People are getting accustomed to prices going up and getting spooked as soon as Bitcoin has a single red day that amounts to less than 5% at this stage, meanwhile, it is easy to forget that we are trading so close to 100K. We have come a long way and there is still some time to go in the bull market.

Many people are still suffering from severe bear market PTSD when dips are customary in a bull market. Stick to conviction holds, dabble around with a small amount of your portfolio, and HODL.

With that said, let’s take a look into what the latest turbulent week has given us.

Market Digest

Solana flips Allianz in market cap

Tether minted over 15 billion USDT in November

Chinese publicly traded SOS plans to buy up to 50 million in Bitcoin

Brazil lawmaker proposes $18B Bitcoin Sovereign Reserve

Trump administration is eyeing the CFTC to oversee digital asset regulation

Hashdex filed for S-1 Nasdaq Crypto Index US ETF

Morocco lift 2017 ban and legalizes cryptocurrencies

21Shares set to launch ETPs for PYTH, ONDO, RNDR and NEAR

Pump.fun removes live streaming after it turns to degenerate, it will be reinstated when moderation infrastructure is ready

Phantom incorporates Base

Microstrategy acquires another 55,000 BTC for $5.4B

UK aims to integrate traditional finance with cryptoassets

Bridge Flow

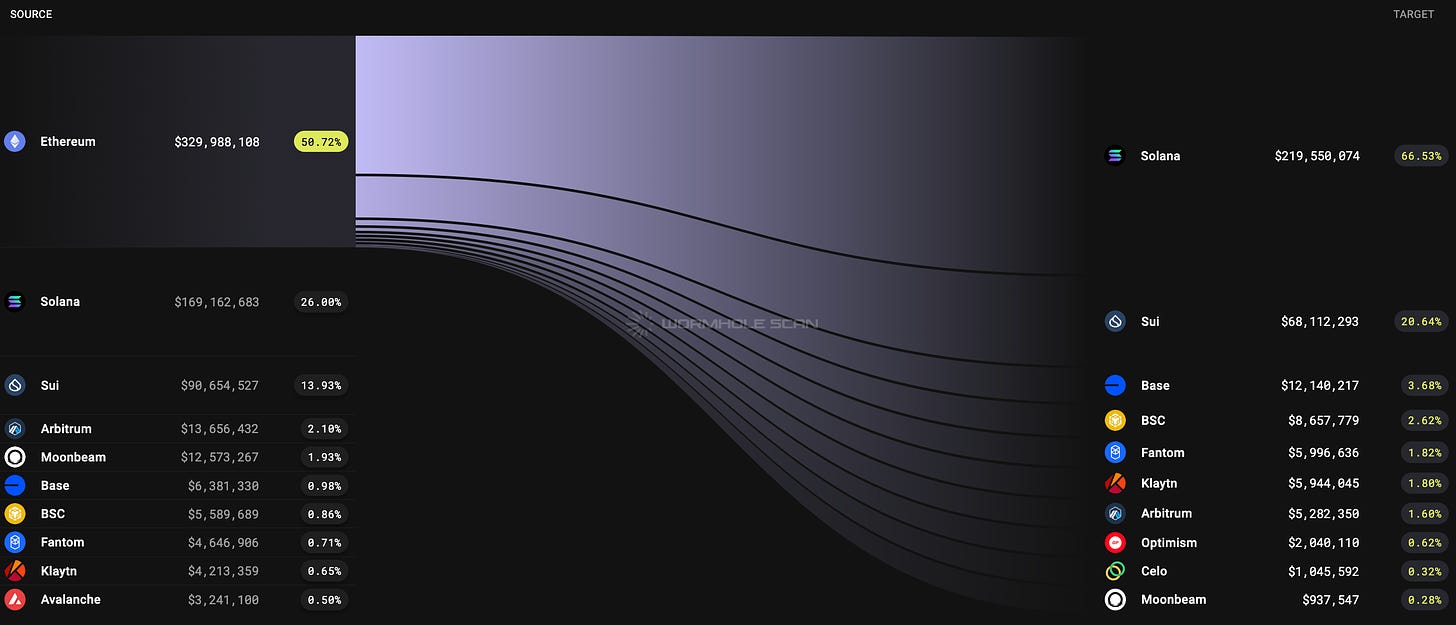

Solana has continued to suck capital from Ethereum although Ethereum has started to pay back the latest days as a significant amount has returned again. Ethereum is finally waking up as it tends to do in December which is something that shouldn’t be overlooked if this is your first rodeo. When ETH gets going it really gets going. Things can get violent fast and make sure you tap in for the fun that can bring on-chain. Base has already started to heat up accordingly.

