Memecoins continue to remain the most contentious topic in the industry whether they are net good or net bad for the industry, while this has been taking on they have continued to reprice higher over the past week while the majority of alts barring a few have been struggling for trading volume and attention.

I think it’s a conversation that stems from the lack of innovation in the core sectors that has been apparent this cycle as the bull market arguably came too early for DeFi. It’s also worth highlighting that you don’t have to like a market sector or token to make money on it.

While purists are important for the industry as they are the ones that garnered belief in the early stages, building the “future of Finance” doesn’t allow you to determine how it will be used. This is what seems to anger most people as the discord continues.

Nonetheless, let’s look into what has happened over the past week.

Market Digest

Swell airdrop checker is live

VanEck launches 30m fund to invest in early-stage fintech, crypto, and AI startups

FTX pays out customers in cash with interest

SUI passes 1B in TVL

Scroll to be listed on Binance

DeBridge unveils Hooks for cross-chain data transfers

Scroll releases tokenomics

Crypto.com receives wells notice from the SEC

Bitlayer a Bitcoin L2 raises $9m in Series A at $300m valuation

Zachxbt exposes Rekt Fencer

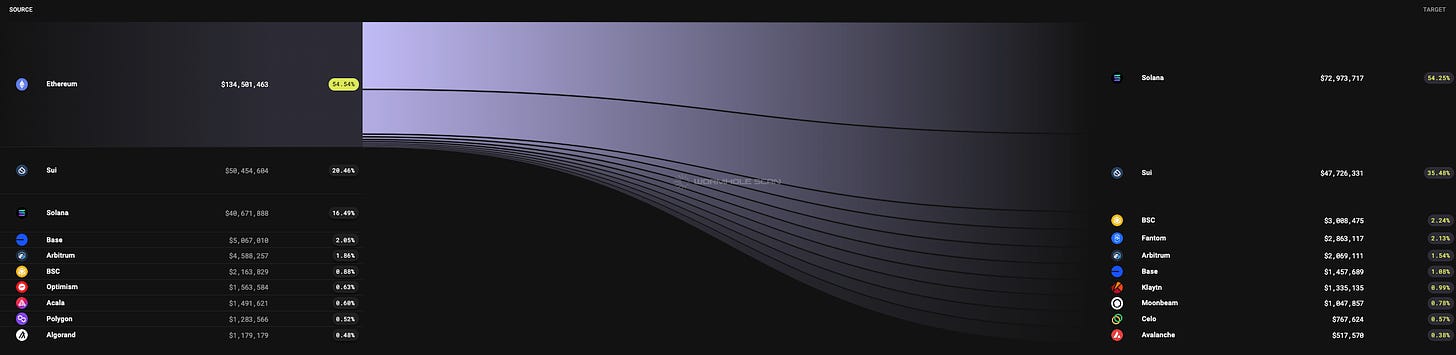

Bridge Flow

As the so-called memecoin supercycle is reaching its second wind which is causing continuous amounts of capital to flow from Ethereum to Solana mainly as people are chasing the hottest memecoins. There are no signs of this stopping soon until a new innovative app launch that captures the mindshare of the people.

