The lack of volatility in the market and continuous ranging is driving people crazy that spend the whole day watching the charts. However, it has been a quiet summer that has given people the time to dive deeper into research and make solid picks on what tokens they want to hold when the tide shifts again. Don’t let it go to waste.

Meanwhile, there has been a continuous wave of news including the latest WBTC fud surrounding Justin Sun that has led protocols to decrease exposure to the asset.

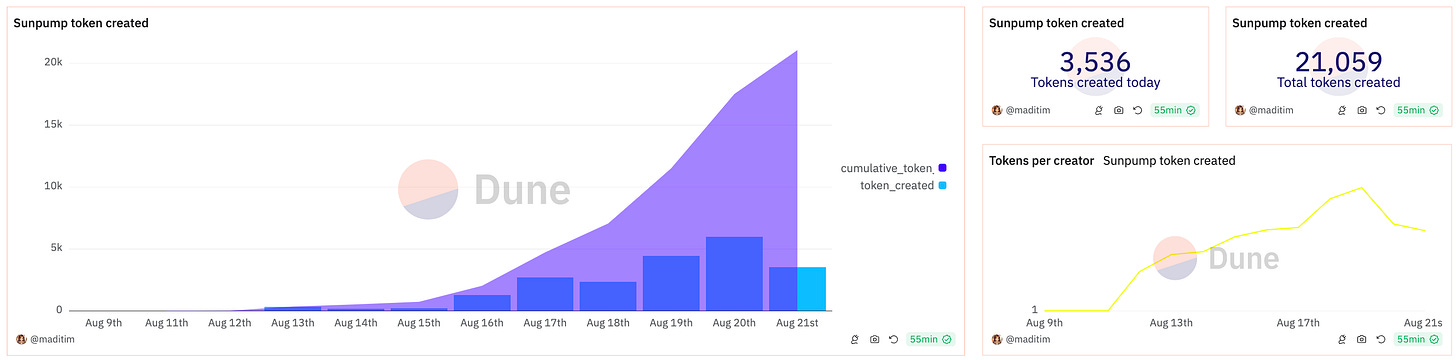

Speaking of Justin Sun, Tron has been very hot over the past week and has been the latest “rotation” by on-chain degens looking to be early to the newest chain on the block.

