This Week On-Chain #96 - Pro Crypto Government, Trump Presidency

BTC is off to the races, here we go.

This article can’t start with anything other than the election which was a landslide win for Donald Trump. This is very exciting if your main focus is on crypto and nothing else. As someone who focuses on this as a single issue, this is very exciting since crypto has been constantly attacked by the previous regime and now we will have a pro-crypto presidency while it is likely that Gary Gensler will have to leave his position as well.

Expect this to benefit utility tokens more than memecoins now as JD Vance is likely to ensure that projects that are building in this industry get rewarded accordingly.

Make DeFi Great Again.

Market Digest

Donald Trump becomes the 47th President of the United States

Swell airdrop is live

Hester Peirce earmarked as a potential replacement for Gensler

Eigenlayer introduces Eigen Economy

Coinbase donated $75m this election cycle

Swift, UBS, and Chainlink complete a pilot for tokenized fund settlements

Wintermute proposes a fee switch for Ethena’s sENA holders

Avalanche Foundation buys back $52m worth of AVAX

Pump fun hits record revenue after the AI memecoin craze

Blackrock spot ETF sees record $4B traded on election day

Bridge Flow

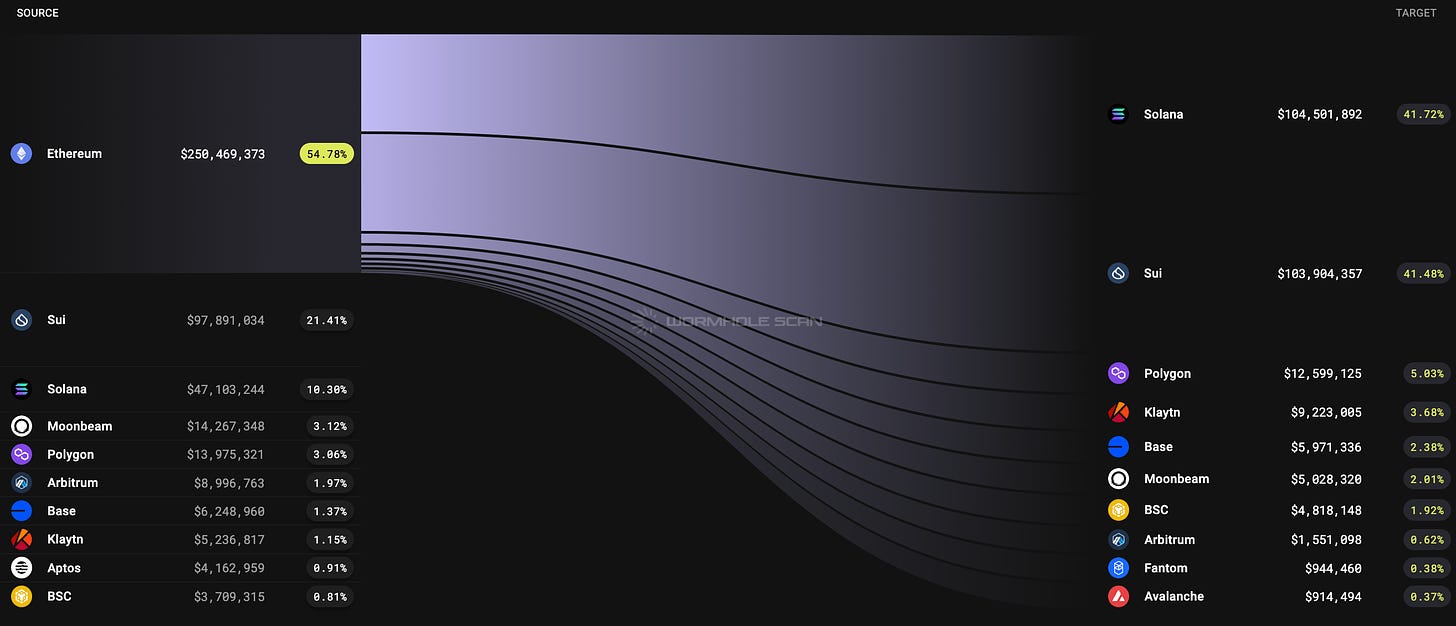

The week started with massive inflows into Solana from Ethereum as usual while the end of the week started with some flows coming back from Solana and Sui into Ethereum as people started to chase DeFi tokens. While the Trump presidency allows actual projects to benefit again as regulations likely will be decent, it will still take some time before they come into effect.

