Onchain natives were inherently scared over the past few days when the news concerning the PUMP token finally was released that have been ancitipated for a long time. There was some kneejerk reactions accordingly as it likely acts as a liquidity drain for the eocsystem if they do a large presale on-chain instead of doing it on Echo or something in that mold.

Considering HYPE being the gold standard of how token launches should be done, many were hoping for an airdrop of a similar mold letting users to get along the ride at base level. While that doesn’t look like it will be the case, it’s too early to react too excessively about the token and its “imminent death” before we know the mechanichs and tokenomics of it.

Still, it is something to keep an eye on nonetheless. Especially, if you spend a lot of time trading on Solana.

Additionally, due to the interest in the Circle IPO there might be some reinvigorated interest into stablecoin related tokens. Keep an eye on those if CRCL does well.

Onto the events of the week.

Market Digest

Pump Fun announces 1B token raise at a 4B valuation

Binance US listing spot HYPE

Classover secures $500M for Solana treasury strategy

Stablecoin Summer thread

Chameleon Jeff thread about transparent trading

Pantera Capital weighs in concerning Digital Asset Treasury companies

Bridge Flow

A lot of capital is flowing directly to the Ethereum mainnet with Base and Unichain suffering the largest TVL lossess. This is interesting considering Base is increasing in mindshare right now with onchain increasingly heating up there. Probably a good time to start taking a look at Ethereum onchain while attention isn’t there.

DEX Volumes

BNB volume is skyrocketing as they are in the midst of experiencing another on-chain season there. If you are verse on trading on BNB now is probably a good time to capitalize on it while the volume is there. Still flying under the radar despite the big discrepancy in comparison to the other chains that doesn’t come close at the moment.

