Welcome, Anon! Today we are going to talk about a protocol that aims to capture a lot of value during layer two season. Remember that you are reading the opinion of a Degenerate Sensei on the internet, this is not financial advice. Alright, let’s dive in.

As we are venturing into a period where layer two networks are preparing for token launch, there is bound to be some initial hype. While these networks won’t save us from a bear market, they still aim to create a smoother experience without excessive gas fees while executing transactions at high speed for their users. While most people currently keep their capital close to their chest, others can’t resist being degens and exploring new protocols even during these testing times.

Layer two season has been talked about for a long time and Optimism aims to kick it off. However, it can’t be experienced without sufficient liquidity on the market. For that to occur, there is a need for a protocol that can facilitate liquidity providing and swaps as Optimism takes off. Thus, enter Velodrome Finance.

What is Velodrome?

Velodrome is a decentralized exchange (AMM) and liquidity marketplace on Optimism, which is a layer two network that resides on Ethereum. Essentially, the Uniswap of the network. However, they have adopted features from the infamous Solidly (the less we talk about that the better - but if you want to learn about Solidly, Average Joe’s Crypto has covered it in his substack), Curve, and Votium. It is founded by veDAO whose initial goal was to interact with the Solidly ecosystem (life comes at you fast).

Considering the protocol is based on Curve, Solidly, and Votium there is bound to be ve-Tokenomics and NFT governance available. However, before getting into the fun stuff, let’s take a look into the tokenomics.

