September has historically been the worst month in crypto and this one has not proven to be any better so far as it is destroying the last piece of hope that people that are participating in this market have. An increasing amount of market participants are leaving and it is starting to look like the same participants that were here in the last bear market along with a key cohort of new participants remain. Retail participation is completely gone and crypto winter is truly approaching.

Now, if you play your cards right this is the best time to be here and capitalize on opportunities that will reward you manifold in gains in the future but before that happens a lot of patience will be required. We’re already starting to see the timeline becoming increasingly agitated and infighting is occurring. Some unsolicited advice from my side, do not flex anything, people are struggling and are hurting having lost a lot of money along with the economy not doing well. As a famous Bull normally says (IYKYK): Smile, nod, and agree.

With that out of the way, let’s look at the headlines of the week:

Market Digest

The long-anticipated protocol Gammaswap has finally launched on Arbitrum mainnet

Daniele Sesta launches his new token WAGMI

ARB incentives are active after the governance proposal passed

Mark Cuban got his wallet drained for $870K

Optimism gives delegators a 2nd airdrop and sells 119M OP tokens in a private sale

TON reaches the top 10 in crypto market cap (And nobody is talking about it)

Nigeria turns to crypto as currency crisis deepens

SEC announces that they plan to go after more crypto platforms

Always something going on in this market somewhere if you’re willing to look.

Bridge Flow

No surprise to see Arbitrum be the clear winner here as $83M has been bridged to the ecosystem over the past week while a similar amount of $84M has left the mainnet. A rotation is happening right in front of your eyes and if you heeded the advice in my previous article you have most likely profited. Don’t chase it now though.

DEX Volumes

Let me make this very clear, despite rotations taking place, etc. The volume is not even close to being back. In fact, it is continuing to diminish. Here is the current market philosophy worth adopting: jeet or be jeeted. If you make profits, take your money and run. There is no need to be slaughtered by actively trading hot potatoes at the moment. The only thing worth thinking about is potentially bottomed tokens with exhausted sellers that you’re comfortable holding for a while along with sniping if you’re good at doing that as well. The rest are food for on-chain sharks.

