Sentiment around the crypto industry continues to steadily increase while we are climbing the wall of worry of CT natives while Bitcoin is sitting at all time highs. Never has there been a larger disparity where the industry is going and where the sentiment is which likely stems from the performance of altcoins over the past years. This becomes evident when you chart the OTHERS/BTC chart.

However, the Plasma raise is indicating that there is a lot of capital still to deploy to the industry and that is is better to lean bullish than bearish at this stage even if the summer might give us some chop. The future is undoubtedly bright and 2025 is shaping up to be exciting.

With the deregulation of the crypto industry continuing, the appetite for people and insittutions to buy what is perceived to be sound value has never been higher whch can be seen by both the CRCL and the XPL raises over the past week.

Quality assets will be repriced.

Market Digest

SEC Chair Paul Atkins says they are working on policy to exempt DeFi platforms from regulatory barriers.

SOL ETF’s could be approved in 3-5 weeks

DeFi projects will be exempt to regulatory barriers

Plasma raises $500m in minutes

Cetus Protocol relaunches after exploit

Strategy acquires 1045 BTC for $110M

South Korea’s ruling party introduces plan to allow stablecoins

Tether financial model

Pump.Fun to distribute protocol revenue to token holders

X partners with Polymarket

Morpho protocol update concerning the MORPHO token

Synthetix launching a perp DEX on Ethereum mainnet (?)

Bridge Flow

Ethereum continues its dominance and attracting significant flows from other chains over the past week with Base and Unichain being the largest losers accordingly. It’s also significant that Solana continues to be in the green while the capital inflow is so large on Ethereum that likely trickles down eventually as on-chain slowly is starting to pick up.

DEX Volumes

Even if Solana TVL isn’t growing as rapidly as it once used to do, the volume is clearly skyrocketing and starting to catch up with the volumes on BNB as attention is on Solana at the moment, especially after the recent ETF news. However, chain volumes are up across the board even if it is more apparent on that ecosystem. Enjoy it while it lasts.

Pair Volumes

A healthy Ethereum on-chain ecosystem tends to feature the tokens we are seeing in this table that includes AAVE, PEPE, SPX which we are all seeing on the list while smaller tokens that are coming into the fore such as ZEUS is making an appearance as well. The ecosystem is on the up and should not be slept on.

Feels good to be able to reside here again but mainnet revanchism is real.

Solana volume numbers are not correct for some reason which will need to be checked after this but the related tokens are right with Fartcoin doing the majority of the volume alongside CHILLGUY, POPCAT, KMNO and SPX. Fartcoin and SPX has been the best performing assets by far over a long period and holding anything else has continued to be a waste of time. Murad was right I guess.

