The market continues to be brutal and shaking out people, this is a good time to look over portfolio and ensure you are in high conviction plays because those are the only tokens you will like when the price moves against you. The Bitcoin halving is coming up in 1 day and people are expecting the market to reverse immediately which most likely won’t bet the case as it’s normally a lagging effect that takes a couple of weeks before showing in the market.

Be diligent and patient in regard to what you hold, now is not the time to capitulate but patient in your long term holding will be rewarded. Just be a cockroach and survive.

Market Digest

Binance converts $1B worth “SAFU assets” BNB and BTC into USDC

Franklin Templeton explores “Runes”

Arbitrum’s LTIPP incentives vote has concluded

Puffer Finance raises $18M in Series A

OKX’s zkEVM L2 is now live

Maverick launches their V2 which is an AI DEX with programmable pools

Lido launches simple DVT module

Zachxbt exposes Prisma exploiter (Trung)

Cobie bans Palau “residents” from Echo

Also, this is a good time to shore up your continued airdrop farming and get those Grass points if you haven’t already. It will be a good one and you can do it here.

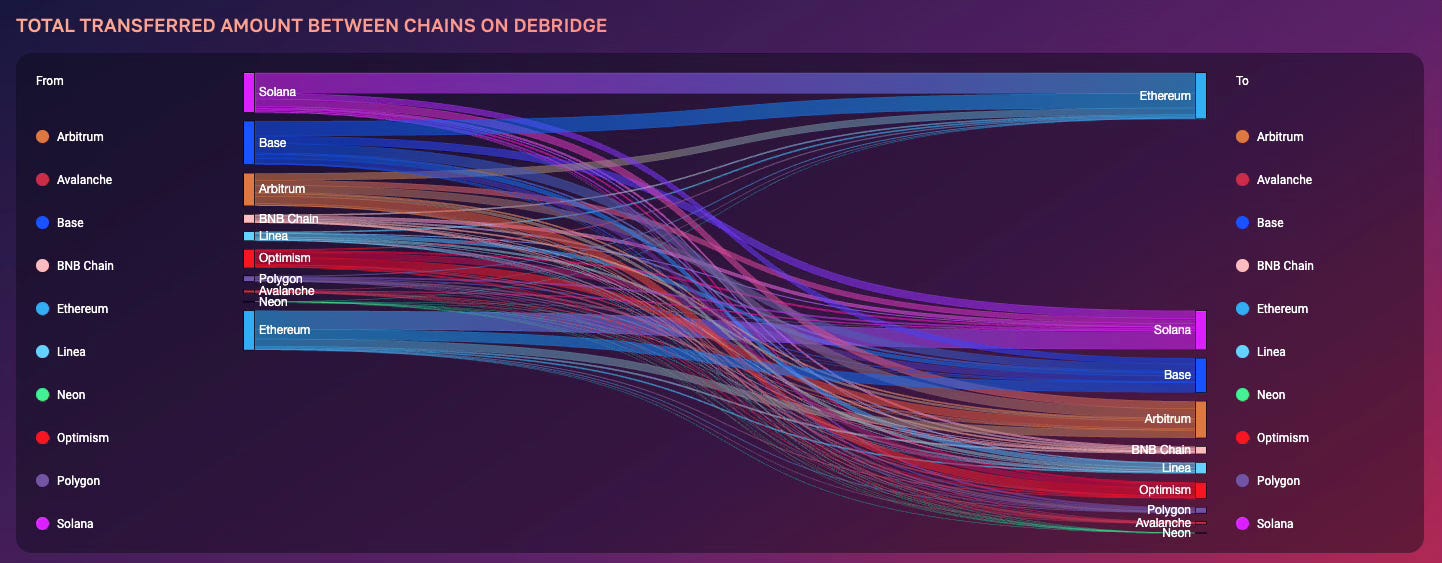

Bridge Flow

There has been a total capital flight to Ethereum from Base and Solana, luckily we caught it early here and didn’t overstay our welcome in the Base party. However, if you think there will be a 2nd wave of that now is probably a good time to start looking into things that are previously interesting to you but was overbought as they are now oversold.

