Bitcoin has been in this endless range that is driving people crazy and is reminiscent of the range we found ourselves in during Summer 2024, and it will likely continue until spirits are broken and people stop calling for “alt season”.

After good news not moving the market anymore, we are now in the process of dealing with bad news that are being absorbed in the same manner as well. When we are exhausted in that manner as well and get big news that show us market direction, everything becomes clearer from that point.

In the meantime, it’s probably a good time to examine Sonic and BNB chains, respectively. We’ve continued to see pockets of outperformance throughout this “cycle,” and these chains are experiencing them right now.

Market Digest

Tornado Cash co-founder Alexey Pertsev released from prison

Franklin Templeton seeks SEC approval to launch “Crypto Index ETF”

Story Protocol announces mainnet and TGE (today)

Unichain is live

World Liberty Fi launches “Macro Strategy” token reserve

Hong Kong now accepts Bitcoin and Ethereum as proof of investment visa

FTX to begin creditor repayments on Feb 18th

Aptos introduces Zaptos

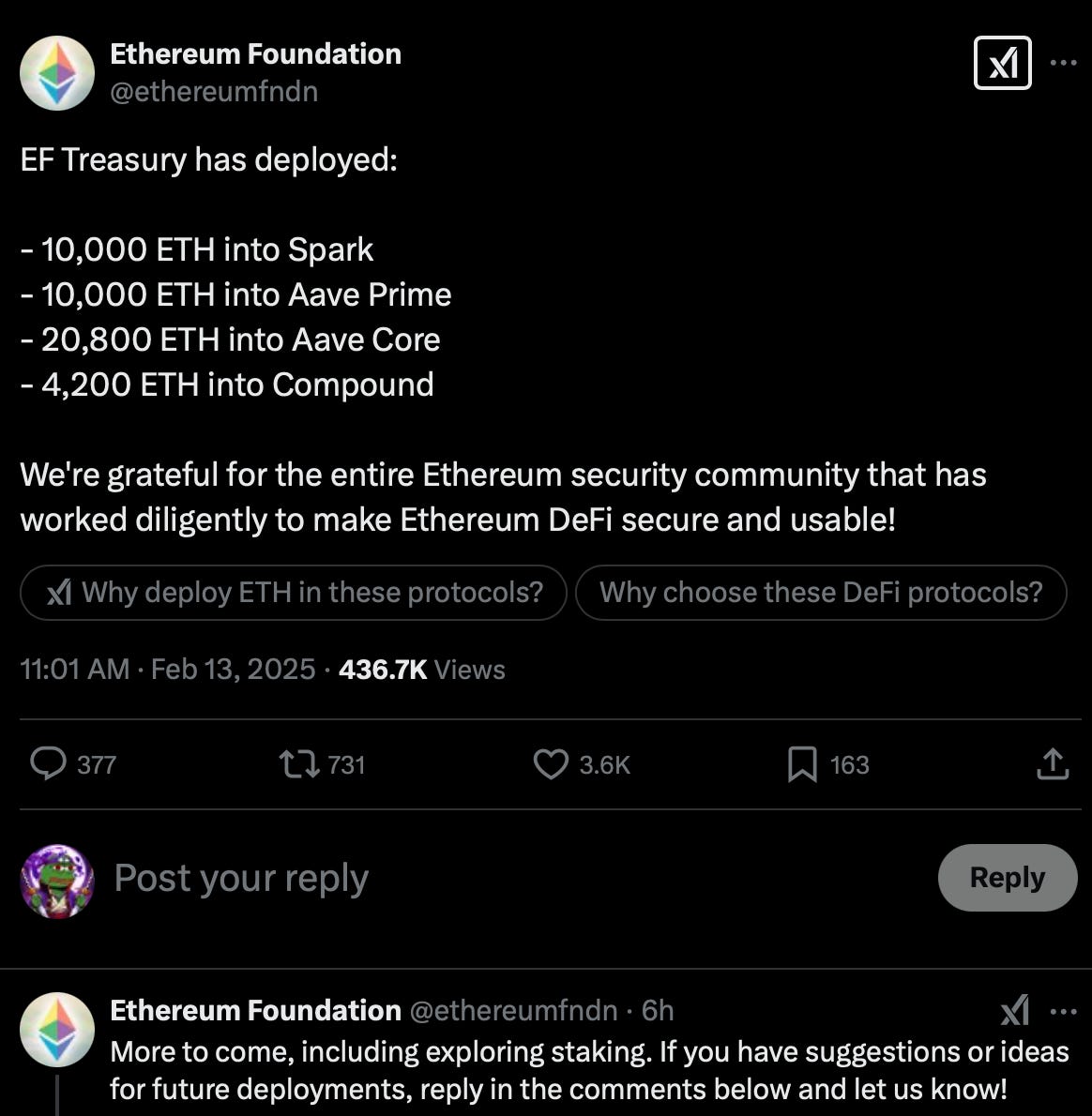

Ethereum treasury deploys 45K ETH into DeFi