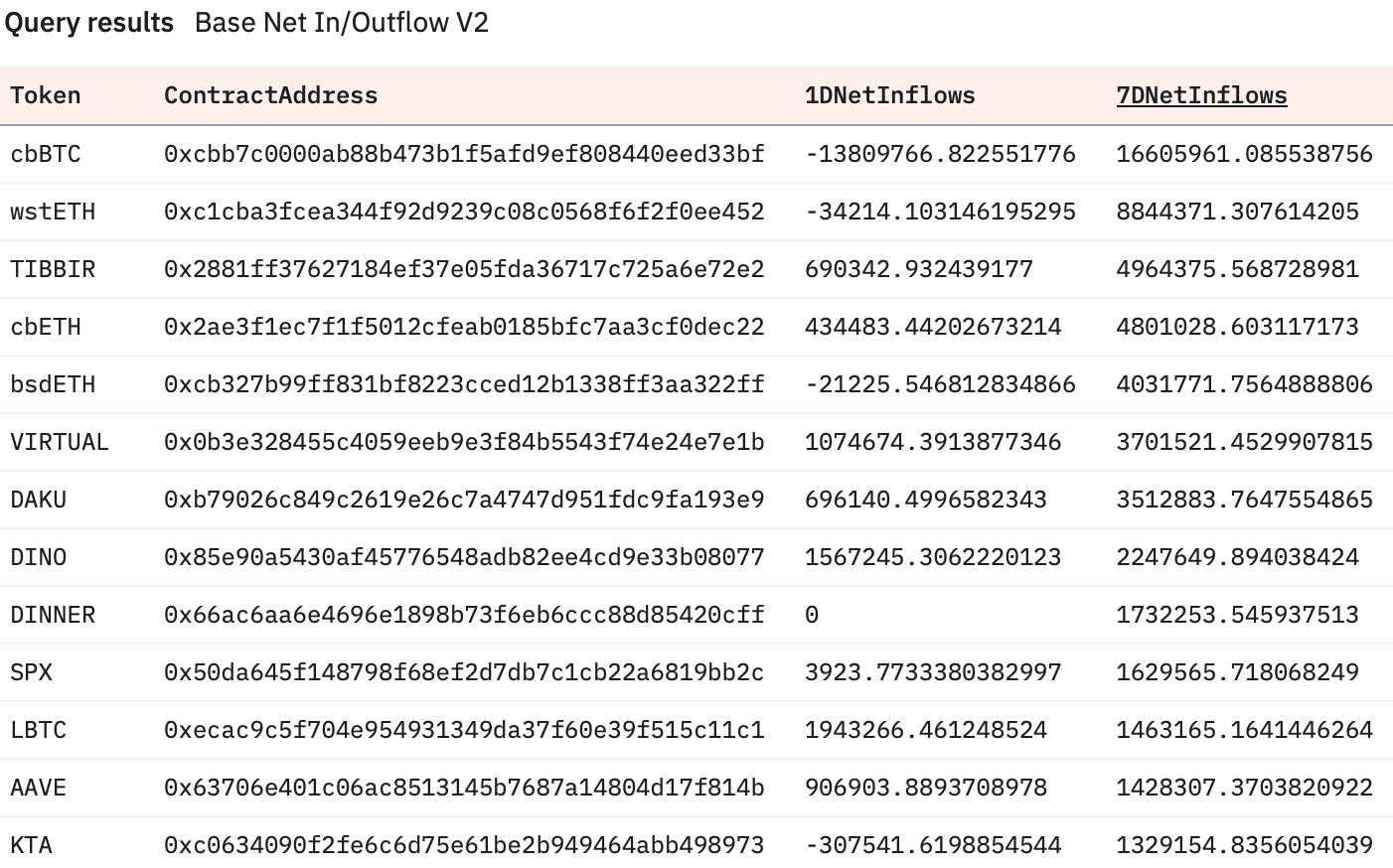

With KTA breaching 1B in FDV without any issues the Base ecosystem has been catching fire with people seeking out other ecosystem plays with cheaper valuations, one of them is VVV which you see appear on the list for the frst time in a while. Meanwhile, VIRTUAL continues to slow grind up and has kept up pace in volume with KTA as the ecosystem unicorn. Opportunities remain to be good here for the time being.

