It’s incredible to see people continue to harp over the past 5 years that people were early and there being discourse about it not being true. The dream about tradFi building on top of DeFi rails used to be a pipe dream which is now coming to fruition with the accelerated effort by Robinhood to offer perpetuals on stocks that will be rolled out in the EU. While simultaneously announcing that they are planning to build an L2 with the Arbitrum Orbit stack which is likely the first L2 that can legitimately compete with Base.

While you won’t see the result of this immediately it is definitely exciting and a glimpse into the future we are venturing into. Crypto bros were right all along.

“First, they will ignore you, then they will laugh at you, then they will fight you, then you will win.” - Mahatma Gandhi

Market Digest

Robinhood announces tokenized stocks and perps with incoming blockchain integration

Bybit partners with Backed to launch tokenized stocks and ETFs

Life lessons from Poker

Controversy around BackedFi founders

Bitcoin Layer 2 Botanix launches their mainnet

SEC approves conversion of Grayscale Digital Large Cap Fund into an ETF

SEC exploring generic listing standard for token-based ETFs

CZ donates $10m to Vitalik Buterin’s biotech project

Bridge Flow

Ethereum is continuing to absorb the majority of the inflows and sucking capital from Base. Meanwhile, Polygon, Bitcoin and Solana has experienced minor positive flows as well for different reasons. Polygon likely due to farming Polymarket is growing in mindshare and is one of the few apps with PMF. Bitcoin never needs a reason to gain flows while Solana had a short window of outperformance over the weekend which culminated in the stocks announcement as well (which lacks liquidity for now).

DEX Volumes

Onchain activity is taking a nose-dive, I suggest you make sure to enjoy the summer while this stabilizes. No need to actively trade but it is a great time to accumulate high conviction positions before no-sleep season commences. Investors will outperform traders from here.