Tokenomics

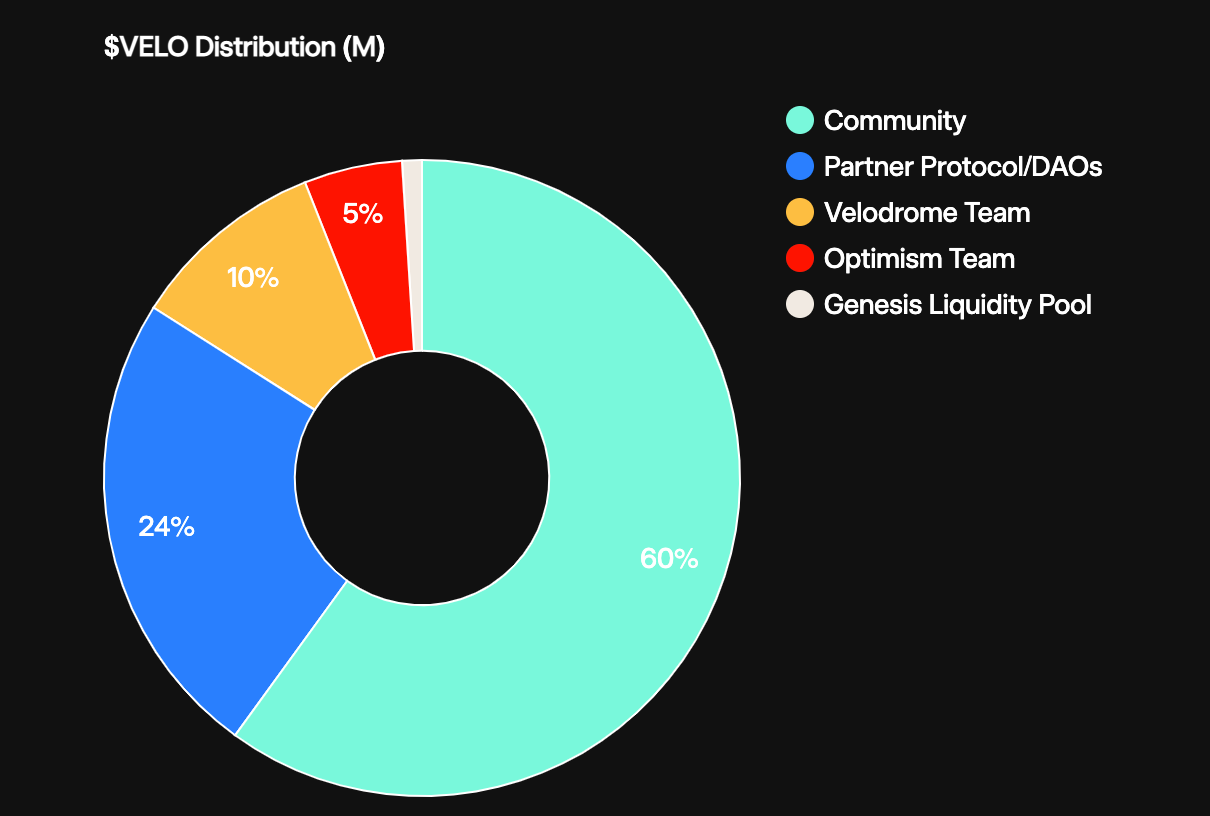

The native token of the Velodrome ecosystem is called VELO and will have an initial supply of 400M. It will start with an emission of 15M tokens per week that will continuously decrease by 1% per week. 60% of the tokens will be distributed to the community (current WeVe holders will benefit the most) while 18% goes to Optimism network users and 15% will be distributed to cross-defi users. This means that a lot of you degens should be eligible for an airdrop. The full distribution is as follows:

Worth paying attention to is the vesting schedules for the team:

15,520,816

$VELOvesting for 12 months, 6-month lock in a$veVELOfollowed by a linear 6-month unlock period. 0.5% of total emissions, taken from emissions to the treasury, will be added to this bucket for dilution control.7,200,000

$VELOvesting for 24 months, 12-month lock in a$veVELOfollowed by a linear 12-month unlock period.All ongoing payments made to the team members in

$VELOwill vest for 6 months, 3-month lock in a$veVELOfollowed by a linear 3-month unlock period.

25% of the tokens vested will be vested in $veVELO to vote on Velodrome pairs, which brings us to the ve-tokenomics.

ve-Tokenomics

If you’re in DeFi at this stage, it is impossible that you haven’t come across vote-escrowed tokens. Similar to Curve, the $veVELO holders have the capability of deciding which liquidity pools should receive emissions for an epoch (which lasts a week). These emissions are distributed proportionally depending on the votes for the designated liquidity pools.

Similar to how there are bribes in Curve, there will be bribes present here as well which means that lockers will receive revenue amounting to 100% trading fees of the pool they have voted for and subsequent bribes. However, they only receive this amount for the liquidity pool they have voted for. The reasoning behind this is to align incentives and make sure that people vote for the liquidity pools that generate the most fees for the token holders —> higher revenue.

The protocol has made sure that the lockers do not get diluted by the continuous emissions by the protocol by adopting rebasing for their veTokens. Considering you lock a certain amount of tokens, without rebasing in relation to emissions, your voting power would be reduced. The locking behind the token would work as follows:

100 VELO locked for 4 years = 100 veVELO

100 VELO locked for 1 year = 25 veVELO

Basically, you lock for 4 years to get not-discounted rewards. Will expand on this further in another section.

To prevent dilution through aggressive emissions this math formula has been adopted for the $veVELO token holders:

(veVELO.totalSupply ÷ VELO.totalsupply)³ × 0.5 × Emissions

As the emissions will start with a weekly rate of 15M tokens per week that will depreciate by 1% per week, it will consistently have a very high emission rate and should benefit early participants. Yield will significantly decrease over time. However, if you don’t lock or provide liquidity, expect to be heavily diluted if you’re a token holder.

As you can see, supply is bound to double within the first 20 weeks, plan accordingly.

Solidly’s fate was unfortunately sealed as soon as Andre Cronje left the project. Velodrome’s plan is to make the original plan even better through their rebasing tokenomics that prevent dilution and make sure the emissions are not too heavily emitted in the early stages. Even though it decreases by 1% per week, emissions are still over 12M tokens per week by week 20. Nonetheless, it does not dispute the fact that early users and participants are set to be rewarded as is normally the case in DeFi.

The protocol takes a trading fee of 0.02% that gets distributed as revenue for the token holders.

NFT Governance

To lock or not to lock? For how long should you lock? These are normally conundrums that users face when they are considering the prospect of locking their tokens for governance power and “boosted” rewards. Not being able to use capital in a market that moves extremely quickly is a risk that has to be weighted correctly. That is the benefit of NFT governance which means that the governance token veVELO is turned into a veNFT that can be traded on the secondary market. It gives you a backdoor exit of your locked tokens or can be used in other pools for collateral etc. It allows for more capital efficiency, which is for the benefit of the holders (and the protocol as tokens get locked either way).

