Crypto is going mainstream more than ever before but it is at the expense of the cytherpunk ethos and counter culture that it was built upon. It has been an industry that has been looked down upon by others but now we are seeing Coinbase directly sponsoring the U.S Army and JP Morgan launching their stablecoin on Base.

Meanwhile, the Genius Act passed which basically is a slap in the face for DeFi stablecoins and are handing over the reigns to centralized parties like, Circle, Coinbase and the other banks that the industry was built on fighting against.

The projected growth and future of the industry is better than ever but looks like it won’t be captured by the retail partipants that are finding hard ways to participate in the upside, instead of will be captured by large institutions and companies that are hard to get direct exposure too.

The future is brighter than ever but sentiment is worse than ever. Call it a Crypto Paradox.

Market Digest

Bybit adds gold, stocks and forex incides on the platform

PUMP valuation report

What to do if you’re infected by malware

Digital assets legalized in Vietnam

Metaplanet acquires 1112 BTC for $120M

Strategy acquires 10,100 BTC for $1.05B

Tron to go public and form a MSTR type company with Eric Trump

Polyhedra dumps 83%

zackxbt exposes WhiteRock scam

Aave introduces V4 architecture

Bridge Flow

Capital continues to flow from other ecosystems (mainly Base) to Ethereum as it is finding its way home to the mainnet which has been the better place to park capital over the last months in comparison to what is taking place on Solana.

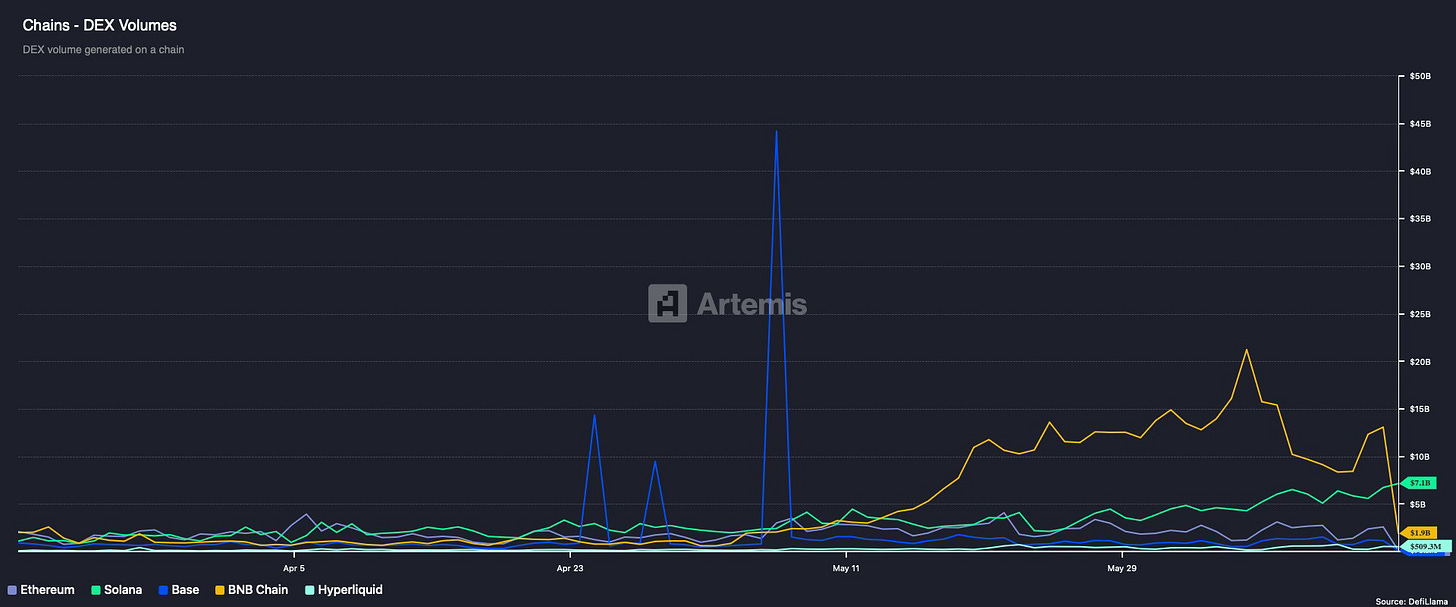

DEX Volumes

The volume on BNB was artificially propped up by Polyhedra which I have mentioned multiple times on this substack. The second the scam crashed the volume on the chain plummeted accordingly and Solana is back doing the most volume again.

Binance alpha farmers in shambles.

