Like A BTRFLY, Her Wings Unfolded

The caterpillar does all the work, but the butterfly gets all the publicity.

Welcome Anon! Today we will dive into the development of Redacted Cartel which has expanded its product offering making it a more robust protocol.

One of the great rebrands that took place during a time when people got tired of vaporware yields was Redacted Cartel which went from a highly dilutive protocol born out of OHM fork season where yields in the excess of 30,000% weren’t unreasonable but commonplace. We’ve truly come far since the madness that took place then. Nonetheless, since that time, the team has been iterating to deliver products that provide value to the broader crypto consumer base. However, before we get into that we need to get an understanding of what the Redacted Cartel is.

What is Redacted Cartel?

Redacted Cartel started as “the original” OHM fork considering it was initially launched with the intention of being a sub-DAO of Olympus DAO focusing on capital efficiency and maximizing value for token holders. This was supposed to be accomplished through the use of meta-governance. If you’re not familiar with meta governance it is the idea that by acquiring other protocols tokens you will have a strong say in multiple protocols governance making your native token valuable. However, meta-governance is primarily effective in a bull market as it creates a positive feedback loop which I’ve gone into detail about here.

Redacted understood when the market changed that solely relying on acquiring governance power and hoping for it to be perceived as valuable wouldn’t be enough to sustain the long-term prospects of the protocol. Thus, they ventured into revenue-generating methods that have proved to be fruitful so far. It’s important to highlight here that the work done mainly as a meta-governance protocol has laid the groundwork for the protocol to become what it is now.

So what are the products that have been serving the protocol well so far?

Pirex

Pirex is a product that leverages synthetic tokens to create a liquid wrapper of illiquid tokens. It enables auto-compounding of tokens that would require consistent restaking and allows you to stay liquid instead of having your token locked. It launched with vote-locked CVX(vlCVX) in mind but can be used with any eventual token as Redacted decides that there is a product-market fit. The product has been adopted by CVX holders which can be seen in the amount of CVX deposited on the platform which equals 1.37M CVX.

Easy mode

Easy mode has been roughly touched upon already, it simply refers to you auto-compounding your vlCVX as it gets relocked every two weeks for vlCVX while letting bribe revenue accumulate without any FOMO. This happens in collaboration with Llama airforce “pounder” vaults. When you deposit your CVX in one of these vaults, you get uCVX in return. One thing to be aware of here is the 7% compounder fee on the deposited assets. Along with a 1.5% exit tax that goes to all uCVX holders. The price you pay for letting the auto-compounder work for you.

Standard Mode

Standard mode works similarly but you deposit your CVX in Pirex and receive pxCVX instead. Each pxCVX is backed 1:1 by vlCVX. However, the pxCVX you receive from depositing your vlCVX in Pirex can then be taken and staked in Llama Airforce Pounder for more rewards.

Hard Mode

So far the text has been roughly easy to follow (I hope), but this is where it gets a bit more complicated. Hard mode enables pxCVX holders to tokenize and trade away their future bribe yield to get access to more capital earlier, allowing for more capital efficiency. This tokenization comes in two forms:

Rewards Future Note (RFN) - This token gives you the right to claim bribe revenue in the future.

Vote Future Note (VFN) - This token gives you the right to vote on gauges in the future

The protocol can choose to buy these notes to hopefully turn bribe revenues into a profit in the future or acquire more concentrated voting power. However, this relies on the fact that bribes are perceived as valuable as governance as well. This has not proven to be the case in a bear market, making it hard to see the Redacted treasury spending meaningful capital on acquiring these notes for the time being. However, hard mode is yet to be released so I could easily be proven wrong on this front.

Nonetheless, despite the product being appreciated by the CVX community, it’s not really a large revenue driver for the protocol, as the revenues generated currently stand at five figures.

Redacted will need to continuously onboard more tokens to Pirex to make it a product that produces meaningful revenue. We have already seen movement in this direction with the planned GMX integration. This would mean that GMX and GLP would receive liquid staked wrappers consisting of pxGMX and pxGLP.

As long as Pirex is an appreciated product that enables people to stay liquid, Redacted can keep onboarding popular and valuable tokens that will help them to stay relevant for a longer time frame. Simplicity at its finest but also a potential necessity for their continued growth.

Hidden Hand

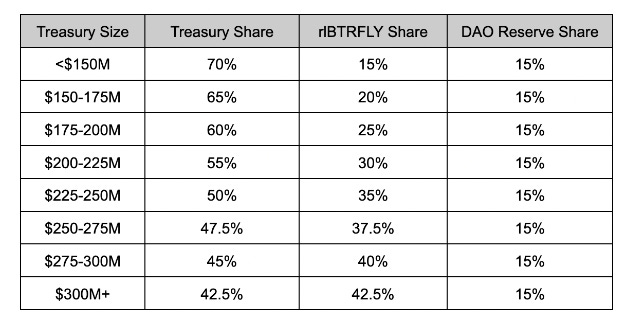

One of the most pivotal moves Redacted has taken what the acquisition of Votemak in January 2022. This laid the foundation of what would eventually become Hidden Hand. The Hidden Hand marketplace is a platform that enables any protocol to launch a Bribe Marketplace for their platform. It supports the endless DeFi flywheel where participants are willing to pay a high price for liquidity. For every bribe that takes place on the Hidden Hand marketplace a 4% fee is taken by Redacted Cartel that is distributed to rlBTRFLY holders.

