This Week On-Chain #143 - Window Of Opportunity

Early bird eats the worm.

On-chain has finally woken up whcih I covered in the upgraded stack over the weekend and there is tons of opportunity available for the people that are willing to dig beneath the surface and try to be earlier than most people. We have seen an echo bubble in relation to x402 and capital is now moving to other sectors with VIRTUAL having been the alt that has captured majority of the flows during this.

The ecosystem is catching increased attention by Fundstrat that highlighted the ecosystem and has plans to talk about it in the coming live webinar on Monday November 3rd.

4 projects stood out to Fundstrat which were:

AIXBT- real-time market intelligence platform designed to detect emerging trends ahead of mainstream recognition, known for its Twitter presence but the terminal is underrated.

MAMO - Personal finance agent that provides automated on-chain yield strategies

FACY - Fact checking agent that is outperforming Perplexity AI

PREDI - Prediction market and bot that allows you to create markets on social media platforms such as X

There is much more under the hood and it is a researchers market so make sure you put the work in or join the upgraded stack in case you want deeper research provided to you.

Market Digest

(Going to try a new format here and share the most high impact news in more details, I’ll put out a vote and you can let me know which format you prefer)

Equity perps are growing in popularity with TSLA and NVDA futures being live on Hyperliquid through HIP-3 and Ostium is competing for a slice of the pie as well considering people are still actively trading on Ostium in hope of an airdrop. The equity perps on Hyperliquid generate $100M in day-one volume and is arguably a good bear market hedge for the future when the time comes.

MegaETH presale goes live (now closed) and ended up being 27.8x oversubscribed with $1.39B in capital being commited to the sale with a pre-market valuationn hovering around $3.8-4.5B. However, due to the interest the allocation will be favoring MegaETH reputation over the size invested as social capital is just as important as financial capital in this ICO.

x402 Payment protocol dominates the mindshare with almost 500k transactions confirmed processing $374k worth of value with Coinbase dominating the facilitation with 80% dominance. With large players like Google, Cloudflare and Amazon having shown an interest into x402 and the role it plays in the transactions between AI agents the upside is very large even if this market sector has been very frothy initially.

Prediction maarket volume explodes with Polymarket having plans to launch in the United States imminently. Considering Basketball and Football season has started the volumes have skyrocketed as they are closely at par with the volumes on election day which is a clear indication of product-market-fit and prediction markets being here to stay. Polymarket are one of the underrated successes from crypto this cycle that has achieved mainstream adoption.

Bridge Flow

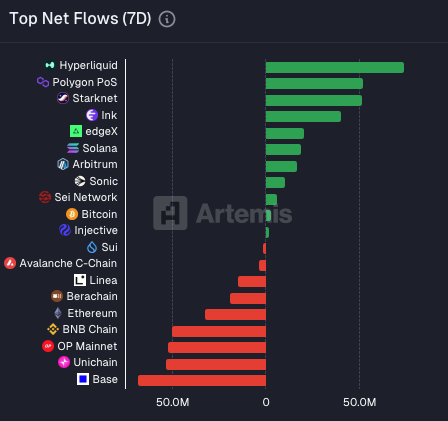

A lot of capital is flowing to Hyperliquid due to the launch of HIP-3 and the interesting part here is that people are still skeptical about equity perps because you can “trade alts”. This is missing the forest for the trees as Hyperliquid is taking the right step in becoming the everything finance app considering the revenue machine it already is. Besides that there has been a lot of distribution of capital across many ecosystems while edgeX receiving that amount of flows is likely an indication of airdrop drawing closer.

Fomo Airdrop (Future unicorn)

As someone that is very focused on on-chain trading and I believe most of you are as well, I don’t think there is any better cross-chain trading platform tailored for on-chain trading than Fomo.

It enables social trading as well and is probably going to be among the better platforms to farm an airdrop on in the coming months. I am very confident that this will be among the most lucrative airdrops to farm as a potential future unicorn as the app has successfully made chain tribalism irrelevant. I will continue to bang the drum as I highly suggest you use it.

Just load your wallet with USDC and you are good to go. If you want to get access to the platform and get 10% off the fees when you start trading, you can use my link here.