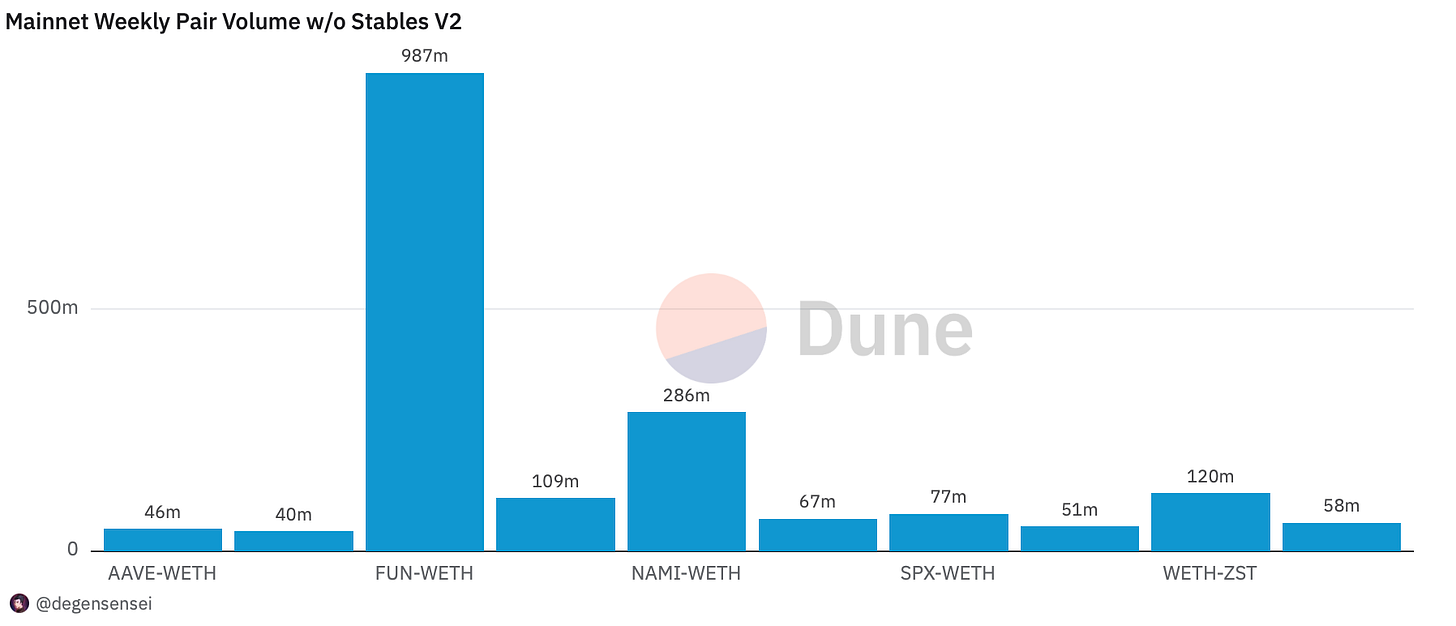

Pair Volumes

The tokens doing consistent high volume over the past weeks remains to be AAVE And SPX. AAVE because they are the most sound business in DeFi outside of Hyperliquid and is a clear industry winner in their vertical with strong buybacks to support the token while SPX has lone mindshare when it comes to degen capital that wants to buy memes.

Dune has been a headache for the past week so this is how it’s looking for SOlana this week with volume being concentrated amongst large caps such as Fartcoin, TRUMP and JLP. Otherwise, not really much going on here at the moment.

AERO benefits from the latest updates that concerns Coinbase integrating DEX trading directly on their app which should make it a future DeFi unicorn at the benefit of token holders in comparison to Uniswap. KTA despite doing a lot of volume is an example of the speculation of a launch can drive something infinitely higher while the actual launch and testing of the network turned out to be bearish.

BNB volume is significantly lower (4.3B less) due to the implosion of the Polyhedra token which puts increasingly more credibility of the BNB chain into question concerning people actually trading there and how much volume is being generated. We’ve practically confirmed already over the past week that it consists of mainly volume farmers on Binance Alpha aiming to get points.

NFT Trading

I might start asking myself what’s the point of NFTs as they are going nowhere.

Larvva Lads the only thing doing significant volume and price appreciation over the past week while this market sector is in a bear market since the PENGU token launched essentially. Barring betting on airdrops, it’s not really something worth paying attention to.

Net Inflow

There has not been a lot of significant alt accumulation over the past week on Ethereum as people have derisked with war uncertainty hitting the markets. This basically means that if you have a long term outlook that you are in a good place to accumulate tokens you believe will be priced significantly higher in some months from now.

The same can be said on Solana even if it has a few more outleirs that stands out including none other than Aura. USELESS tokenwhich has been pushed by Bonk Guy has been performing very well as well while LABUBU is among the strongest brand as the famous plushie has showed strong price action and interest as well.

On Base, AERO is done letting VIRTUAL stealing their sunshine and is back as the leader again with the latest Coinbase news and JP Morgan news benefitting the token directly due to how the tokenomics are set up. GAME has also been accumulated significantly that resides in the VIRTUAL ecosystem with the impending launch of ACP.

Sleuthing

Majority of trader positions in the market (on Hyperliquid) is overwhelmingly short except for people trading Fartcoin, AAVE and LTC amongst the tokens doing top volume. The bleed continues but it’s likely that we get a hgih volatile event soon to rip off the bandaid.

Token Unlocks

MRS - supply worth $220.00m on June 21st

MURA - 1.00% of supply worth $2.20m on June 23rd

EIGEN - 0.42% of supply worth $1.52m on June 24th

IOTA - 0.39% of supply worth $2.45m on June 25th

VENOM - 2.85% of supply worth $9.44m on June 25th

This is a summer where you are better off taking a break and recharging your batteries. Think long term, enjoy the good weather and come back stronger. Don’t over trade.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here. Tax season is underway and you get a 20% discount on your first year with the DEGEN20 code at no additional cost for you.

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.