The amount of crime and scamming that has increased in careless nature over the past weeks has become increasingly alarming, and a grand cleansing is now happening that has wiped out many people as onchain assets are down over 80% from their peak worth.

The LIBRA coin debacle was likely the final straw for many people, and we now see an aftermath that might even strike Milei himself. Even if the prices aren't going up, there is never a boring day in crypto, and there is a reason why this is the best industry in the world—it acts like a soap opera.

Still, while people were zigging, people were zagging that took advantage of the TVL growth on Sonic as I highlighted in last week’s post, and as a man once said:

“There is always a bull market somewhere.”

Market Digest

CZ shilled his dog causing immense onchain PvP on BNB

Tether announces minority stake in Juventus FC

21 Shares file for ETH staking ETF

Onchain payment landscape

Yuga Labs sells Meebits IP

Pump.fun releases mobile app

Coffeezilla interview with Hayden on LIBRA

Meteora statement concerning LIBRA

JupiterExchange statement concerning LIBRA

Kaito snapshot taken and deployed on Base

ByBit removed from France AMF blacklist

Ethereum Pectra upgrade scheduled

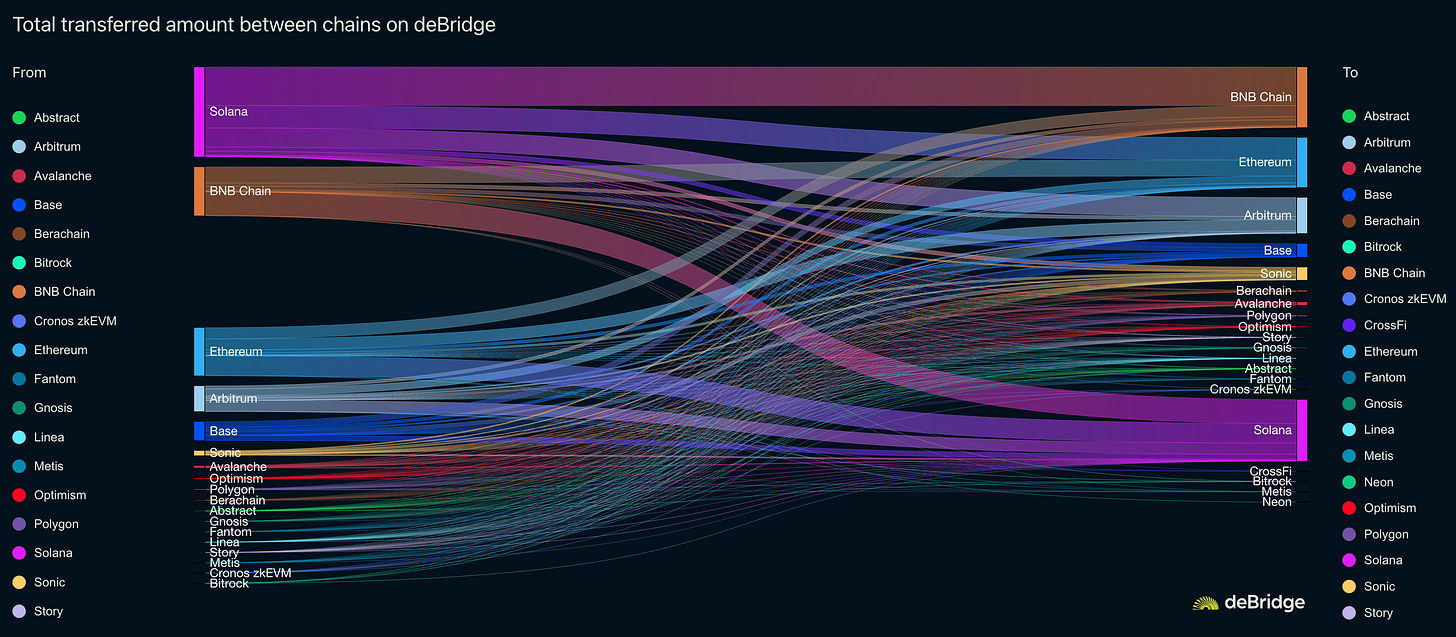

Bridge Flow

The clear trend is that capital is leaving Solana to find a temporary home elsewhere as the extraction events continue, with BNB benefitting the most.

Also, it might not be huge, but Sonic TVL is skyrocketing compared to last week and is currently in a local bull market.

DEX Volumes

Onchain volumes are starting to bottom but we can remain in a Sahara desert longer than people are comfortable with. Until this changes, you will likely only see pockets of outperformance within subsectors as there isn’t enough volume to sustain it across the board.