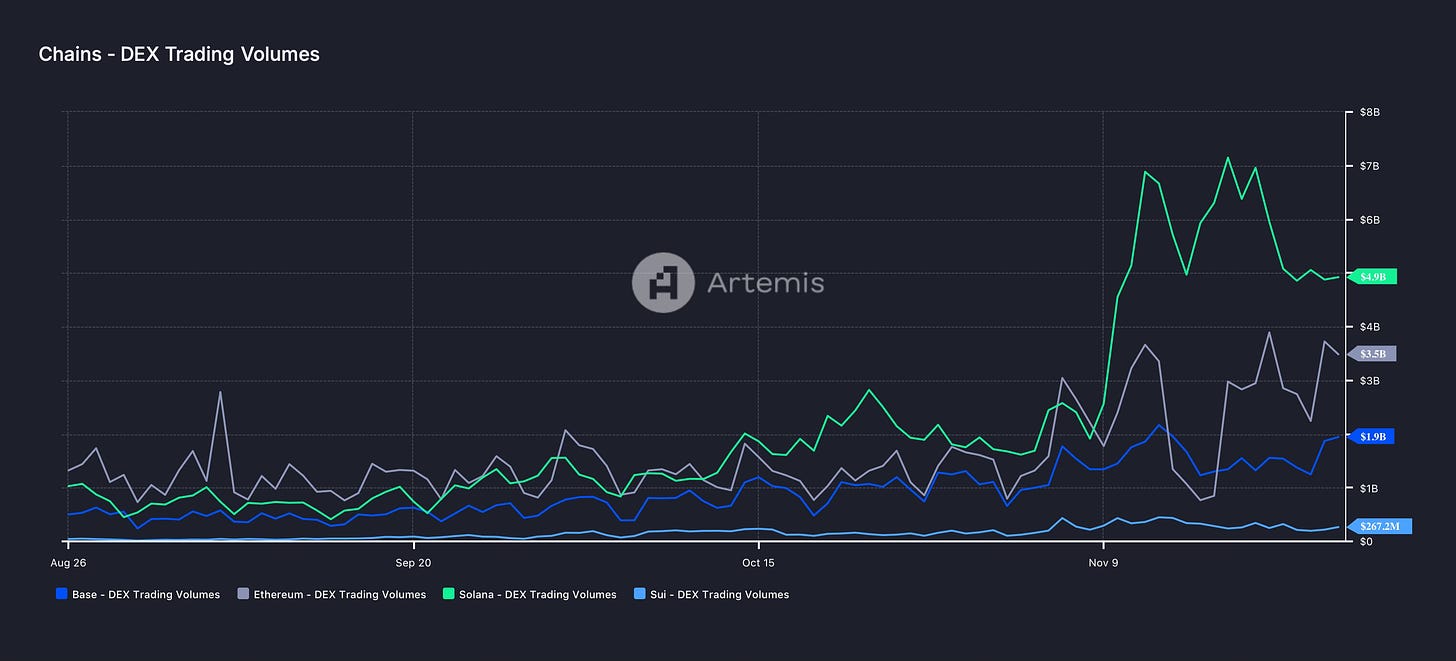

Solana made an all time high in DEX volume which surpassed Ethereum’s all time high in 2021. However, what actually stands out in this chart is that Base volume is starting to get close to the Ethereum mainet which is very significant. It wasn’t too long ago that I highlighted here that the ecosystem was almost dead as it was lacking any significant activity whatsoever. It has made a roaring comeback and aren’t showing signs of slowing down.