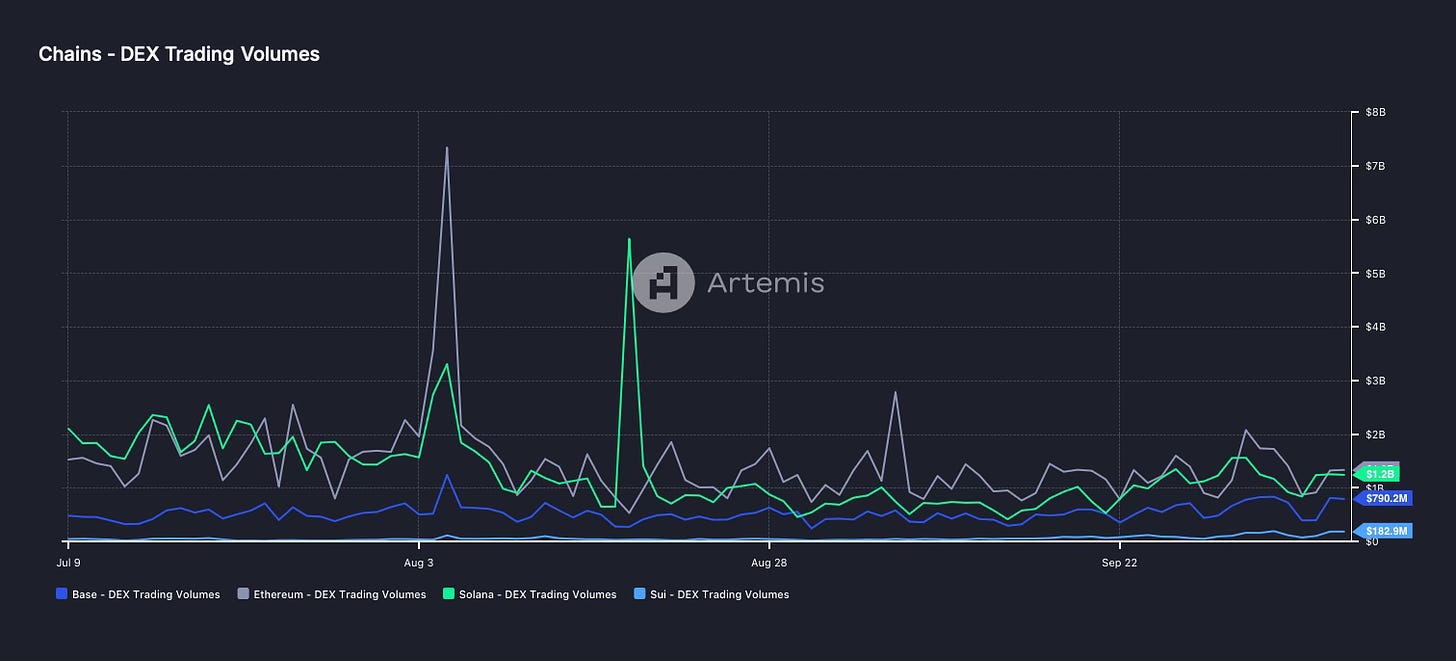

DEX Volumes

Might be hard to discern on the chart at first glance but since the middle of August DEX volume has shifted from a downtrend to a slow and steady uptrend which still has room to become much more frothy in a similar mold to the early parts of this year. This can be seen across the board on all ecosystems while Base has made the more significant jump over the past days.