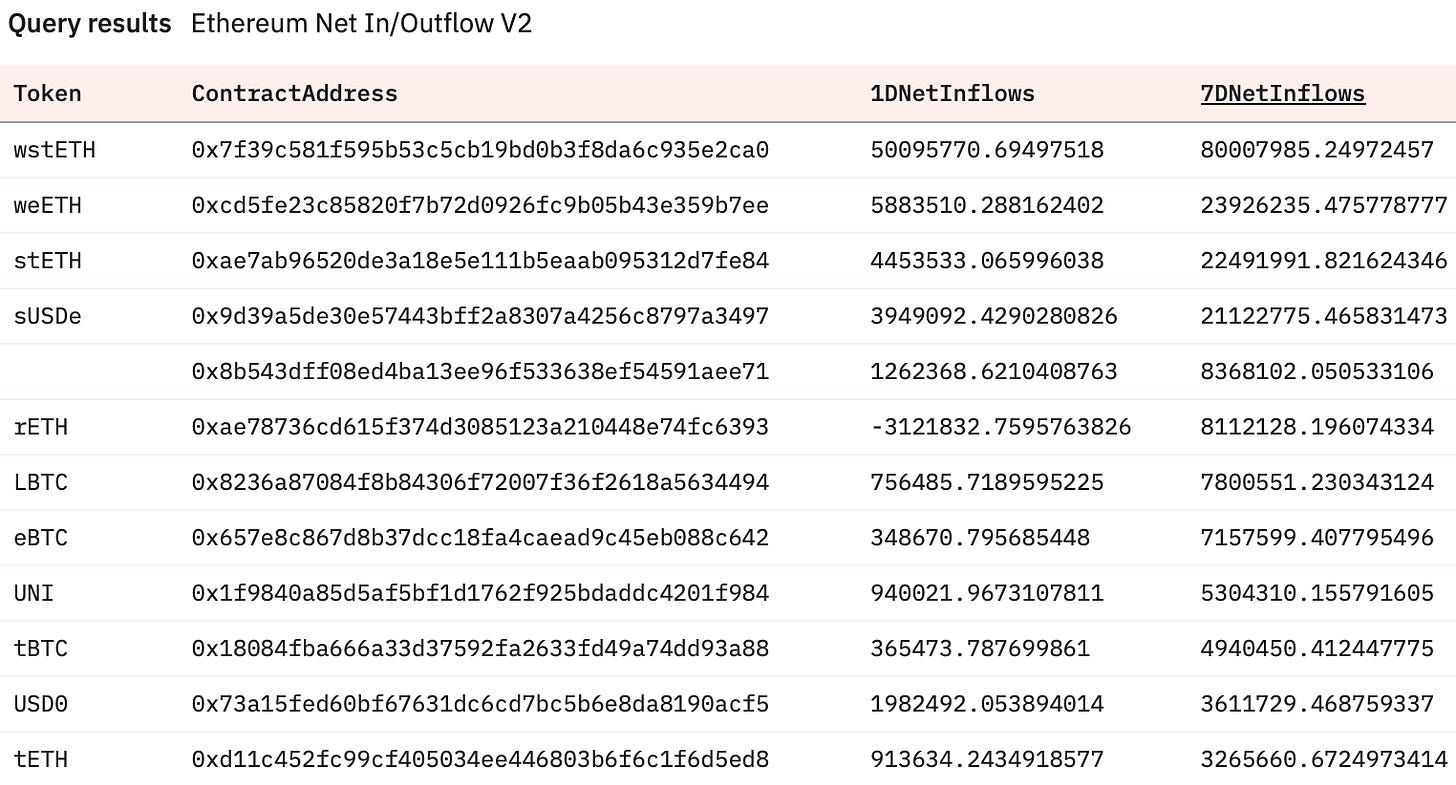

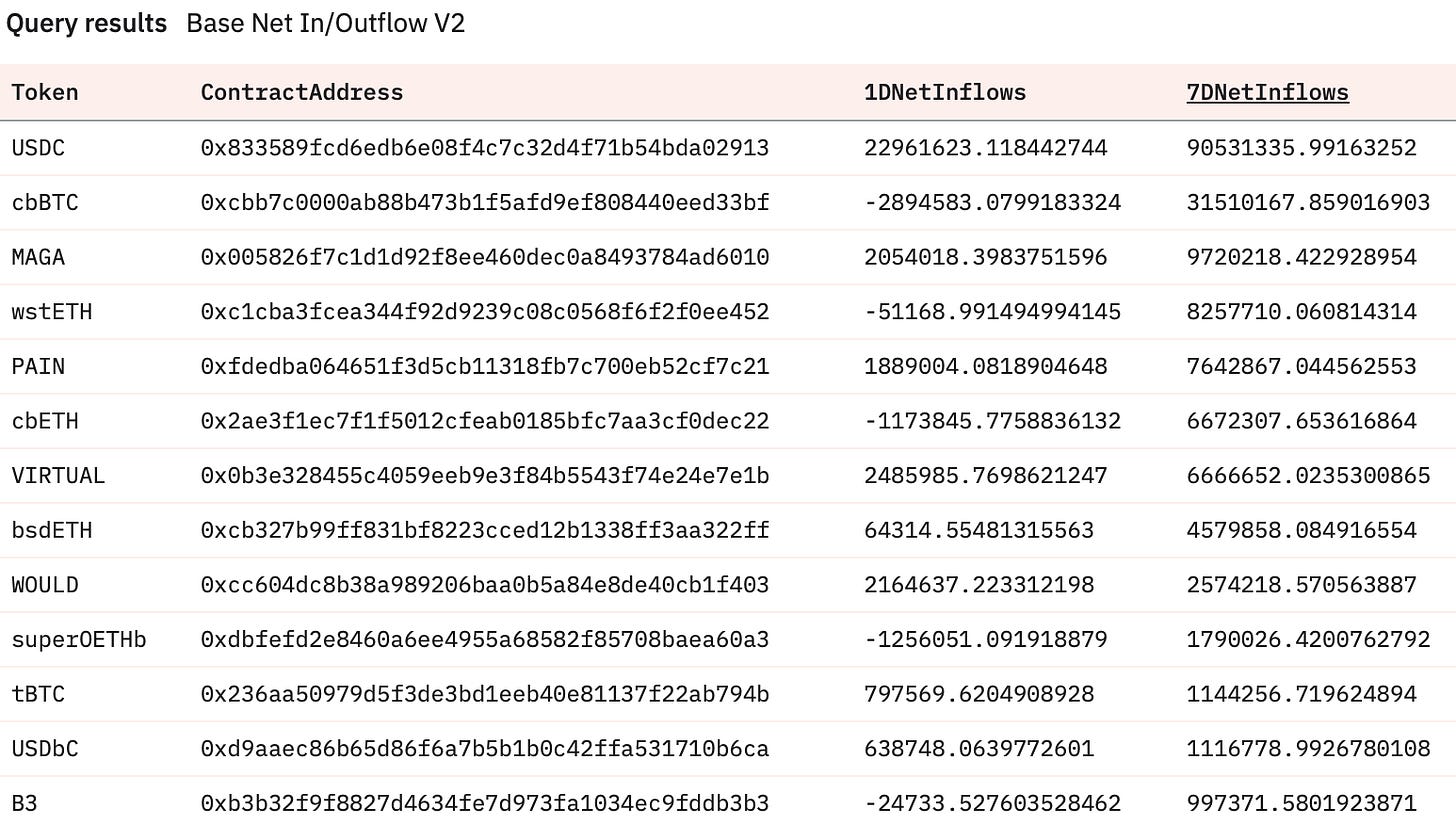

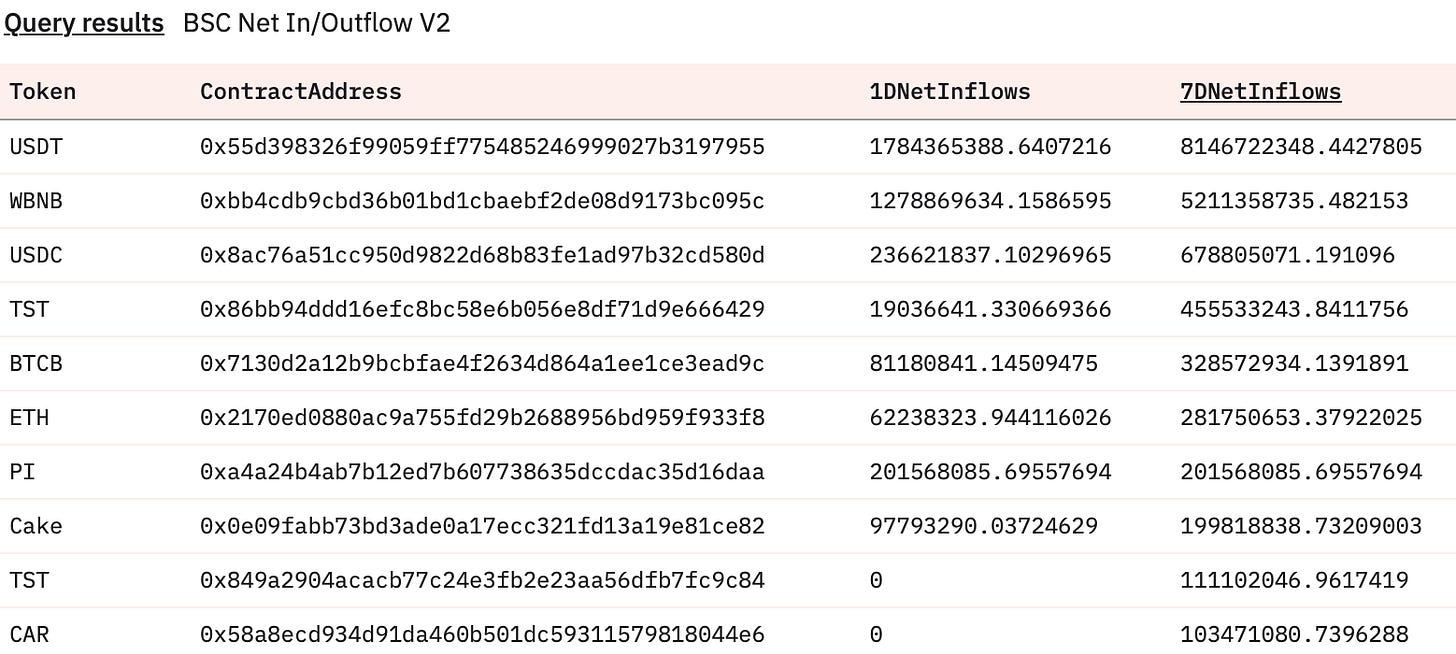

Bridge Flow

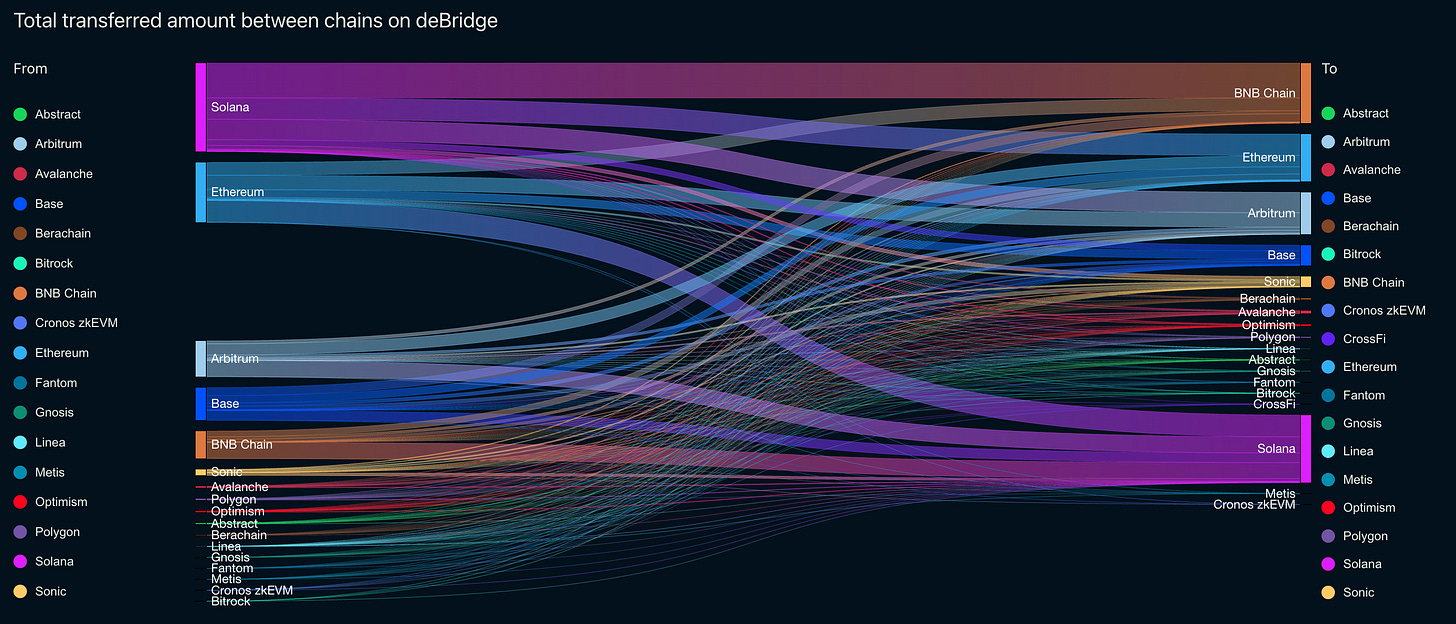

BNB chain is leading the table for inflows for the first time as there has been a shift with CZ actively pushing activity on BNB while sentiment was at the lowest on Solana. Frankly, he struck at the perfect time and we are starting to see the effects of it already as PancakeSwap volumes are going through the roof.

BNB szn is here and even if the Sonic flows are miniscule right now, it is in fifth place and net positive. Pay attention.