There are currently 8 protocols that have been onboarded to the Hidden Hand platform. However, to be frank, it is only Balancer and Aura Finance successfully running a bribe marketplace through veBAL, thus far. While bribes sound good for many protocols, it is and will not be perceived as valuable for external parties to bribe the token holders of a number of protocols. This is something other protocols that are looking towards Hidden Hand should consider.

Hidden Hand is the main revenue driver for Redacted since its inception with $1.8M in revenue since its launch.

Governance has been perceived as less valuable during the bear market and the stark decline in bribes is a clear example of that. This is among the reasons Redacted decided to take a deeper look into their BTRFLY token. For all the plaudits that have been given to the products, one of the main reasons for the recent success is a revamp of the tokenomics.

Redacted V2 Tokenomics

The Redacted team understood that governance is more valuable for DAOs and whales than it is for individual token holders. Thus, they decided to split the BTRFLY token into two segments. One that focuses on revenue generating and one that focuses on governance power.

rlBTRFLY

rlBTRFLY stands for revenue-locked BTRFLY and accrues revenue that the protocol generates through its line of products and productive assets. For people that solely want to maximize revenue, this token provides a better option as you relinquish governance power in return for a more revenue-focused token.

The rlBTRFLY token has been fruitful for yield-hunters so far as it has returned rewards at a rate of 51% APY. If this is sustainable will be proven over time, but it has delivered for token holders in the first 3 months of its launch.

Note: Take into consideration that the first month is inflated due to a longer period of accumulation prior to the first month of rewards released to rlBTRFLY holders. This will have an effect on the inflated projected APY as well.

rlBTRFLY has a supply cap of 650,000 tokens which is pale in comparison to v1 which had an infinite supply with rebasing that finished with 1,129,733 tokens. Healthy tokenomics leads to healthier customers that don’t get diluted to death.

glBTRFLY

glBTRFLY stands for governance-locked BTRFLY and focuses on voting power as Redacted Cartel has a strong position in multiple protocols such as Convex. If other DAOs want to influence voting and control gauges in their favor they would acquire glBTRFLY and influence proceedings on Redacted’s behalf. However, this token has not been released yet.

The glBTRFLY supply is yet to be announced but will be updated here when there is more clarification.

Treasury

One important point to highlight aside from Redacted’s products is the productive treasury that the protocol sits on that is consistently generating rewards for the token holders as well. I suggest that you track the treasury and multisig value in relation to its market cap to determine if you want to pay a premium for the token. When you buy it at a “premium” you’re essentially buying because you’re expecting future revenue to be worth the price you’re paying. This is something that you wouldn’t want to do in Redacted V1 but actually makes much more sense after the V2 migration. You can find the contracts below.

Treasury: 0x086C98855dF3C78C6b481b6e1D47BeF42E9aC36B

Multisig: 0xa52fd396891e7a74b641a2cb1a6999fcf56b077e

Native stablecoin

I won’t go deep into Redacted’s native stablecoin as there isn’t a lot of information about it yet. However, in a previous article, I briefly touched on Redacted’s native stablecoin. If you’re not familiar with it, Redacted Cartel is launching a stablecoin called Dinero. It will be over-collateralized by custom material block space that will allow users to deposit ETH into CDP (collateralized debt position) lending vaults and use Dinero for meta transactions.

This one is the vaguest so far but when hasn’t Redacted Cartel been cryptic with exciting news surrounding the protocol?

Conclusion

Redacted Cartel has heavily benefitted from a rebrand that has turned it into a more sustainable protocol that is optimizing for real products that facilitate liquidity being moved throughout DeFi. We are currently in an environment where there is a clear distinction between good and bad tokenomics and taking a conscious decision to change this instead of having pride as the token price trends downward into oblivion is a welcome change.

However, while the protocol has developed good products there is still more to be done to increase the revenue for the rlBTRFLY holders. If they can get that right then there is nothing stopping the protocol from solidifying itself as a cash cow in the DeFi industry. The right signs are there and I will follow the protocol from afar as the team keeps plugging away. Redacted’s metamorphosis might have taken place at just the right time. It’s time for the BTRFLY to spread its wings.

Well done if you managed to congest all that information, I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me, do not hesitate to subscribe. Thanks for taking the time!

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. I am just a random degenerate sensei sharing an opinion.