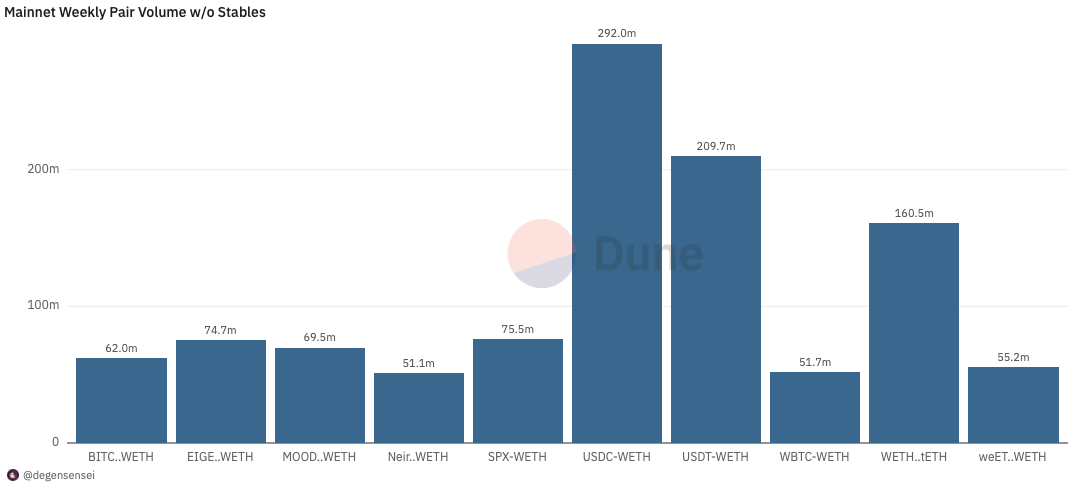

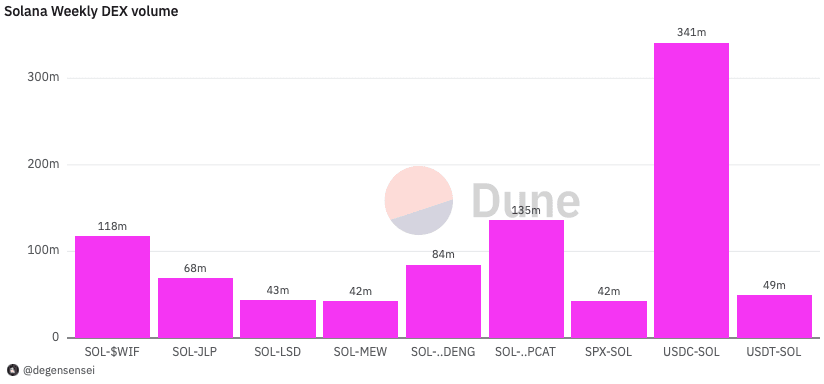

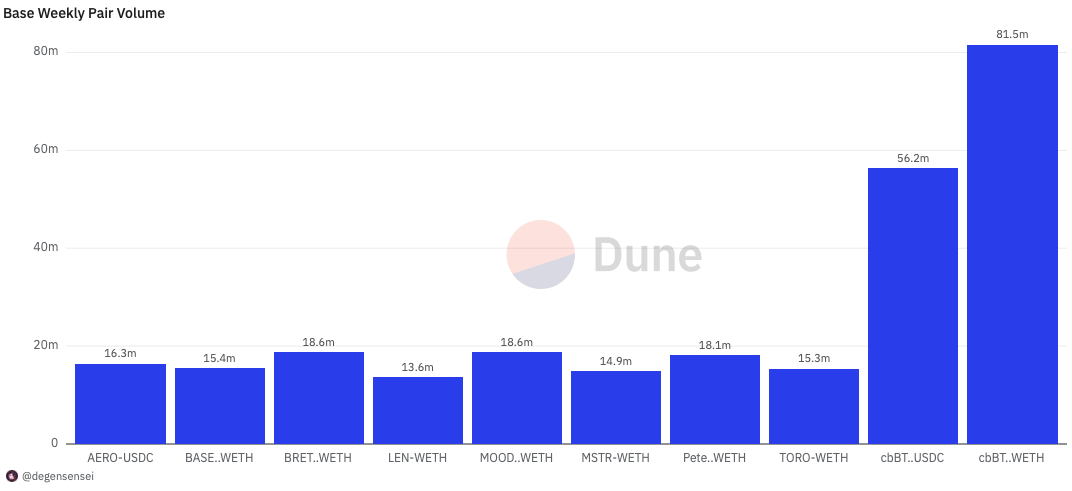

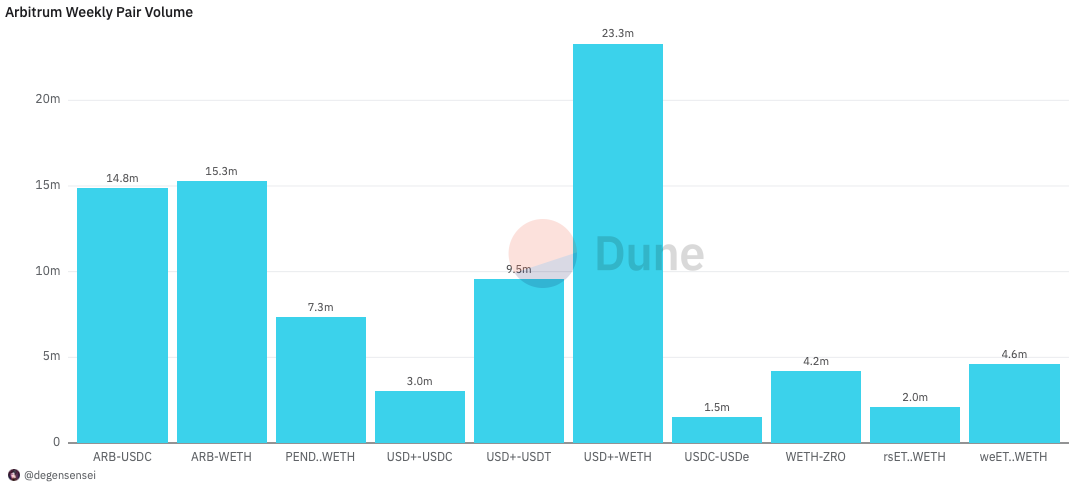

Pair Volumes

The majority of the hottest tickers are unsurprisingly memecoins with SPX leading the way in on-chain activity having more than delivered 50x this month alone. EIGEN is the only token outside of memes producing large numbers after the FUD seems to have passed for now. Moo Deng on Ethereum soared after a tweet from Vitalik thanking the community for their donation to charity. Meanwhile, the eternally cursed ticker Bitcoin has managed to reach a new all-time high after 16 months of ranging.

