Last week, I discussed our need for a grand reset, and I did not expect us to receive one so swiftly. However, when you consider everything holistically, it’s hard to say that we didn’t deserve this, given the amount of blatant scamming and crime that was happening in front of everyone and going unpunished.

Bitcoin said, "Enough is enough." The tide went out, and we found out who had been swimming naked. This is a good time to reflect and revise your strategy, but it's also the worst time to give up, as many opportunities will present themselves in these market environments.

Attention isn’t scattered and there aren’t new meme runners every day. However, people can now concentrate their capital into ecosystems and few tokens pulling all in one direction. That is how we get onchain runners again. If you are an onchain trader, this is your time to shine.

With that said, let’s take a look at this week’s headlines.

Market Digest

The DOJ is going to investigate LIBRA - crime will be punished

Bank of America to launch a US stablecoin if lawmakers pass legislation

Elon Musk considers sending all Americans $5000 using DOGE savings

Thread on potential governance attack on Maker

Monad testnet is live

ByBit hacked for $1.4B in ETH - Lazarus confirmed to be behind it

Dynamic TAO guide

Franklin Templeton seeks approval for Solana ETF with staking

KIP protocol statement on LIBRA involvement

Aya Miyaguchi becomes president of the Ethereum Foundation

Aave V3.3 is live

Uniswap SEC investigation officially closed

Prices have been hit but there has been some fundamental good news that is to the benefit of the long-term health of the industry, not including the Bybit hack.