DEX Volumes

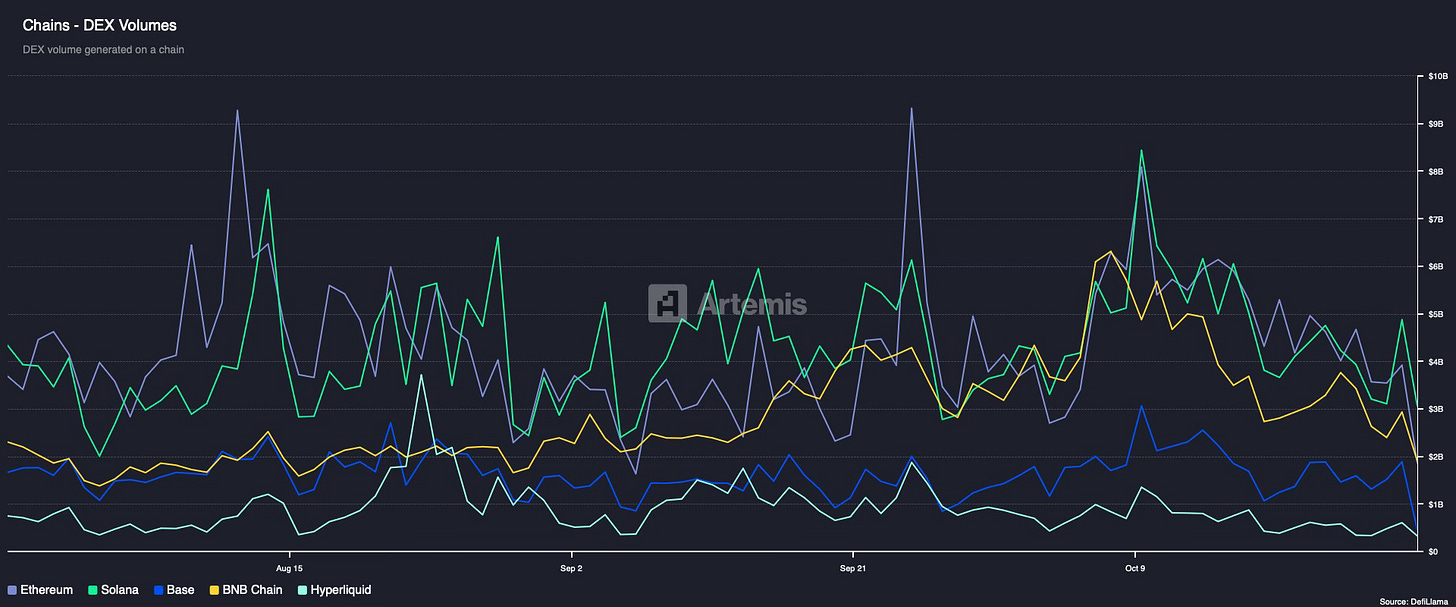

DEX volume is continuing to drop since the 10/10 liquidation event and has fallen back to levels it where since before then. It is also why rotations are becoming increasingly quicker and that you are better off sitting on your hands and frontrunning or buying high-conviction plays instead of chasing and ending up being exit liquidity.

