This Week On-Chain #74 - On-chain Summer

Concentrated attention

We’re currently in a market environment where there are few winners, majors are ranging and many people are getting frustrated by the lack of volatility as their alts haven’t moved for a long time. This is the time to reflect on your positioning and make sure you’re holding alts that you’re comfortable with going sideways for a while and potentially bleeding as attention will remain concentrated amongst a few alts as the same amount of capital rotates from market sector to market sector. You can expect this to continue until the ETH ETF launches.

However, despite the relatively slow volatility, tons of things keep happening in the market that shouldn’t go unnoticed, so let’s look into what the past week gave us.

Market Digest

Swell gives an update on the SWELL airdrop

DWF Labs makes investment into the FLOKI memecoin

Yes Money (Baseline Markets) relaunched and died

Starkware plans to bring ZK technology to Bitcoin

MEV is treated as illegal market abuse by the EU MiCA rules

Spectra Finance is live after 2 years of building

Coinbase launches their smart wallet

ZkSync is in the cross-fire for applying for a ZK trademark in 9 countries

MEV Scanner launches that tracks how much MEV a wallet has suffered

Evaluating token incentives for DePIN networks

Bridge Flow

Solana and Base continue to be the ecosystem that is sucking capital from the rest of the market. Solana has been strong with people flooding to buy the celebrity tokens which have surfed while Base is growing in stature as they recently launched their smart wallet. These chains seem to be the ones where the majority of the on-chain activity happens for now while fundamental and institutional projects are residing on the Ethereum mainnet.