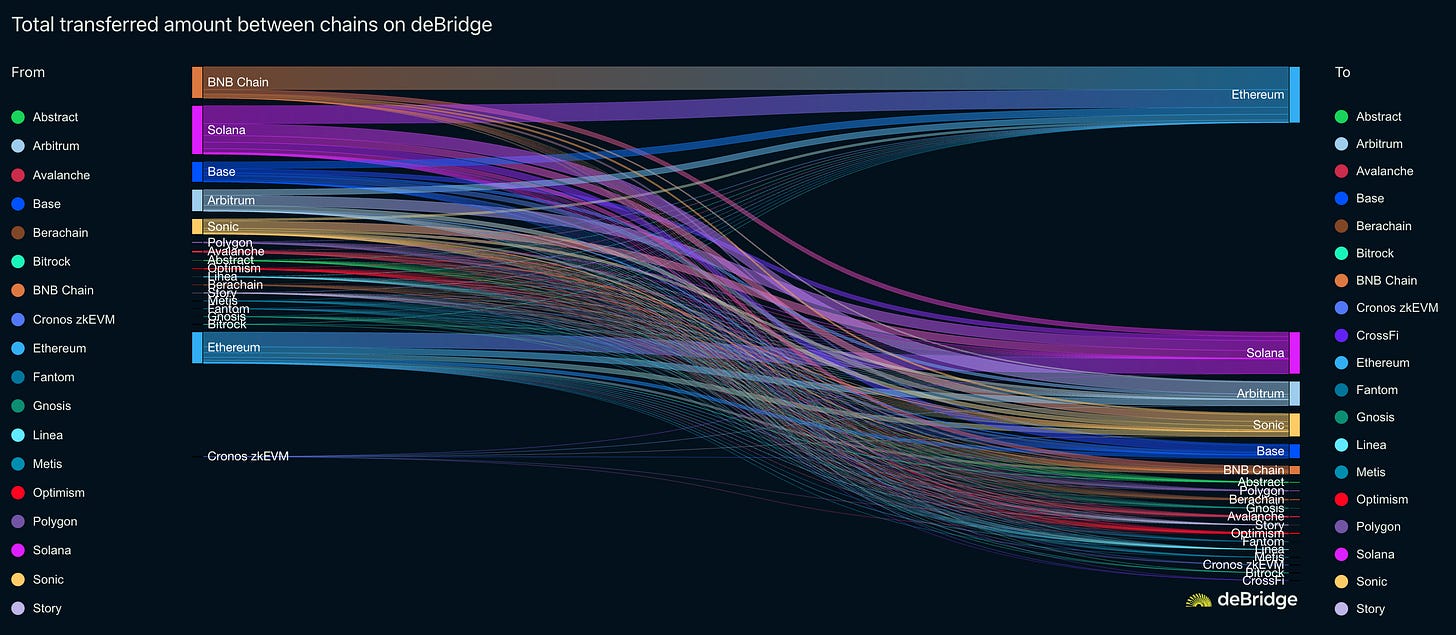

Bridge Flow

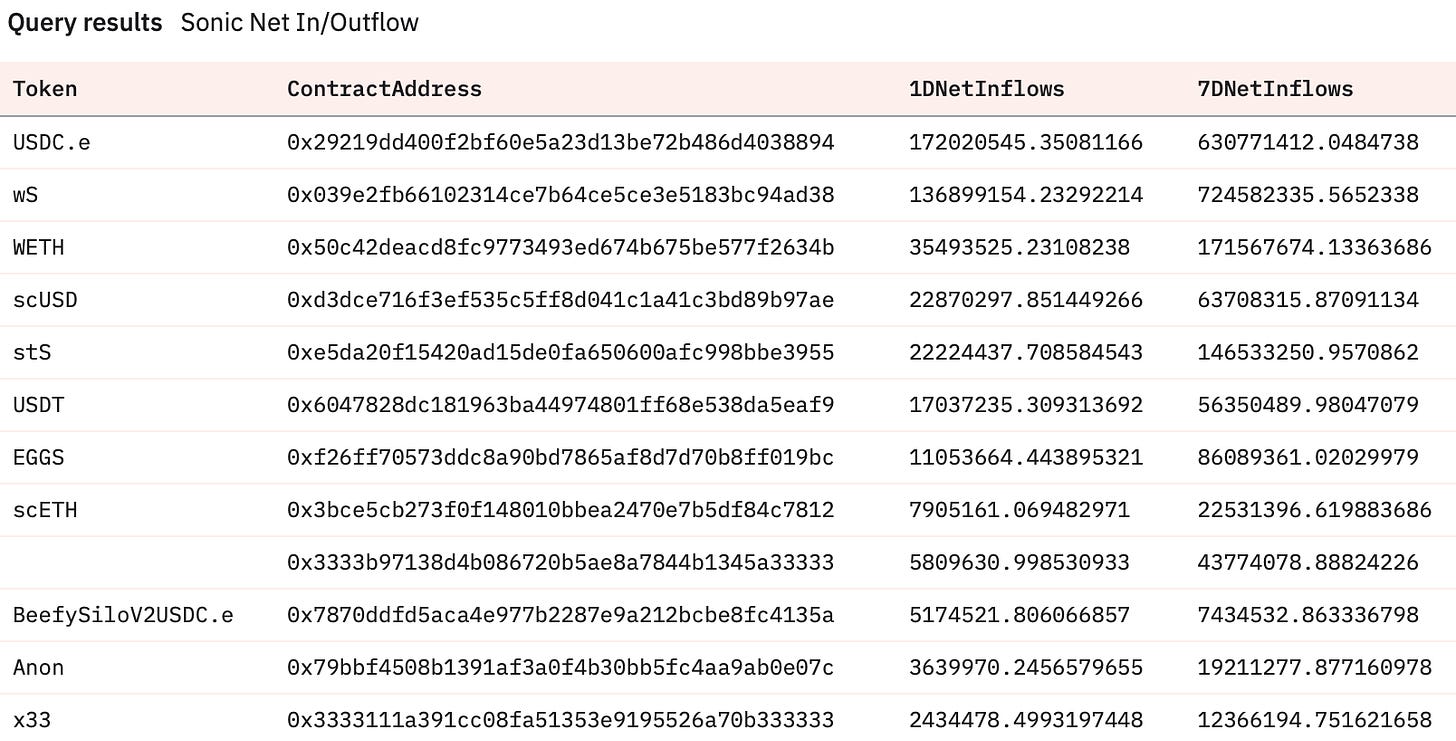

Capital isn’t flowing to Solana at an aggressive rate anymore, but Sonic’s pie continues to increase in value as it is still in a local DeFi bull market, which DeFi lovers have been starved of. It’s been fun, and make sure you enjoy it while it lasts. Those APRs are very juicy.