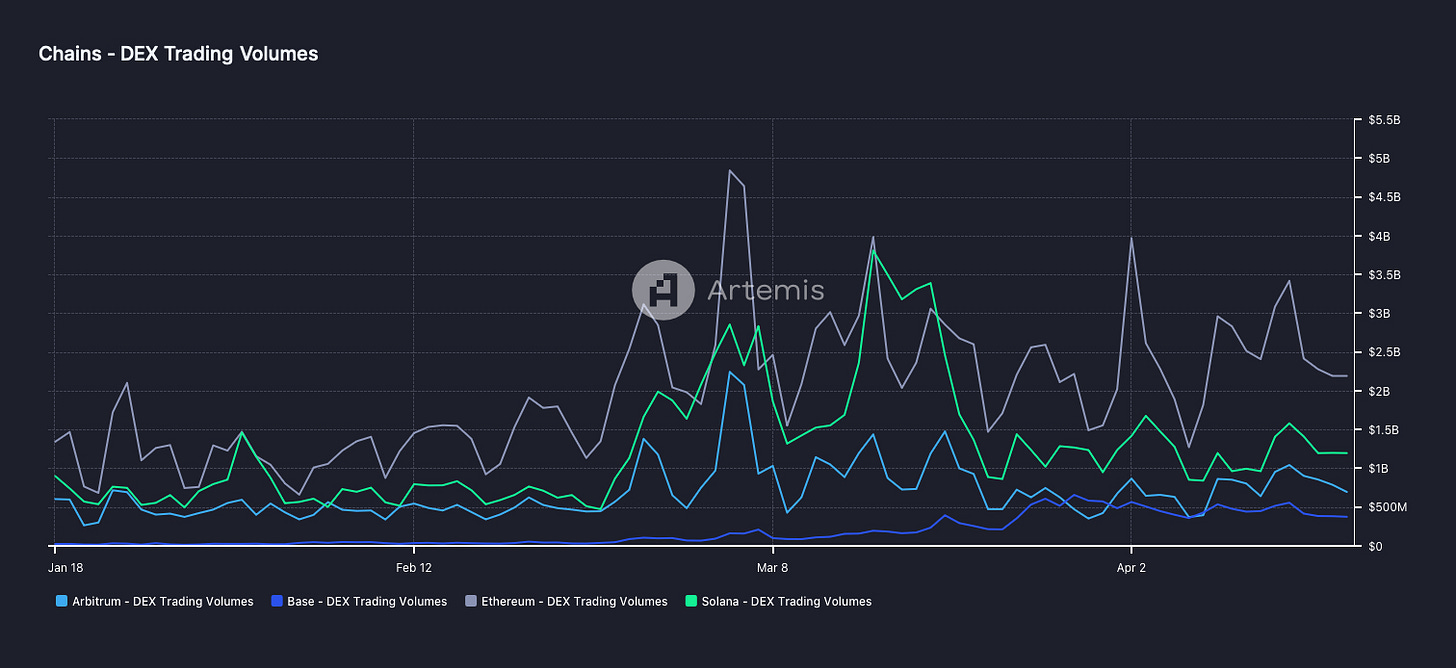

DEX Volumes

DEX volume has been downwards for a while and needs to reverse before we see significant amount of on-chain activity. Right now that activity is concentrated between a select few alts while the volume of the majority of on-chain alts are dead and almost sub $1M per week. It has been ogre but it means it’s a sale that you want to buy as no one else is buying.

Pair Volumes

Adjusted the query this week to give you a clear week of the alts that have been remotely interesting to people in the current market environment, while the majority has received zero interest. No surprise that all of these alts have been the best performers as well with BVM and OLM leading the way being completely unfazed by the market while RAIL rallied 300% as Vitalik mentioned the importance of on-chain privacy.

DEGEN continues to do the majority of volume on Base, meanwhile FOMO was the pre-sale I was alluding to recently as they raised $15M and only deployed $1M to the LP. For what it’s worth memecoin pre-sales are never bullish for the other memecoins in the ecosystem because it indicates that people are desperate from not making money on memecoins and it sucks liquidity from the ecosystem into the pre-sale. If everybody buys the pre sale with no cap, who is left to buy? Questions for Plato.