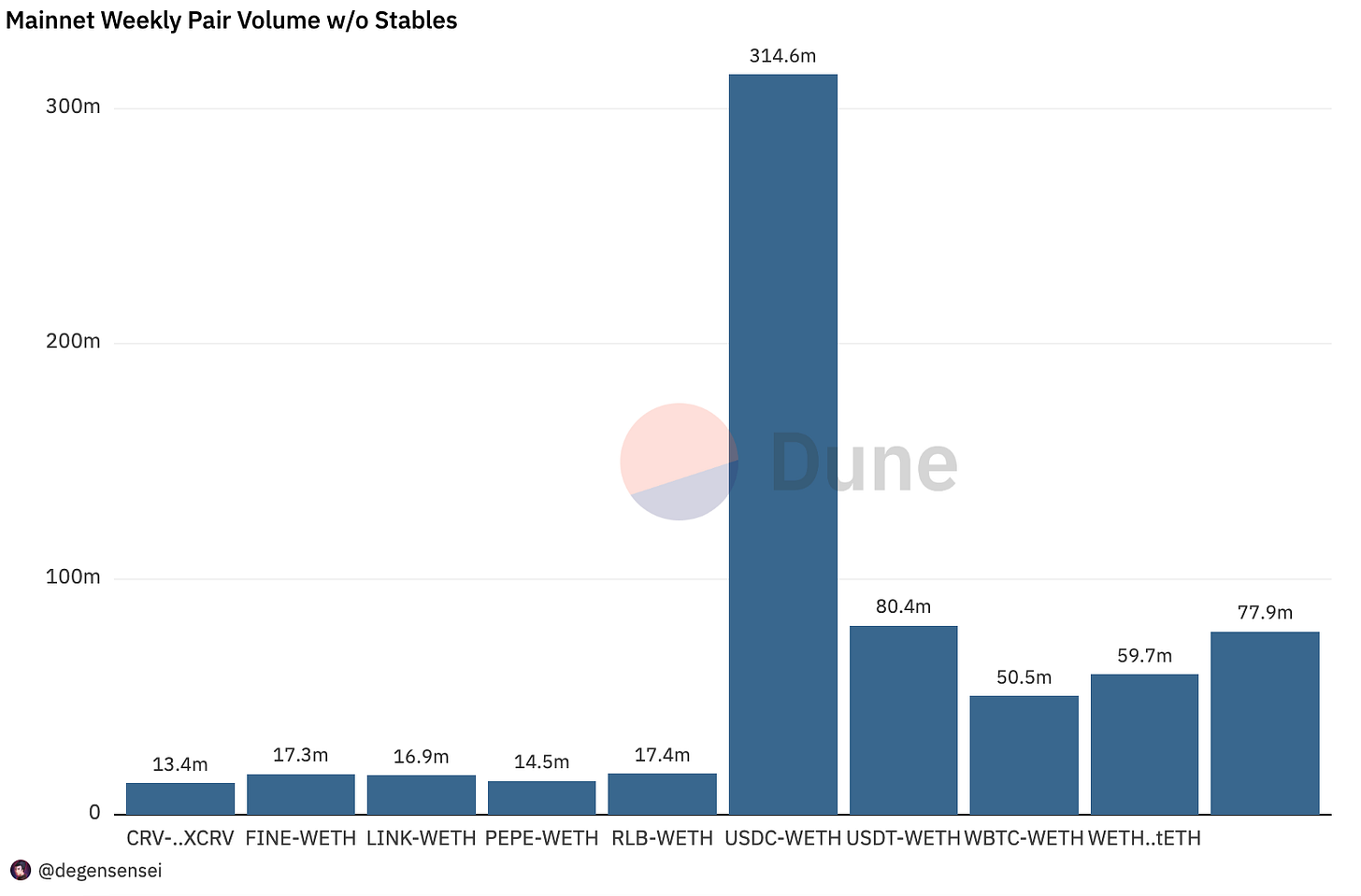

Pair Volumes

Trading activity among alts is increasingly dwindling, when LINK starts to receive a significant bid and pumps it is normally the queue to start running which was the case again. RLB continues to receive a lot of interest despite suffering from the price action. People are chasing memecoins that are experiencing diminishing pumps and FINE was the latest one in that regard.