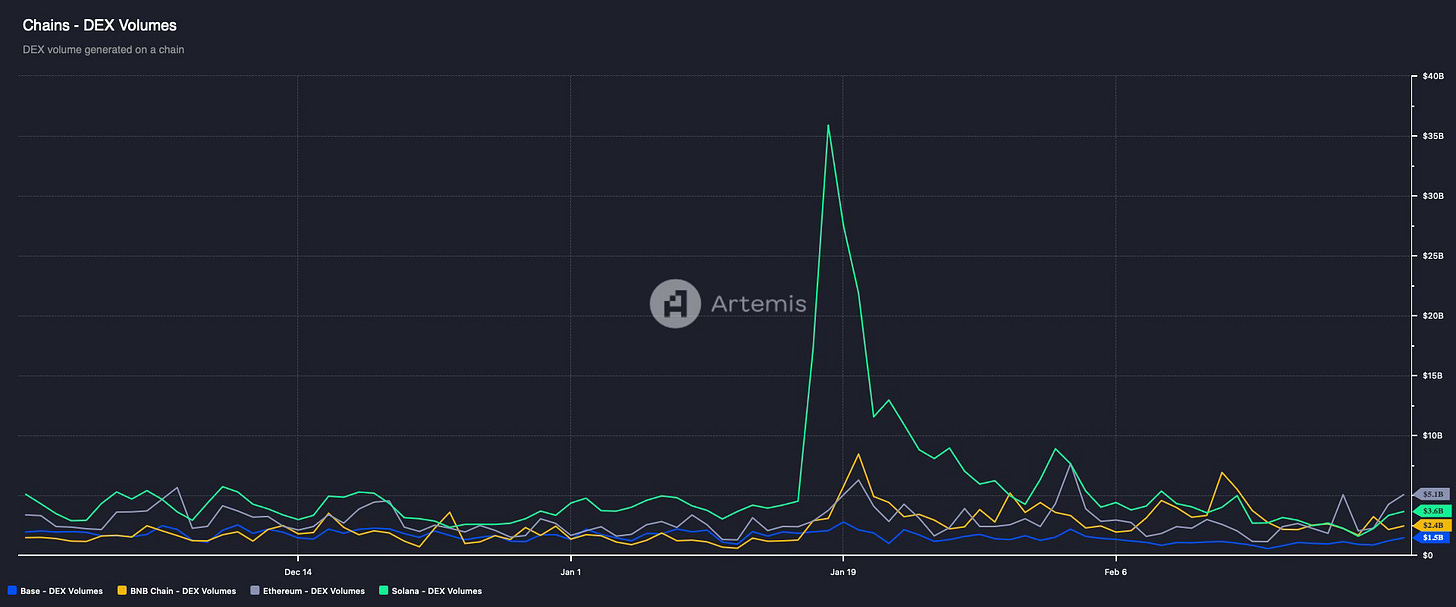

DEX Volumes

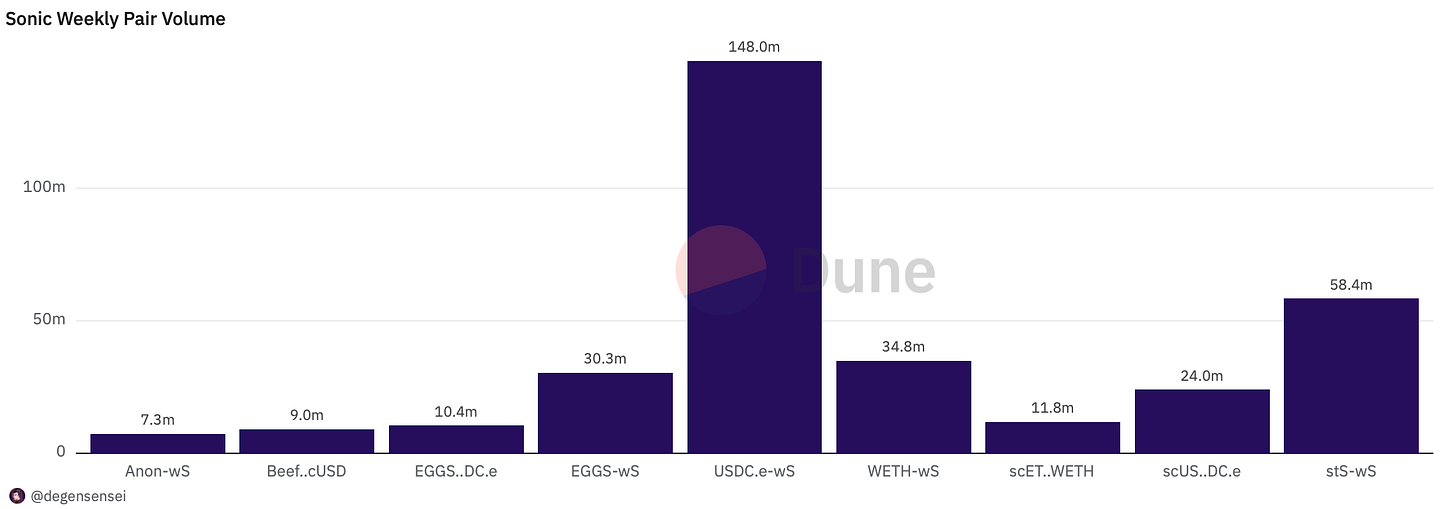

DEX volumes are perking up from bottom values but still nothing out of the ordinary yet, you probably won’t see ferocious alt moves across wide sectors for a while. Even if Sonic isn’t covered in this chart, it is the ecosystem experiencing high volume trading for the time being while the other ecosystems are taking a backseat.