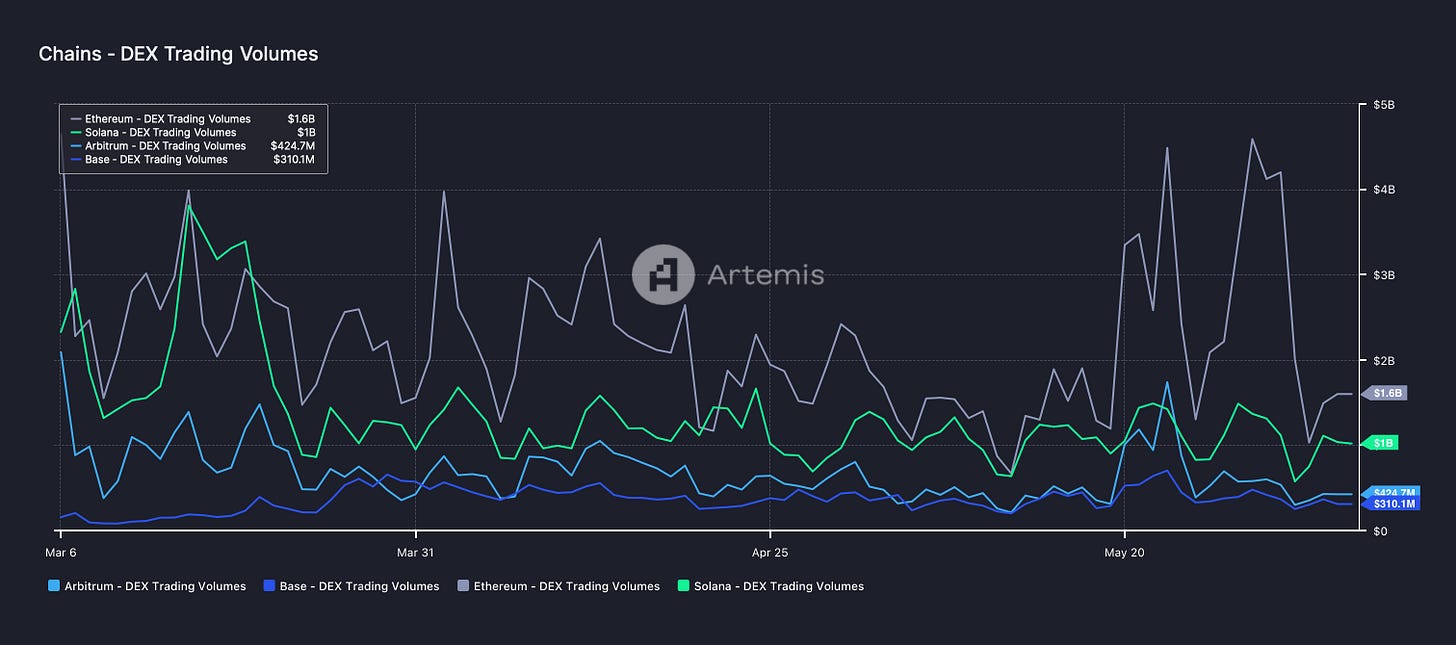

DEX Volumes

DEX volume continues to be the highest on Ethereum, similar to last week, although Solana continues to edge closer. Last week we reached the highest DEX volume in a very long time. Meanwhile, people continue to be worried about the market as we are climbing the wall of worry while we are hovering around all-time highs with an Ethereum ETF about to launch relatively soon.

Pair Volumes

Good volume across the board on many alts on the mainnet as PEW unsurprisingly led the way which was dissected in the upgraded stack last weekend. GME caught a lot of attention again after RoaringKitty revealed a $180M GME position which led to the degens bidding the on-chain versions of it. MAGA continues to be strong as Trump gets a stronger position in the election despite being convicted. PEPE remains an ever-present while ENA has DeFi integrations coming its way which has benefitted the interest in trading the token.

ULTI seems to be a GameFi ecosystem that was airdropped to a large amount of people. BRETT broke 1B this week and has officially become the first Base memecoin that has breached 1B market cap, while majority of people are seething because they missed out on this they are better off seeing it as a good thing because it raises the target of the whole ecosystem. Apart from Brett dominance, it has been relatively dispersed across the ecosystem and you rarely see DEGEN with this low volume which might be a good signal that it is coiling for its second run.

