It has always interested me how war panic causes such distress in the market due to the risk of World War 3 or nuclear war taking place that would risk world extinction. When people panic for this reason and sell it makes for irrational behavior due to the fact that if something like that would happen you would have far more important things to worry about than money.

Thus, the choices are to either:

Buy every war dip that ever occurs and benefit from a rebound when things get better

Worry for your life and potentially die

When those are your odds you should Martingale it every time and hope that people don’t get hurt over barbaric things that causes people to kill each other.

Quite blunt but it’s the frank truth. With that out of the way, let’s look into the past week.

Market Digest

Celestia Founder considering ditching Celestia staking

Aave will be going to its first non-EVM chain (Aptos)

Arbitrum is streamlining treasury oversight

DeFillama research about undercollateralized lending

Hyperlane builds their own MCP server

Insitutional-grade DeFi platform OpenTrade raises $7m

GoodAlexander thread on sell pressure

Expansion of the BTC ecosystem

Arthur Hayes article

DeFi derivatives: All you need to know

Bridge Flow

Ethereum has been a TVL machine over the past few months which should not be overlooked and it continues to suck TVL from other chains including Base mainly. This is not showing up in price or onchain activity yet (although it is slowly increasing), but it is definitely one of those cases where you want to be ahead of the curve and position accordingly.

Funny thing about this is that even though if Base is bleeding TVL to Ethereum, it is still increasing in TVL from other sources which bodes well for both ecosystems.

DEX Volumes

BNB volume continues to plummet and likely takes some time to recover after the Polyhedra fiasco. The main trading activity is currently taking place on Solana while Ethereum is coiling even if it took a slight dip in activity over the past week. Capital concentrates on Ethereum which makes it better for long term holds and new launches with good teams.

Pair Volumes

AAVE continues to carry the torch for Ethereum with continued strong performance and volume as it was one of the Q2 outperformers. UNI is being accumulated as incentives have restarted for LPs and there are rumours of an IPO incoming as well.

Solana volume are lower than what they have been previously but the majority of volume still takes place there and especially in a summer that is far from peak activity. What stands out from this list is the amount of volume the labubu token continues to do otherwise it is sporadic and mainly rotates between low caps.

Aero and Virtual generating a lot of volume and pumping? We call that Base szn which should ignite the ecosystem again. Still early doors here but definitely not a bad time to get positioned before the herd starts screaming “Base is PvE” which is your sign to rush for the exits. Now? Let the fun begin. Outside of that, KTA had a strong recovery as well after a deep dip and continues to be a top performer.

BNB is not even worth covering this week. But the S token just got listed on Coinbase and might lead to a quick ecosystem pump that is worth keeping an eye on considering Sonic Labs fired Wintermute as their market maker for the S token as well.

NFT Trading

If you have a long term view you can start accumulating Punks, Miladies or Pudgies. Outside of that, NFTs remain in a slumber but these are the blue chips which I can see come back at some point and is a good way to hold ETH with leverage.