DEX Volumes

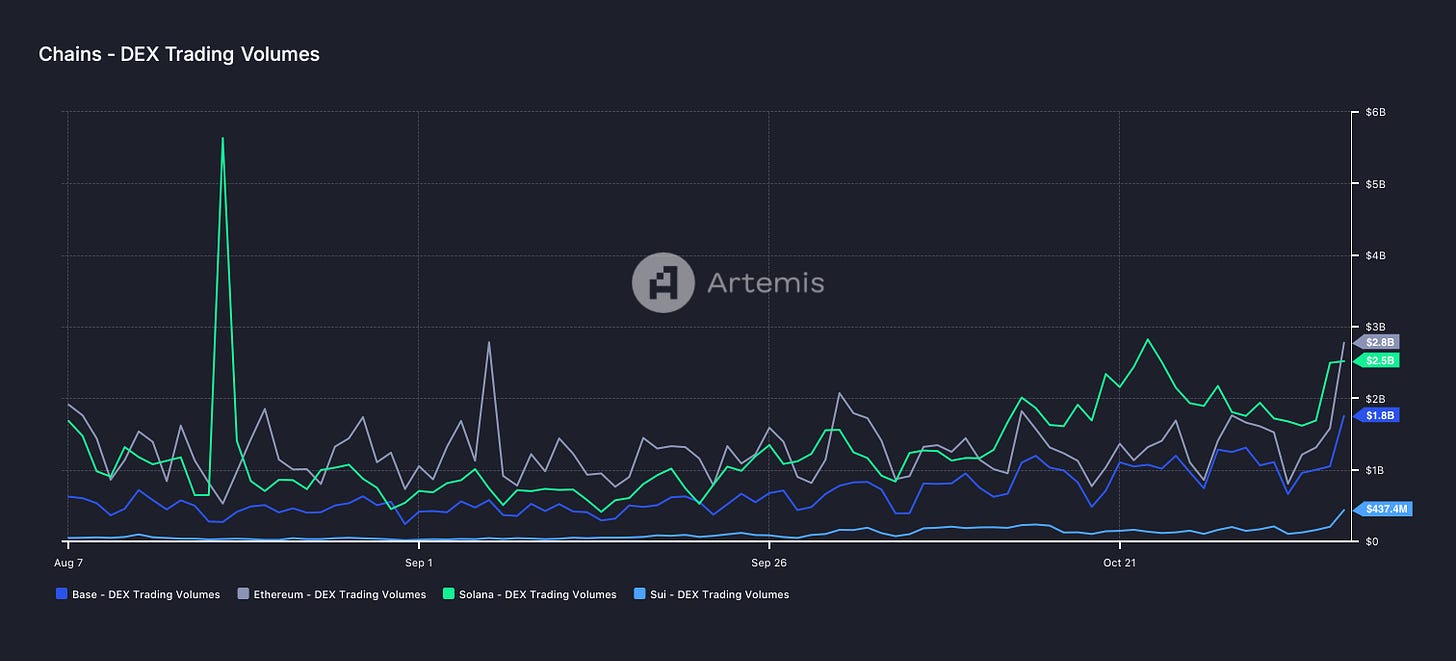

Unexpectedly, DEX volumes have been skyrocketing since the beginning of September, and you can expect this to continue to accelerate from here, barring any big surprise. It’s a good place to be in, and your main focus should be on this market going forward.

Pair Volumes

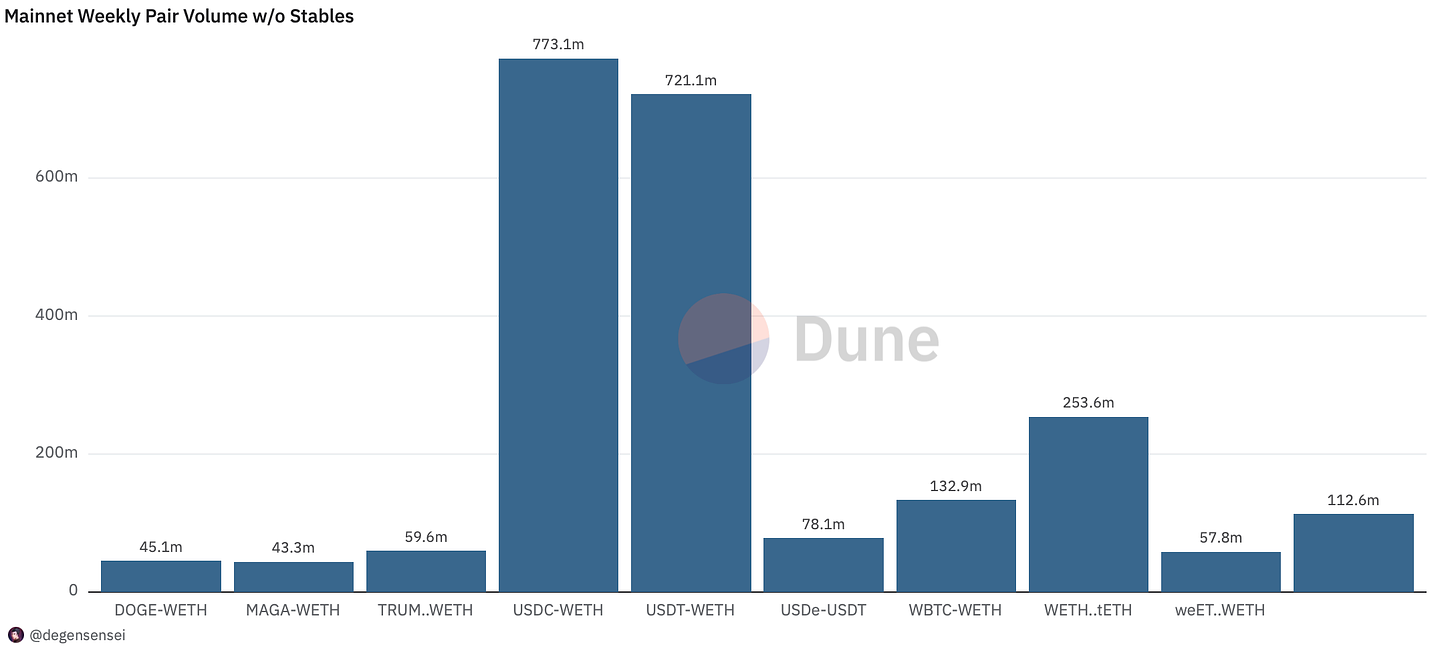

No surprise that Trump-related tokens have been the most traded over the past week with TRUMP, MAGA, and DOGE receiving a lot of trading volume and were very green when the presidency was announced.