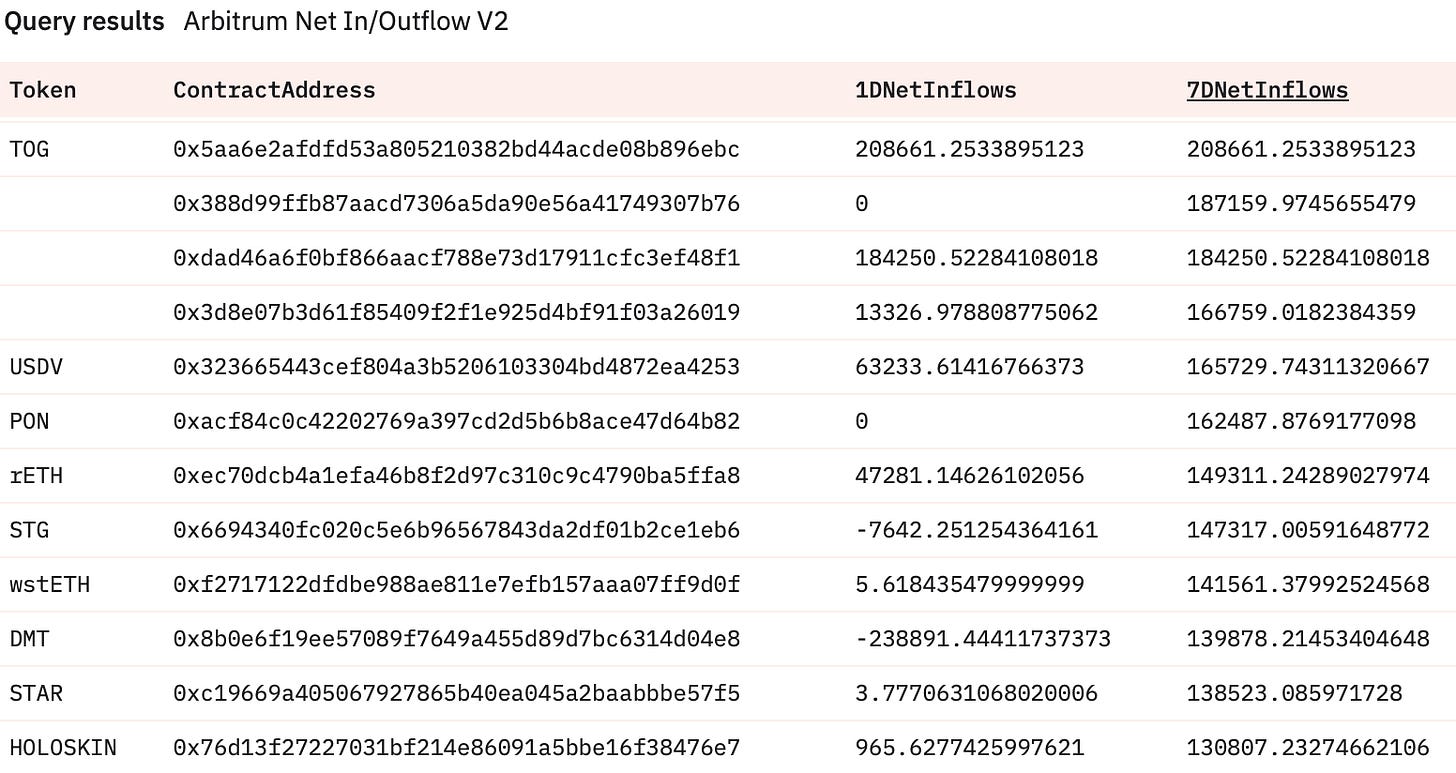

PENDLE continues to be the main alt of interest here outside of ARB while GMX has also been strong recently. Apart from that the ecosystem remains slow which might change now as the ARB incentives will get started again. BWB is a rug.

NFT Trading Volume

ETH NFTs continue to show weakness and Ordinals on Bitcoin are showing strength again while Runes are also surging.

This is a good lesson in that whenever CT tells you something is dead, it’s probably a good time to accumulate it.