DEX Volumes

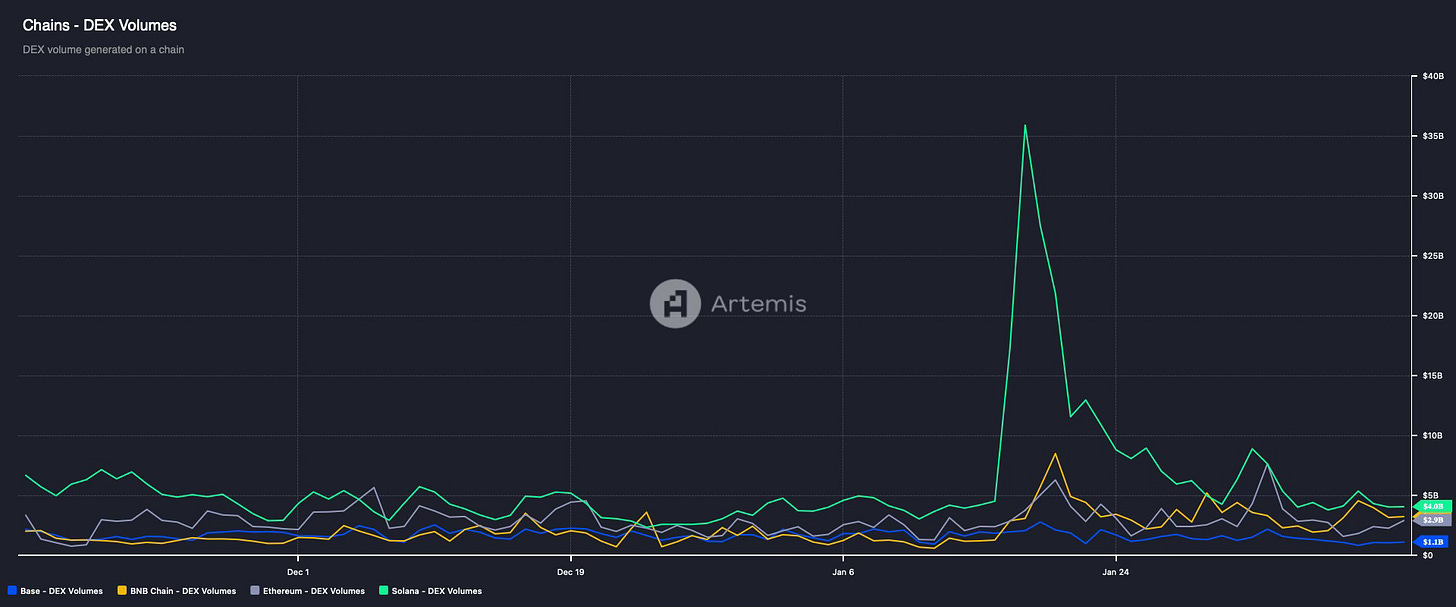

Strongest continous volumes have been BNB since the turn off the year wheareas Solana clearly peaked on the Trymp launch. A lot of people have discretion for bridging to BNB which likely will prove to be a mistake as a lot of activity is taking place there right now with the base asset BNB trading so strongly as well.