Another caveat is that protocols that want to participate in the ecosystem with their token need to receive a whitelisting. This is done in order to prevent malicious behavior that will game emissions à la Mochi in the Curve Wars.

Partnerships

Numerous protocols are betting on the launch of Velodrome which can be seen in the numerous partnerships they have acquired. Considering the governance and bribes present in the protocol, it is no surprise to see the meta governance protocol Redacted Cartel among the partners. They will go multi-chain through the launch of Velodrome and open up their Hidden Hand marketplace for bribing. An example of where incentives align. Other partners include protocols that are contributing to the growth of DeFi. Notable names include Curve, Convex, Lyra, TreasureDAO, Alchemix, and MakerDAO among others. All protocols will receive a share of the token in order to facilitate the launch and get them involved in the governance.

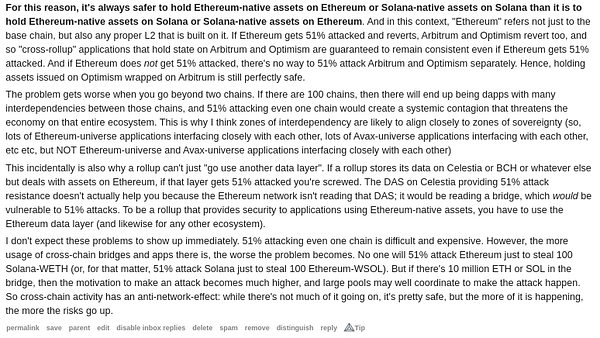

Seeing native Ethereum protocols go multi-chain bodes well and fit the notion of a multi-chain future Vitalik has talked about.

Protocols increasingly going multi-chain could be a potential start of layer two summer, time will tell.

Personal thoughts

While Velodrome is getting hype for kickstarting the summer, there are some things to be cautious about. The protocol essentially aims to recreate the success of Curve while adding elements of Solidly to it on Optimism. Curve is a fascinating protocol but very hard to recreate as you need to create a universal place where people want to swap a specific asset with low slippage. In Curve that is obviously stablecoins. The Curve Wars were not the intention of the protocol, but rather a product of its environment. Curve is the de-facto exchange for stablecoins with very high volume, which is hard to recreate.

Secondly, there are a lot of people in the market that are traumatized from how the Solidly debacle ended and will stay away due to this reason. The protocol is reliant on people that will look beyond this along with people that luckily didn’t experience that situation and will be willing to participate in the ecosystem.

Thirdly, ve-Tokens is every protocol solution nowadays to hopefully create a flywheel where participants will be willing to draw emissions to themselves. However, getting maximum governance implies that people care about governance.

What you’re trying to create is a situation where tokens get taken out of the market to reduce sell pressure. Basically, you get paid for not dumping the token. The risk of ending up as exit liquidity increases. If you’re a DAO or a whale, the emissions will be valuable. Retail locking up for 4 years is bold. Most protocols will not be around for 4 years as the narratives constantly change. You can easily end up as exit liquidity, just ask the VCs with 4-year vesting.

However, the farming rewards will most likely be very lucrative in the beginning. This does come with a price. That price is that there will be a lot of sell pressure on the token as it gets farmed and dumped due to the aggressive emissions. While this might be considered a negative view, nuance is needed in the industry when people are overly bullish about every project and push narratives.

If the protocol gains traction and can achieve its goal of becoming the liquidity base layer of Optimism, then it is bound to generate a lot of volume. In that case, there will be actual value and revenue generated for the token holders considering the 0.02% fee of every swap. With success, that will be a strong revenue generator for the protocol. It will be required to sustain price levels.

The token might get farmed and dumped aggressively (to be honest, it’s the safest way to not become a bagholder). Nonetheless, I haven’t mentioned the potential of bribes. We have already seen instances of very lucrative bribes being presented through the Hidden Hand marketplace. This could be a potential mitigant that might offset sell pressure of the token as the prevalent bribes could showcase strong value in holding the token. Basically, bad token price do not mean that it’s a bad protocol.

If the Optimistic summer narrative truly catches on, Velodrome could be the protocol that ignites the fire.

Let the summer games begin.

Well done if you managed to congest all that information, I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback as well.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me, do not hesitate to subscribe. Thank you very much for taking the time!

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. I am just a random degenerate sensei sharing an opinion.