Pair Volumes

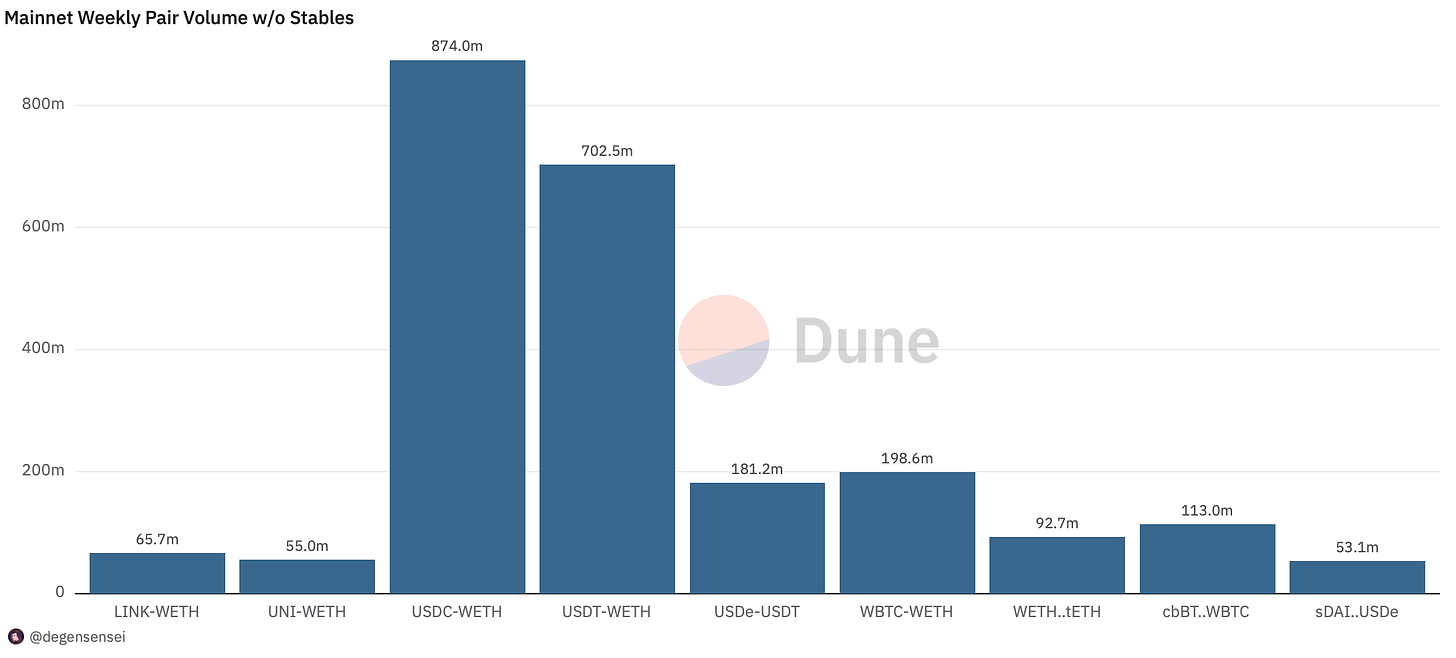

Not too long ago I was mentioning that the Ethereum mainnet hadn’t reached bull market activity levels yet, well we can finally change the tune now as the on-chain activity is well and truly back as it’s go-time. The alt pairs that have done the most volume are LINK and UNI, Uniswap in particular is likely due to the launch of Uniswap v4 edging ever closer and people getting excited about it. The price action speaks for itself.