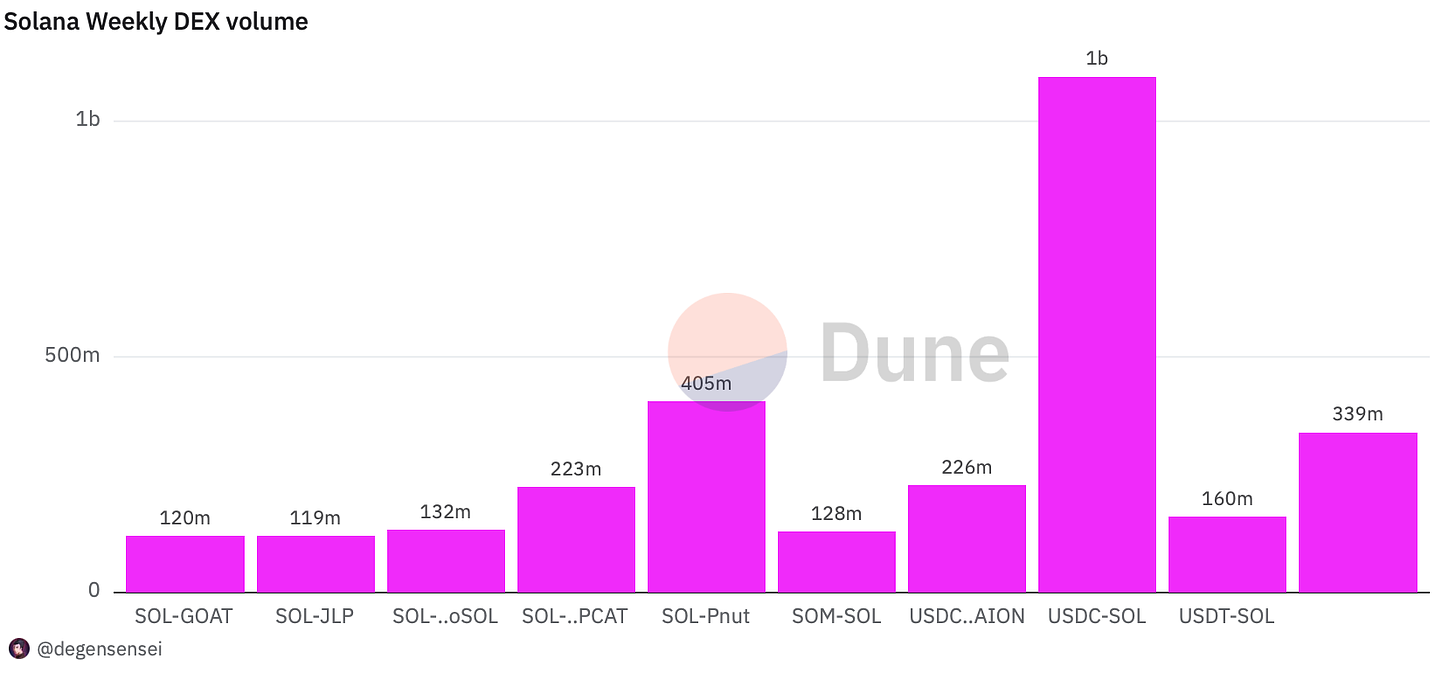

Pnut was the beloved squirrel that was embraced by Elon Musk and Donald Trump which is why it has been heavily traded over the past week. Otherwise, winners have continued to win as GOAT and POPCAT are on a tear on Solana.