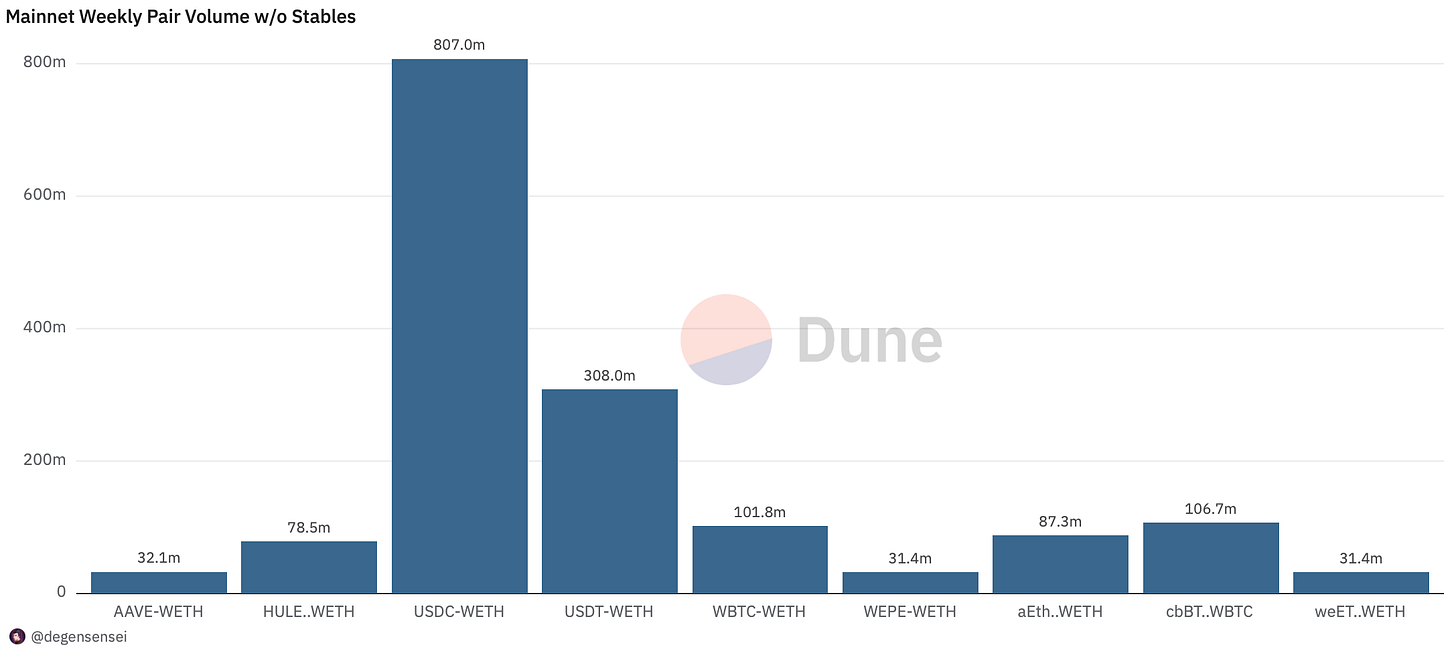

Pair Volumes

HULEZHI has done a lot of volume this week for strange reasons as someone burt 500 ETH to send this message onchain: “The CEOs of Kuande Investment: Feng Xin and Xu Yuzhi used brain-computer weapons to persecute all company employees and former employees, and even they themselves were controlled.”

Very weird. Apart from that not much going on except for some bids on AAVE while the mainnet continues to remain in a slumber as it has been doing for over a year by now.