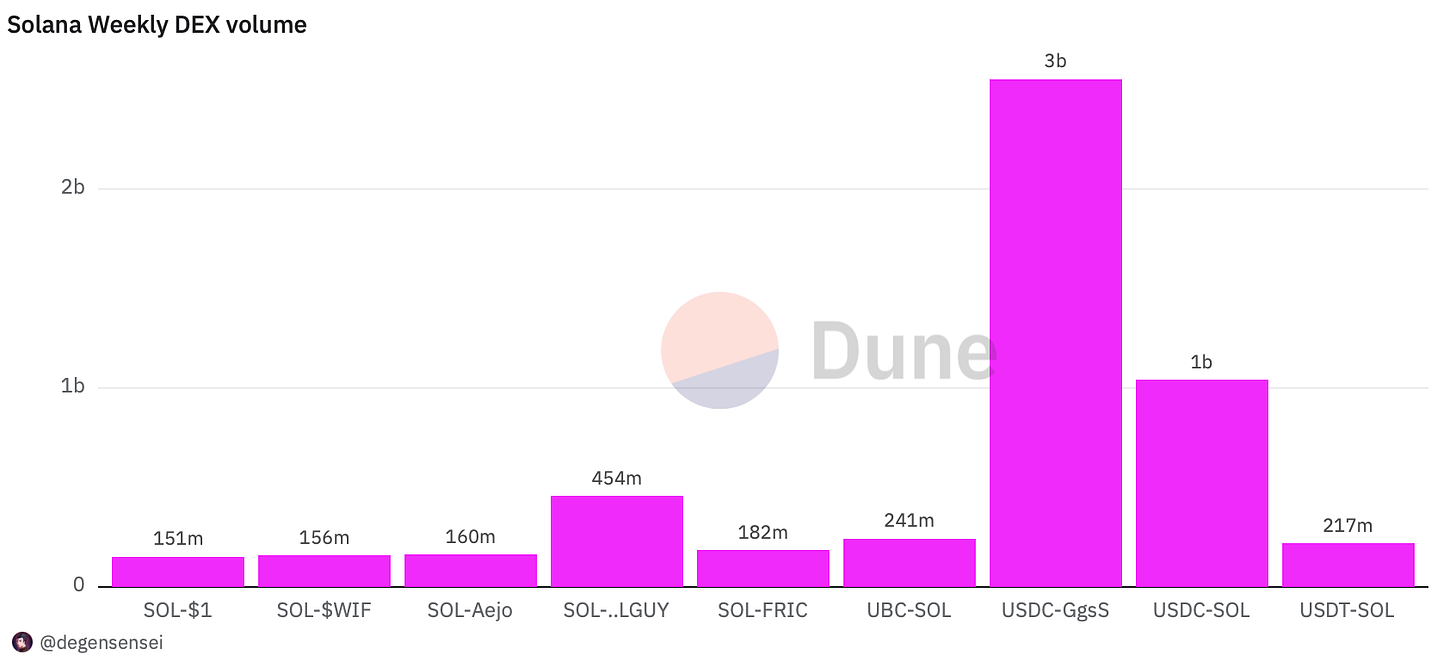

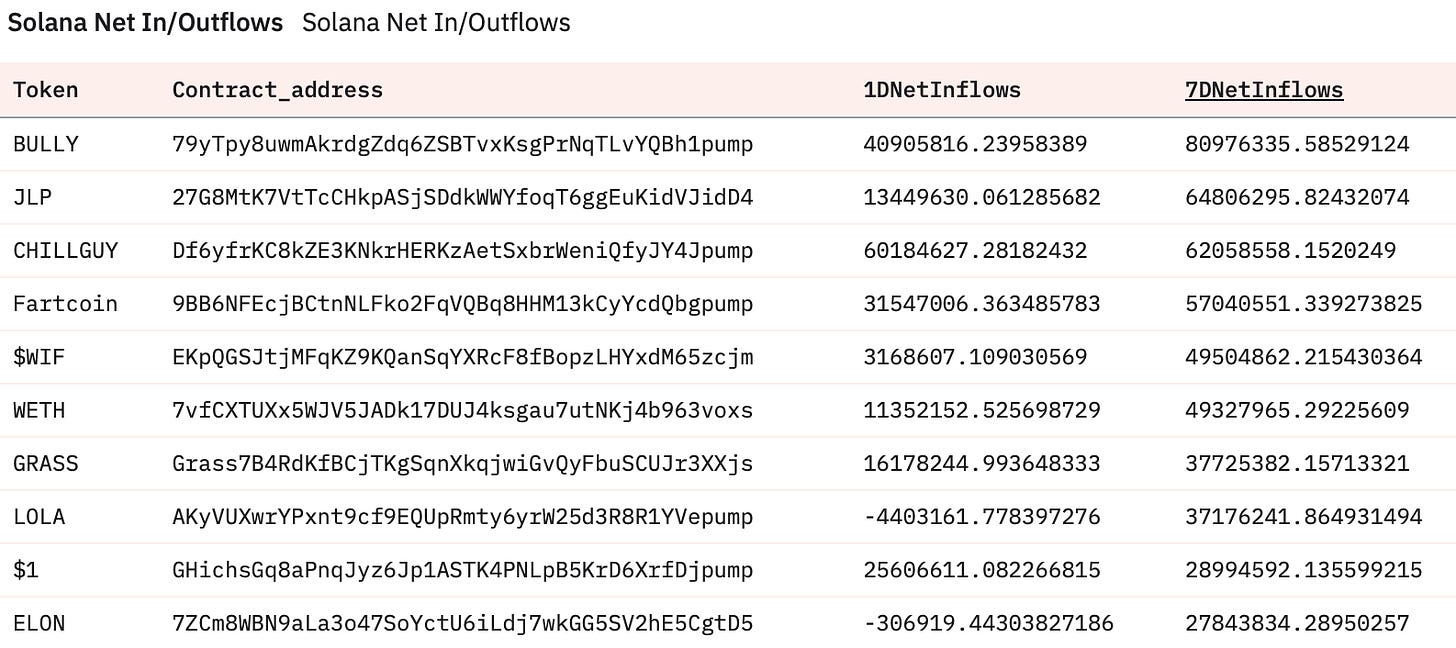

Considering Solana made an all time high in on-chain volume it still dwarfs everything else whith Chillguy leading the pack while a lot of low caps have been following and mooning over the past week such as $1 and UBC. What all of these have in common is that they weren’t popular on CT while having up only price action. It is obvious at this point that CT finding things too early leads to too much PvP. If you got a runner, keep quiet.