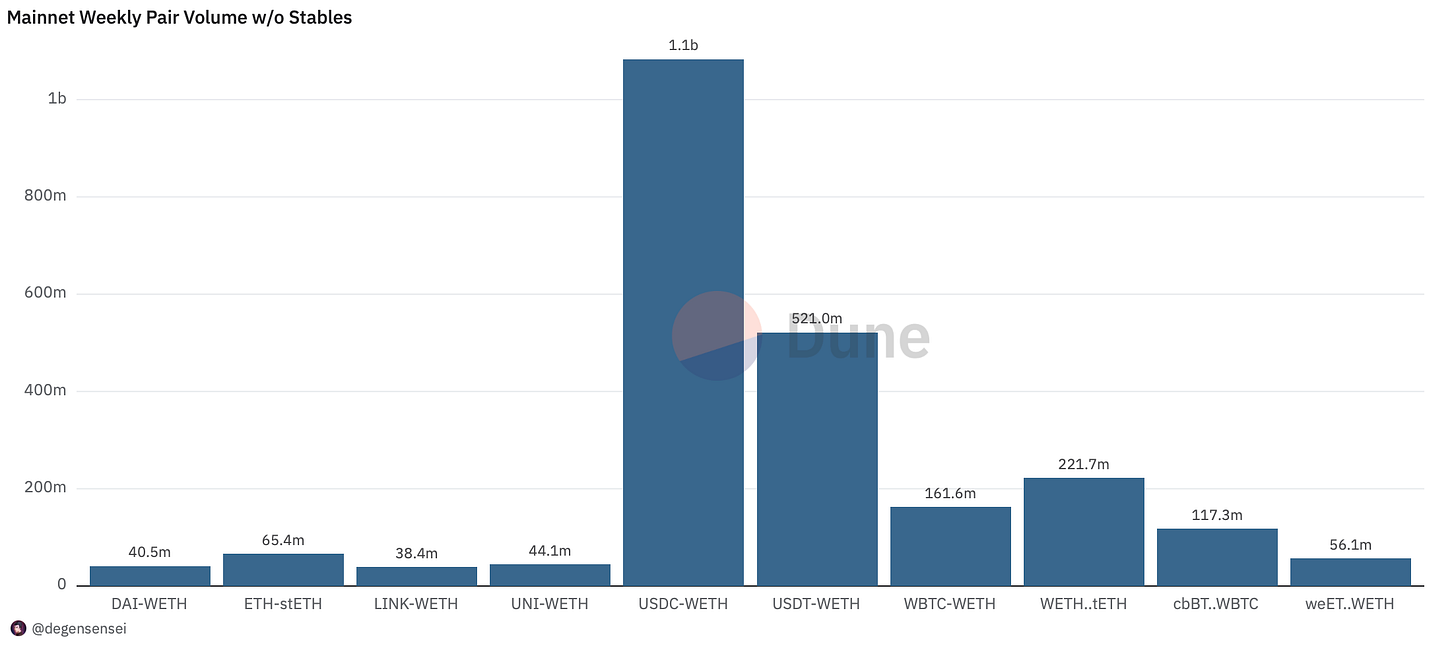

Pair Volumes

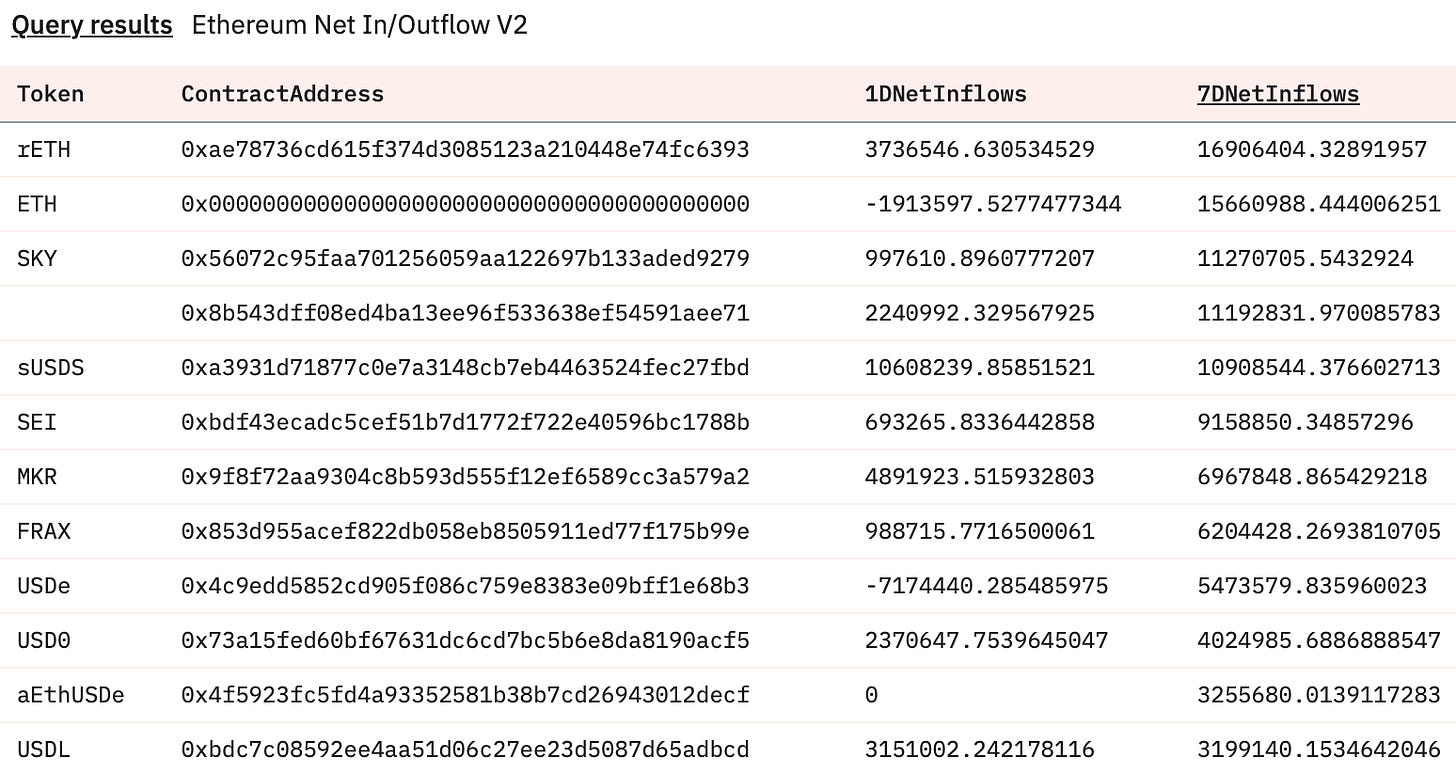

It’s a stablecoin bull market and the flows into DAI speaks for itself as people have been depositing a lot of money into Sky over the past week to farm incentives as they are risk averse after a tough market period. Only alts of interest with significant volume is LINK and UNI (which aren’t under investigation anymore). SKY just