Redacted Cartel started as a meta-governance protocol and while the flywheel effect has been weaker in a bear market, two years of work have laid the foundation for what they're about to build now. The governance power acquired is about to take effect, and who would have thought that the late entry into what we called the Curve Wars in 2021 would come in so handy now?

Before we delve into those details, let's explore what has made "Redacted Cartel" so successful.

Why Redacted?

Redacted Cartel acts as an on-chain liquidity hub and facilitates deepened liquidity across different ecosystems. How have they done that?

They have built products that are optimized to capitalize on ecosystems and are not necessarily tied down to individual retail users. I won't go into them in detail as I have already covered them in a previous article here. Hidden Hand (a permissionless bribe marketplace) can scale at the same rate as new flywheel ecosystems emerge that require bribing. Hidden Hand started with the Balancer/Aura ecosystem and has recently expanded to Pendle and Bunni. Hidden Hand can be used anywhere by any DAO and is infinitely scalable as long as people are willing to rent liquidity.

Pirex facilitates farming and acts as an auto-compounder for users who value staying liquid instead of locking their tokens, pxCVX has been the most successful product of Pirex so far, while there is a possibility to deposit GMX, GLP, and BTRFLY as well.

The Road To DINERO

When DINERO was announced, people were perplexed about what would be used to back it. After many months of silence and building, Redacted announced that they were building their own LST in the form of pxETH (Pirex ETH). The testnet was recently launched, and it is in the final phase as it gears up for the launch. However, if you think this will simply launch without a heavy growth plan, you're sorely mistaken. Remember that I mentioned in the beginning that Redacted is a meta-governance protocol; this is where it comes in handy.

Flywheel preparation for pxETH

When Redacted launched, they had a treasury bootstrapping program that allowed people to bond by buying BTRFLY at a discount in exchange for flywheel-related tokens at the time. These were initially CRV, CVX, and OHM in the first iteration. At a later stage, FXS and TOKE (the less said about TOKE, the better - yikes) were also allowed.

This move allowed them to build a war chest of treasury and create a strong CVX stack that came in handy as they amassed a large amount of voting power, which they retained.

When they launched Pirex, people who simply wanted to maximize their APR would deposit and have their CVX auto-compounded while relinquishing their governance power to Redacted. At the time of writing, 3.2M CVX has been deposited into Pirex which is worth $10.7M.

Outside of the deposits of users Pirex Redacted Cartel holds $4M worth of CVX (1,411,779 CVX tokens) that can be used to bootstrap pxETH pools. We will not factor the users Pirex in these calculations as Pirex is built to optimize for the highest bribes as it acts as an auto-compounder.

With this in mind, we can see that the protocol has enough CVX to drive 19K worth of incentives to facilitate the growth of pxETH (see Excel calculation further down). This does not factor in the individual flywheel tokens that certain team members and advisors might have as well. Considering many of them are deeply entrenched in the DeFi flywheel it would not surprise me if the number is larger. Also, this was presented at the latest conference:

Now, this $7.5M number is most likely based on multiple years so let’s go with my conservative number for now in order to manage the hopium.

If we look towards Frax, they have 3.5M CVX which has come extremely handy for them whenever they aim to bootstrap a new pool or drive incentives to their current pools. If we look at the frxETH pools on Curve we get $115M in pool TVL for deep liquidity. As ideally 50% of these are frxETH it amounts to roughly $57.5M based on the peg balance at the time.

Based on the amount of CVX Redacted holds, they should be able to incentivize enough pools to reach a minimum TVL of around $46M quickly. This is based on the calculations of the amount of emissions they direct per year, bear in mind that the average liquid staking pool has a yield of around 4%. Otherwise, people are more incentivized to solely stake the ETH instead of providing liquidity. However, if the activity on the mainnet increases from here, LSTs would likely benefit.

Now, this would only factor in pxETH growth and does not factor in apxETH which is an auto-compounding vault where the pxETH earns ETH staking rewards and MEV tips earned by the Redacted validators. People who simply want to stake will opt for that instead. How to calculate the potential market share of apxETH is a more difficult prospect that I will leave to speculation. However, as it is autocompounding apxETH will be backed by an increasing amount of ETH over time and increase in value to a similar mold to c-tokens such as wstETH, rETH, etc.