Market Digest

Tether to launch on Aptos

Drift Protocol introduces prediction markets on Solana

Malaysian authorities destroy over 900 Bitcoin mining rigs

Velodrome releases deep article on DEXs

Almost no chance for an SOL ETF

Defiance Capital publishes Aave thesis

Chaos Labs $55m Series A raise

Multiple crypto projects (25+) hired DPRK workers

Maker disables WBTC borrows

Tether launching a new stablecoin pegged to the UAE Dirham

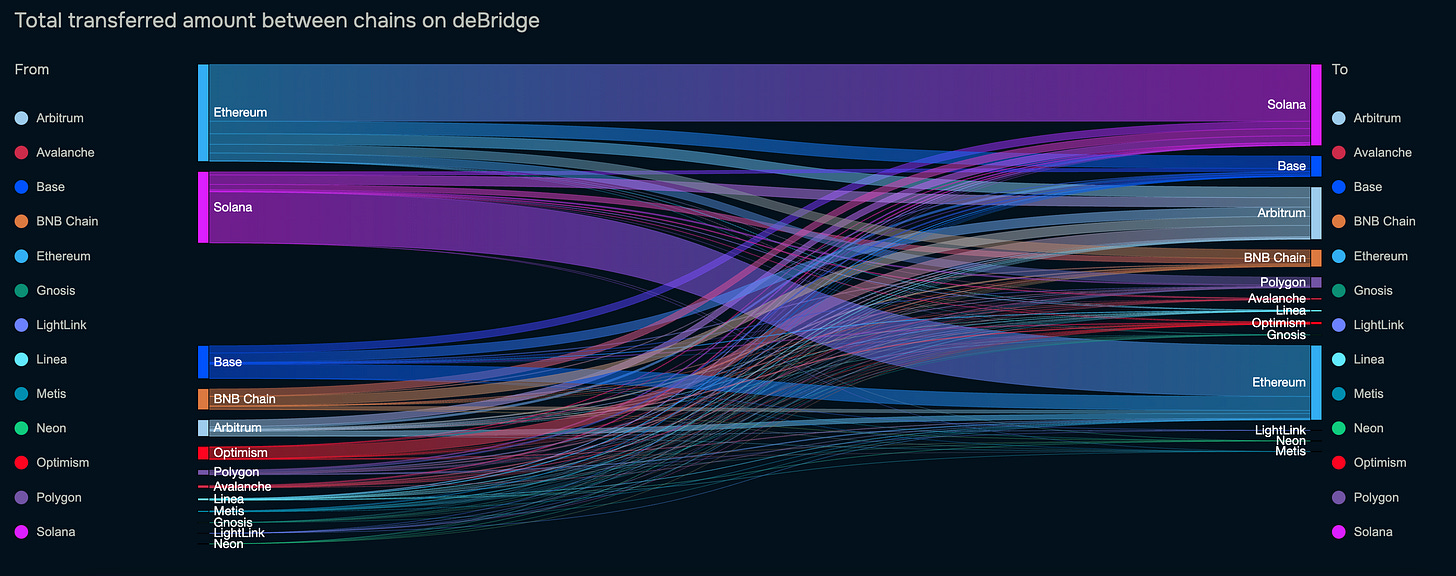

Bridge Flow

The flows to Solana are definitely slowing down considering the net inflow between Ethereum and Solana has only been +$2m for the SOL ecosystem as it has been saturated and a lot of value has been extracted over the past months. However, what this image isn’t showing cause it’s not featured in the table is the amount of capital that has been bridged to Tron over the past week which is the latest rotation.

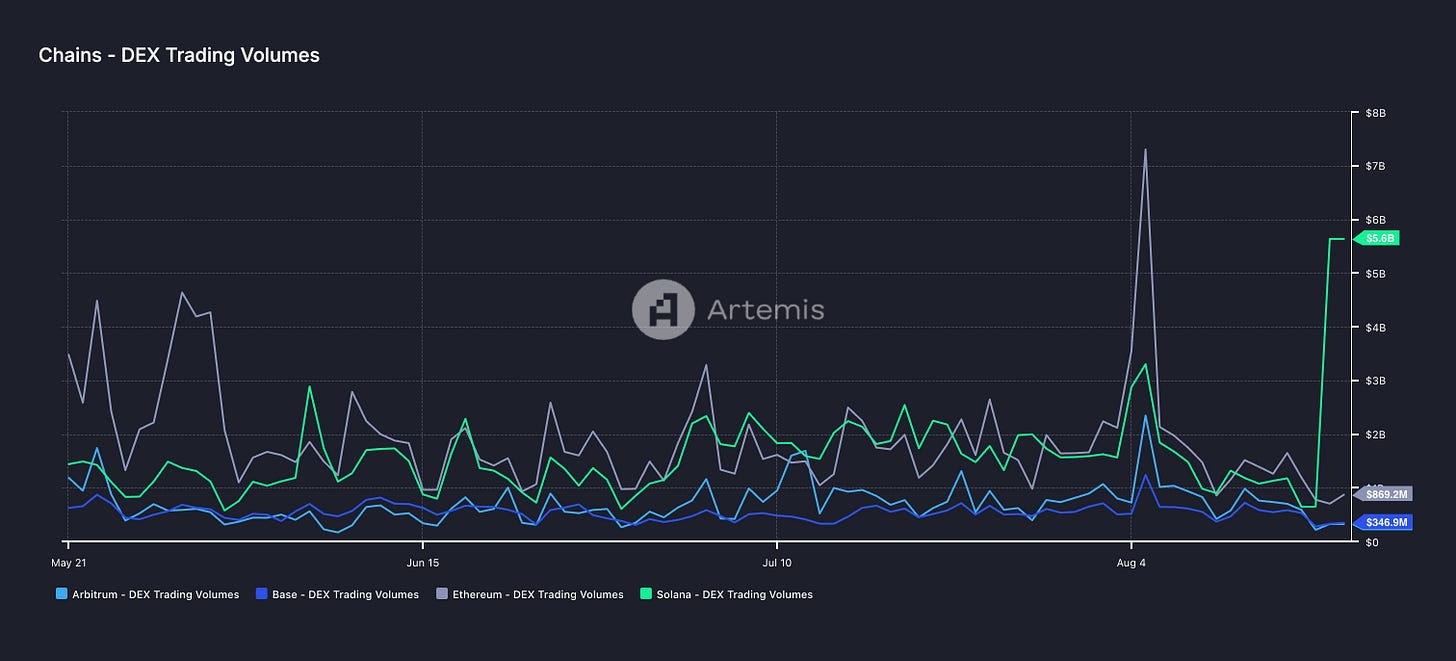

DEX Volumes

There was a big spike in Solana on-chain activity on the 18th which is hard to explain the reason for at the moment. Apart from that the volume has remained relatively slow during the summer lull. Thankfully, summer is over soon.