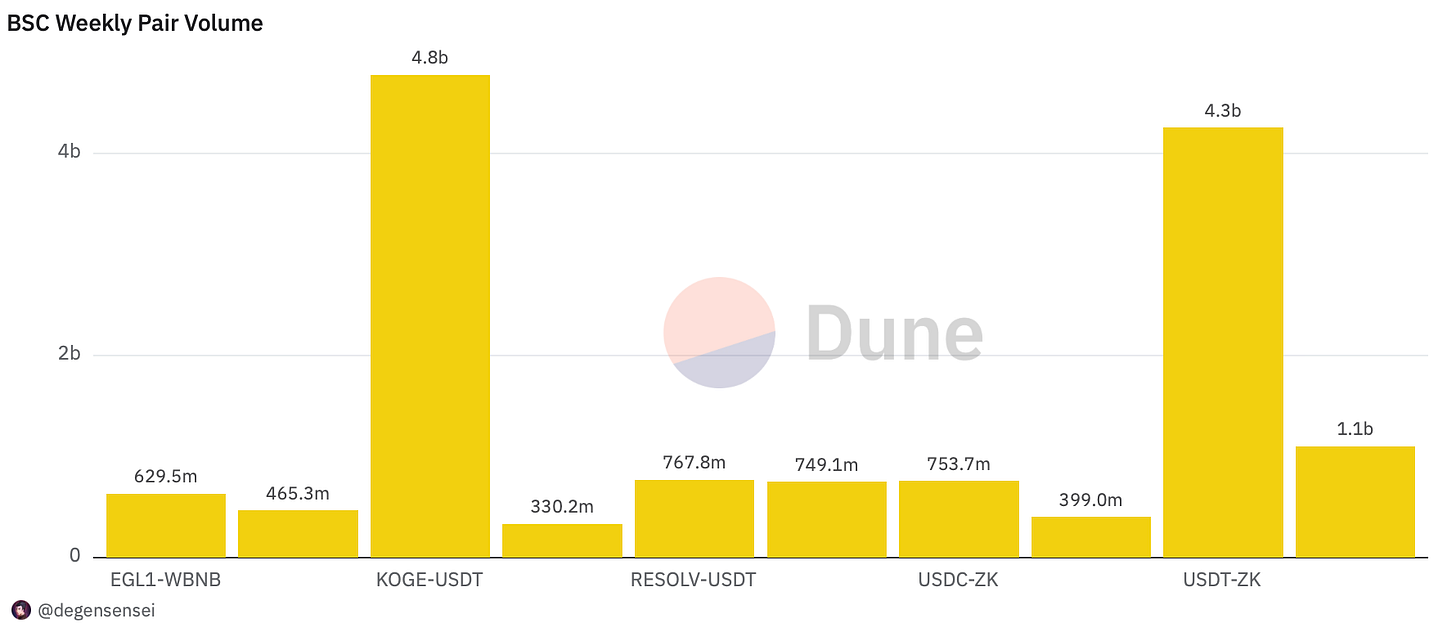

The BNB ecosystem is very good at capture the volumes and fees of new launches which can be seen over the past week considering the volume RESOLV and HOME have been doing on the ecosystem over the past week (they also have liquidity on Ethereum and Base respectively) while TAIKO is one that is growing in attention and has been actively traded as well. It’s still the volume dominant chain for now.

NFT Trading

NFTs continue to not be remotely interesting unless you are holding the blue chip collections as time is better spent elsewhere.

However, one NFT collection to watch is Pythenians that might be a dark horse when it comes to a potential Fogo airdrop in the future. The risk / reward is relatively good considering they are trading at 1.88 SOL floor price. I’m not buying these for the chance of them increasing in floor but simply for a potential future claim. If it doesn’t materialize the loss will be minimal from my side.

I base this on the fact that you can access a NFT gated channel in the Fogo Discord if you hold a Pythenian which is a decent clue.

Net Inflow

Not too long ago this list consisted of solely stablecoins and LST’s so this is a welcome change as AAVE, ETH and UNI are the main tokens that continue to be accumulated with size on the mainnet and long may it continue although you should be more careful the deeper we get into the summer.