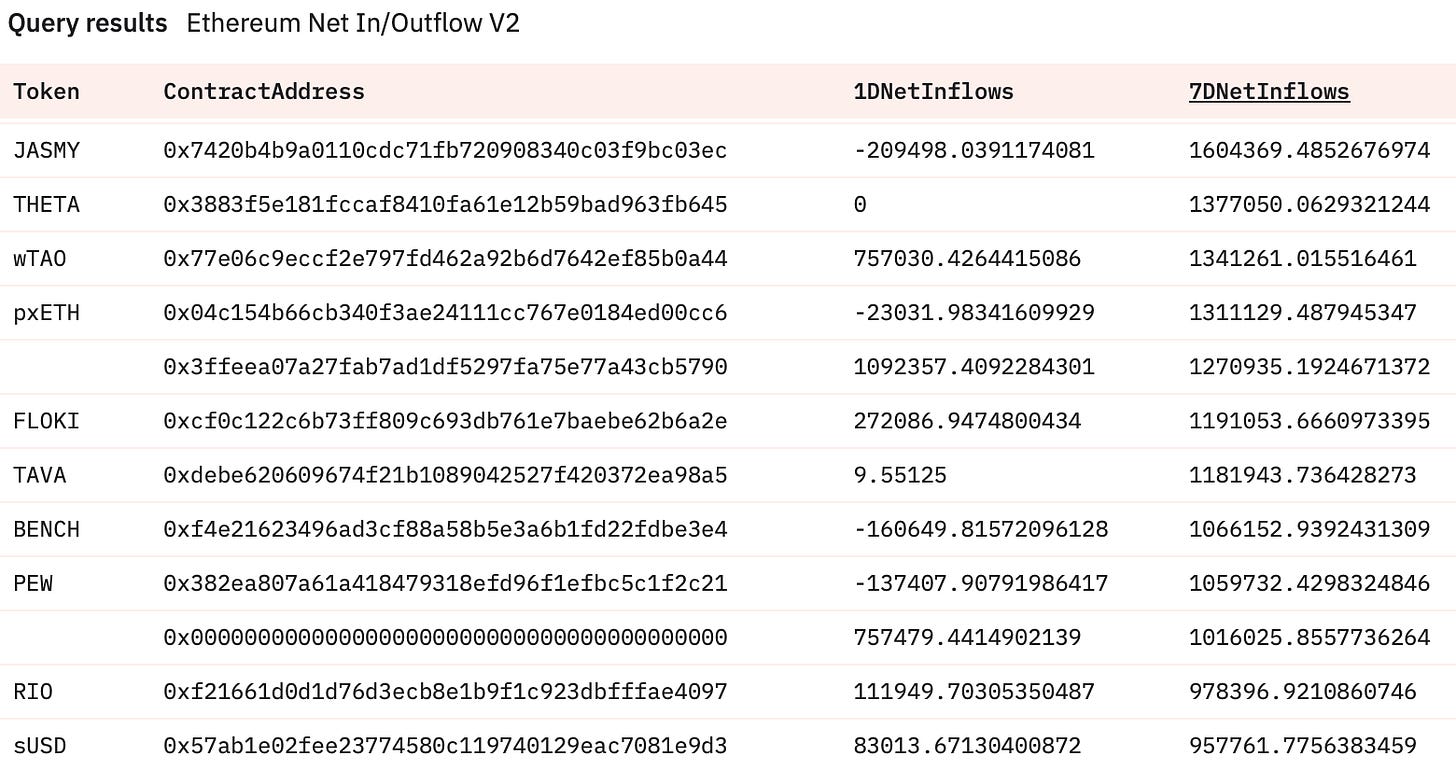

Net Inflow

The most accumulated tokens over the past week are none other than JASMY, THETA, and TAO. Meanwhile, FLOKI has been very strong as an additional proxy to the strength of BNB as well. PEW is the latest on-chain runner and it’s no surprise to see it on this list.

BRETT dominates the accumulation on Base and is experiencing a hated rally at the moment. DEGEN has been ranging for a long time but is also being heavily accumulated at the moment and Normie is following it being exploited. KLIMA is flying under the radar as an RWA protocol on Base while SPEC is the go-to AI. token at the moment that is outperforming the market sector.

TOG is a honeypot so it can be ignored which is the same for the addresses without tickers in the table. I think what mainly stands out on Arbitrum is that DMT continues to be accumulated despite the strong run it has had and people buying STG in anticipation of LayerZero airdrop.