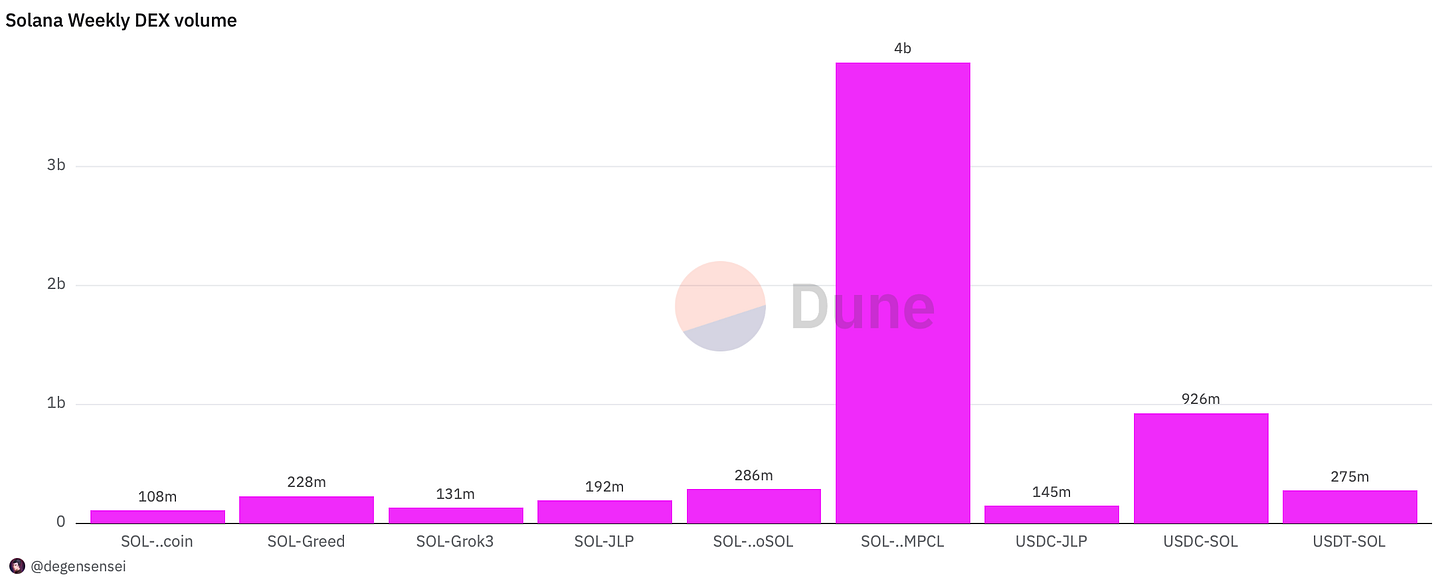

LIBRA not being tracked here yet but should undoubtedly be the one token that dwarfs everything else in volume as it was a black hole of onchain liquidity and another mass extraction event on Solana which tends to be a weekly occurrence by now which is why people are fleeing the ecosystem. Also not great to see the Jupiter and Meteora team get dragged into this.