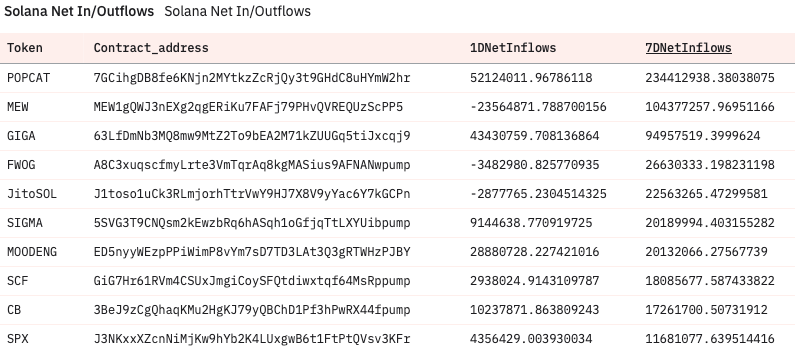

On-chain activity has woken up on Solana, with POPCAT and WIF leading the way for the meme charge, which has seen MEW and the SOL version of SPX follow. We’re at a stage now where people are questioning everything due to the performance of memes in comparison to the rest of alts and frankly, it’s a worthwhile discussion to have.

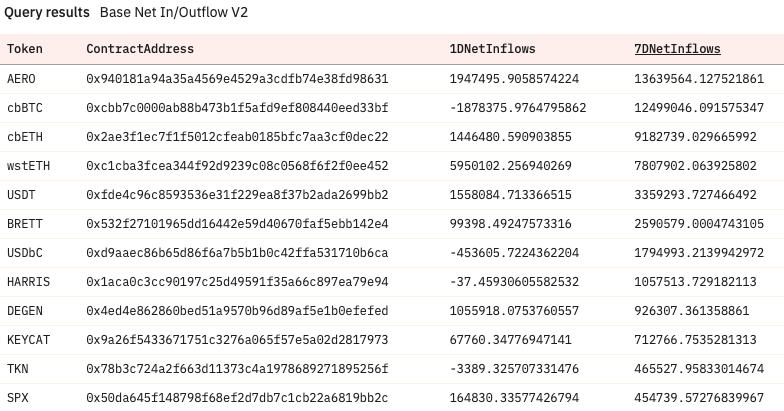

Base season is underway with the performance of AERO leading the charge and fellow memes following accordingly such as BRETT, as it currently stands the gains have been spread out across the board in the ecosystem. Enjoy them while it lasts.

The less said about this chain, the better.

NFT Trading

One man’s shill was enough to revive a whole market sector with NFTs repricing significantly over the past week.

Sproto Gremlins and AEON’s have repriced significantly due to the performance of ticker Bitcoin and SPX over the past week as they are the NFT collections that are representations of their communities. Being a Sproto or Aeon is in fashion again.

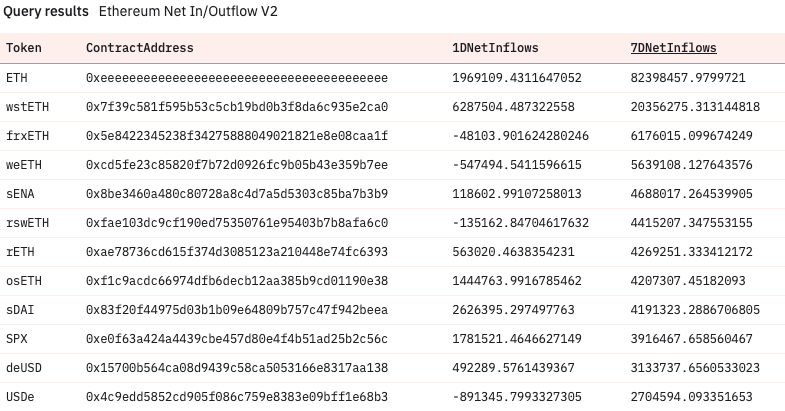

Net Inflow

On-chain people have been buying ETH (while dumping it on CEXs) and derivatives, the only tokens that makes the list from a standpoint of large sustained bids are sENA (staked ENA) and the one and only memecoin SPX that aims to flip the stock market.

