RoaringKitty aka “DeepFckingValue which is famous for the GME (Gamestop) run last cycle came back which made GME soar in public markets and memecoins including the memecoin GME soaring 5000% on Solana. The timeline is more toxic than ever as some call for cycle top while others think we haven’t even started. This is driven by that gains haven’t been distributed across the board as it has been largely concentrated within a few sectors while the majority of the market has been weak.

Nobody knows where we are going especially with more TradFi involvement that includes ETFs, but you will be better off sticking to your guns no matter where we go from here.

I don’t think we are anywhere near done but summer is also coming and seasonality is real, time will tell.

Market Digest

Equalizer frontend was hacked

Tornado Cash Developer Found Guilty in Dutch court for money laundering

Degen Chain (L3) experienced a 500k Block reorg and has been down for 2 days

Pudgy Penguins plans on launching their game soon

Pear protocol launches beta

Zapper Fi teases token

Vertex Protocol is launching on Botanix Labs Bitcoin L2

State of Wisconsin bought $100M worth of Bitcoin

Sonne Finance hacked

Bridge Flow

Capital that was attracted to Base by the FRIEND airdrop is clearly flowing back to both Ethereum and Solana that has heated up due to the memecoin frenzy on the respective ecosystem. On Solana, GME has been leading as a crypto native response to GME being halted in the stock market while PEPE has been the undisputed leading memecoin on Ethereum. Arbitrum has also received a significant amount of funds that is being unnoticed, some of it has most likely flowed directly to MOR and Hyperliquid.

