Another week of chopping driving people crazy despite BTC breaking all time high’s. This likely stems from the vast majority of market participants not having any exposure to BTC while actively tracking the charts of alts every day which can lead to visible frustration.

Add to the fact that summer seasonality is about to come in which participants have not so fond memories of over the past years and you can see why the concerns could be validated.

However, the demand for BTC has never been higher with an increasing amount of companies using BTC as a treasury strategy as there are few things that have managed to outperform it and long may that last. A strong BTC is good for crypto as a whole.

Respect the king.

Nonetheless, BTC dominance showing indications of topping or being close to a top for the time being.

Now, what has happened under the hood over the past few days?

Market Digest

Plasma announces XPL token sale, if you are looking to get a primer on Plasma you can read about it here.

Gamestop announces $500m worth of BTC purchases

Cetus (the largest Sui DEX) got hacked for assets worth $200m at the time

Worldcoin raises $135M from A16z and Bain Capital

Kraken to launch tokenized stocks and ETF trading

Hyperliquid responds to CFTC

A Polygon founder stepping down

Strive raises $750m to buy more BTC

SharpLink announces $425M ETH reserve strategy

Blockchain Group completes bond worth $72M to buy more BTC

Trump media announces $2.5M BTC Treasury deal

Bridge Flow

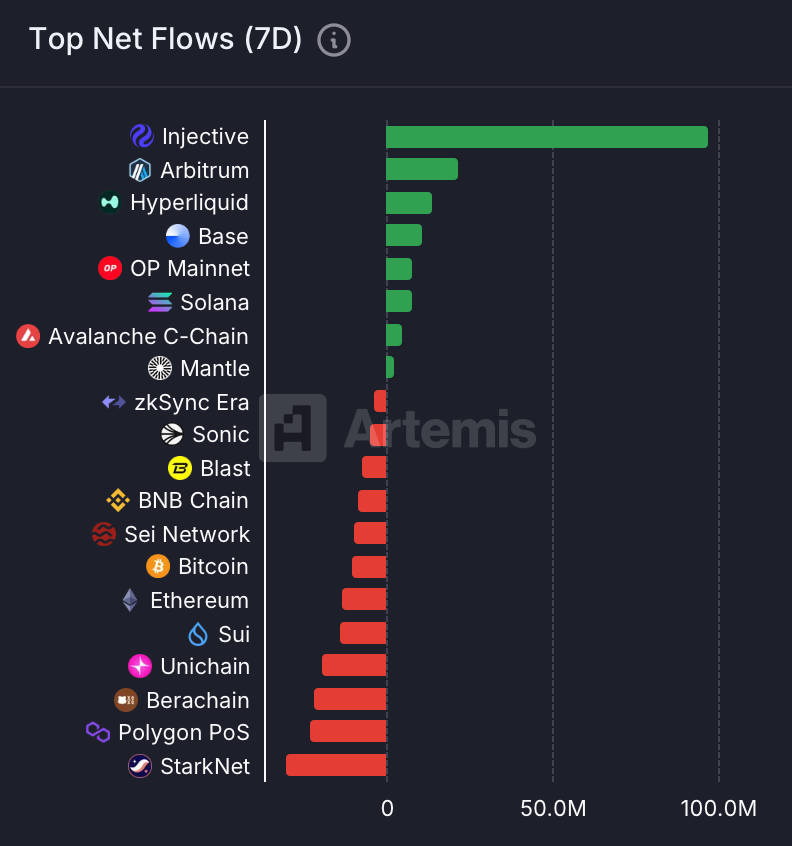

I’ve mentioned continously over the past weeks in the pro substack that Hyperliquid ecosystem is one to watch and it is finally showing up in the net flows as well as capital continues to find its way as the TVL of the ecosystem is soaring. However, what’s more interesting is what’s going on at Injective which remains a peculiar question for now.