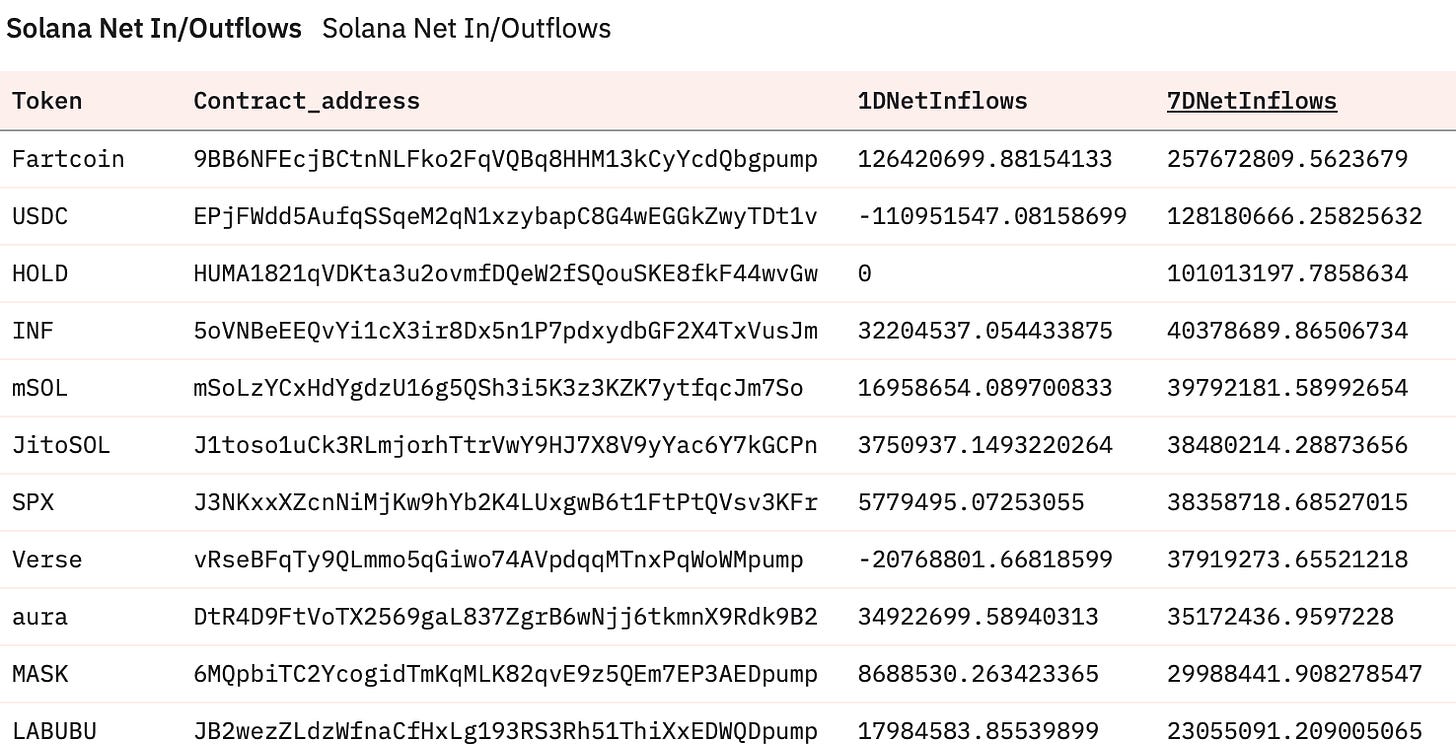

Fartcoin continues to be the on-chain risk indicator on Solana and is dominating mindshare and capital flows. Especially, considering it finally was listed on Coinbase as well. Fartcoin holders have come a long way, congratulations. SPX is validating Murad’s thesis with its price performance while Verse was the latest daily on-chain runner not too long ago that reached 100m in one day. Aura erased 6 months of painful price action in 1 day as it has skyrocketed from 1m to 100m at the time of writing within 48 hours. LABUBU is the world’s most famous plushie right now and people are biddig it as if that is the case as well.

I mentioned previously that VIRTUAL is keeping up with KTA when it comes to on-chain volume and that is likely due to the performance of TIBBIR which is a bet on being a Ribbita Capital stealth launch that has continued to go from strength to strength and breached new all time high’s as well. Otherwise, it has been low caps fighting for craps of capital flows while the winner’s are dominating.

Survival of the fittest.

BNB volumes ripe with a lot of wash volume that gets recycled on centralized exchanges to farm Binance alpha points considering the flows on-chain are insane but the price isn’t moving which can only mean one thing. Bots and market makers are doing their thing.

Sleuthing

High demand for the Plasma raise that has raised $1B in total considering they raised their cap on short notice last night which made it one of the most attractive raises in a long time and a good testament to the high demand for solid crypto projects by sidelined capital.

Asset selection will become ever important and people with a good eye will be rewarded.

Token Unlocks

IMX - 1.33% of supply worth $12.42m on June 13th

STRK - 3.79% of supply worth $16.78m on June 15th

XCN - 0.87% of supply worth $4.30m on June 15th

SEI - 1.04% of supply worth $10.57m on June 15th

ARB - 1.91% of supply worth $35.23m on June 16th

ASTR - 0.12% of supply worth $257.52k on June 17th

ZK - 20.91% of supply worth $41.22m on June 17th

APE - 1.95% of supply worth $10.94m on June 17th

EIGEN - 0.42% of supply worth $1.88m on June 17th

FTN - 4.66% of supply worth $88.80m on June 18th

S - 1.68% of supply worth $17.57m on June 18th

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here. Tax season is underway and you get a 20% discount on your first year with the DEGEN20 code at no additional cost for you.

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.

Great update. Thanks.