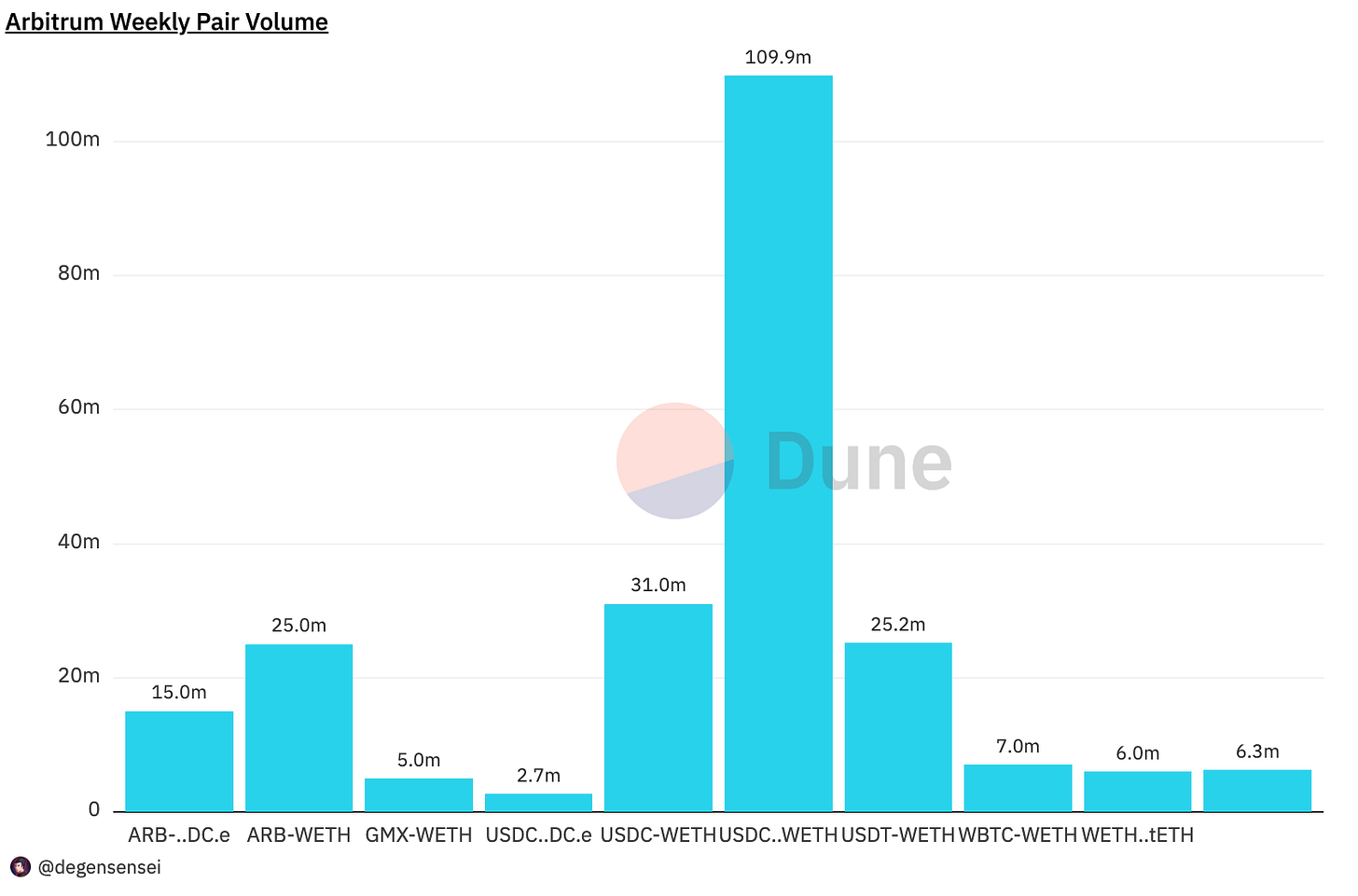

Optimism had a nice bounce last week as there were some short squeezes that took place, it is back to slow activity again and got another bearish catalyst with the foundation selling tokens. It will probably be a while before it picks up again. All eyes are on its direct competitor for now.

Arbitrum volume is not higher than last week yet as the incentives just started. I would expect this to pick up over the coming week as the farming rewards start being allocated across the ecosystem. But if not, it really says a lot about the current market environment we are finding ourselves in. But hey, at least the tokens are pumping (for now), am I right?