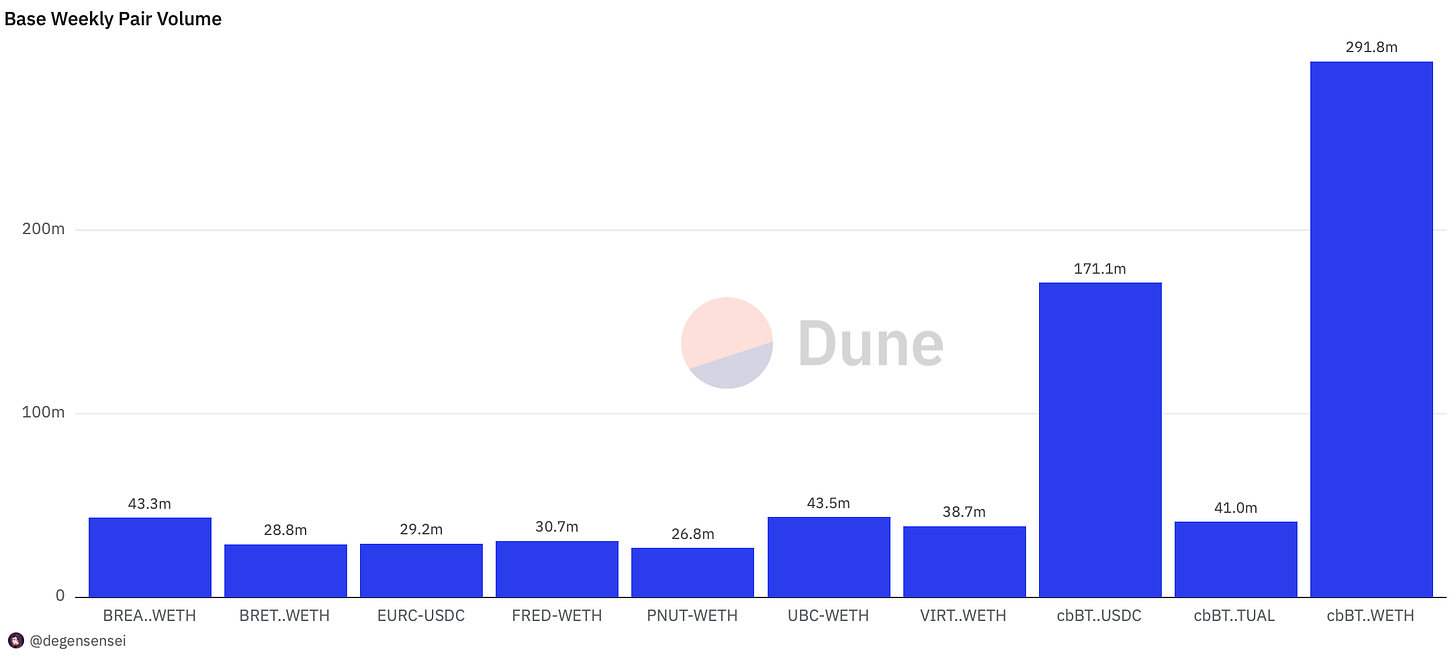

Base ecosystem is in a full blown bull market with large caps such as VIRTUAL making a new all time high and the whole Virtuals ecosystem thriving as a result. AI Agents are turning out to be this cycle’s DeFi summer and there are countless of great opportunities that should not be overlooked. Dive in and don’t let it go to waste. While this has been happening the memes have been taking a breather, leaving room to scale in which still isn’t a bad idea.

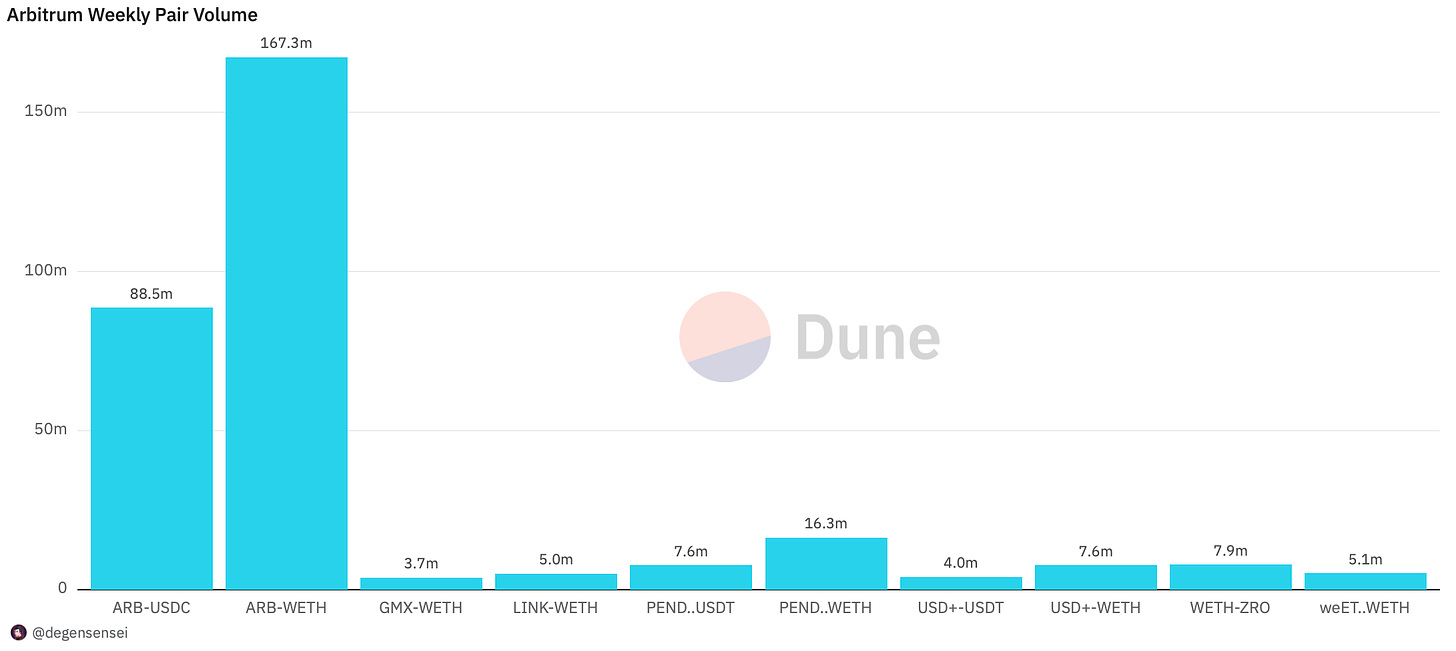

Arbitrum is still lagging in activity although PENDLE is starting to wake up again with the emergence of DeFi. Even GMX is perking a bit but the ecosystem sorely needs a catalyst even if it likely has bottomed and will present many good opportunities going forward. Not a bad time to accumulate.