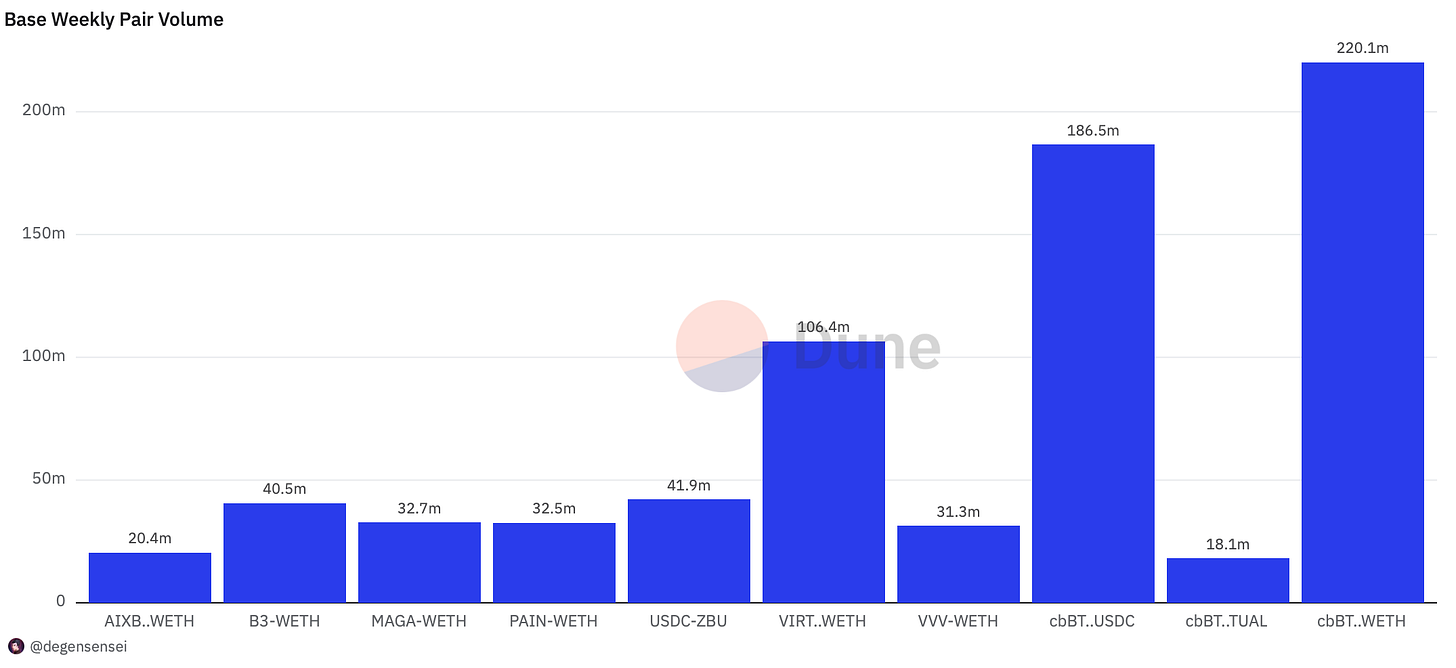

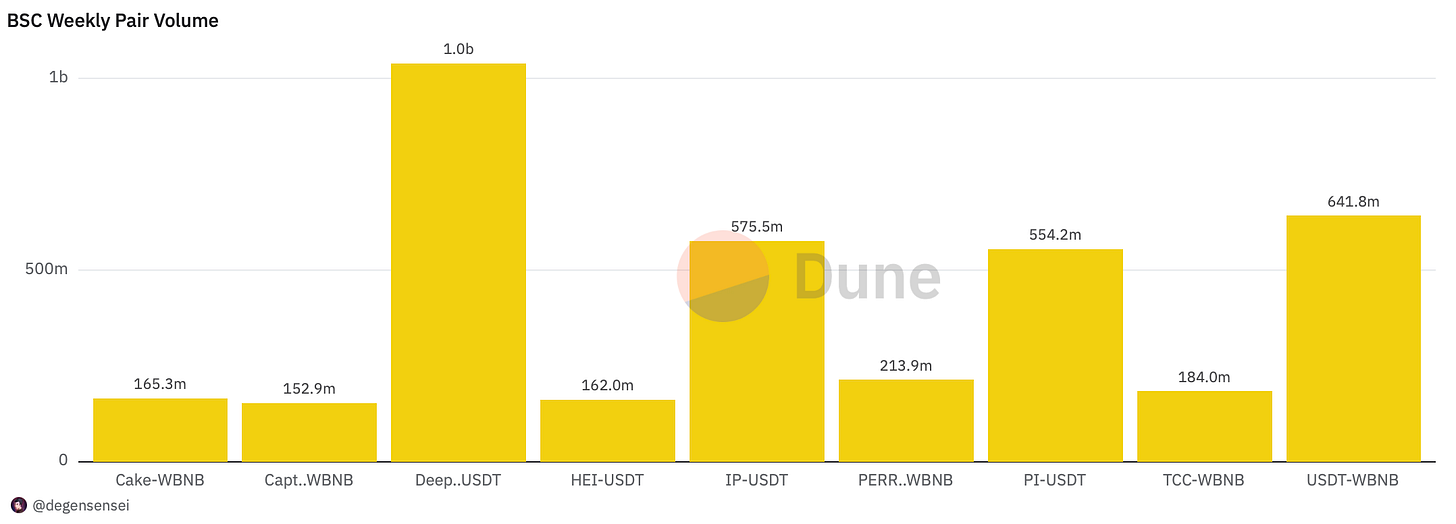

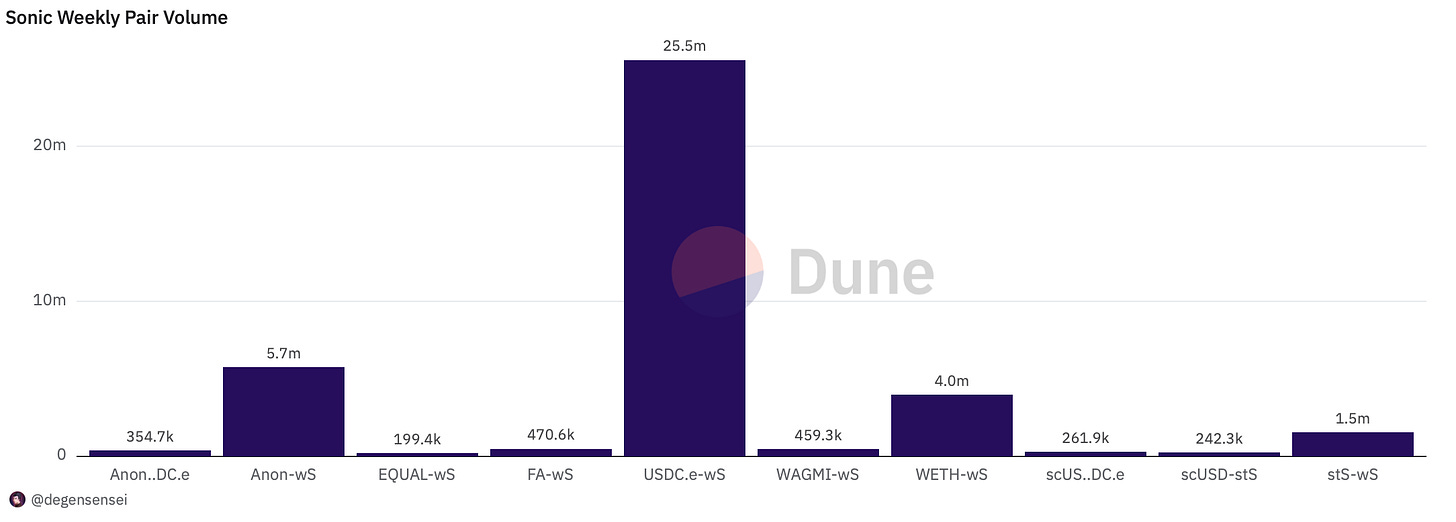

Pair Volumes

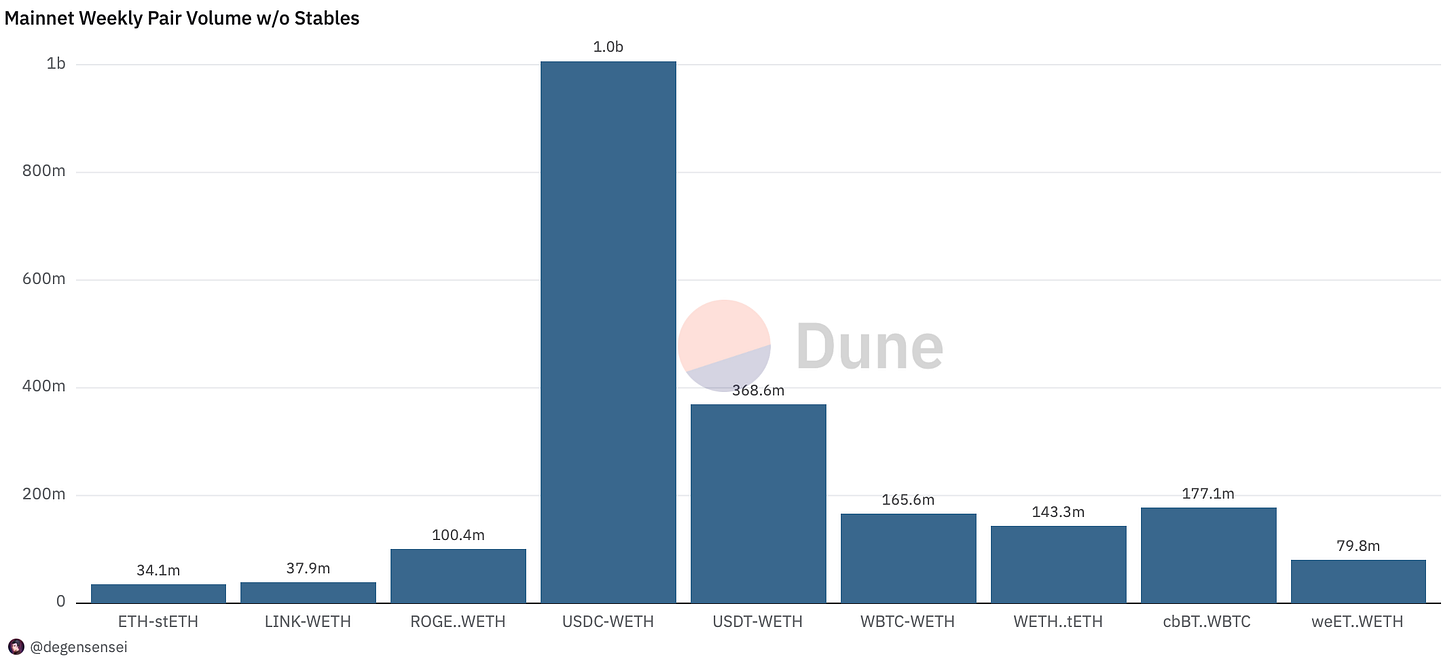

Even if DeFi activity is picking up a bit due to the Ethereum Foundation finally moving some of their ETH into DeFi protocols, onchain activity is lacking as LINK remains the most traded alt outside of ETH.