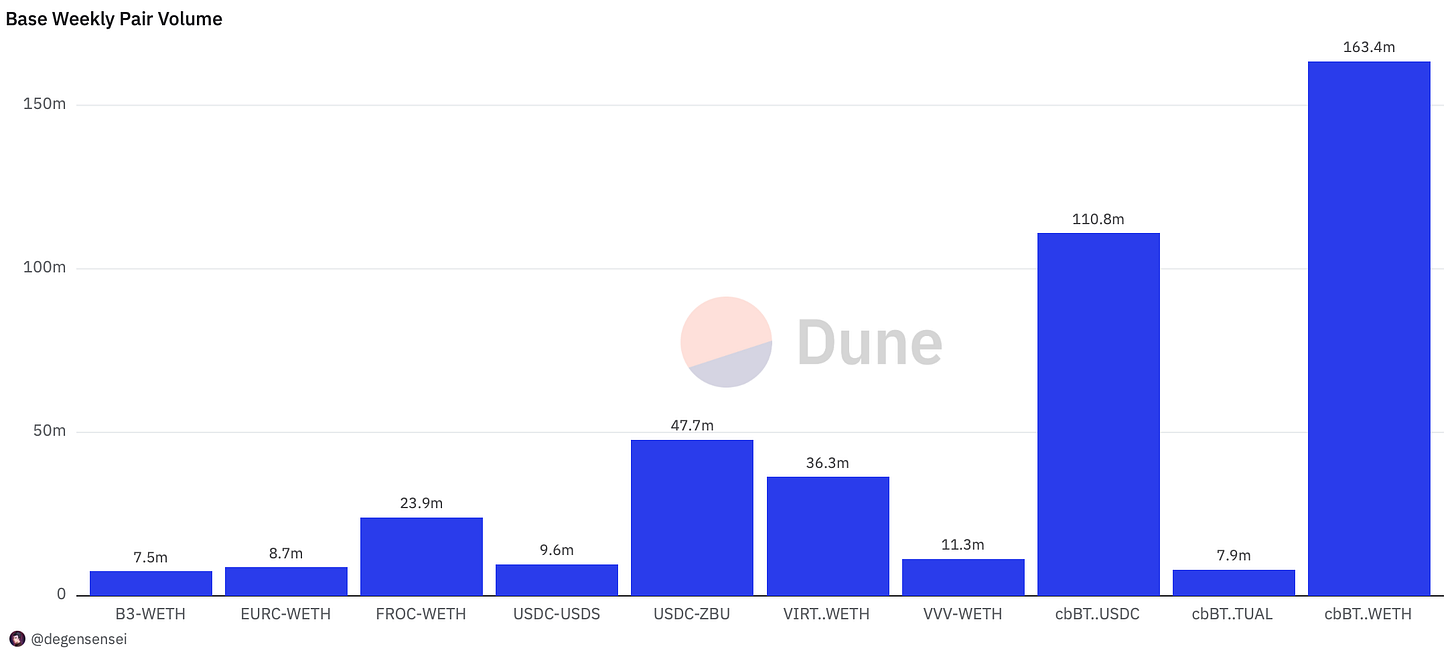

The one thing to pay attention to here is FROC which is a memecoin launched by Coinbase that seem to be following the BNB playbook with TST. Otherwise, there isn’t really much happening except for some sporadic bids on B3 and VVV which were the latest Coinbase listings. Meanwhile, VIRTUAL still isn’t listed which is mindboggling.

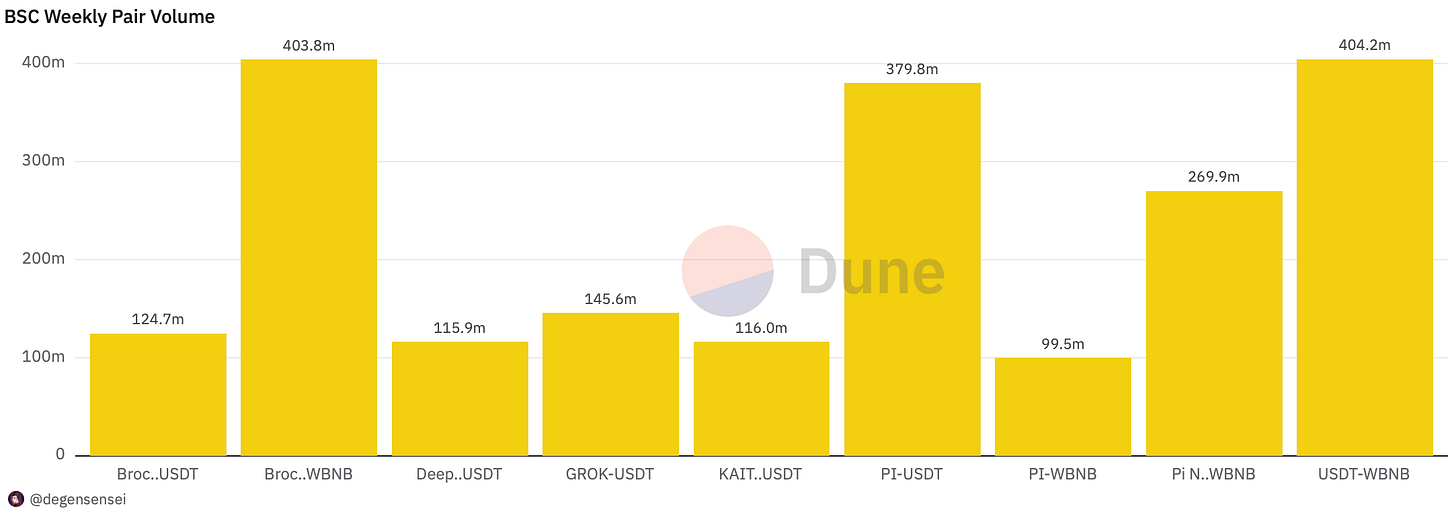

The Broccoli debacle broke the goodwill the BNBchain team had built the previous week, as it ended up vampire attacking the tokens other people had bought on the ecosystem, causing the majority of participants to lose money. It takes a lot to build trust and get people to enjoy your ecosystem, but it only takes 1 mistake to break that trust. Lesson in there.