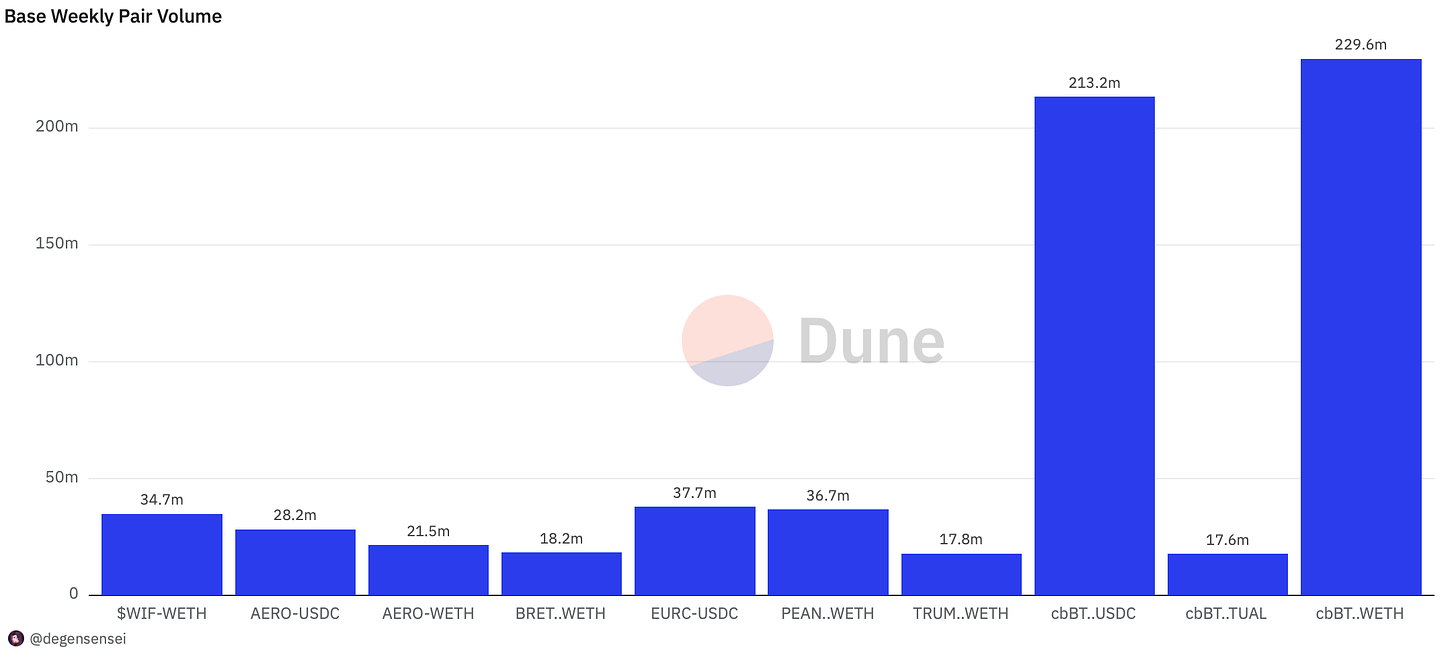

As DeFi is viewed as a Trump trade due to the regulatory benefits, it is no surprise that Aero is heavily featured in the volume charts. It is the Base proxy and one of the strongest-performing DeFi tokens of his cycle.

