This Week On-Chain #56 - JUP Airdrop Stimmy, TAO breaks the Chasm, Remilio

While BTC and ETH are ranging and have been flat for the month, people have been losing their minds as the market remains choppy. However, there is always a bull market somewhere and AI tokens like TAO have been heating up as it made a new all-time high as people caught wind of a $25M investment into the ecosystem.

Meanwhile we have also experienced among the biggest airdrops in history which was the Jupiter airdrops, a big congratulations if you got to partake in the windfall.

With that said, let’s dive into what else has happened this week.

Market Digest

Jupiter finally launched their airdrop, if you’re eligible you can claim here.

FTX expects to fully repay customers

ImgnAI raises $1.6M

Binance Labs invests in Puffer Finance

Swell launches restaked swETH

Picasso launches restaking vaults on Solana

Aevo migrates to start using Celestia

Dymension airdrop allocation updates after almost half or eligible wallets didn’t claim. Check your allocation here.

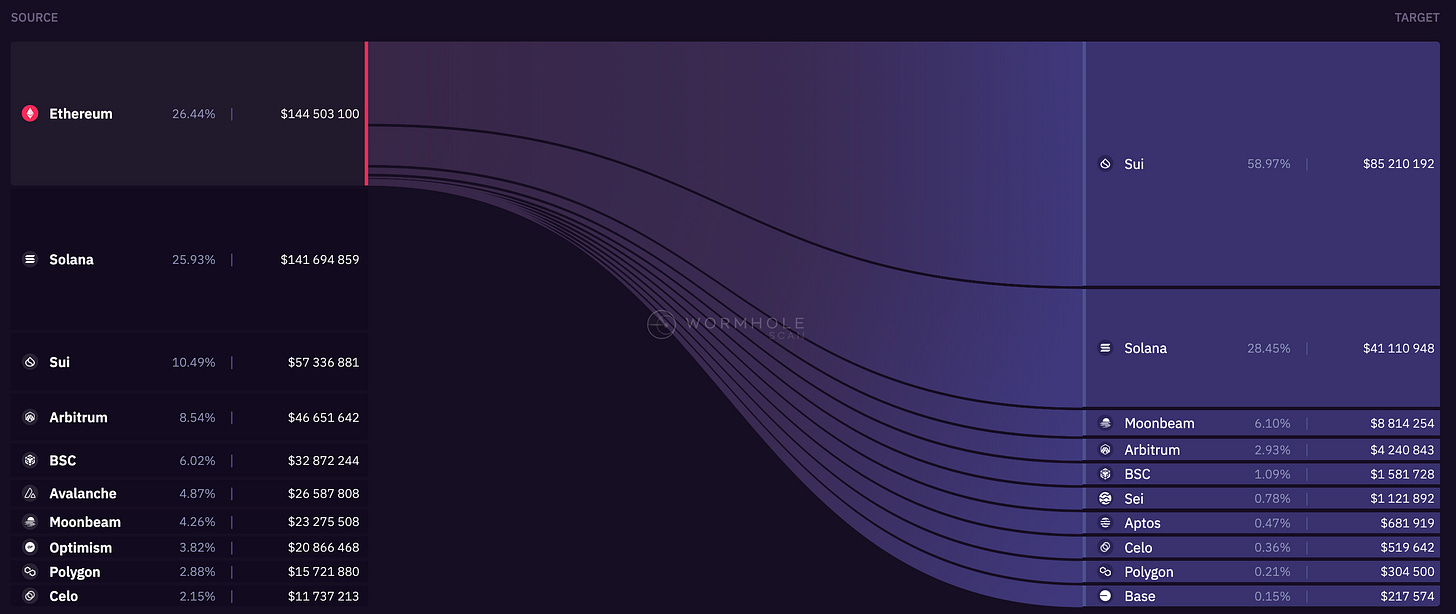

Bridge Flow

While Sui has continued to maintain onchain flows, Solana’s rate of the share increased in comparison to the last week as well which isn’t surprising due to the highly anticipated Jupiter exchange finally launching their token, giving lots of early users a significant windfall. Probably going to be worth tracking Solana flows specifically next week to see whether it marks the top in activity for now or fuels new activity downstream.