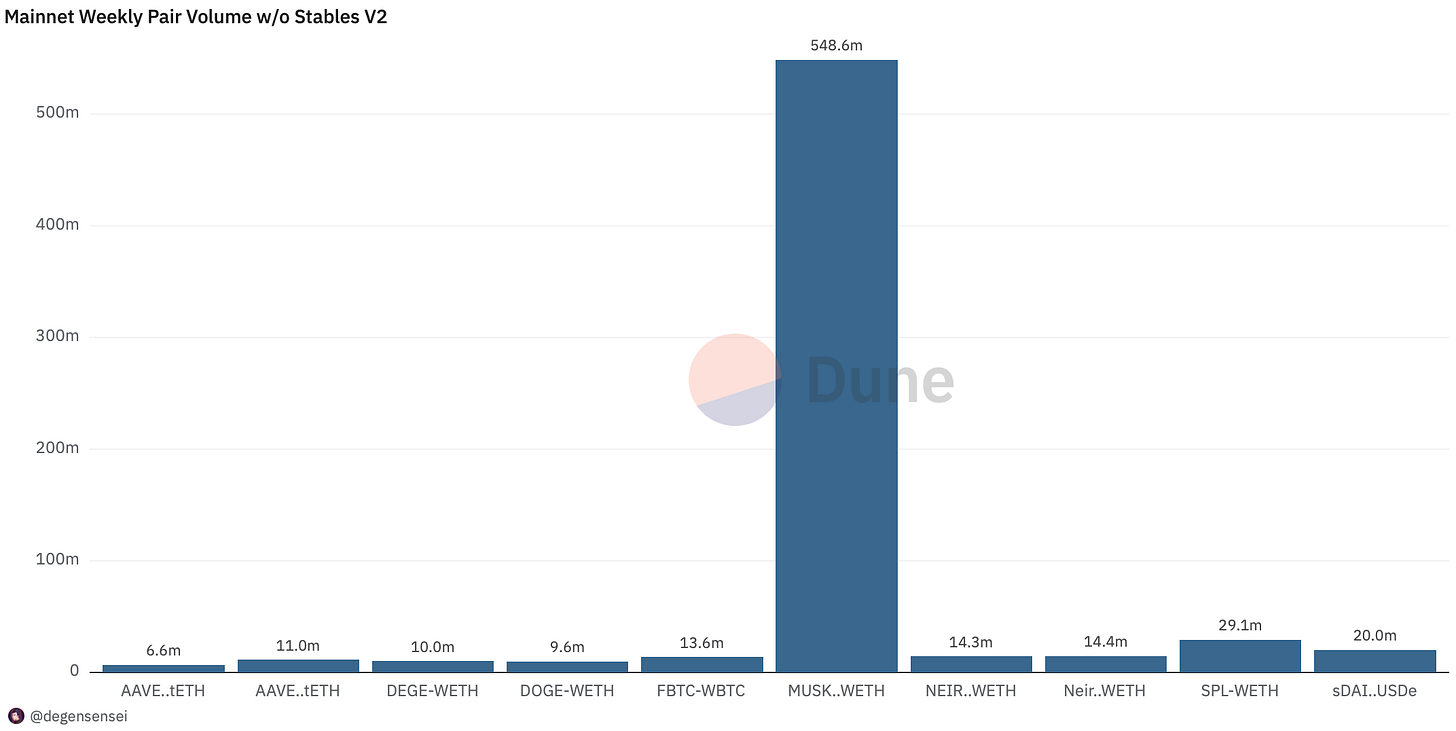

Pair Volumes

The insane volume from “Muskito” is fake and artificial but in the grand scheme of things on-chain volume has been dying out and the Ethereum mainnet continues to be a ghost chain for now except for a few tokens that have generated marginal volume such as AAVE and NEIRO.