PENDLE continues to be the only interesting token on Arbitrum at this moment in time, Boop had its 15 minutes of fame but has calmed down for now. We only see some volume on ARB, FLY and GMX outside of this. The largest L2 needs to wake up.

NFT Trading Volume

Pudgy Penguins has been silently rising in floor again as they continue to get airdrops and are close to all time highs again. BAYC has made a small jump in floor price but are struggling at 12 ETH as there is no clear demand for them at this price level yet. The most significant growth is Lasogette which is the first collection of the Bitcoin puppet creator which will eventually be bridged to Bitcoin which is the reason for the surge as people realized this.

Interesting mints:

The majority of interesting mints are taking place on Bitcoin right now which I continue to share in the upgraded stack with the latest being Compos which is an inscribe-to-play game that will be migrating to Runes.

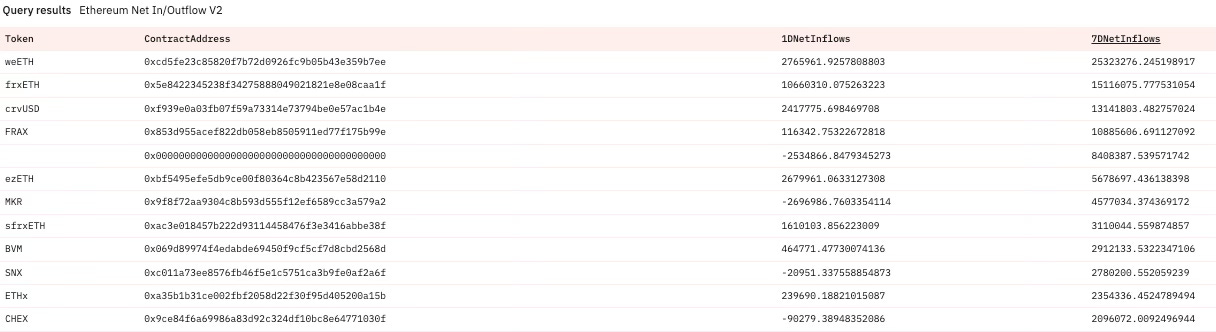

Net Inflow

This table is a clear indication of how risk averse people have been over the past week with alts not being any of the top 6 most accumulated assets as it it’s either ETH derivatives or stable coins that people want to use to farm with. The alts of interest have been MKR which normally is a defensive token, BVM which has caught a strong tailwind due to the focus on BTC ecosystem, SNX and CHEX (RWA L1 for tokenization in Singapore).

Same tendencies here as the largest bought tokens are USDC and WETH. However, there has been more interest to bid ecosystem coins here as INT and TKN has been the strongest out of the pack while FOMO has garnered some interest as well. However, considering the attention it has got people have been bidding the wrong FOMO tokens as well. Typical.

There’s basically been zero interesting action over the past week on Arbitrum as the most accumulated alts have been tokens that are native to mainnet outside of the ARB token. Even the contract that isn’t named is the Arbitrum version of the BVM token.

Sleuthing

Today’s episode of sleuthing is going to feature what happens when you painfully try to catch the bottom instead of letting the market play out in front of you. Anybody that has ever tried buying this token since launch has learned quickly that SHU has been a painful experience, it’s nicknamed “Shutter Island token” or a reason.

(Maybe this will mark the bottom though)

Token Unlocks

Asymetrix Protocol - 12,74% of supply worth $848,487 on April 19th

Xana - 3,67% of supply worth $1,57m on April 20th

Rarible - 0,3% of supply worth $287,250 on April 21th

biconomy - 0,75% of supply worth $3,76m on April 23th

DAO Maker - 5,5% of supply worth $16,09m on April 24th

Avalanche - 1,33% of supply worth $327m on April 24th

It’s been a turbulent week but it will all get better soon, patience will pay off. Until next time, stay alive.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Bypass the complexities of crypto tax calculations effortlessly with the best-in-class tax calculator app – quick, precise, and at your fingertips here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.