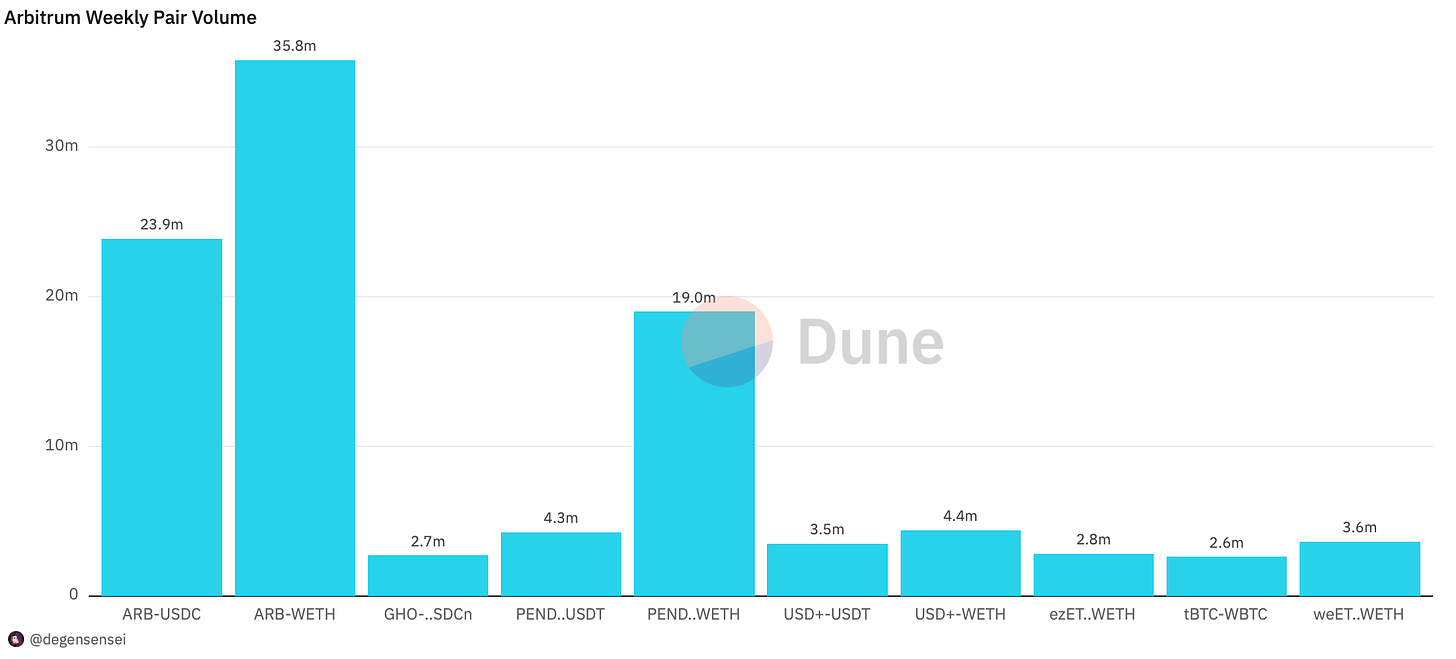

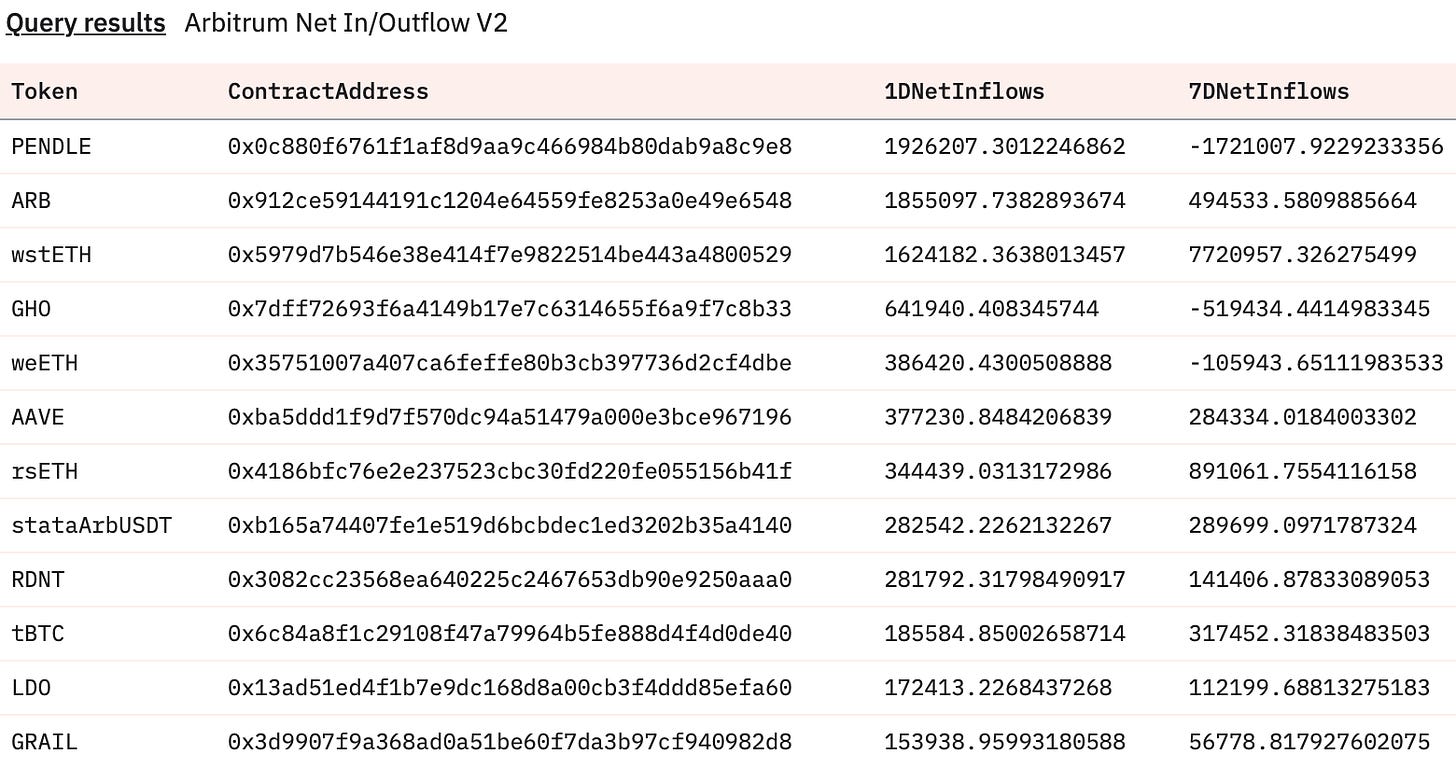

It's nice to see Arbitrum do some decent volume, although it is mainly attributed to PENDLE and ARB, which moved alongside all the DeFi tokens as the discount is disappearing. It's a good time for long-time holds, though it will take some time before they actually accelerate.

NFT Trading

NFTs are being overlooked again as memecoins are the craze again. While they have rebounded from the bottom, you likely won’t see a significant NFT pump outside of Ordinals until the end of 2025. There are tons of better opportunities out there. NFTs performing well is a clear indication of froth.