POPCAT continues to lead the way concerning inflows as it is currenely consolidating around all time highs. As cats has been the rage of the town since POPCAT broke a billion in market cap, MEW has followed accordingly as people view it as a “beta play”. Let’s see how it turns out. Otherwise, GIGA and FWOG continue with their strong performance while SIGMA has followed GIGA accordingly. MOODENG is recovering and the whole memecoin ecosystem on Solana has bounced leaving utility alts in the dust.

AERO leads the way on Base as the unofficial designated Base token as it acts as a good proxy for the ecosystem. The memes have followed accordingly as BRETT has performed well alongside KEYCAT that has 10xd over the past month while DEGEN has been strong since its Coinbase listing as well.

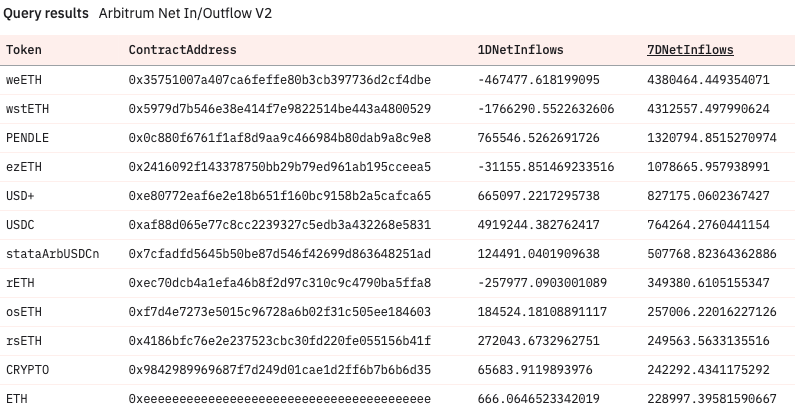

Arbitrum is just sad at this point as the only altcoin receiving any remote kind of bid is PENDLE. The rest are duds at this stage.

Sleuthing

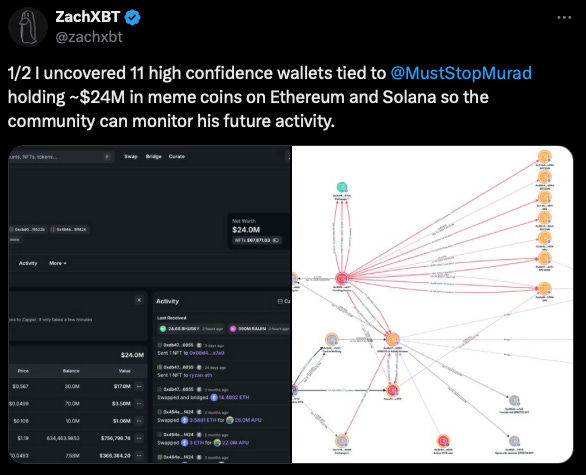

Well the talk of the town is Murad so might as well mention that Zachxbt exposed all of his wallets and credit to the guy because he has diamond held his purchases which turns out is bullish for the token holders of respective tokens if he stays true to his word.

Believe in something.

Token Unlocks

GLMR - 0.34% of supply worth $493.90k on Oct 11th

EUL - 0.22% of supply worth $118.98k on Oct 11th

IO - 2.22% of supply worth $3.85m on Oct 11th

APT - 2.25% of supply worth $103.15m on Oct 11th

ADA - 0.05% of supply worth $6.31m on Oct 12th

NEAR - 0.04% of supply worth $2.00m on Oct 13th

FORT - 0.01% of supply worth $5.66k on Oct 13th

TAIKO - 15.62% of supply worth $18.96m on Oct 14th

The message remains simple: Stop Trading and Believe in Something.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.