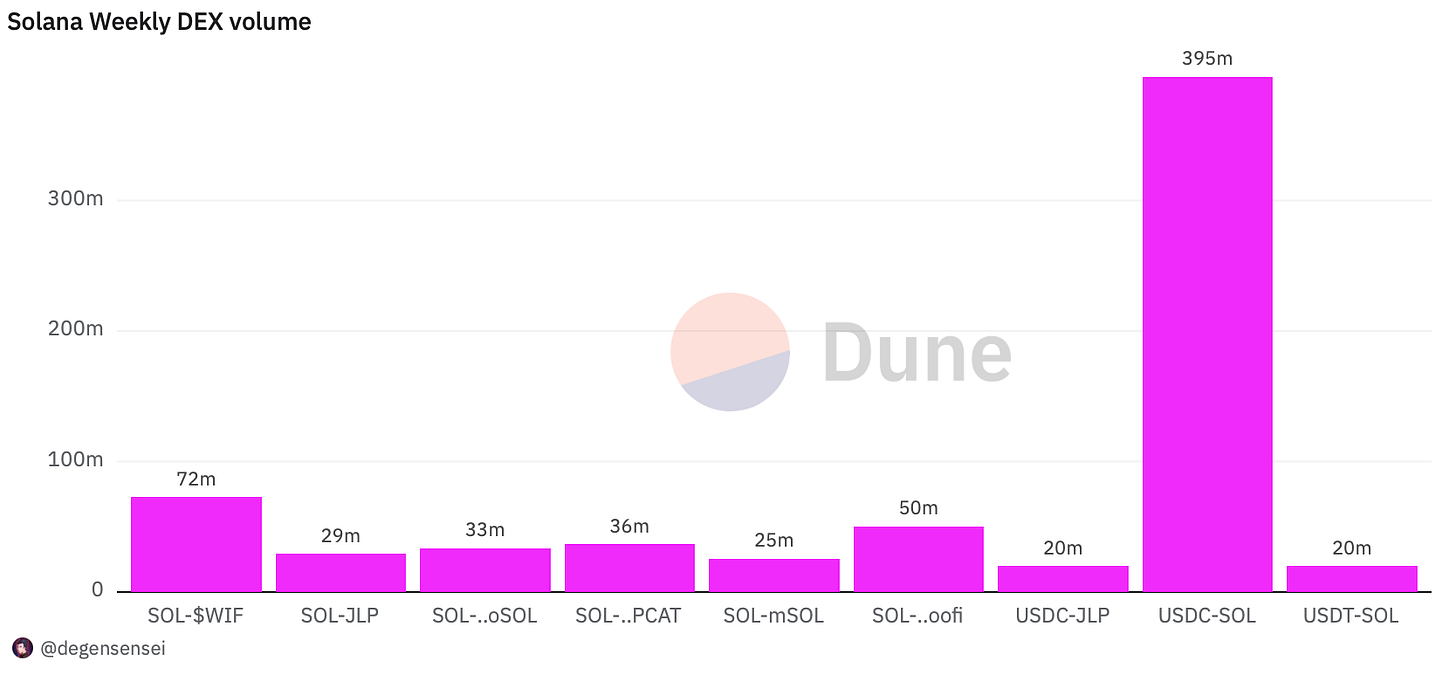

Solana volume is also going in the wrong direction with WIF taking the lion’s share of the DEX volume and snoofi which was the latest hot token on the block did some significant volume as well. POPCAT remains an ever-present at this point but there are signs of Tron stealing the volume from Solana directly.

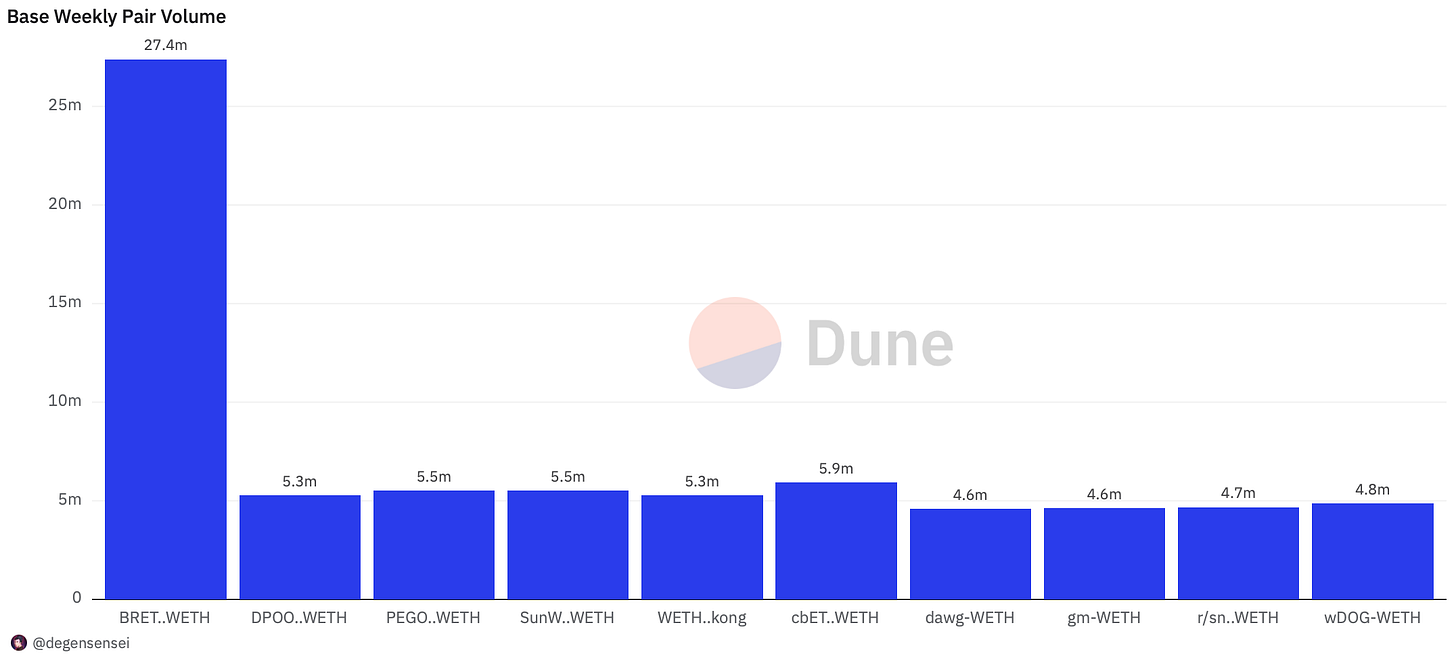

BRETT is the only token that can maintain sustained activity on a weekly basis within the Base at the moment. Outside of BRETT, there has been clear weakness across the ecosystem as people remain relatively risk-averse for the time being. Capital preservation mode.