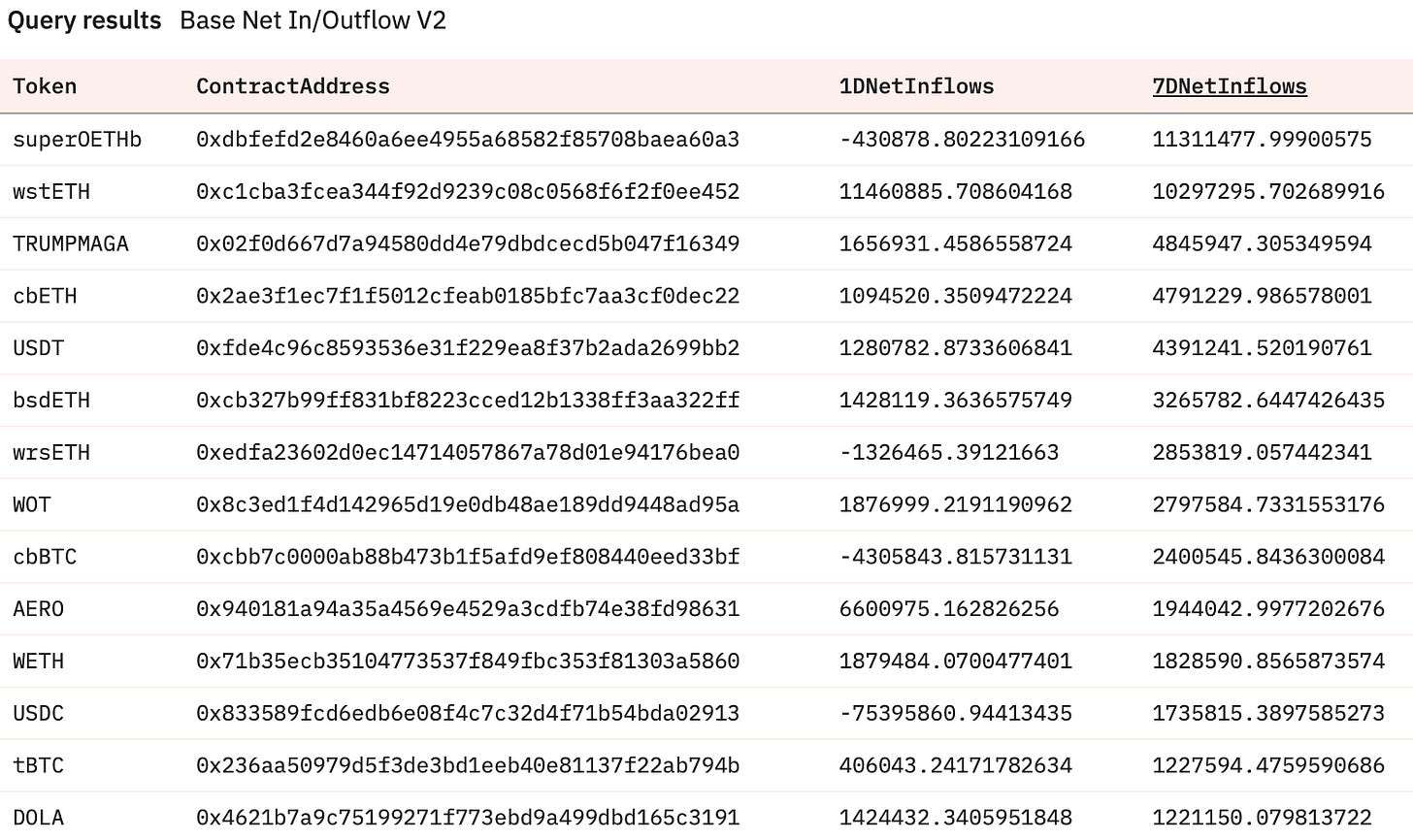

Net Inflow

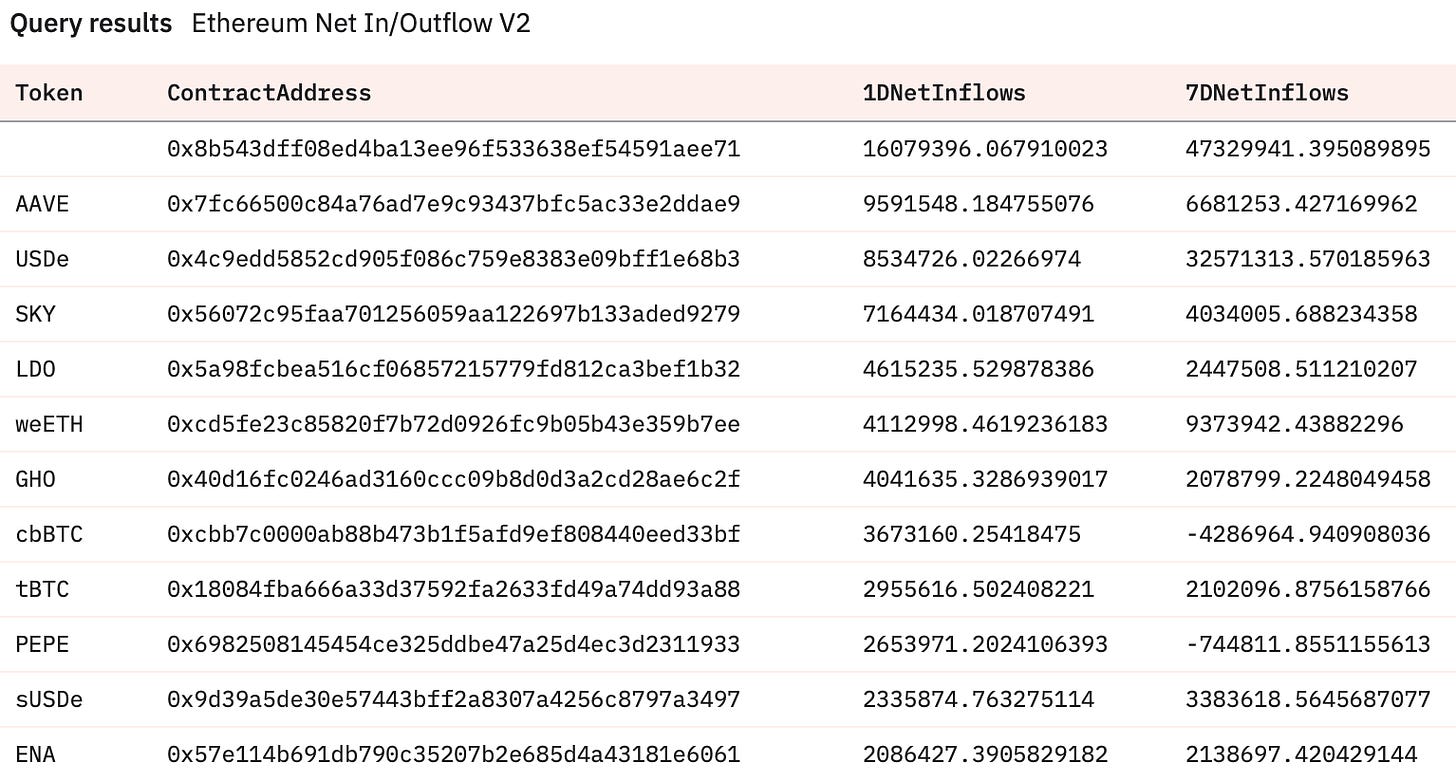

As you can see on this list, it is clear that DeFi has been heavily accumulated as a response to the Trump trade with AAVE and SKY (previously Maker) leading the way and LDO following accordingly. While PEPE has been the leading meme and ENA as well. What is evident from this is that the market leader out of each sector has been catching the most concentrated bid and is a reminder that you should bid winners at the beginning of large trends even if they are large caps.

