People that have been through a long and grueling bear market are reaping their rewards as alts are continuing to pump aggressively, still, it is now time to test people’s resolve concerning the alts they are holding which we saw this week with the brc20s, and the tokens related to that ecosystem after a shakeout by one of the Bitcoin core developers that wanted to ban inscriptions. This caused fear and an inevitable shakeout but any rational market participant realizes that this wouldn’t be profitable for miners and the incentives don’t match.

The people who got shaken out got their tokens swooped up by savvy market participants. A tale as old as time. Let’s take a further look into the shenanigans of this week.

Market Digest

Luka Dash called inscriptions an exploit and wants to ban it

MarginFi controversy

Jamie Dimon wants to shut down crypto

Mantle introduces mETH which is an LST native to Mantle

Thirdweb discovers security vulnerability

Jito announces airdrop eligibility

ZachXBT exposes PokerBrat for being involved in previous scams

Dopex addresses community concerns after failed rdpx v2 launch

Inaccurate wstETH/ETH price feeds from Chainlink leads to liquidations on Silo

Arbitrum DAO approves $23M backfund for protocols that missed the initial funding round

Crypto Volatility Index launches their V4

Always eventful in this industry and it will keep heating up along with the market. Less sleep and more eyes on this going forward from my side.

Bridge Flow

Layer 2 ecosystems are slowing down and it’s going to be painful to have exposure there for the time being as funds are bridging back from Arbirum and Optimism to the mainnet instead. Looks like action is going to remain there along with alternative L1s such as Solana Avalanche and Cosmos until gas gets extremely high pushing people to L2. Expecting L2 tokens to underperform until that happens as well.

Only worth being there at the moment if you plan to farm the tokens.

DEX Volumes

Volume is on the up again and not at crazy levels which is a good thing. It implies that only the core members of the crypto community are the majority for now and we are nowhere near bull market levels despite prices starting to move up. Indicates that there is a long way to go before things get crazy. When it does, you’ll miss the calm before the storm. Treasure it and make the most out of getting positions in protocols at cheap valuations and make sure to raise your targets.

Pair Volumes

No surprise to see MUBI(BRC20 bridge for ERC20) tokens along the tokens with the most volume this week as it was affected by the drama surrounding inscriptions, the people who bought the FUD are now up over 50%, funny how that works. LIK continues to dominate the volume charts while PEPE remains among the most traded tokens as well along with GROK.

SNX remains the only token of interest in the optimism ecosystem for now and has been in a key range that a lot of traders have been eyeing along with the potential launch of Infinex which got delayed. The time of delay can be seen in the chart in case you want to take a look.

Volume remains very high on Arbitrum. However, the ARB token is currently suffering from farming and dumping which is affecting the sentiment of the whole ecosystem as it is being suppressed. MAGIC has experienced a boost in activity though with the impending launch of Magic chain which is their L3. No interesting pairs in the Camelot DEX table except for GRAIL so excluding that table for this one.

NFT Trading Volume

Pudgy penguins are taking over and surged to an all-time high of 10 ETH during the last week and seem to be the NFT collection that will come out the strongest out of the bear market. It has focused on licensing its IP and dropping collections that can be sold in stores such as toys that are driving real value and generating revenue for the collection.

One collection that is flying under the radar with a strong treasury is Pixelmon, so keep your eyes on that one.

Interesting mints:

Black Mirror Experience - This hasn’t been minted yet but looks interesting despite being cryptic for now.

BitAliens - Basically a free mint on Solana, didn’t go far but free money is free money.

Note: Anyone who minted the Fractional Uprising NFTs is almost up 2x and the game will launch on Epic Games soon.

Net Inflow

While people have been heavily accumulating ETH a protocol that is flying heavily under the radar despite extremely strong price performance is FLC (Flooring Lab Credit) which is an NFT lending protocol. BEAM is the gaming ecosystem built by MeritCircle and was mentioned on the upgraded stack a week ago. AXL (Axelar) is receiving heavy bids along with MUBI which alludes to an appetite for bridges and blockchains that facilitate interchain communication. RBX is the latest hot derivatives exchange with Starknet exposure as well.