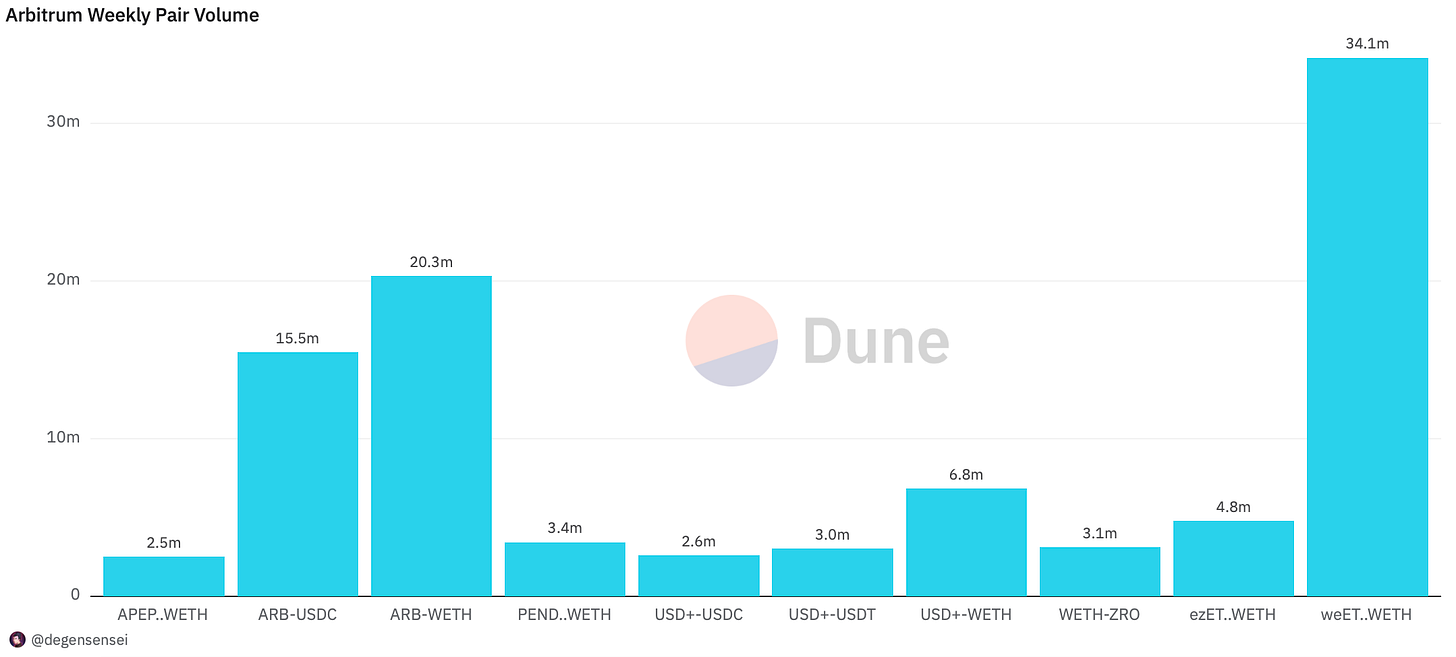

The only tokens you have to consider on Arbitrum at this stage are PENDLE, ZRO, and DMT as the activity on this ecosystem is non-existent. Almost so bad I’m considering removing it from the weekly analysis altogether but let’s not get hasty here.

NFT Trading

CryptoPunks got a severe uptick in bids over the past few days which led to a floor price increase of 29% which led to BAYC and Pudgies following. NFTs are not fully back yet but encouraging to see some life here. In order for ETH NFTs to fully wake up, you probably would need ETH to make a new all time high.

Also, it’s probably a good time to look at Bellschain ordinals and OP_NET on Bitcoin. All information is readily available in-depth on the upgraded stack.