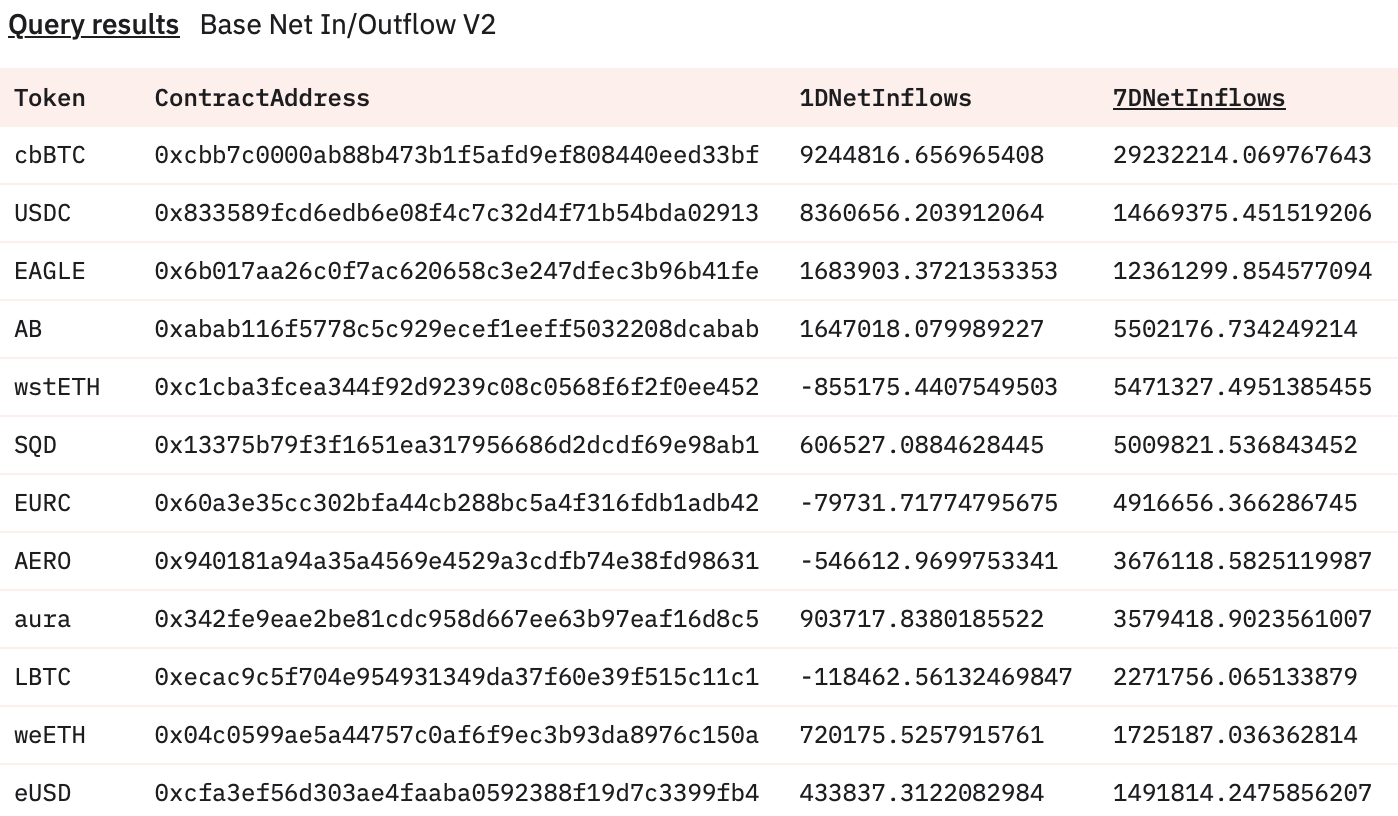

Net Inflow

Based on the net inflows we are seeing over the summer, the majority of flows are likely institutional capital deploying to the ecosystem with the large influx of cbBTC and USDe into Ethereum mainnet. Although SEI did catch a pump as a response to Circle being an investor into the ecosystem and having a lot of Sei tokens on their balance sheet.

The on-chain casino lives on for the people that like to speculate on memes on Solana. After aura took a heavy breather over its immense run, it has been heavily accumulated over the past week with $83.7m worth of inflows over the past 7 days. Crazy. USELESS token spearheaded by Bonk guy is doing very well alongside the plushie doll craze that involves LABUBU.

On Base the SQD token (subsquid) has experienced some accumulation alongside AERO and the base version of aura which isn’t a memecoin but a decentralized AI marketplace that flies under the radar due to the aura token on SOL. Nonetheless, aura holders on Base won’t be complaining about its performance and likely are content with it continuing to be under the radar.

As I mentioned Sonic for the first time in a while above, it would only be natural to cover it for once. Tokens to pay attention to remains to be S, Shadow and Anon which are the clear leaders within the ecosystem. The rest of the ecosystem remains a headache and if you are going to trade this you are better off focusing on the winners and protocols with main attention.

Sleuthing

Majority of positioning on Hyperliquid is still short and it doesn’t likely have to mean anything as it’s just noise but that’s where the bias lies at currently. In an ideal world these people get squeezed.

Token Unlocks

FET - 0.12% of supply worth $2.07m on June 28th

TRIBL - 9.17% of supply worth $34.98k on June 28th

OP - 1.79% of supply worth $17.23m on June 30th

SUI - 1.30% of supply worth $122.75m on July 1st

DYDX - 0.56% of supply worth $2.05m on July 1st

EIGEN - 0.42% of supply worth $1.45m on July 1st

Expect a lot of summer chop while stock might continue to do well. Nobody really knows anything but it is reminiscent of previous summers. Enjoy the summer and let the pump come to you.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here. Tax season is underway and you get a 20% discount on your first year with the DEGEN20 code at no additional cost for you.

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.