misses the list narrowingly but has experienced a lot of volume after the recent buyback proposal.

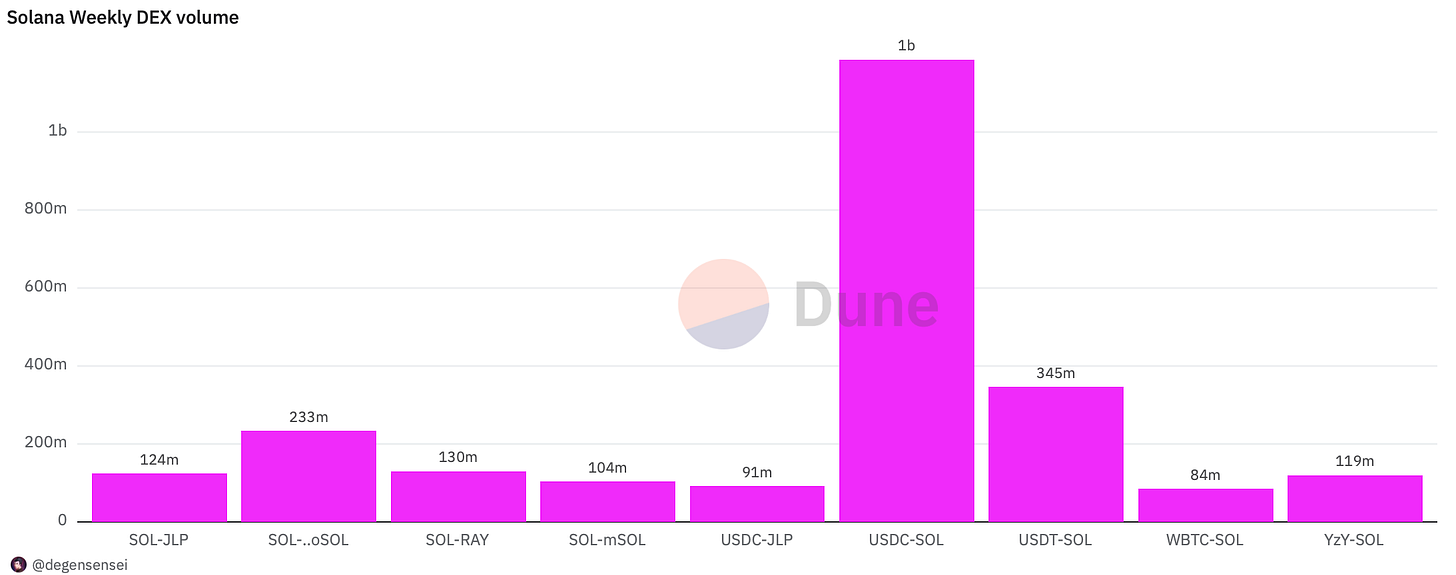

Solana volumes are still higher than Ethereum but significantly lower than when it was an alt season in the ecosystem. RAY has experienced a lot of volume for bad reasons as Pump.fun plans to launch their own DEX which means that Raydium will do significantly less volume going forward.