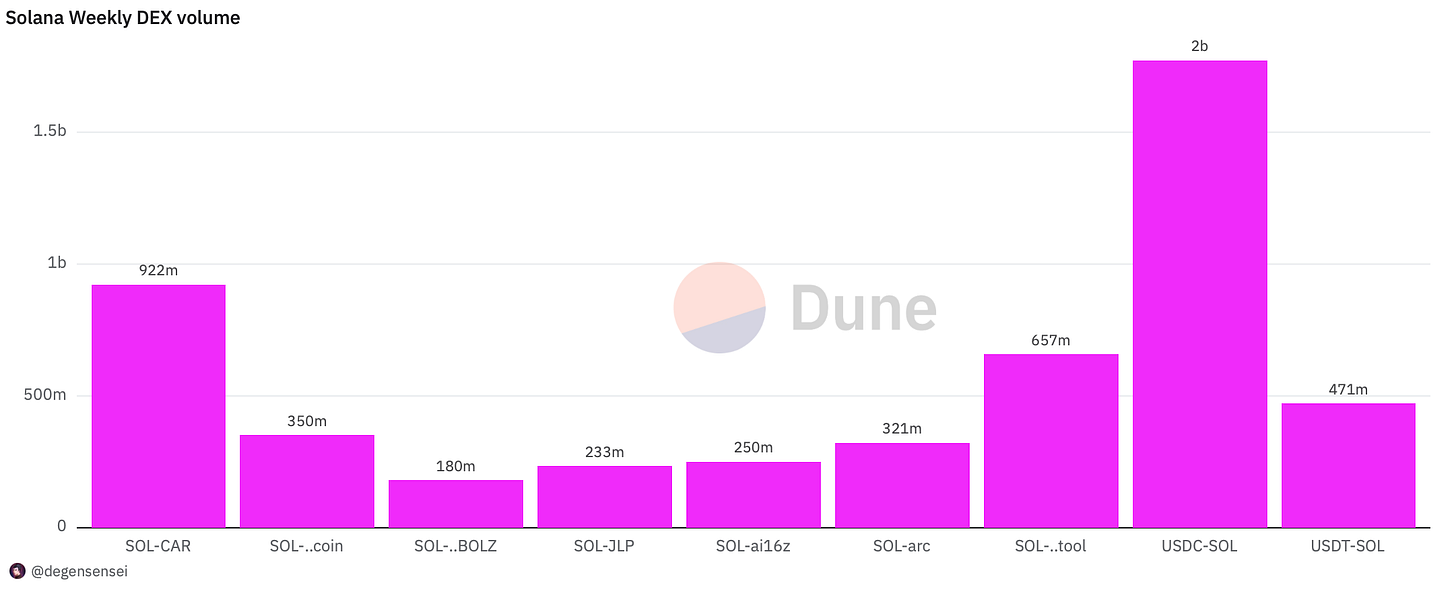

A memecoin based off the Central Republic of Africa dominated minshare on Solana over the past week outside of the David Portnoy memecoins which includes jailstool with 657m volume. Arc leads the AI come back although the onchain volume is trending in the wrong direction on Solana right now.

Base volumes are holding up relatively well which VIRTUAL leading the way which recently launched on Solana as well. B3 is the latest Coinbase listing which is a gaming ecosystem built by ex-Base team members. VVV is seeing less interest and the drama surrounding this listing still haven’t gone well.