Net Inflow

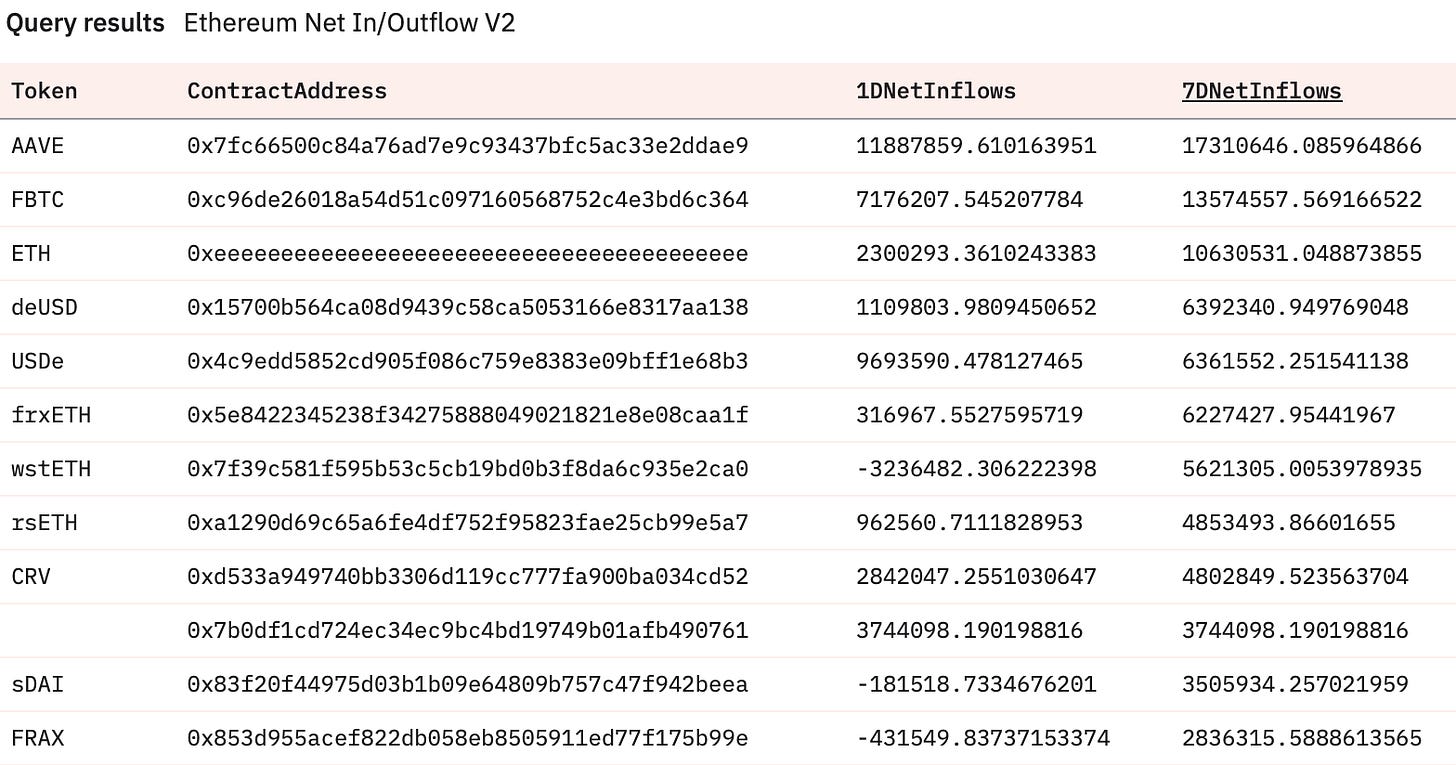

The market is maturing and only focusing on buying high-quality assets such as AAVE which has received $1.7M in net inflows over the past week. It has had more on-chain inflows than ETH on the mainnet and apart from this, it is only CRV that has garnered any interest as well.