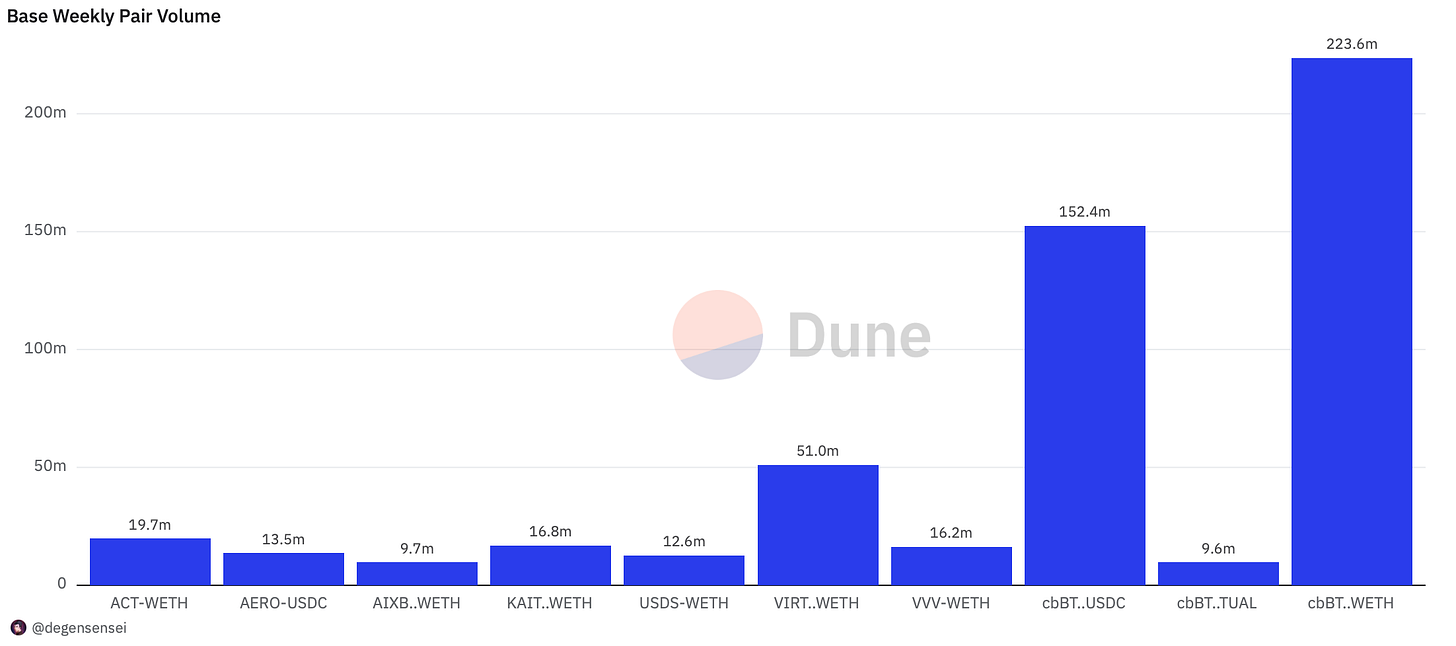

VIRTUAL remains the most actively traded token in the ecosystem after cbBTC since it has a lot of AI agents trading under the same umbrella contributing to the volume. The KAITO launch has been very successful and is the reason why it is among the most actively traded tokens as well as it recently breached a new all time high again. New tokens are good.

Sonic continues to go strong even if it isn’t properly covered here, although Anon which has been championing the ecosystem since day 1 has remained among the most actively traded tokens there. If you are a fan of DeFi ponzinomics, EGGS is one for you that like to play games involving game theory.

BNB season was short-lived and there is nothing interesting to cover there. CZ made a big mistake with the Broccoli debacle which killed all momentum.

NFT Trading

Only thing really interesting here is teh OCH Genesis Heroes which is a GameFi platform built on Abstract that has been performing well. While Welathy Hypio Babies is the “Remilios” of Hyperliquid. Apart from that, not much to see in NFT land

Interesting mints:

Wassie on Bera - Wassies embody crypto culture and because of that there was a Wassie collection that recently minted out on Berachain for 10 BERA each.

Net Inflow

A chain for humble farming and letting the SKY buybacks do the job for the holders, otherwise, there isn’t really much going on here. SEI has surprisingly attracted a lot of buyers for whatever reasons.