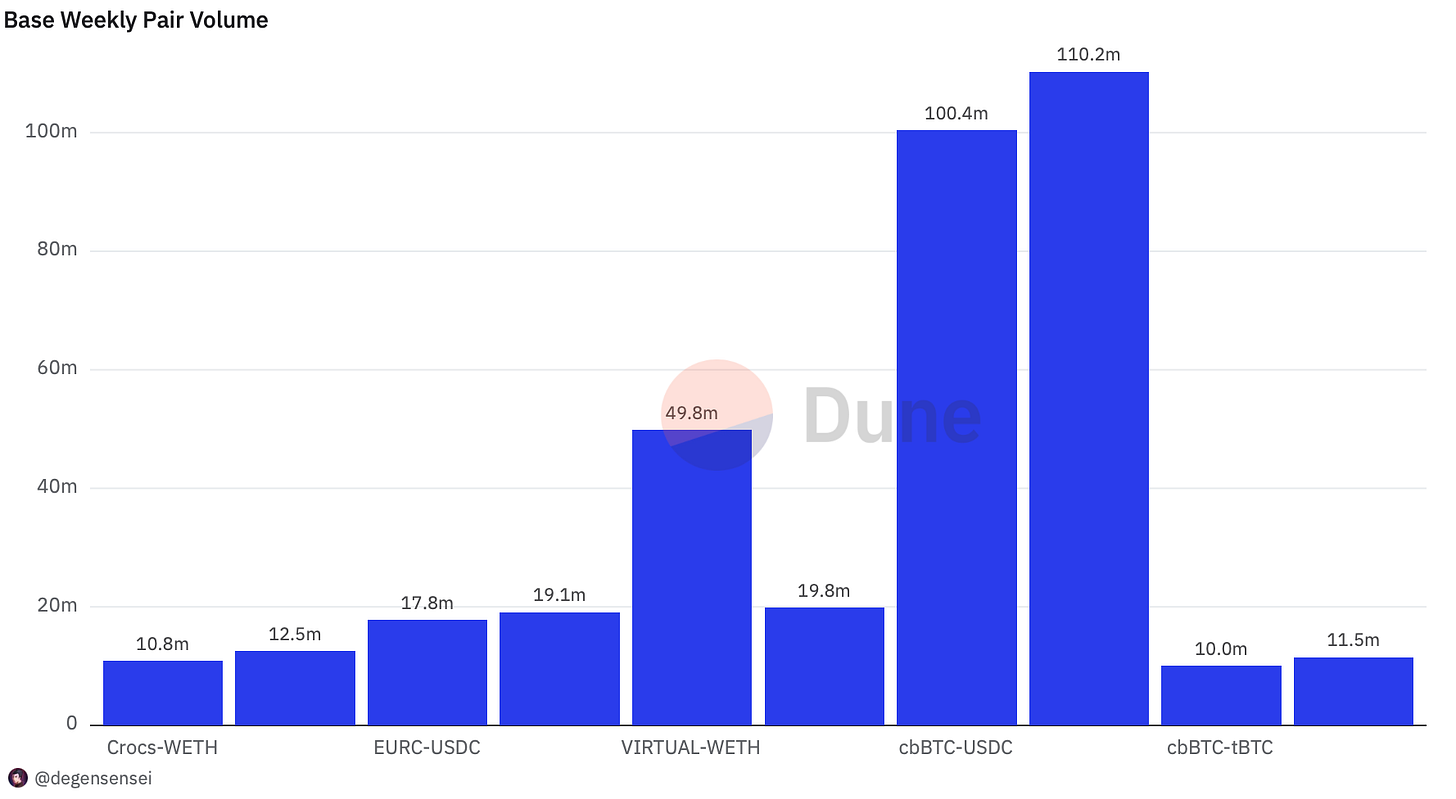

Pair Volumes

Activity is evidently increasing with AAVE, UNI, SPX, PEPE and SBET all doing an increasing amount of volume on Ethereum which hasn’t been the case for a long time which is an indication of the ecosystem finally waking up which is worth paying attention to.

Ethereum on-chain looks ripe which has been long time coming but it’s time to finally give the bat signal.

Solana continues to chug along but is becoming increasingly more difficult and extractive requiring more skill from participants. If you’re going to play the memecoin game with a significant amount of capital, Fartcoin continues to act as the risk-on signal for the ecosystem.

VIRTUAL and its underlying ecosystem is where it continues to happen on Base and where majority of attention within this ecosystem is best spent. KTA is taking the majority of the remaining attention and it continues to go from strength to strength based on its price action. Impressive to say the least. Time spent on Base is worthwhile at the moment which hasn’t always been the case.

The BNB volume was dominated by ZK in the previous weeks but is now spread across the ecosystem and is looking healthy which is a good sign.

NFT Trading

Moonbird has gotten a new leader of the project which is why it is up so much. Otherwise, there is not really much going on here as there isn’t really a point in buying NFTs unless you think there is a catalyst coming or holding a blue chip.

Don’t be a Japanese soldier.

Net Inflow

MKR has been the biggest beneficiary of on-chain flows as people are preparing themselves for a stablecoin focused “narrative” and accumulating it in hope of attention coming its way. Likely not a bad idea, I respect it.

On Solana SPX is making a resurgence and have been heavily accumulated there alongside the GIGA meme. It’s basically people taking out an Murad insurance policy if he ends up being right and who can blame them? People hate coping on the sidelines and this is the way to deal with that fear. Aside from that, Candle which is another token launch platform has accumulated significant flows as well.

TIBBIR is the best performing Virtual related tokens since the bottom on April 7th as the connection to Micky Malka and Ribbit Capital is showing increased correlation and people are getting excited about it. It’s a binary play that has paid off very handsomely to holders so far.

KTA continues to attract new holders and flows which its price action demonstrates while SPX are getting significant bids on Base as well. MAMO is the latest Base on-chain runner that has flown under the radar but has done very well.

On BNB, Polyhedra continues to find large buyers although price isn’t really budging which indicates that a lot of it is market making activity or people farming volume on Binance alpha. What has generated a lot of flows though is Port3r and the B-squared token which took a severe hit on token launch but seems to have stabilized a bit for now.

Sleuthing

This is the result of Pump Fun traders over the past month with only 5 people making more than 50K in realized gains. Pump Fun deciding to launch their token is a clear sign that they realize that their casino is about to slow down and the odds are clearly not in your favor trading in the “trenches” on Solana anymore. Better opportunities are likely to be found elsewhere (Ethereum and Hyperliquid) from here.

Token Unlocks

ENA - 2.95% of supply worth $59.89m Today

BGB - 0.01% of supply worth $225.69k on June 6th

MOCA - 0.09% of supply worth $207.82k on June 9th

MOVE - 1.96% of supply worth $7.46m on June 9th

EIGEN - 0.42% of supply worth $2.05m on June 10th

IOTA - 0.40% of supply worth $2.83m on June 11th

RENDER - 0.10% of supply worth $1.92m on June 11th

AXS - 0.40% of supply worth $1.64m on June 11th

Ethereum will likely have its renessaince as people will have a hard time readjusting from hating the asset. It will likely be a great long term hold from here as capital is always flowing to different places and signs are indicating that we are at the point of an early shift back to where it all started for many people.

Circle raised 1B and is 25x oversubscribed for their IPO. Take a look where majority of their funds lie and things aren’t difficult to envision.

Ethereum revanchism is back on the table and make sure you don’t miss it.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here. Tax season is underway and you get a 20% discount on your first year with the DEGEN20 code at no additional cost for you.

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.