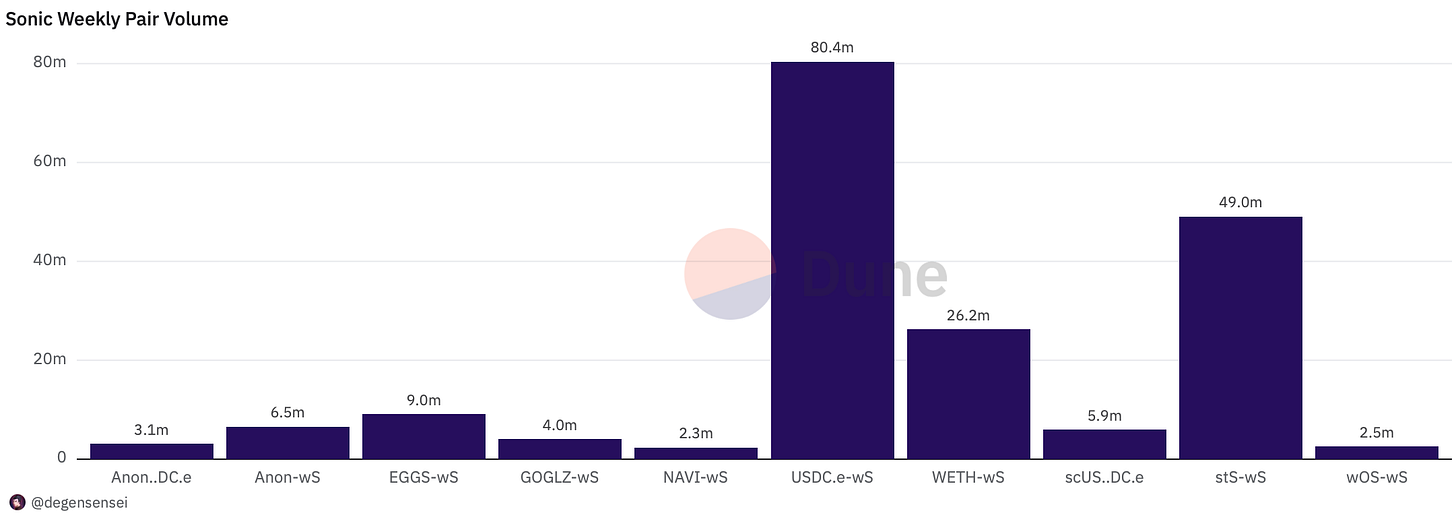

Sonic activity is picking up even if the data isn’t mature yet, with EGGS being the latest attempted DeFi ponzi that has managed to do well so far. However, the story of Sonic is the DeFi tokens that have been skyrocketing in the form of METRO, SHADOW and SWPx.

NFT Trading

NFTs are largely cooked at this stage as no one wants to hold an illiquid image in bad market conditions. When things get worse, people sober up and see things for what they are.

Kaito NFTs did well temporarily due to airdrop speculation but obviously plummeted as expected as soon as the snapshot was taken. Gemesis has been increasing in value as speculation for the SEA airdrop, even if the first snapshot was taken. Holders are likely hoping that they get a larger allocation if they hold GEMESIS NFTs.