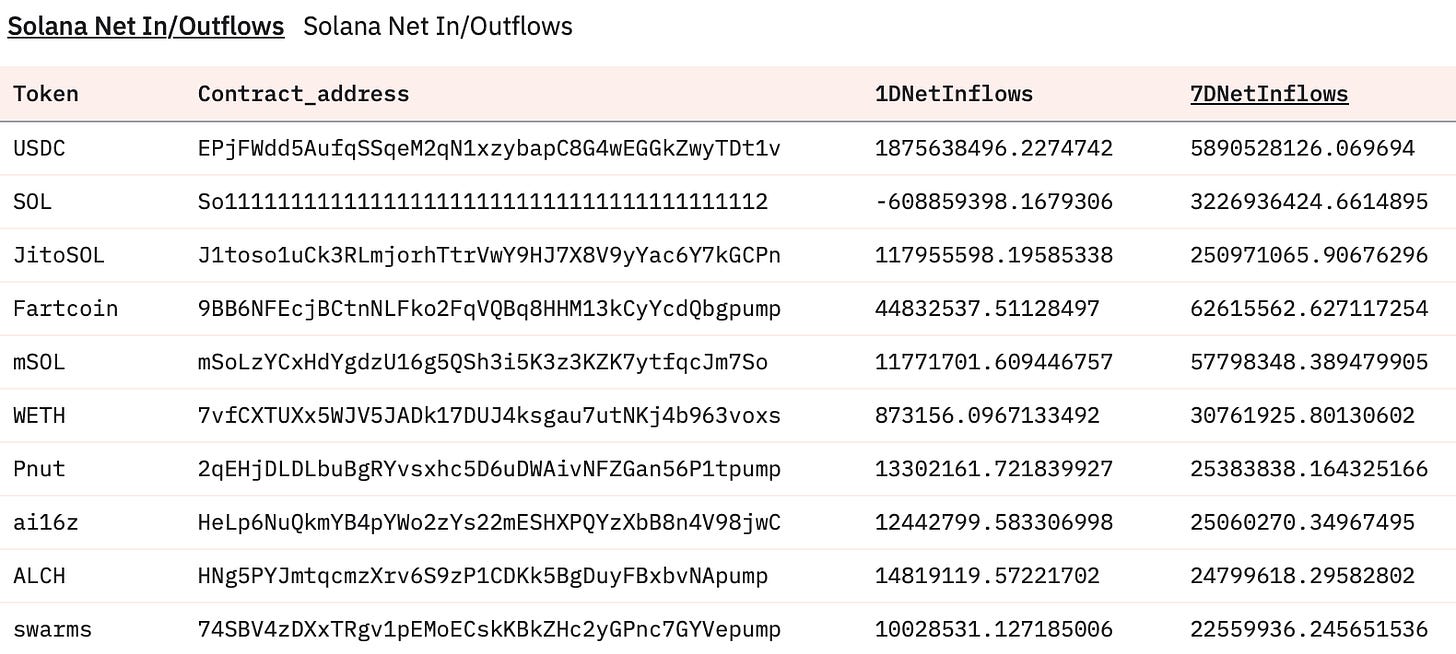

Capital continues to flow to USDC on Solana as the ecosystem is experiencing a severe sell off that can’t offset the amount of flows some of these tokens have received. The inflows to Fartcoin under these market environments is fascinating to say the least. PNUT, AI16Z, swarms and ALCH haven’t done too bad either with PNUT being the biggest surprise. Because who in their right mind is buying that?

Questions for Plato I guess.