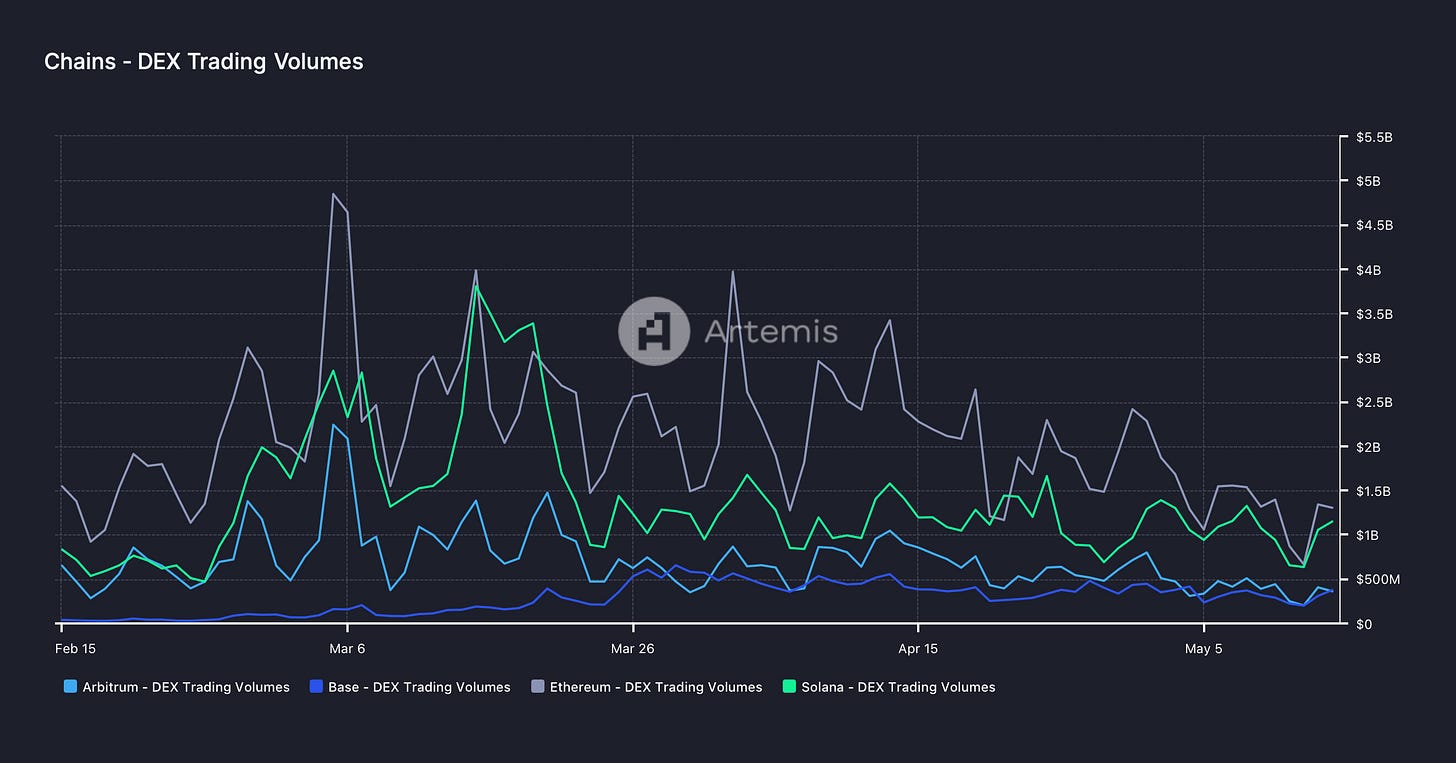

DEX Volumes

Volume seems to have bottomed on May 12th and has seen a significant uptick across the board since then in all ecosystems on the chart. It only took one tweet from Roaring Kitty for people to dare deploy their sidelined capital again and participate in the on-chain casino. Bear in mind that for the people to win that you see on the timeline, the majority has to lose. Be aware of what game you are playing. Either way, on-chain is ripe with opportunities if you know how to play it well.

Pair Volumes

PEPE is undoubtedly leading the way on Ethereum as not only the strongest token from a performance but also the one most people are willing to trade and is generating the most volume, LP’s must be happy. The Ethereum version of GME tried to create momentum but it is clear that people gravitated to the one on Solana already which has done more than triple in volume. APU which is deemed as PEPE’s cousin is also doing well both from a volume and performance standpoint and wQUIL is the latest hot new AI token on the block.

Base volume is starting to become more concentrated amongst a few tokens such as GME and APED in comparison to prior weeks as the ecosystem needs a catalyst to revive it again. However, if you played the Base ecosystem before now is probably a good time to accumulate tokens you have conviction in before a 2nd wave starts again.

Arbitrum ecosystem continues to remain a ghost town outside of PENDLE. GMX received some minor trading interest this week after announcing that it will be deployed on Solana. CTOK is also a new AI gaming project that launched this week and has received some trading interest as well. Apart from that, not much to see at the moment in Arbitrum although the LTIPP campaign is scheduled to start at the beginning of June which might be worth keeping an eye on alongside Sanko Corporation launching their chain (L3).

NFT Trading Volume

Ethereum NFTs continue to bleed which will most likely continue until a significant amount of wealth has been made on-chain as they act as a way to flaunt the money you have made. Until that resolves, I expect them to continue to be weak. All the top collections are down double-digit percentages over the past 7 days while Kanpai Pandas has taken a significant hit with a -27 % drawdown since many people held it as they were waiting for the LayerZero snapshot which has taken place now.

Interesting mints

None this week.

Net Inflow

People are dabbling in alts although they continue to remain heavy in ETH and stablecoins. TONCOIN is the one that has been accumulated the most this week while wQUIL has been 2nd based on weekly accumulation. Pepecoin takes the third place from an alt standpoint but otherwise, it is very sporadic with violent swings across memecoins.

Same theme on Base as well as people are defending their capital in this environment with the dominating tokens being stablecoins and ETH too. Tokens such as Bald, NoHat, TRUMP, and WSB got some bids but it has been short-lived so far as the rotations continue to get more violent and brutal.

Sleuthing

BlockTower capital’s hedge fund has been compromised and the hacker seems to have decided to buy PEPE with the funds.

Token Unlocks

APE - 2,48% of supply worth $19,03m on May 17th

RNDR - 0.20% of supply worth $$7.76m on May 17th

Moonbeam - 0,4% of supply worth $817,247 on May 18th

ZetaChain - 2,33% of supply worth $2.4m on May 19th

Pyth - 141.67% of circulating supply worth $927.20m on May 20th

AVAX - 2.50% of supply worth $328.33m on May 22th

It has been a very noisy week despite the price action being sideways for the majority of it until the CPI news yesterday. Crypto Twitter should only be used as an avenue to get a market sentiment, never take the opinions there seriously, and make sure you build your conviction.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Bypass the complexities of crypto tax calculations effortlessly with the best-in-class tax calculator app – sort out your taxes in a few clicks here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.