NFT Trading Volume

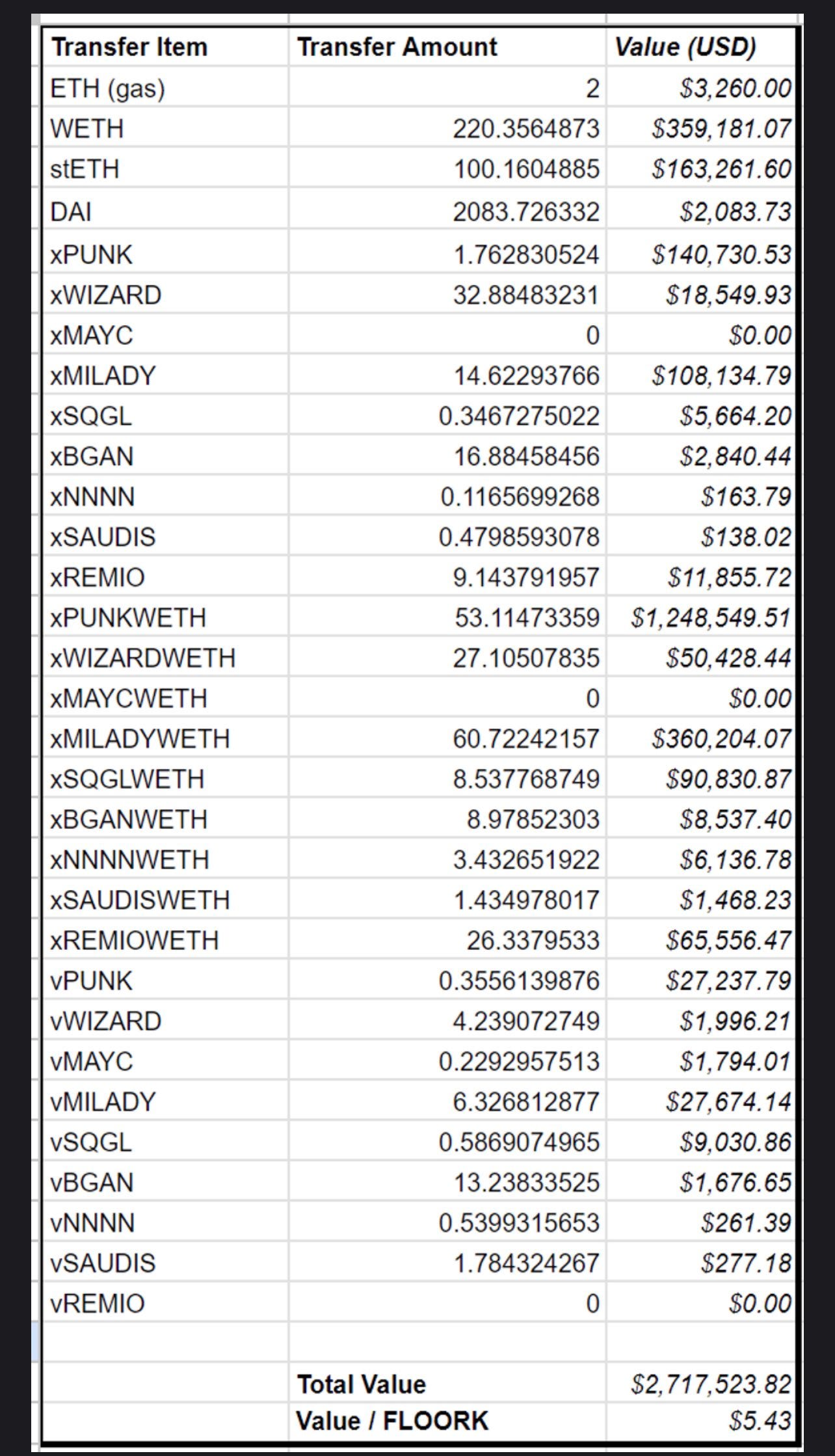

Milady NFTs continue to be the ones to suffer the most after previously having been the strongest NFT based on performance this year. There is another Curveball coming its way (along with other collections) as Floor DAO will liquidate its treasury. After governance decided to fork the protocol through a rage quit and liquidate the treasury to USDC.

The NFT bear market continues with more pain. What do you think will be the catalyst to revive NFTs again? Personally, I think it will be gaming but happy to hear other opinions.