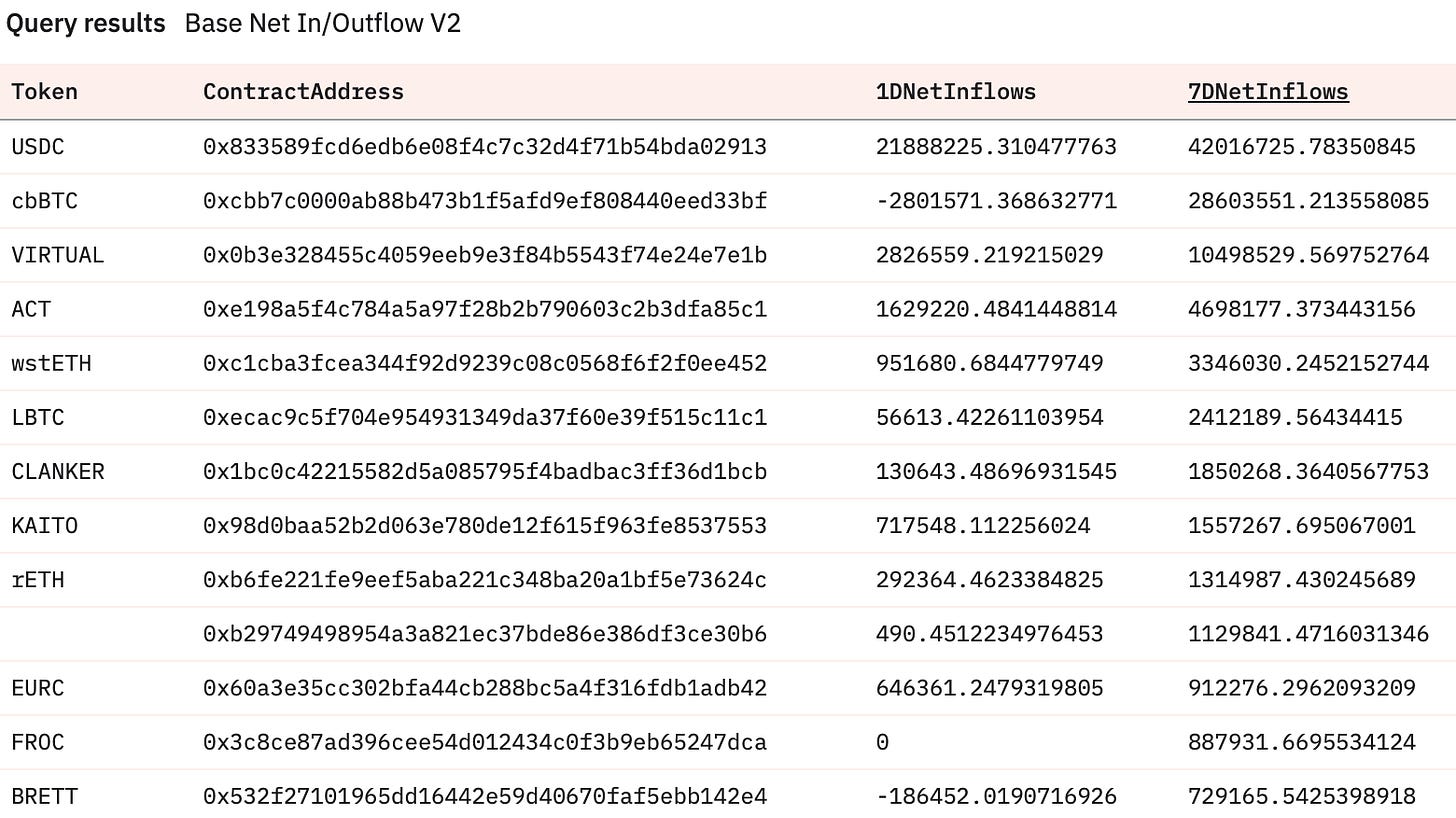

USDC bull market is prevalent on Base as well although VIRTUAL, CLANKER and KAITO have received decent flows over the past week as well. 10m worth of inflows into VIRTUAL when the market takes a downturn makes me think that there might be news coming. Worth watching.

This table isn’t really mature yet but still highlights tokens such as Anon, Eggs and x33 which actually just scratches the surface. The remaining tokens on the list are likely only used for farming purposes whih are very lucrative on Sonic right now.

Sleuthing

One word: Bloodbath.

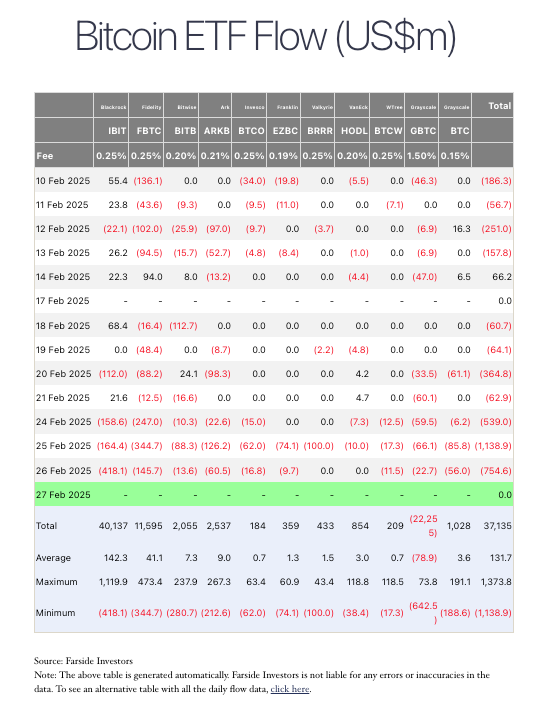

We are seeing the largest ETF outflows in history and the resulting bloodbath because of it. No need to get to hasty but make sure you stick with a plan of when you see value instead of trying to to find the perfect bottom.

Token Unlocks

FET - 0.13% of supply worth $2.18m on Feb 28th

CELO - 0.51% of supply worth $1.11m on Feb 28th

MOCA - 0.13% of supply worth $293.93k on Feb 28th

TRIBL - 10.12% of supply worth $173.78k on Feb 28th

OP - 1.93% of supply worth $35.10m on Feb 28th

1INCH - 0.01% of supply worth $16.12k on Feb 28th

SUI - 0.74% of supply worth $68.44m on March 1st

ZETA - 6.48% of supply worth $12.70m on March 1st

DYDX - 1.14% of supply worth $5.85m on March 1st

ENA - 0.25% of supply worth $3.20m on March 2nd

One thing you do not want to hold in bad market conditions are tokens with large looming unlocks. The unlocks won’t hit immediately as they start distributing the tokens until it can’t be sustained anymore. Look at ONDO for reference.

Survive.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.