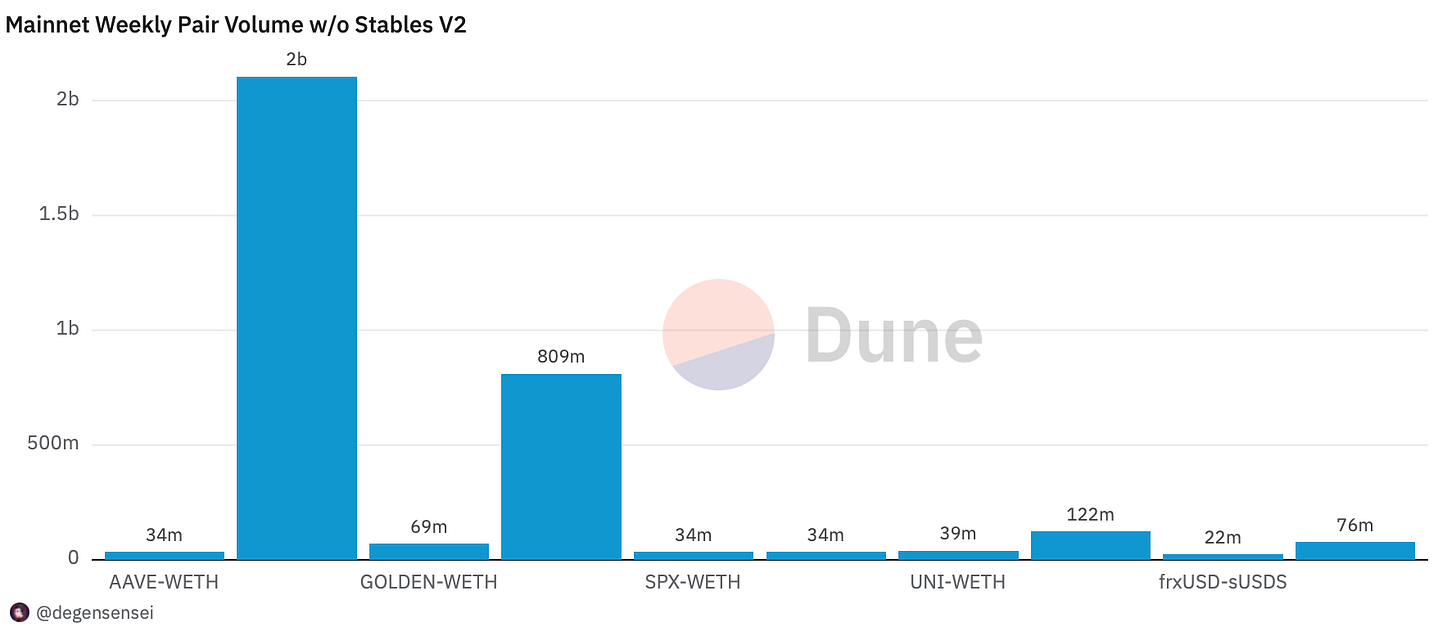

Pair Volumes

AAVE, SPX and UNI is where the volume continues to lie at and are likely the tokens (mainly the first two) worth accumulating over the summer as you likely will have a lot of time to do that. Apart from that it’s unlikely there will be a lot of things going on.

Fartcoin continues to dominate alt volume and likely continues to be the memecoin with the highest mindshare, outside of that LABUBU is retaining volume and is likely one of the next ones that is up. The plushie craze isn’t showing any signs of slowing down.

The only tokens of notice doing any substantial volume on Base are AERO, KTA and VIRTUAL and the same lies true for these three as the ones mentioned concerning the Ethereum mainnet. These are the winning horses that likely carries the torch for the Base ecosystem when attention and liquidity returns which likely takes a while.

Sonic volume used to be okay but it is getting to tragic levels at this stage. Unless that ecosystem launches something that you can’t find elsewhere, it will likely go nowhere.

NFT Trading

Pudgies are holding their value better than most NFTs in a hope to have an ETF approved and be the first NFT that an ETF holds. No guaranteee but somethnig people deem worth speculating on based on the potential upside and illiquid nature of them.

Interesting mints

Bad Bunnz - First notable MegaETH related NFT mint that has surged to 0.5 ETH in value since launch.

Net Inflow

The weekly inflow on ETH validates that there isn’t really a lot of activity right now with only ETH being the token of significance that have received any meaningful flow in the ecosystem as people are in capital preservation mode during the summer. Things can change very quickly though considering people accumulating ETH and not stablecoins which is good.

Solana onchain flows are becoming more erratic with increasingly less staying power as people are chasing new launches as the gambling continues with the impending launch of Pump Fun.

On Base it is very conservative as well as USDC has received the largest inflow but one token to keep an eye on is REI that has been one of the top performers since the April bottom and continues to do well.

Arbitrum is actually worth highlighting for once with the recent Robinhood news as people opted to buy GRAIL as a proxy for the catalyst considering the Camelot team announced that they had plans to deploy on the Robinhood L2 as soon as it launches and likely will attempt to keep a close relationship with the team going forward.

Sleuthing

Robinhood making an on-chain transaction on Arbitrum. Things are moving along nicely.

Token Unlocks

IOTA - 0.22% of supply worth $1.32m on July 4th

MOCA - 0.07% of supply worth $167.66k on July 4th

EUL - 0.17% of supply worth $348.77k on July 4th

1INCH -0.01% of supply worth $5.42k on July 4th

MOVE - 1.92% of supply worth $8.73m on July 9th

Bullish news does not mean that we are immune to the summer chop that we continue to see. Patience will prevail so while the future is bright, it is still worthwhile to enjoy some time in the sun and charge up for a very exciting Q4.

During the week of July 14th I will be taking a 1 week break, so there will be an article next week as well but not the week that follows.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

Steer clear of security compromises and safeguard your assets reliably with Trezor - the premier hardware wallet available on the market here.

Bypass the complexities of crypto tax calculations effortlessly with the best-in-class tax calculator app – quick, precise, and at your fingertips here.

Wallet security overview for beginners here.

Earn free subscription months when you refer a friend who subscribes.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. I am just sharing my opinion. This post may contain affiliate links.