Glad to have BNB back here as it is actually interesting this time with tons of activity going on here. Suprised TST isn’t picked up here but oh well. BNB memecoin season is in full swing as you can see Captain BNB doing 152m in volume over the past week and Perry doing 213m. One to watch. Cake naturally doing well as they are the largest benefactor of this with Thena following.

Sonic volume is very small in comparison to all other ecosystems and is mostly interesting as a farming opportunity. Anon leads the volume when it comes to onchain trading outside of S although I doubt all platforms on the exchange (Shadow, Metro and SwapX) have been fully integrated into the table yet.

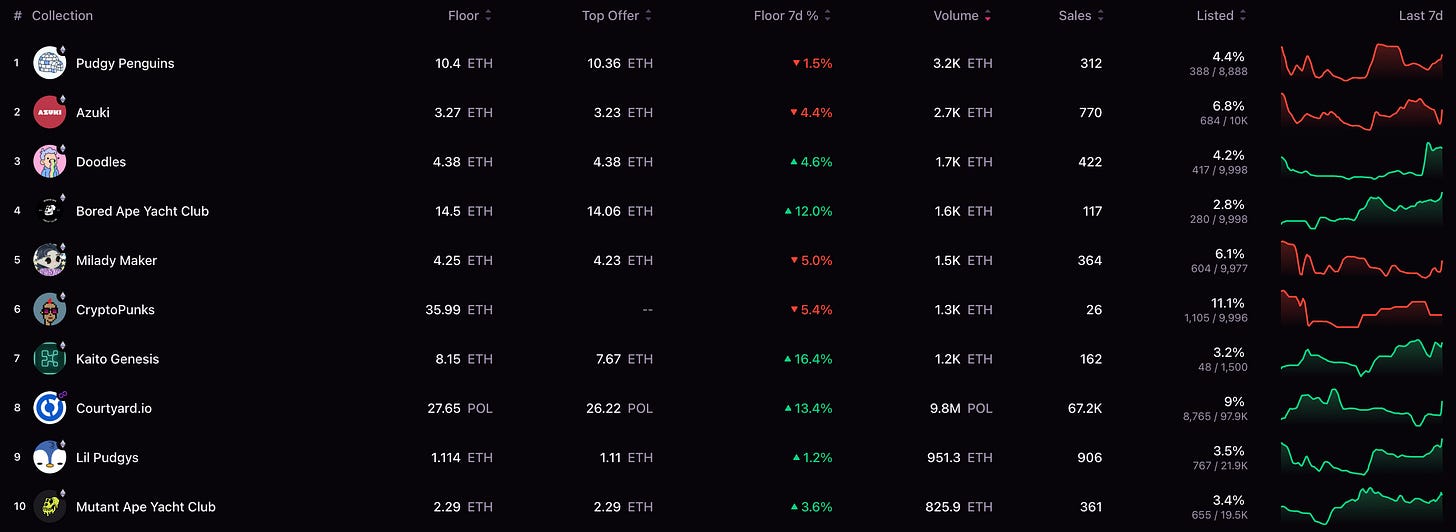

NFT Trading

The only interesting thing that has happened concerning NFTs over the past week is that OpenSea announced that there will be a SEA token and a likely airdrop.

Kaito NFTs are strong in anticipation of the Kaito airdrop but will likely endure a steep selloff when the airdrop is out.

Net Inflow

Unless you are farming ETH staking yield, spending time on the mainnet right now is largely a waste of time as the only thing that has been accumulated outside of idle capital is UNI. And that was likely in anticipation of the Unichain launch.

SOL and USDC dominating flow again on Solana as the ecosystem remains risk averse. However, the tokens that have garnered any kind of interest are ai16z, ye and POPCAT but there is not much to do right now.

USDC supercycle, stablecoin remains king right now during market uncertainty and will likely be the case for a while as we wait for the market to turn risk on again. Not much interesting things going on here really.

TST remain the story here as it went to 500m in 3 days which caused a lot of capital to bridge to BNB and start trading onchain. A lot of contenders out there that aren’t showing up due to the huge volumes right now.

No need for this on Sonic yet as the data is still very nascent.

Sleuthing

The bigger story is Ethereum foundation finally using DeFi after 5 years which means that they likely won’t have to continue dumping endless of ETH on the market.

Looks like this is the beginning with them planning to stake their ETH to generate more yield as well.

Token Unlocks

SAND - 8.41% of supply worth $79.86m on Feb 14th

STRK - 2.48% of supply worth $14.67m on Feb 15th

XCN - 0.91% of supply worth $7.06m on Feb 15th

SEI - 1.25% of supply worth $12.81m on Feb 15th

AVAX - 0.40% of supply worth $42.10m on Feb 16th

ARB - 2.13% of supply worth $44.25m on Feb 16th

PRIME - 1.37% of supply worth $5.05m on Feb 17th

ASTR - 0.13% of supply worth $388.38k on Feb 17th

APE - 2.16% of supply worth $11.34m on Feb 17th

The launches of Story protocol and Berachain is a clear indicator that there isn’t sufficient demand to absorb new tokens on the market. If you’re holding any of these tokens, watch out.

The chop continues and there continues to be a simple message here, survive.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.