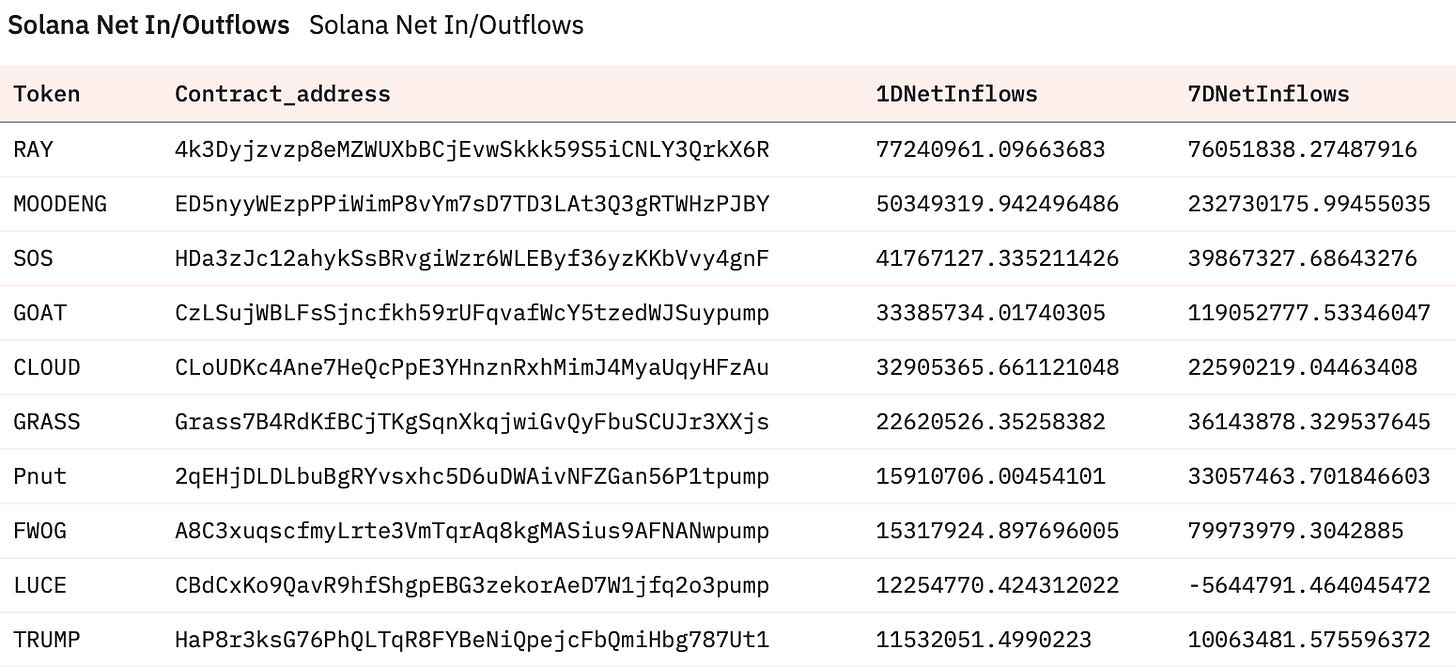

DeFi tokens also leading the way on Solana with Raydium catching significant bids which is a rare first on Solana. Although this chain is more degen by nature it is more dominated by memes in comparison to Ethereum with MOODENG being heavily accumulated with SOS and GOAT tailing. Then you have utility tokens such as CLOUD and GRASS while Pnut and FWOG, LUCE, and TRUMP have all found significant bids.