Net Inflow

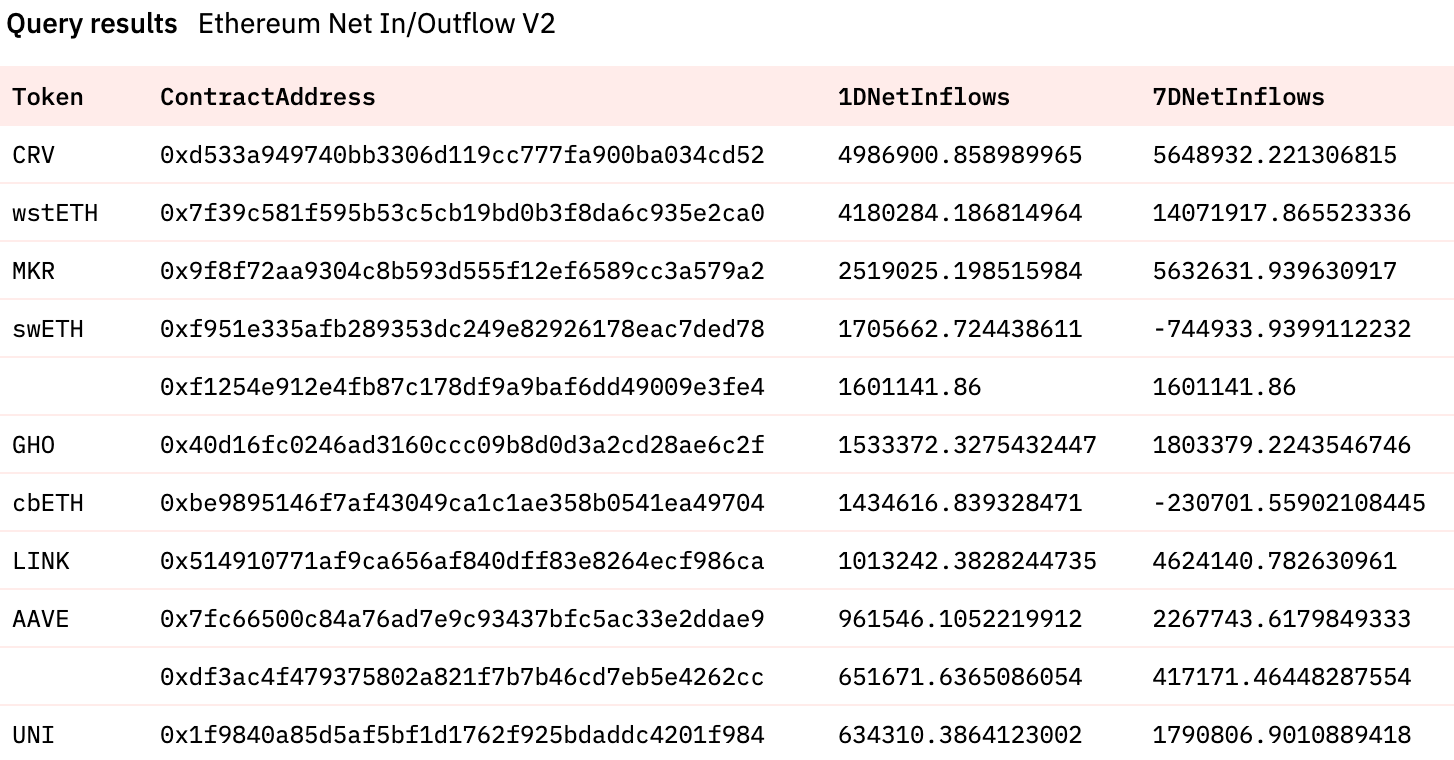

People are aggressively bidding old-school DeFi again with CRV and MKR leading the way based on inflow. MKR has had the strongest performance despite VCs + Vitalik dumping the token as they have one of the most sustainable token models out there. A clear sign of strength. It also looks like people are willing to bet on Aave fixing their GHO peg giving them a free arbitrage of 3% if that is the case. Always a throwback to see all those tokens leading the way as the ones being purchased, let’s see if it lasts.

Not so much going on at Optimism as OP has received some kind of bid even though it received negative sentiment after its private token sale. WLD is the one altcoin that is receiving any kind of bid with Andrew Kang being behind the bids and openly endorsing the token as a good alt to buy.

To the interesting stuff, this table clearly indicates what people are bidding on Arbitrum as the proposal was nearing approval. No surprise to see ARB and GMX leading the way as it’s the native token and the blue-chip protocol of the ecosystem that takes the largest piece of the pie. RDNT follows in third place and PENDLE in fourth. The only surprise on this list is not seeing MAGIC as all the other large cap protocols make it here while degens opt for WINR as the low cap play with high beta. DPX is a contrarian bet with small bids relative to its size although a catalyst could play in its favor here.

Sleuthing

Fake Zhu as we like to call him nowadays back at it again as he was solely responsible for the $BITCOIN pump yesterday as he sold off his MOG position to rotate into it. As he has a history of TWAP’ing into these tokens, no surprise to see people try to frontrun him on this trade.

This is what happens when you got 550 people following you on DeBank, a literal pain in the ass. This is not necessarily a good thing for these tokens as he becomes an overhang on these tokens and keeps them hostage until he dumps. He still has $68K worth of MOG left and it wouldn’t be surprising to see him continue in the same fashion.

That’s it for this week, hope you enjoyed it and see you in the next article.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

Steer clear of security compromises and safeguard your assets reliably with Trezor - the premier hardware wallet available on the market here.

Bypass the complexities of crypto tax calculations effortlessly with the best-in-class tax calculator app – quick, precise, and at your fingertips here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me, do not hesitate to subscribe. Thanks for taking the time!

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.