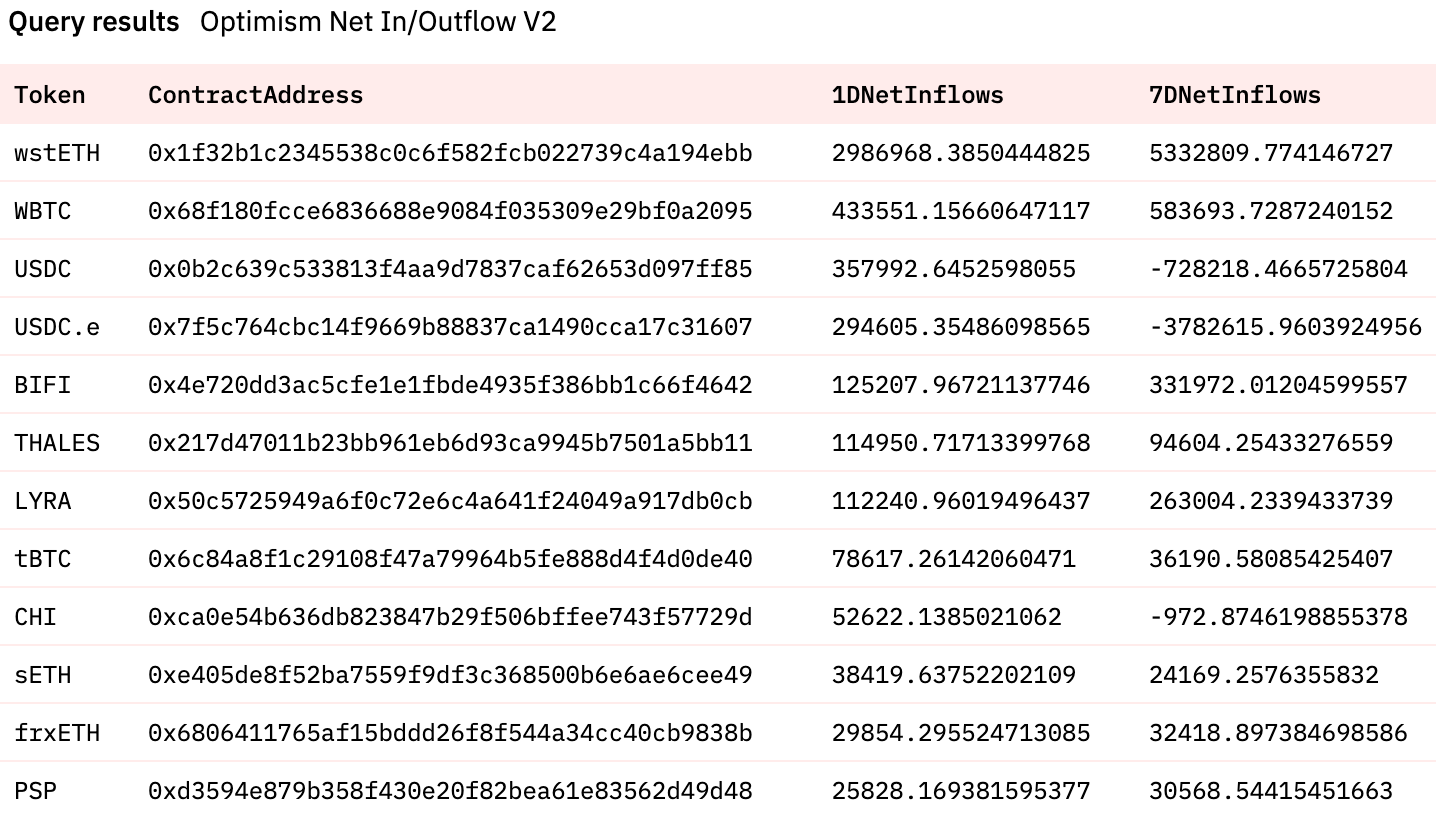

It looks like mid and low caps are starting to accumulate on Optimism after BIFI, THALES, and LYRA are all catching bids which is a sign of some interest coming back to the ecosystem. LYRA is no surprise as v2 is ever closer. PSP (Paraswap) has a positive flow well worth taking notice of as it’s a token largely forgotten about despite being heavily used by many.

When the Arbitrum ecosystem slows down you see the large players inherently suffer, with large outflows of both GMX and MAGIC over the past week whereas people have been increasing their exposure to GRAIL and WINR which arguably has a higher upside in the long term. Either way, as things remain quiet again, now is the time to accumulate if you can think ahead. It will most likely require a lot of patience though.

We’ve also seen new launches on Arbitrum this week such as Good Entry which experienced a violent pump on day 1 but is now slowing down significantly.

Sleuthing

We are going back to none other than Fake Zhu who was ridiculed for being unprofitable before but seems to have turned it around with very good trade. Buying OLAs between $0-8-1.6 and exiting around $4 and recently entering AGRS as well. Probably a wallet worth adding to your tracking list if you haven’t already. AI-related tokens seem to be serving him well. He also sold ATOR one day before it nuked -60%

Here’s the wallet if you’re not already aware: 0x7deccdcf71e07d1ddead572cc459458d8a0c9d9b

Token Unlocks

Primal - 8.9% of tokens worth $85,436 on the 8th of December.

DeFiato - 4.6% of tokens worth $14,412 on the 8th of December.

ENS - 3.08% of tokens worth $8.41M on the 8th of December.

Rarible - 0.7% of tokens worth $119,250 on the 10th of December.

WOOFi - 21,214,285.71 WOO worth $5.1M on the 10th of December.

CLever - 3,333.33 CLEV tokens worth $31,433 on the 12th of December.

Aptos - 8.9% of tokens worth $188.55M on the 12th of December.

LooksRare - 6.9% of tokens worth $3.99M on the 12th of December.

Big week and exciting times ahead, hope you’re enjoying yourself.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

Steer clear of security compromises and safeguard your assets reliably with Trezor - the premier hardware wallet available on the market here.

Bypass the complexities of crypto tax calculations effortlessly with the best-in-class tax calculator app – quick, precise, and at your fingertips here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me, do not hesitate to subscribe. Thanks for taking the time!

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.