Base is not fully risk-on yet as the token that has received the most inflows is superOETHb which is a high-yielding LST as people want exposure to a product that accrues in value as ETH is going up. When you start to see AERO reprice aggressively, the whole Base ecosystem will likely move along with it.

The Arbitrum inflows are meek in comparison to the rest of the tokens as PENDLE has been positive over the last day while still negative over the past week, while native tokens as RDNT and GRAIL have received some inflow but they are tame in comparison to Ethereum and Solana.

At this point, this might be the last rotation that takes place this cycle and should act as a warning.

Sleuthing

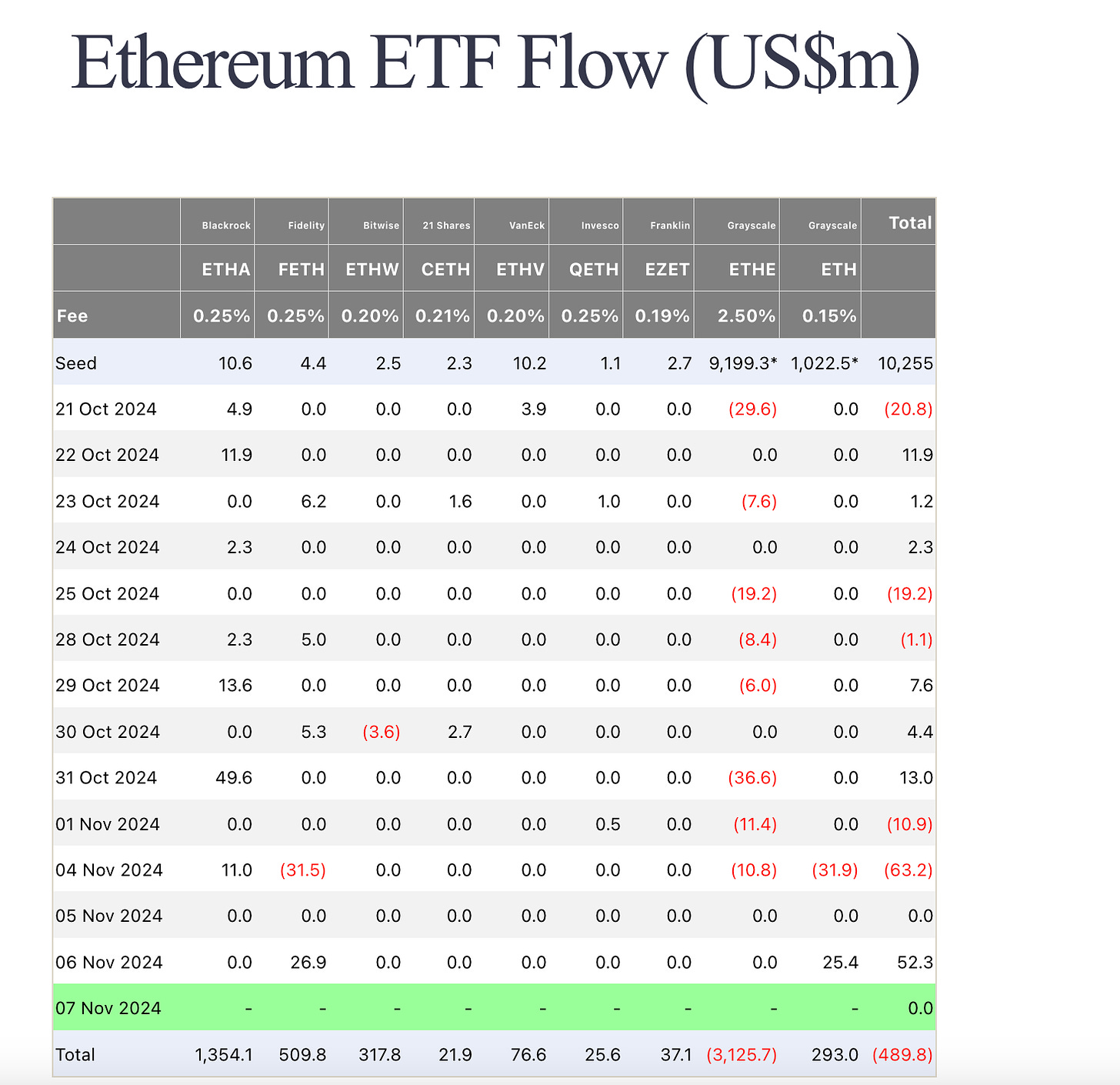

It’s taken a long time but Ethereum ETF flow is finally starting to come to life and it will need much less to move the price when reflexivity kick in. Strap in.

Source: https://farside.co.uk/eth/

Token Unlocks

BGB - 0.38% of supply worth $6.72m on Nov 10th

ADA - 0.05% of supply worth $7.18m on Nov 11th

APT - 2.18% of supply worth $109.82m on Nov 11th

ENA - 0.45% of supply worth $6.50m on Nov 13th

It’s time to throw away all the bearish stances, lower your IQ and simply hold. The real bull market is finally here. Enjoy because it’s going to be a lot of fun.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.