DEX Volumes

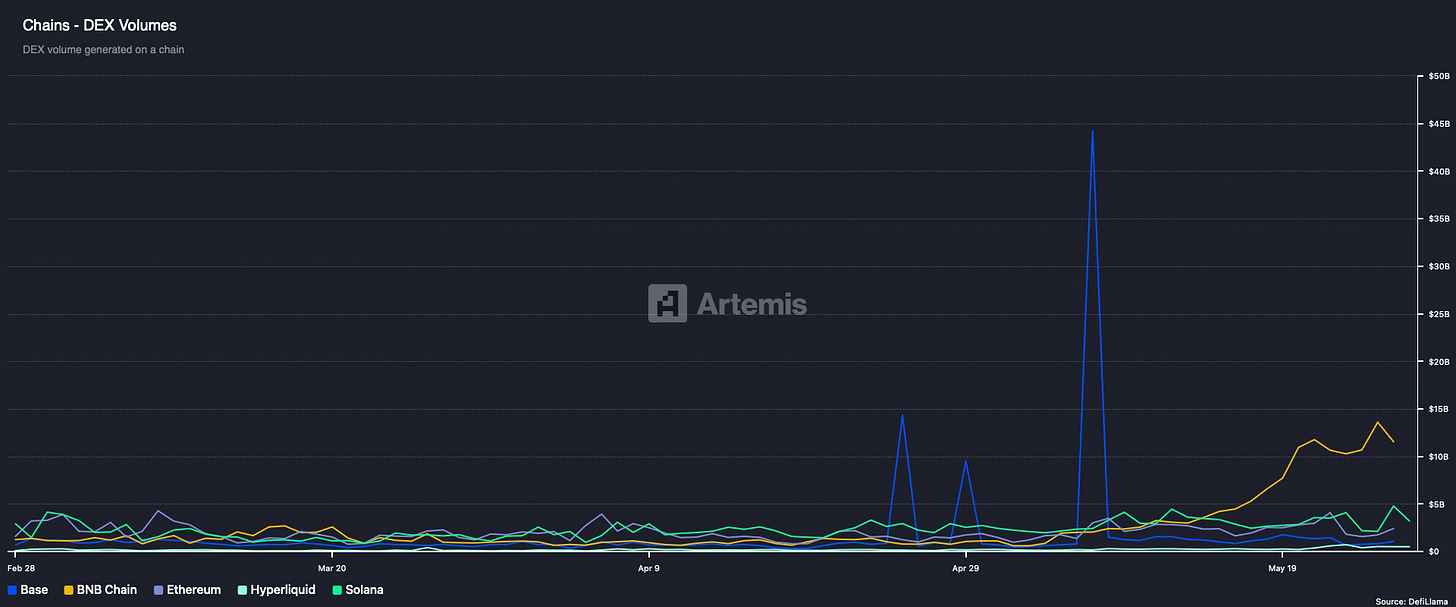

DEX volume is exploding on BNB due to the Polyhedra volume while it’s slowly creeping up on Solana. Hyperliquid volume is on the rise and is doing well but still pale in comparison to the leading ecosystems such as Ethereum and Solana. However, the trend continues to go up and to the right.

Pair Volumes

The vast majority of trading volume on Ethereum mainnet is happening amongst the large cap alts such as AAVE, UNI, LINK and PEPE as these are the least volatile and are be bought without moving the price too much with large size. AAVE in particular have had an impressive performance since activating buybacks.

On-chain environment on solana is getting increasingly more difficult with more people trying to farm market participants in difficult environments. On-chain ceilings are becoming increasingly lower as there is sitll a lot of capital on the sidelines in an impending summer lull. In order for that to change, BTC would have to seriously start trending again to breed confidence.

Base ecosystem is gradually increasing in volume which is directly related to the Virtual ecosystem and how well it is doing at the moment. The on-chain volume of VIRTUAL have doubled over the past week and you wouldn’t even notice if you didn’t look beyond the surface. Carry on.

ZK (Polyhedra) continues to do a ton of volume and I realized that it is likely due to being listed on Binance alpha which causes tons of bots and users to do a lot of wash trading in hope of generating points. Not much else to see here but at least we got an answer to that question now.

NFT Trading

There is literally nothing going on in NFT lands and I genuinely feel bad for the people that believed “ancient BTC whales” would buy their Ordinals. Memes stole the thunder from NFTs and that will continue to be the case unless we see a full blown altseason again which would require quantitative easing.

Net Inflow

First three can be ingored again, the ones to pay attention to are AAVE, PEPE and UNI which are the only tokens that are garnering any interest by large money outside of SPX6900 which is edging closer to a new all time high.