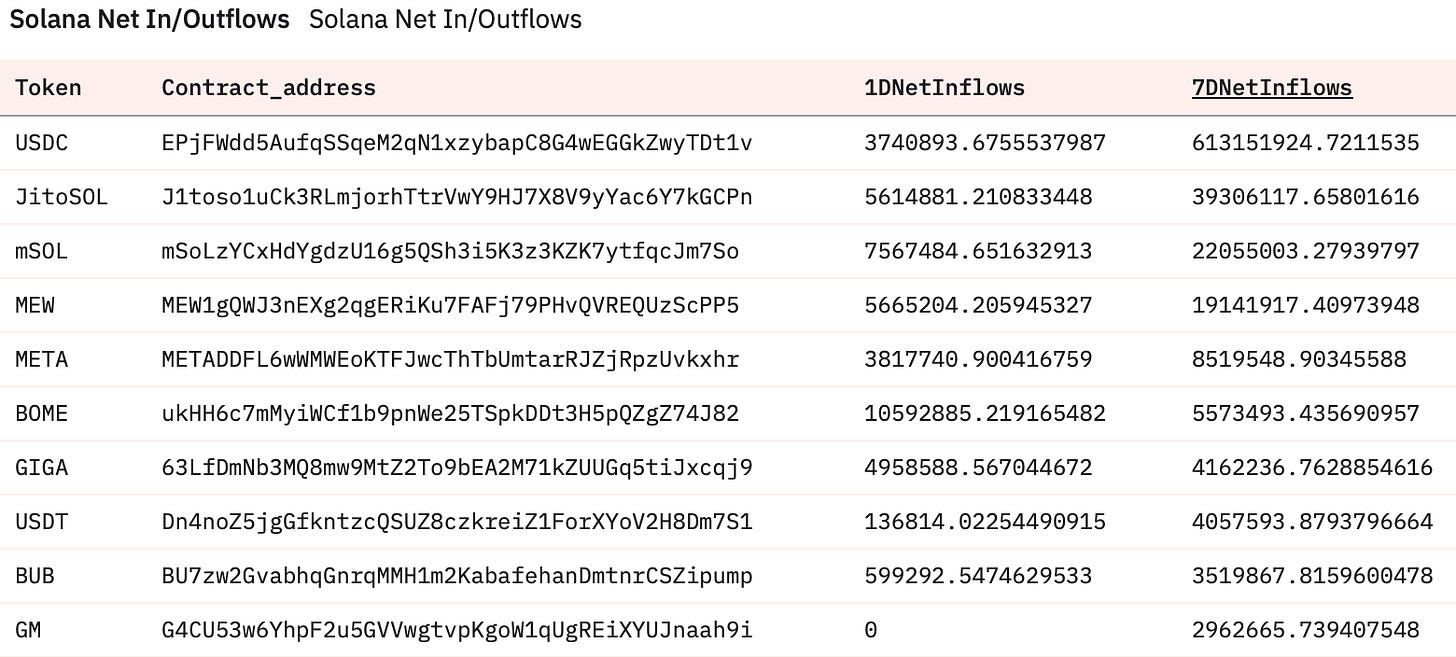

The Solana ecosystem has seen a sell-off as the most accumulated “token” over the past week has been USDC as many people have capitulated their memecoins that have been down only since the music stopped. Only a select few have continued to receive positive flows which are MEW, META, BOME, and GIGA.

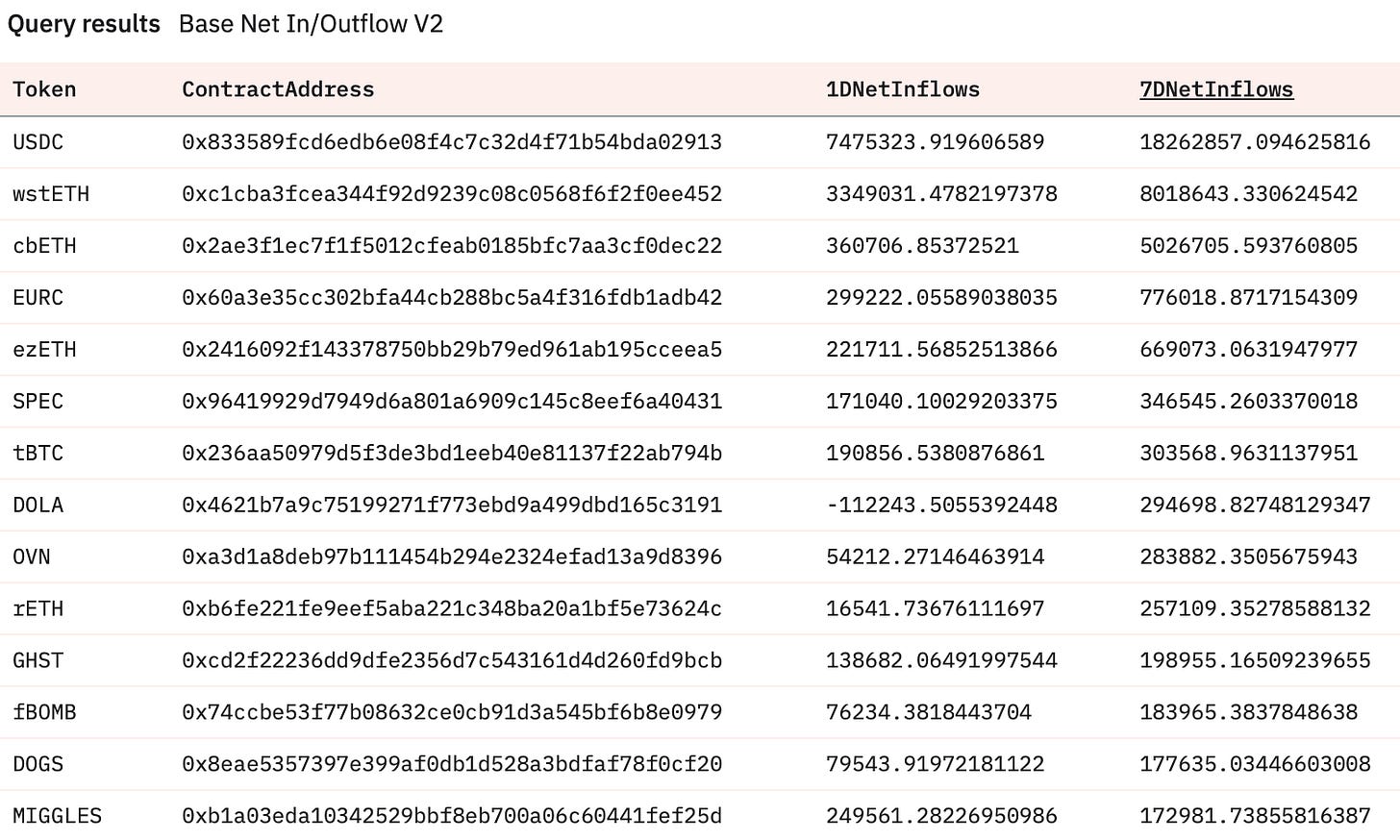

The same has been the case for Base which has seen 18m in USDC net inflow while majority of memes outside of BRETT and Miggles have continued to bleed. The only interesting altcoin that have received a small amount of in flows have been SPEC which is an AI token.

