Base with USDC and cbBTC being the flight to safety while Flay which is the latest launch took place at the wrong time as the risk appetite is more or less gone at this stage. Great casino at the wrong time and for the wrong people. The prime time degens reside on Solana and not Base.

Sleuthing

Following up on last week’s World Liberty Finance post. There has been controversy regarding a “campaign” by the WLFI team which remains unverified. However, people are claiming that there was a gentleman’s agreement that if you boughta significant amount of WLFI supply (>10m) they would buy the same equivalent of your token. The MOVE purchase is likely what has been causing this as it was out of character.

Don’t know that it is true but either way, desperate times calls for desperate measures.

Token Unlocks

MOCA - 0.14% of supply worth $324.69k on Feb 7th

MOVE - 2.13% of supply worth $30.39m on Feb 9th

APT - 1.97% of supply worth $67.07m on Feb 10th

RENDER - 0.10% of supply worth $2.21m on Feb 11th

AXS - 0.51% of supply worth $3.29m on Feb 11th

EIGEN - 0.55% of supply worth $2.27m on Feb 11th

ENA - 0.25% of supply worth $4.15m on Feb 12th

ATH - 10.21% of supply worth $22.58m on Feb 12th

Altcoins are currently in a depression until we get some clarity on BTC in ether direction so make sure you watch your head with these unlocks incoming as there isn’t enough demand to absorb it in the current market regime.

The message remains the same, survive and don’t be reckless now and you’ll be fine. Defense is the move.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.