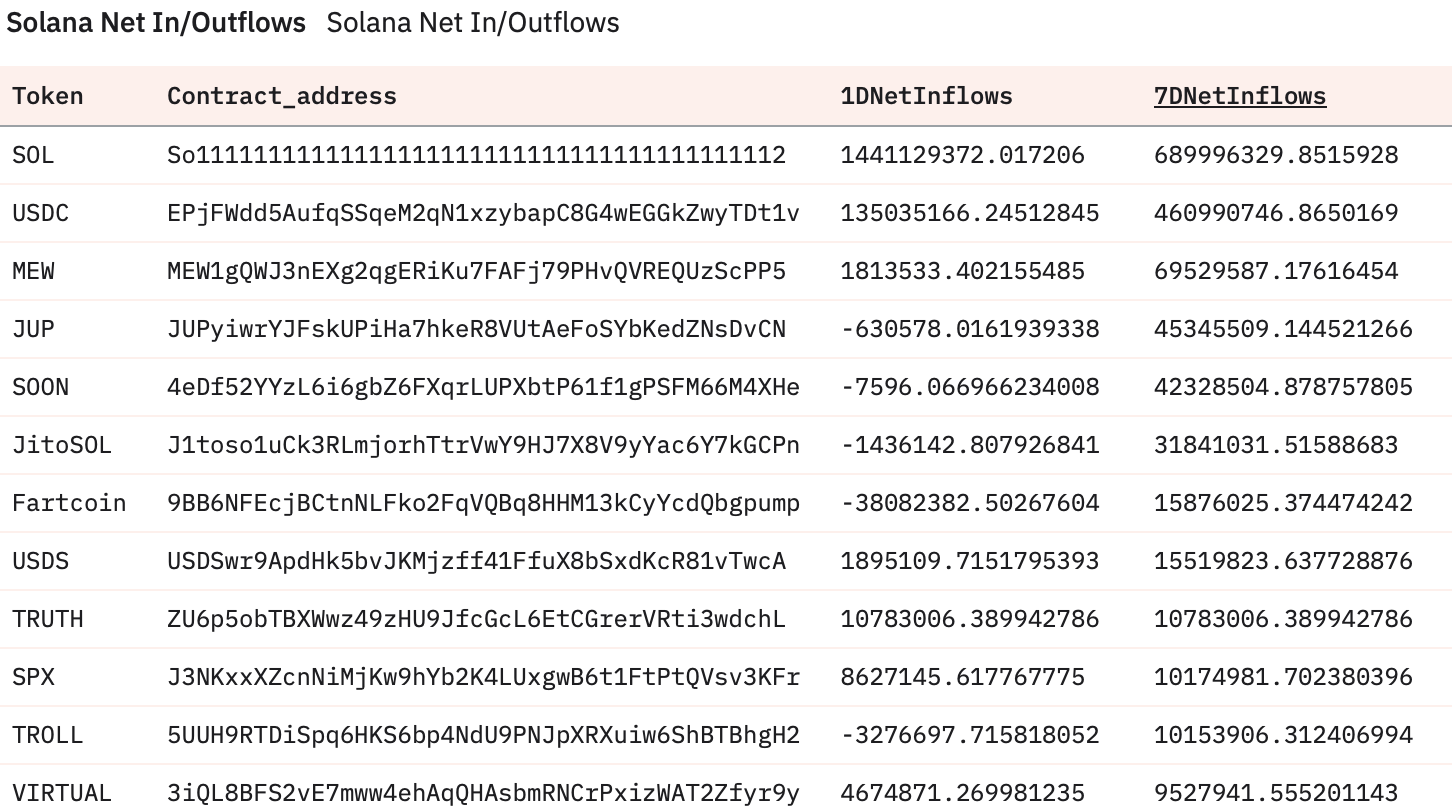

On Solana there are more spread out purchases along the board (including SPX6900) as MEW got listed on Robinhood while JUP, SOON and Fartcoin have seen relatively strong flows as well.

Since I mentioned that Fartcoin was losing momentum the alt market has taken a beating and when things are ready to go again it is likely that it will lead the pack and go first as well.

DINNER the latest rug pull so that can be ignored. The ones to pay attention to on this list are SPX and VIRTUAL while BRETT and KAITO remain sleeper plays. VIRTUAL is only the tip of the iceberg but staking it and acquiring virgen points continue to remain very worthwhile as it is getting increasingly closer to all time high’s as well.

Sleuthing

The SUI hacker got away with $52m and bought ETH with it while the majority of the funds were frozen and will likely be returned to the protocols and users that lost their funds on the chain due to validators intervening.

Token Unlocks

OP - 1.83% of supply worth $24.23m on May 31st

SUI - 1.32% of supply worth $160.58m on June 1st

DYDX - 1.07% of supply worth $5.28m on June 1st

ENA - 0.70% of supply worth $15.83m on June 2nd

EIGEN - 0.42% of supply worth $2.00m on June 3rd

IOTA - 0.23% of supply worth $1.80m on June 4th

BGB - 0.01% of supply worth $247.74k on June 6th

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here. Tax season is underway and you get a 20% discount on your first year with the DEGEN20 code at no additional cost for you.

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.

Staying in the large caps seems to be the trade for this cycle, mostly.