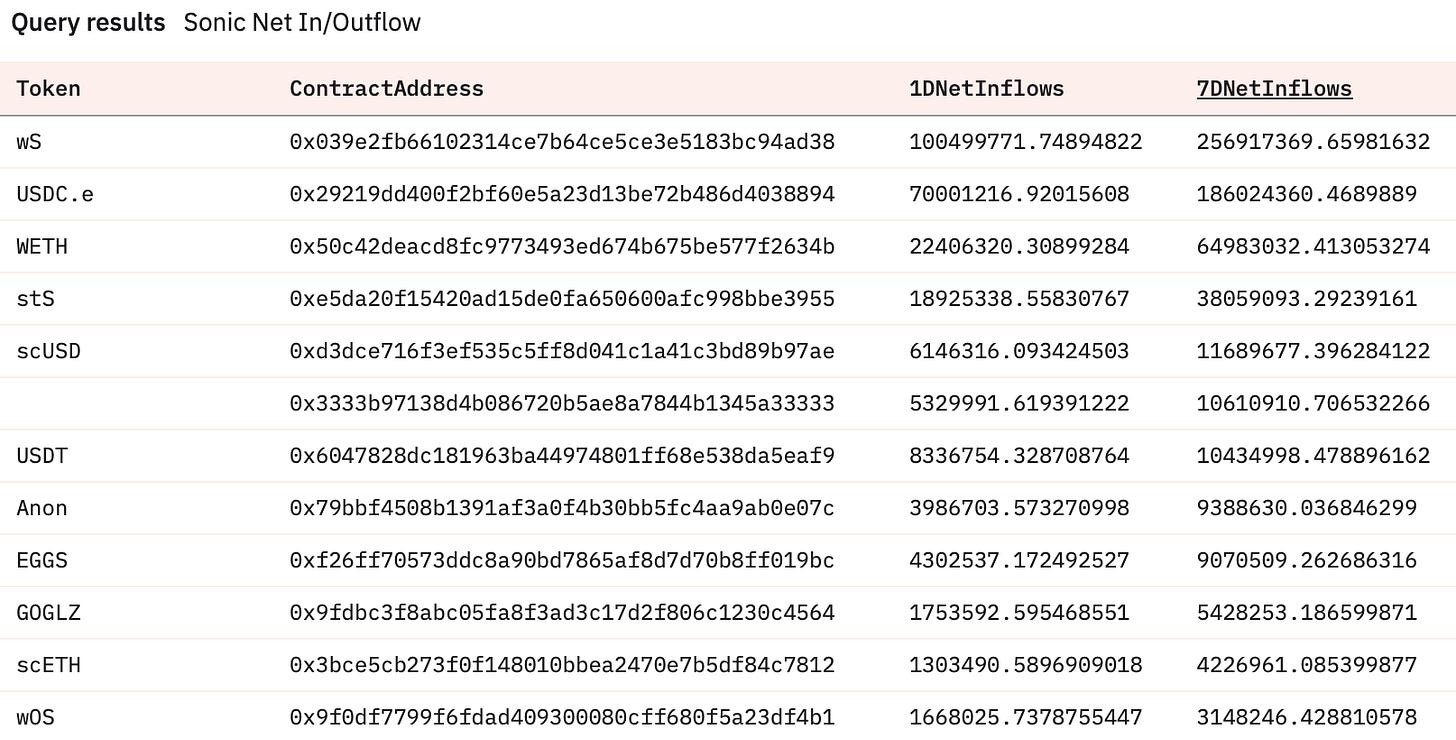

Net Inflow

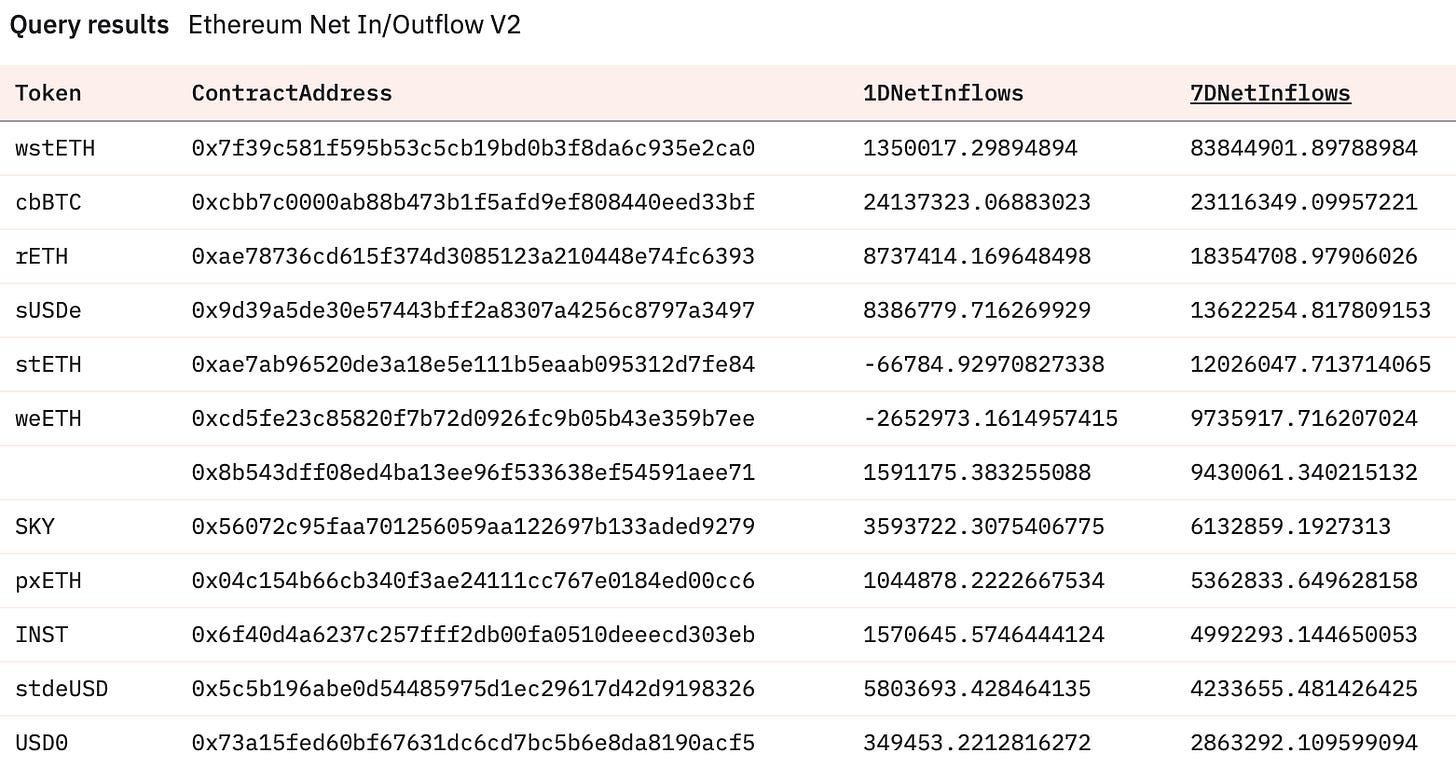

Not much going on here as expected, the only thing notable is that SKY and INST have been receiving bids as people are anchoring to projects with strong fundamentals in adverse market conditions. If you have been reading this for a long time, you will remember how strong MKR was in the bear market after they activated the buyback mechanism.