Lastly, I have not factored in BTRFLY Pulse emissions here that most likely will be used to incentivize pxETH pools as well. I have put a conservative number of $1M per year in my calculations whereas the protocol has stated that they set aside $7.5M in total incentives so if you are extremely bullish on the protocol and numbers, you can take everything I have done and multiply it with 7.5.

I’m doing this in order to temper expectations. Underpromise, overdeliver.

I haven’t put this as a starting number because we don’t know over what time period these $7.5M will be distributed. I would expect it to be relatively frontloaded to ensure the launch is strong so if we are conservative and boost it with 2.5x in the first year it would imply $118M pool TVL in their pxETH pools outside of apxETH.

DINERO

Dinero is the native stablecoin of the ecosystem that will be minted by pxETH and acts as a CDP. People are naturally inclined towards taking leverage and the project has made sure that they want to keep this in-house in order to generate additional fees through DINERO. Parts of the fees generated by DINERO are sent back to rlBTRFLY lockers, thus the yield is not based on vaporware.

Now, one can argue why anyone would use DINERO. This brings us back to the incentivization again which most likely leads to aggressive DINERO growth in the early stages. Why?

Bear in mind that the average ETH yield lies at 4%< and if Redacted’s pxETH pools are at let’s say 6% and the DINERO interest fee is at 2-3%, people are incentivized to loop and mint more pxETH to farm the spread —> increasing the protocols TVL and ETH staking fees —> more revenue.

As long as the incentivization beats the interest rate, people will borrow large sums to capture what essentially becomes free money at the cost of smart contract risk.

DINERO also aims to become a cross-chain stablecoin, why does this matter? Because Redacted is a close partner with Berachain and as Sami has hinted that px products will expand outside of Ethereum it is most likely that we will see pxHONEY become one of the upcoming px products after pxETH.

As they are close partners Berachain will most likely support them which will put them in a position to have a strong product in pxHONEY that will bring a lot of additional TVL and staking fees. Bear in mind that the latest round of Berachain was valued at $420.69M. Bringing us back to the cross-chain stablecoin, don’t be surprised if you will be able to mint DINERO with pxHONEY as well.

It’s important to highlight here that these numbers are bear market numbers from an incentivization standpoint, if you believe DeFi will trade higher from here in the next year you can adjust the numbers based on your bias.

You can look into the Redacted treasury here.

While I was planning on finalizing this article, Redacted decided to announce that they are launching another product called Marionette. It is a voting optimizer for veToken holders that ensures the votes go to the most profitable pool maximizing rewards for token holders. Redacted will charge 10% of all voting power delegated to it which becomes a cheap way to amass voting power while removing a bottleneck for the end users.

The BTRFLY Token

It’s already well documented that rlBTRFLY accrues parts of the revenue the protocol generates so I won’t go into that part to avoid boring you. I’ve covered how the token functions here if you want a refresher.

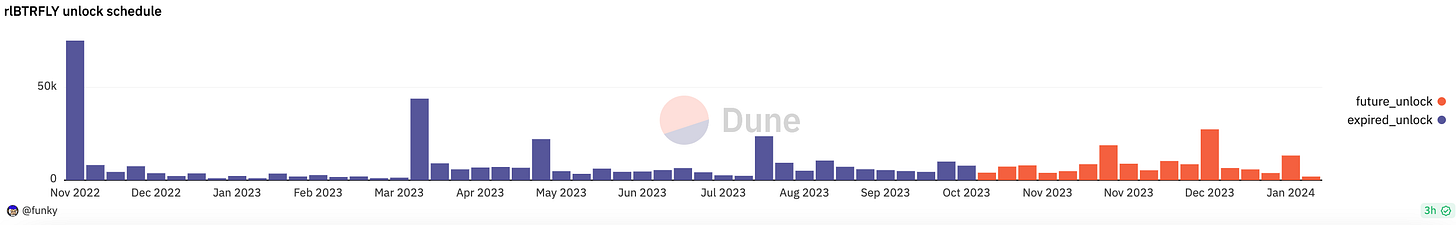

However, what currently has suppressed the token price are the prior large unlocks along with emissions. If we look at this chart, the majority of these large unlocks are behind us with the next big one coming on the 15th of November. The good part about this unlock is that a large part of it are the BTRFLY tokens that Olympus DAO holds in their treasury that already have been purchased back by the Redacted team and will be consummated by the Redacted DAO treasury, easing sell pressure. You can find the co-proposals regarding this matter from both Redacted and Olympus in these links:

I view Redacted Cartel as a protocol that is taking a similar approach to Frax by having multiple products that are high-ranked “tokens” in the Coingecko top list. For Redacted these would be:

Governance token and access to revenue share - BTRFLY

Receives revenue share from:

Yield farming

Hidden Hand fees

Pirex fees

Liquid staking token - pxETH

Autocompounding liquid staking token - apxETH

Stablecoin - DINERO

While there is no guarantee that all of these will reach the top 100, they have the opportunity to grow high enough for the BTRFLY token to become a behemoth with the war chest they have on their side if executed right.

At the time of writing, the BTRFLY token is sitting at a $41M market cap with an FDV of $113M. Plenty of room to grow after having been silent for a substantial amount of time.

Counter Arguments

Newer products such as pxETH and DINERO always have risks as they haven’t been tried and tested. People naturally gravitate towards lindy products and new products have to hit it off quickly to avoid fading into irrelevance.

Leaders in the LST space have mostly been established, it might take months for this to play out as they are fighting for the same pie as other competitors in the current market environment until a large amount of new capital starts to flood in.

Although we are seeing the first sign of retail interest coming back, mostly from the people that were dabbling around last cycle too.

Caveat:

Newer products always come with risk as they haven’t been tried and tested, I will make sure to review the audits when they are published.

Other protocols planning to launch their LST in a probable similar timeframe with strong incentives from their side too will most likely dilute attention and growth. Not necessarily a bad thing as pxETH LPers in that case would earn more yield if that was the case.

While the BTRFLY pulse emissions will be effective in incentivizing the growth of pxETH and DINERO along with the large stack of CVX the protocol holds, it will also lead to sell pressure as it is used by bribes that ve-token lockers will receive in different ecosystems to drive emissions to pxETH pools. Pick your poison. This number is impossible to estimate as the 5% pulse emissions is an upper limit and determining the exact amount of tokens that would be deployed for this becomes difficult.

Also for clarity, I am positive towards Redacted as I personally like the team and how they conduct things which might make me more biased. If anyone wants to write a counterpiece and call out the flaws I am more than open to view the other side. I’ve tried to stay level-headed while writing this to not mislead anybody reading. If I see a DeFi protocol with a bottomed chart, a strong catalyst, and a reliable team, then I am more than prepared to take a punt on it. Nonetheless, something tells me that it is Redacted’s time for metamorphosis after a long slumber.

Conclusion

In conclusion, Redacted Cartel's journey in the crypto space has been a testament to its resilience and strategic prowess. They have already proven to find product-market fit with Hidden Hand as they have demonstrated an understanding of what the DeFi industry needs.

The imminent launch of DINERO, backed by pxETH comes with a formidable growth plan which indicates that the team knows what they are doing as they are tapping into a market segment where the demand already is strong. With a robust treasury and a formidable CVX stack, Redacted is well-prepared to incentivize pools and promote pxETH's growth.

DINERO's prospects are promising, as it offers a strong proposition in a landscape where yield and leverage are desired. The protocol's strategic partnership with Berachain and its plans for cross-chain expansion signal potential growth beyond Ethereum.

It’s still worth keeping track of the token unlocks if you view this as a short-term play instead of a longer-term play. Still, with the information provided in this deep dive, you should have the necessary information to tackle the next phase of Redacted Cartel accordingly.

“You’ve gotta be a caterpillar before you are a butterfly. The problem is, most people aren’t willing to be a caterpillar.”

The moment is now.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

Steer clear of security compromises and safeguard your assets reliably with Trezor - the premier hardware wallet available on the market here.

Bypass the complexities of crypto tax calculations effortlessly with the best-in-class tax calculator app – quick, precise, and at your fingertips here.

Wallet security overview for beginners here.

Sharing this post helps it reach out to more readers which would be great. If you are interested in future posts from me, do not hesitate to subscribe. Thanks for taking the time!

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. This post may contain affiliate links. I am just sharing an opinion.

send it