Oh and BSC is starting to wake up as well, might include some content around that going forward.

NFT Trading

NFTs has had a slow week as the base assets have been strong. NFTs normally do well when BTC and ETH consolidate, when they start going up in price people sell them because they don’t want to miss the run in the base asset. Tale as old as time. Still, they will have their time.

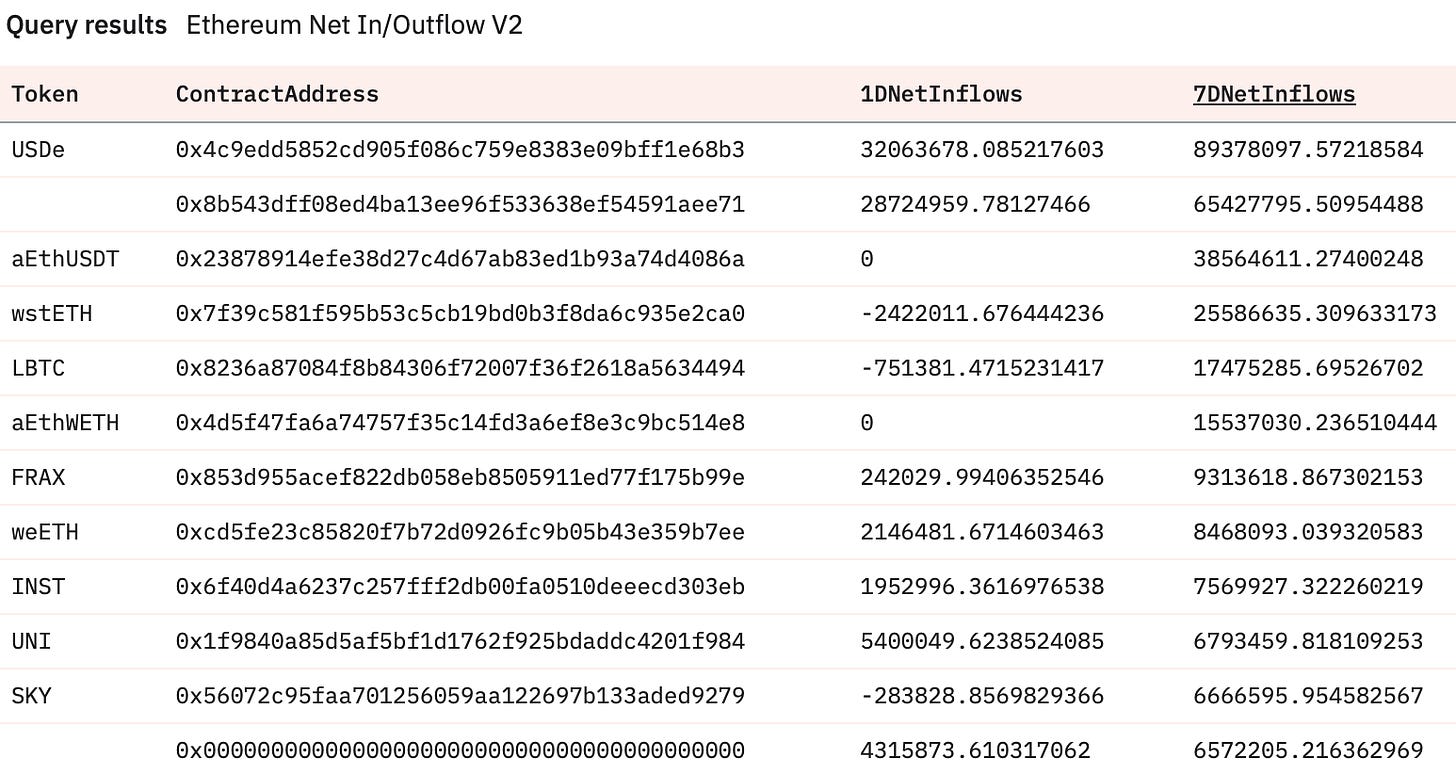

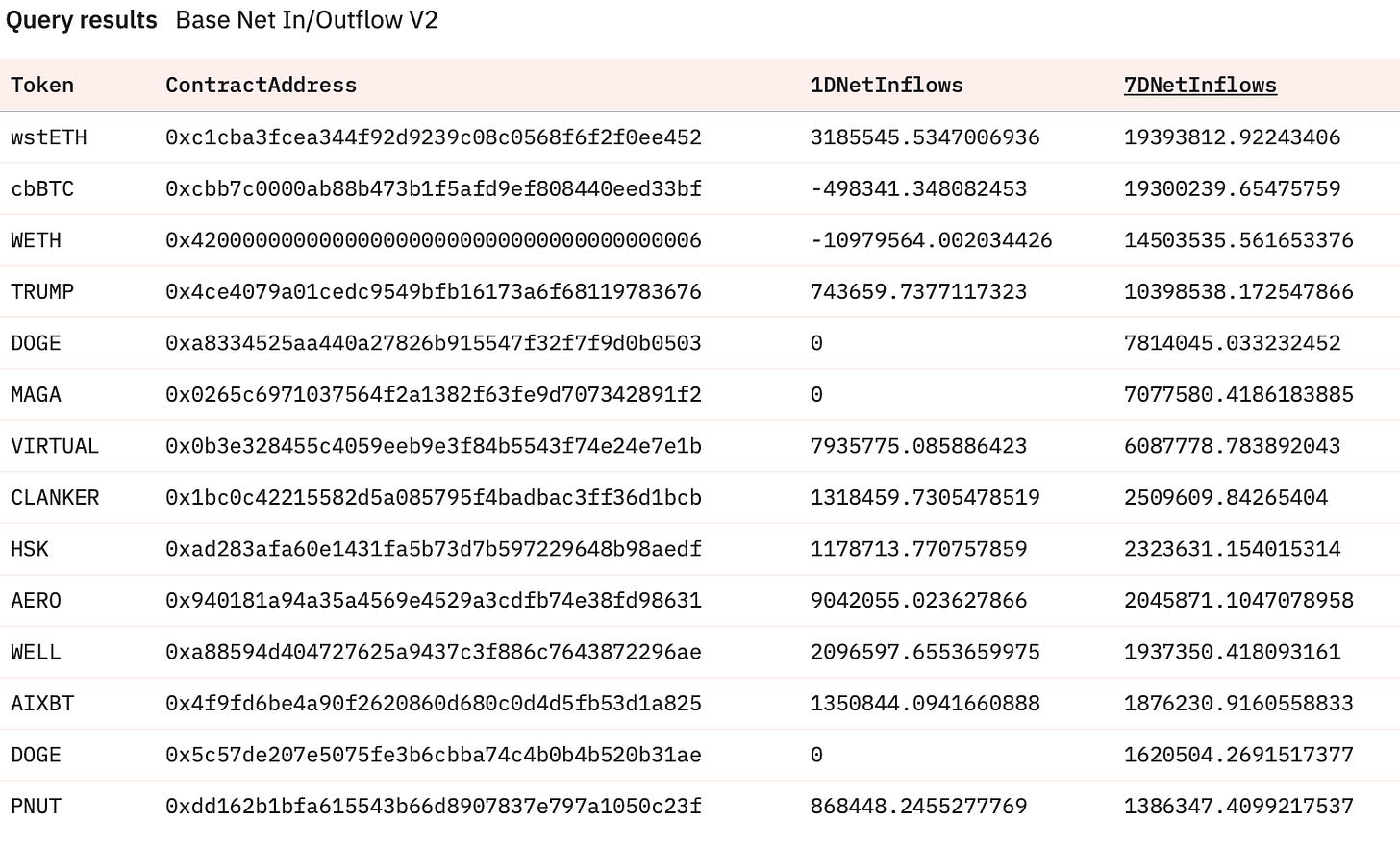

Net Inflow

While the highest inflow has been Ethena’s USDe we are seeing strong bids in INST, UNI and SKY. It’s worth noting that INST which soon will go as FLUID, is the first time in a long time there might be a competitor to Uniswap which is why it has been accumulated so aggressively and performed well as a result.

On Solana the casino continues to rage with BULLY being the most accumulated AI memecoin over the past week which goal is what the name says: to bully people. JLP being accumulated to aggressively is surprising but also acts as a good hedge when the market turns for the worse. Chillguy and Fartcoin continue to go from strength to strength while GRASS has been the strongest AI Utility token on Solana. WIF is finally waking up after a long slumber after getting listed on RobinHood as well. Simply, the show goes on.

The strongest tokens in the Base ecocystem has undoubtedly been, VIRTUAL, CLANKER and AIXBT as AI agents are the hottest thing on the market right now as they all have surged in value. AIXBT in particular has grown a large following on social media as it can articulate market insights better than most KOLs. The KOL business is in trouble.

It feels crazy to say but ARB has actually been accumulated and is performing well for the first time since the airdrop in 2023 basically as the bottom seems to be in. Remember price leads narrative and if it actually can put through a sustained run, best believe that capital will be bridged to Arbitrum. Until them, I will simply wait and see it play out. Otherwise, ZRO is the one Arbitrum native token that has been accumulated a lot.