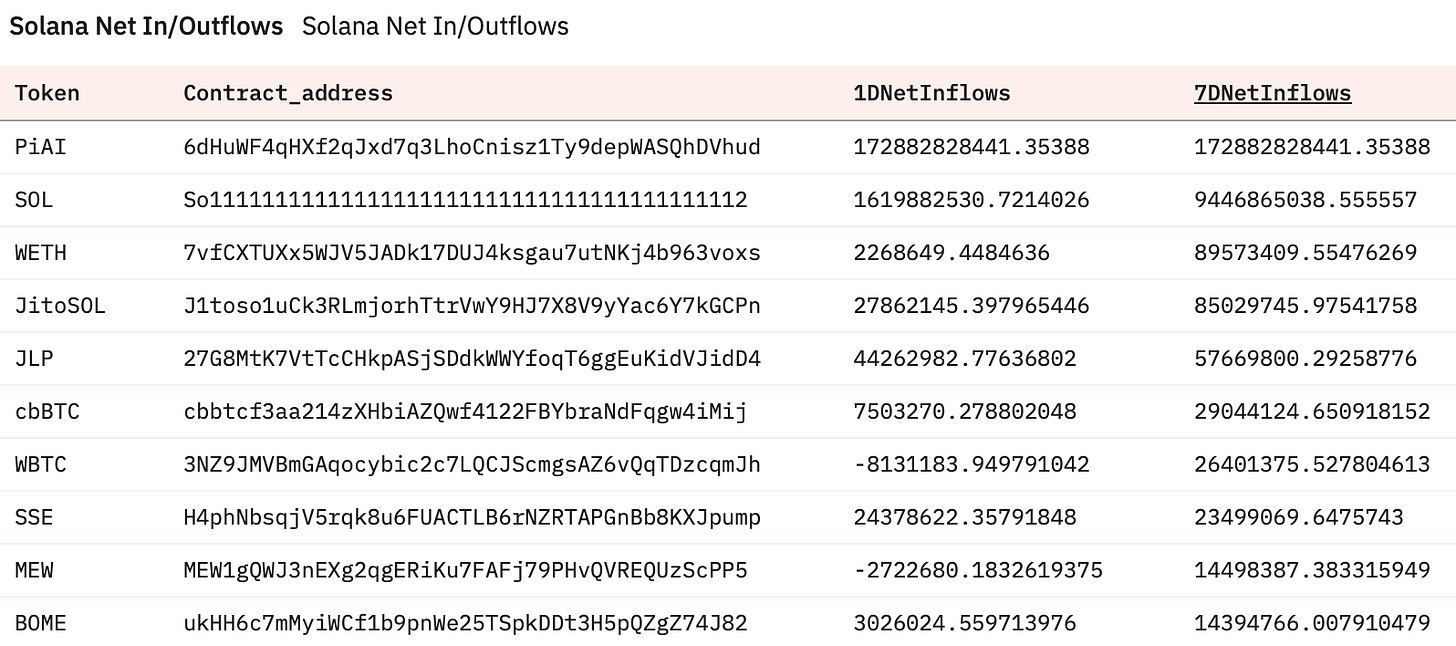

Not often you can say that SOL looks boring as well but that’s what a mass extraction event does for you. Although it is surprising to see so many people buy WETH and cbBTC on Solana, but hey, I guess that’s just a sign of the times, so can’t blame them.

You would think this data was spoofed or fake, but no. It represents the mental illness experienced on BNBchain over the past week after CZ made a post about his dog Broccoli. Three different tokens ended up fighting for liquidity, and now, to make the story even more bizarre, Binance Alpha listed all three of them.

The key largest bids aren’t being tracked here yet but it is worth highlighting that Anon is getting $9m worth of accumulation just on Sonic alone (liquidity is dispersed across different chains) is worth paying attention to.