Sleuthing

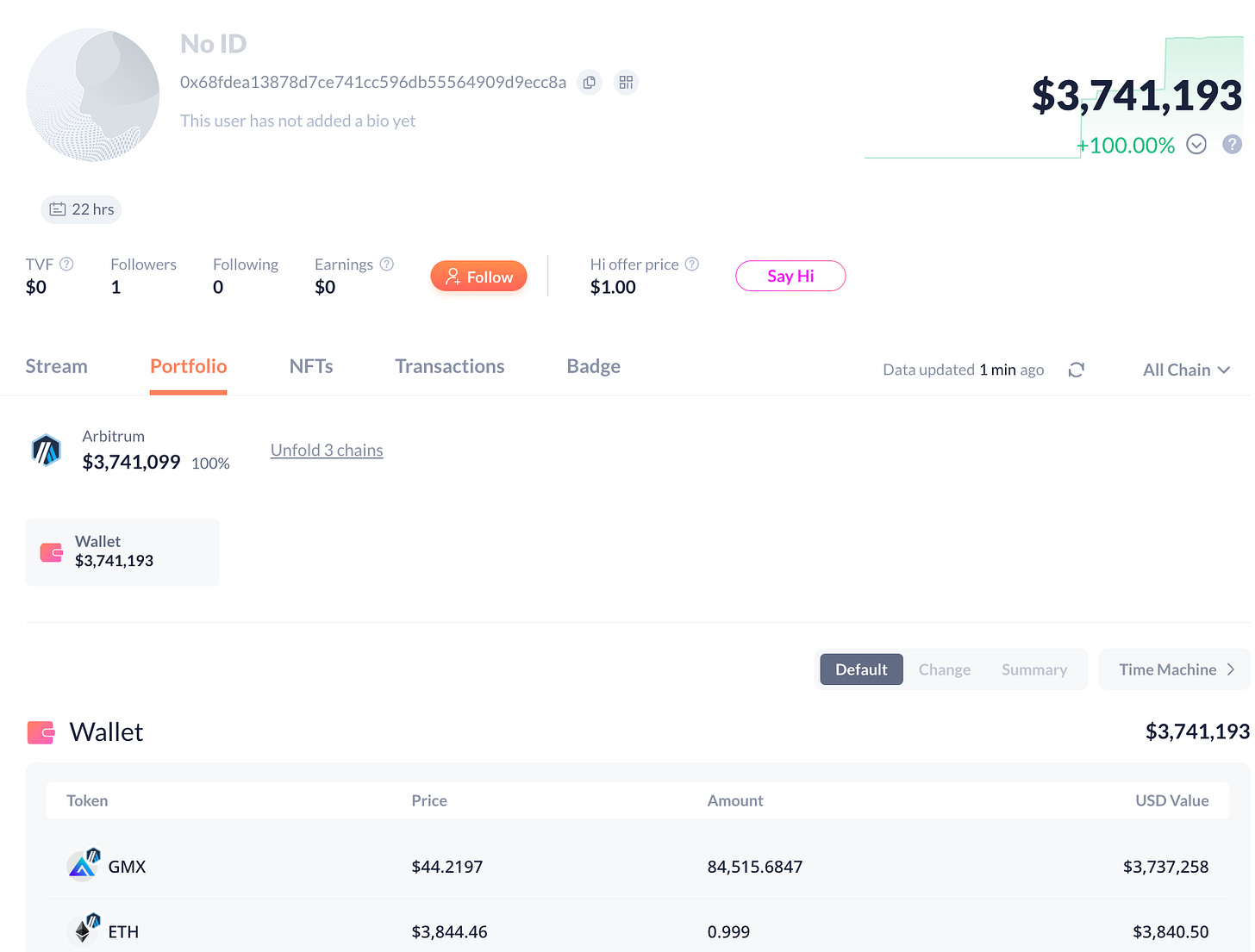

Speaking of GMX earlier, a fresh new wallet has bought $3.7M worth of GMX in the past 24 hours which is most likely why the token is pumping.

The address can be found here.

Token Unlocks

HFT - 3,35% of supply worth $4.35m on June 7th

GMX - 0,01% of supply worth $18.62k on June 9th

1Inch - 0,01% of supply worth $10.18k on June 9th

GLMR - 0.35% of supply worth $1.01m on June 11th

dYdX - 0.55% of supply worth $3.34m on June 11th

Pendle - 0.02% of supply worth $222.41k on June 12th

Aptos - 2.58% of supply worth $104.16m on June 12th

Whatever you do, don’t get trapped in tokens such as dYdX and Aptos that might get heavily pushed due to unlocks. Always consider that people are out there to take your money away from you if you don’t protect your capital. Not only here but generally in on-chain summer. Beware but don’t completely plug off, there will always be opportunities.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Bypass the complexities of crypto tax calculations effortlessly with the best-in-class tax calculator app – sort out your taxes in a few clicks here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.