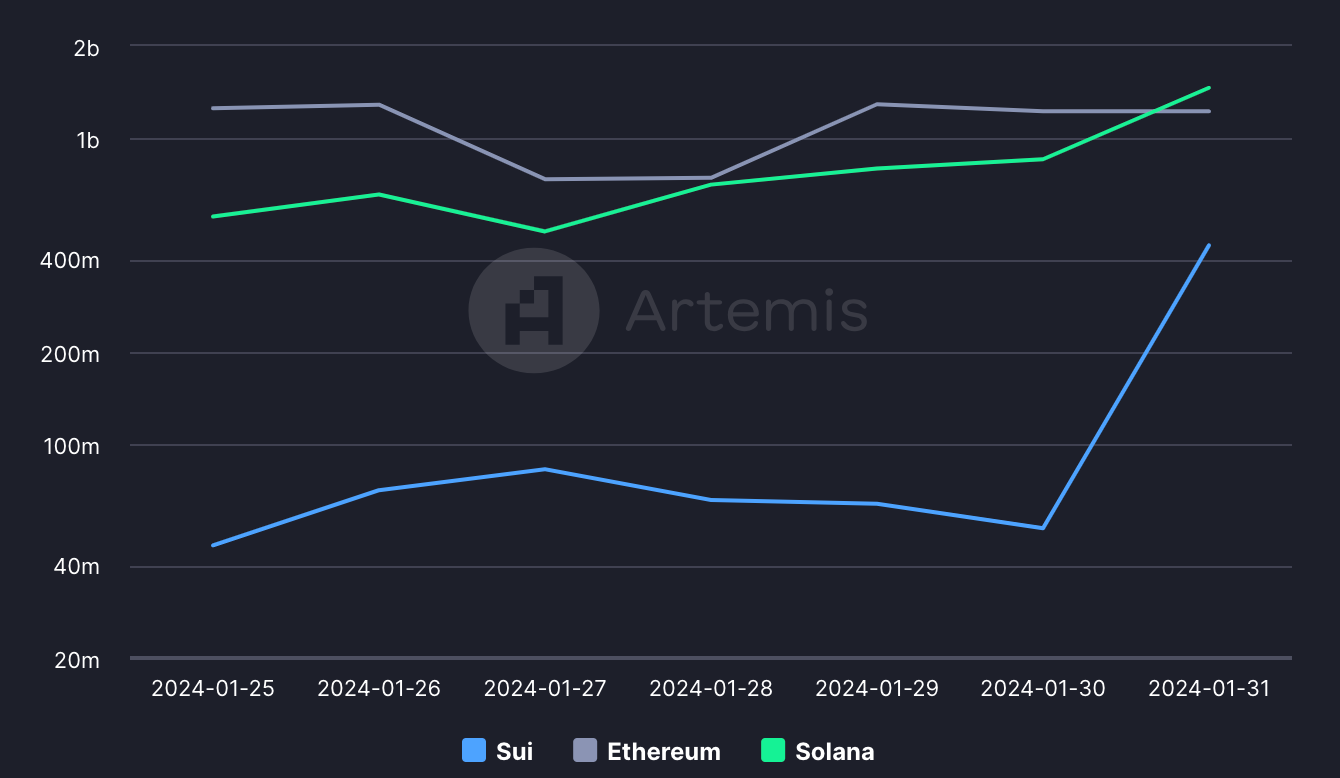

DEX Volumes

The Jupiter launch caused Solana on chain activity to cross Ethereum’s for the first time since December during the memecoin mania. Meanwhile, Sui is an ecosystem worth targeting as it is growing exponentially in onchain acitivty and might be where the next onchain season takes place. Always be open to trying our new experiences and I can share that Sui is very smooth to use.

On another note, Aptos is trending up in daily active addresses as well.

Pair Volumes

PORK is the latest on-chain memecoin that launched this week and has skyrocketed in value which makes it no surprise for onchain degens that it is leading in regards to activity. FLC is starting to recover after a heavy sell-off that took place as their incentives program started which was heavily front-loaded. PEPE and LINK are ever presents at this point and doesn’t really surprise anyone except if the volume is much higher caused by rapid price movements.

Volume on Optimism has basically remained stagnant for the past week and nothing has been going on there as the mind share is limited at this stage and attention has been elsewhere. The large caps which are OP and SNX does the majority of the volume.

Pendle continues to show strength in comparison to the rest of the market which can be seen in regards to the spike in activity in comparison to other Arbitrum ecosystem tokens. MAGIC had a similar spark after being heavily sought after since both Optimism and zkSync have submitted proposals trying to lure them away from Arbitrum.

NFT Trading Volume

The table is not displaying it properly but there is no doubt that the biggest loser of the week is Redacted Remilio Babies after falling more than 30% in price as one holder was too over leveraged which liquidated 330 NFTs in one go. The Milady collection caught some collateral damage due to this as well and is down 18%. Otherwise, Pudgy Penguins is cooling down after previously rallying to 20 ETH.

Berachain NFTs are experiencing their own bull market now as they are surging in value and Bit Bears have reached a 5 ETH floor.

Interesting mints

Quantum Cats - Cat collection on Bitcoin that is minting on the 5th of February after continuous delays. The collection is related to Taproot Wizards and is extremely hyped.

Net Inflow

LINK is the heavily accumulated token this week which should be promising for LINK holders as it has been ranging for a long time and is due. PORK is the latest Pauly coin that people have been aping, so if you lose money on that there is no one but yourself to blame. FLC also being strongly accumulated and I am surprised that it has been accumulated at more aggressive levels than TAO this week despite the AI hype. RLB is also gaining social velocity again after ranging since November.

VELO is the sole Optimism native token that has been somewhat accumulated this week since they got listed on Coinbase along with Aerodrome which should serve them well long term in the bull run. Otherwise, the ecosystem remains slow.

LINK has been accumulated heavily on Arbitrum, otherwise it is MAGIC and GRAIL that is catching attention due to the upcoming launch of Magic Chain and GRAIL launching on Arbitrum Orbit as well. Pendle should be on this list although the rate of accumulation most likely is slowing down.

Sleuthing

1 person made $1M on the JUP airdrop after spinning up 9,246 wallets, that’s what sybiling effectively can do for you.

You can check out the post here.

Token Unlocks

Liquity - 0,8% of supply worth $932,750 on the 3rd of February.

Rarible - 0,6% of supply worth $$99,750 on the 3rd of February.

ImmutableX - 2,05% of supply worth $54,38m on the 5th of February.

Stepn - 6,2% of supply worth $25,72m on the 7th of February.

ENS - 3,04% of supply worth $16,37m on the 7th of February.

That’s it for this week, thanks for reading as always and see you next week.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Bypass the complexities of crypto tax calculations effortlessly with the best-in-class tax calculator app – quick, precise, and at your fingertips here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.