Sleuthing

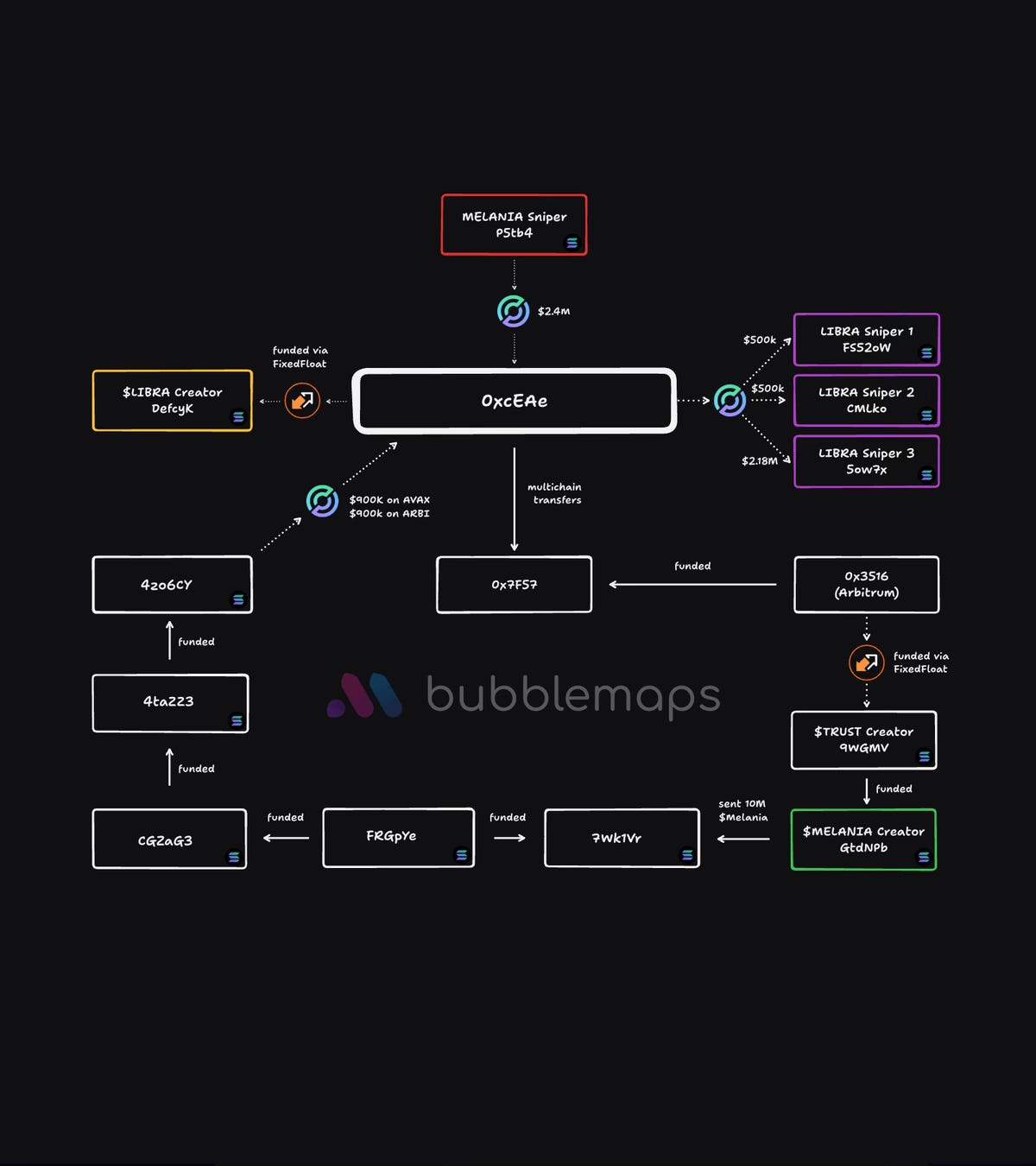

Nothing else comes close to the LIBRA debacle so of course the sleuthing piece is going to be about that because the plot goes even deeper.

Bubblemaps dove into how the LIBRA tokens were created by the same team that launched MELANIA and other decimated coins. You can find the full thread here, but they have done a great job dissecting this.

Token Unlocks

MRS - 11.87% of supply worth $40.20m on Feb 21st

IMX - 1.41% of supply worth $18.04m on Feb 21st

MOCA - 0.13% of supply worth $308.26k on Feb 21st

1INCH - 0.02% of supply worth $72.24k on Feb 21st

MURA - 2.00% of supply worth 44.00m on Feb 23rd

OM - 0.02% of supply worth $1.77m on Feb 23rd

EIGEN - 0.53% of supply worth $2.18m on Feb 23rd

ENA - 0.25% of supply worth $3.20m on Feb 26th

The choppy market continues, and the great cleanse is underway. While it might be painful, we will be better off for it in the future. Stick to long-term plays and survive. Goodspeed.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.