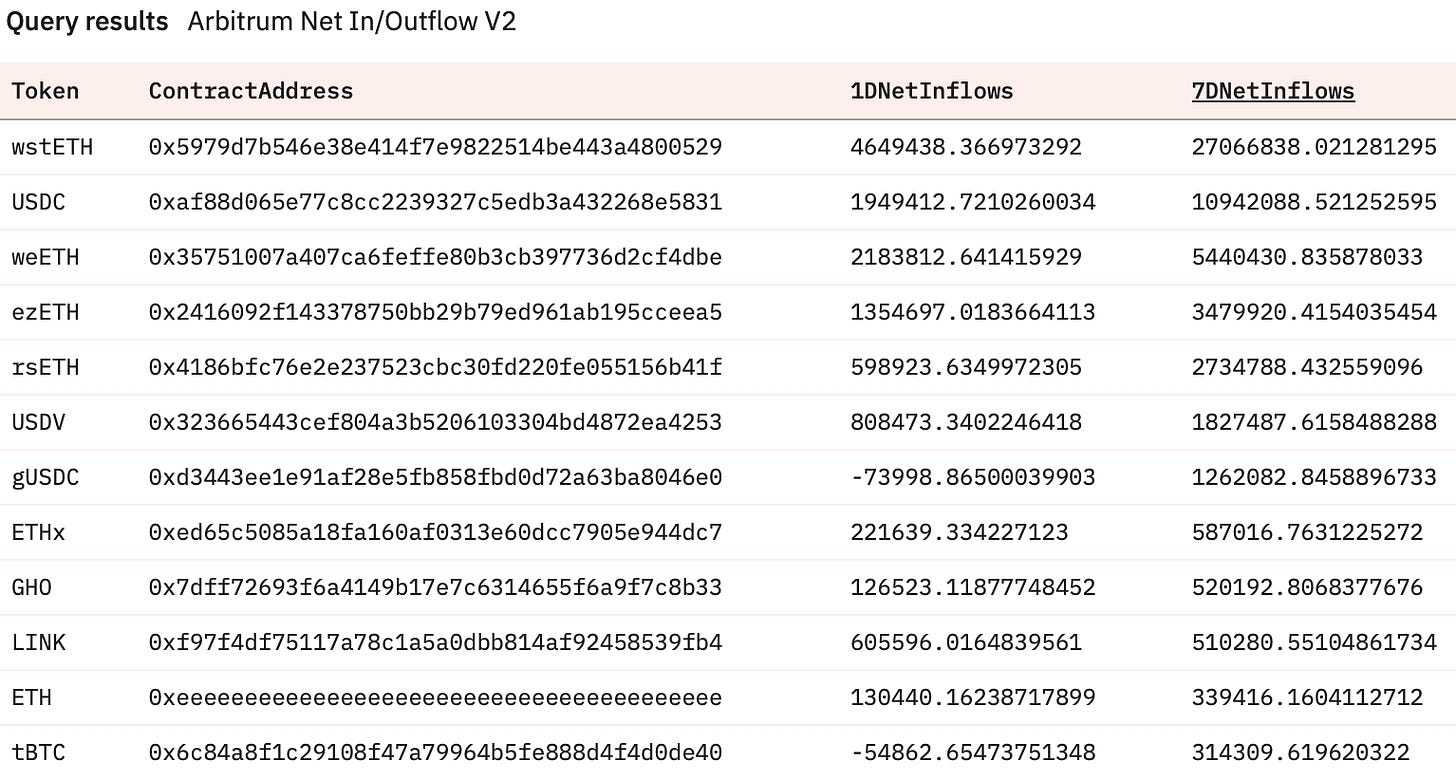

There is zero demand for Arbitrum alts except for farming purposes with wstETH and USDC leading the net inflow race over there. Will be interesting to see how the ecosystem will be affected by the ARB incentives campaign ending in 2 weeks.

Sleuthing

The Tron rotation is in full flow and over 21K tokens have already been created over the past week, if you’re going play this game you’re better off finding winners with high volume than trying to strike gold on this app.

Each to their own.

Token Unlocks

1INCH - 0.02% of supply worth $71.63k today on Aug 23rd

GAL - 0.47% of supply worth $1.43m on Aug 23rd

ACA - 0.46% of supply worth $276.61k on Aug 25th

ENA - 0.82% of supply worth $4.25m on Aug 25th

YGG - 3.71% of supply worth $5.42m on Aug 27th

AGIX - 1.56% of supply worth $3.22m on Aug 28th

PORTAL - 0.52% of supply worth $239.43k on Aug 29th

This is the phase of the market that is intended to make you give up. Don’t waver and hang in there.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Bypass the complexities of crypto tax calculations effortlessly with the best-in-class tax calculator app – sort out your taxes in a few clicks here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.