Sleuthing

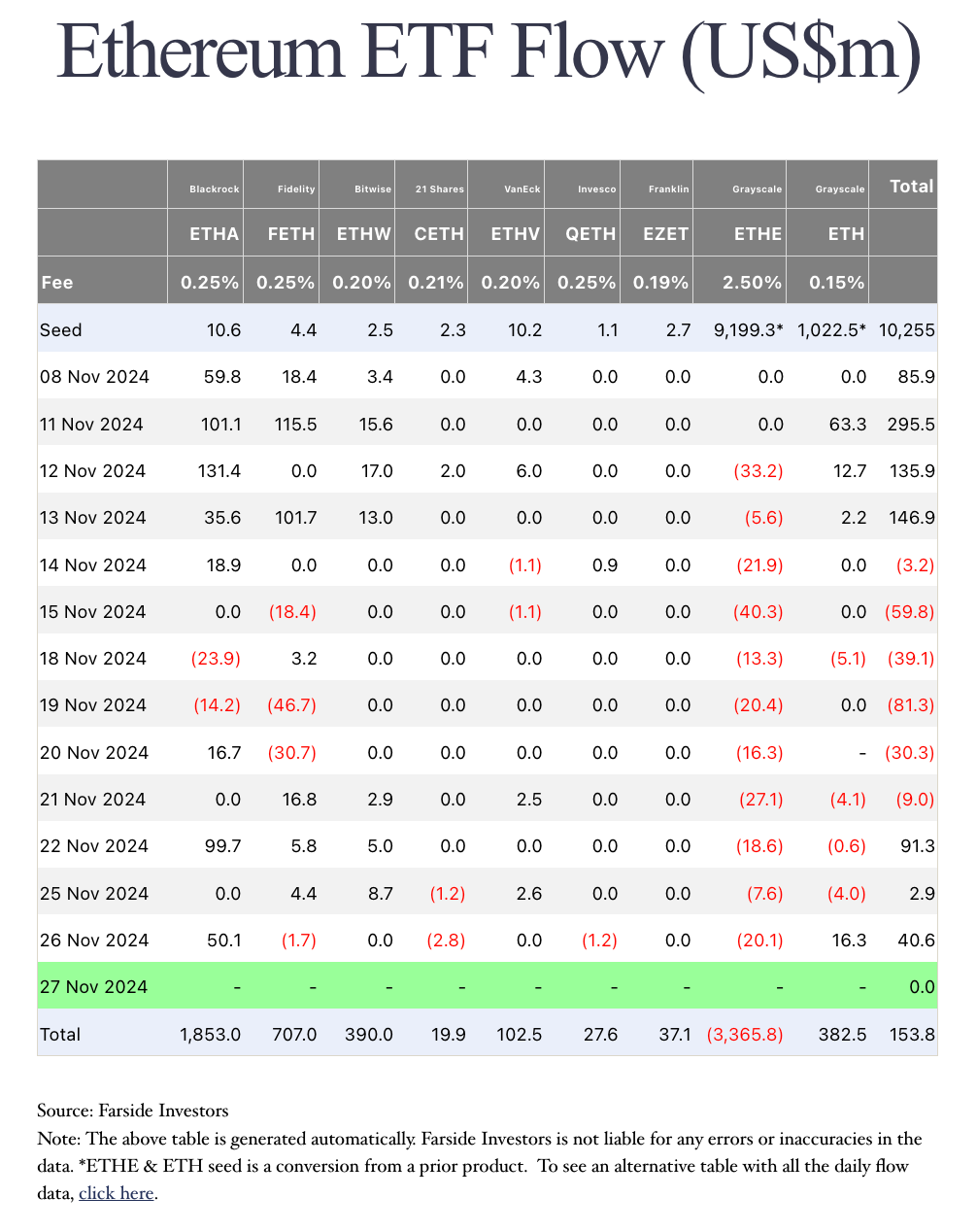

The Ethereum ETF is finally getting flows after everyone called it dead and that it never will pump again. December is coming which is when ETH tends to ignite. Exciting times ahead.

Token Unlocks

IMX - 1.47% of supply worth $42.91m on Nov 29th

OP - 2.50% of supply worth $72.40m on Nov 30th

1INCH - 7.72% of supply worth $41.05m on Dec 1st

SUI - 2.26% of supply worth $219.55m on Dec 1st

ZETA - 10.41% of supply worth $42.49m on Dec 1st

ADA - 0.05% of supply worth $18.90m on Dec 1st

DYDX - 1.19% of supply worth $13.25m on Dec 1st

ENA - 0.45% of supply worth $8.48m on Dec 4th

We’ve waited long for the bull market to take off, throw out the bear market PTSD, and enjoy it from here because it will get a lot crazier. Thanksgiving always provides some “scary” shakeouts every year. At this stage, it is customary, and no reason to sell long-term positions even though it gets volatile over an illiquid weekend.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

If Crypto Taxes ever give you a headache, check out our suggested Tax Partner here

Steer clear of security compromises and safeguard your assets reliably with GridPlus - The Fortnox of Hardware wallets here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me or premium research, do not hesitate to subscribe. Thanks for taking the time.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.