Pair Volumes

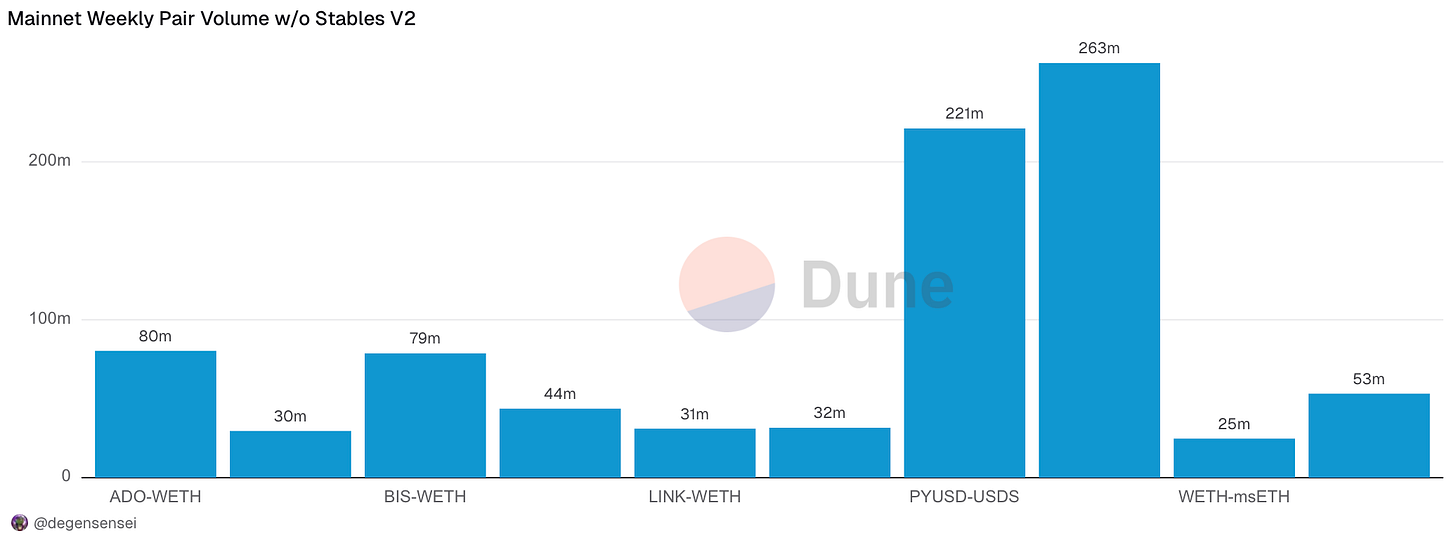

Majority of volume remains focused on LINK on the mainnet as it has seen a lot of accumulation by whales, besides that not much happening as majority of volume barring LSTs and stablecoins are spoofed volume.

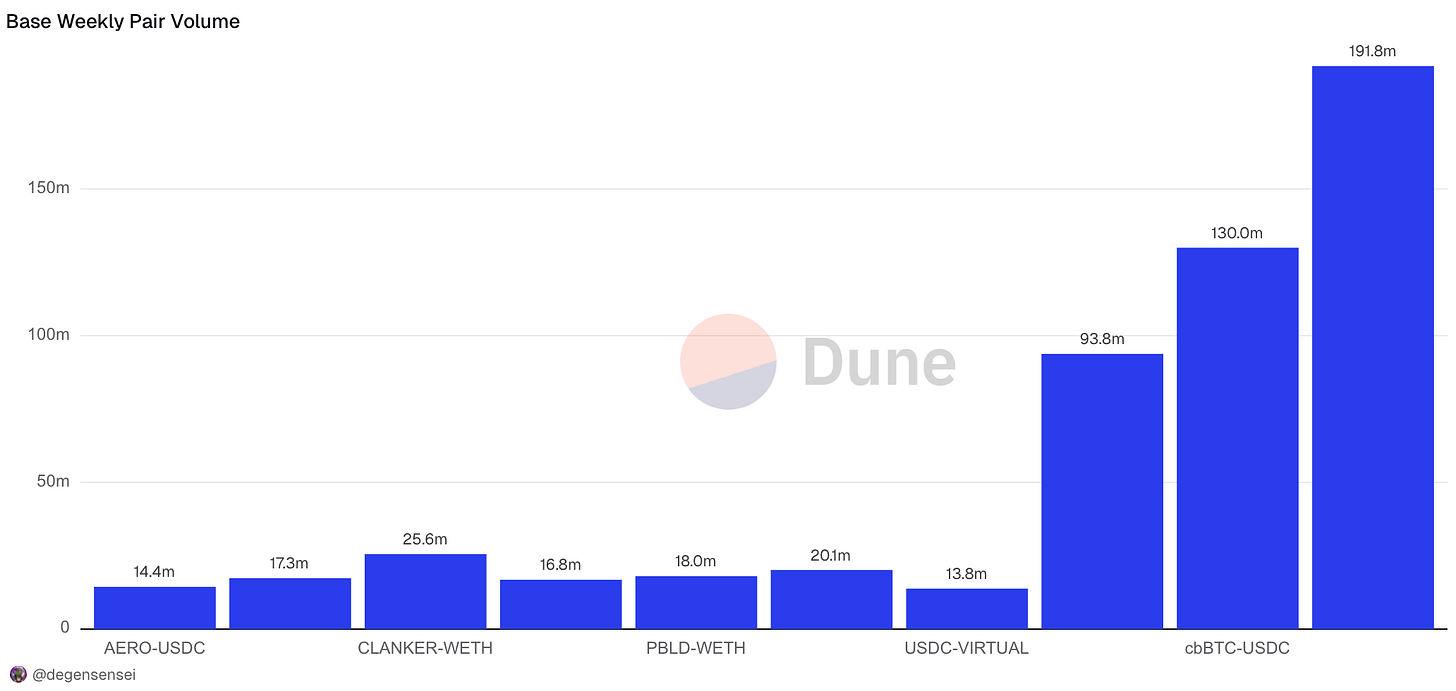

Base ecosystem is thriving as airdrop talks are intensifying with them being rumoured for Q1 2026 for the time being. Capital allocators are starting to accumulate AERO sub $1 and lock the token in hope of a lucrative Base airdrop while VIRTUAL have been on a tear alongside Clanker that is rivaling Pump Fun in volume and have been acquired by Farcaster and activated buybacks. PING ignited the x402 market sector with the amount of transactions it generated even if it is on a steep correction right now after running to 80m without any pullbacks.

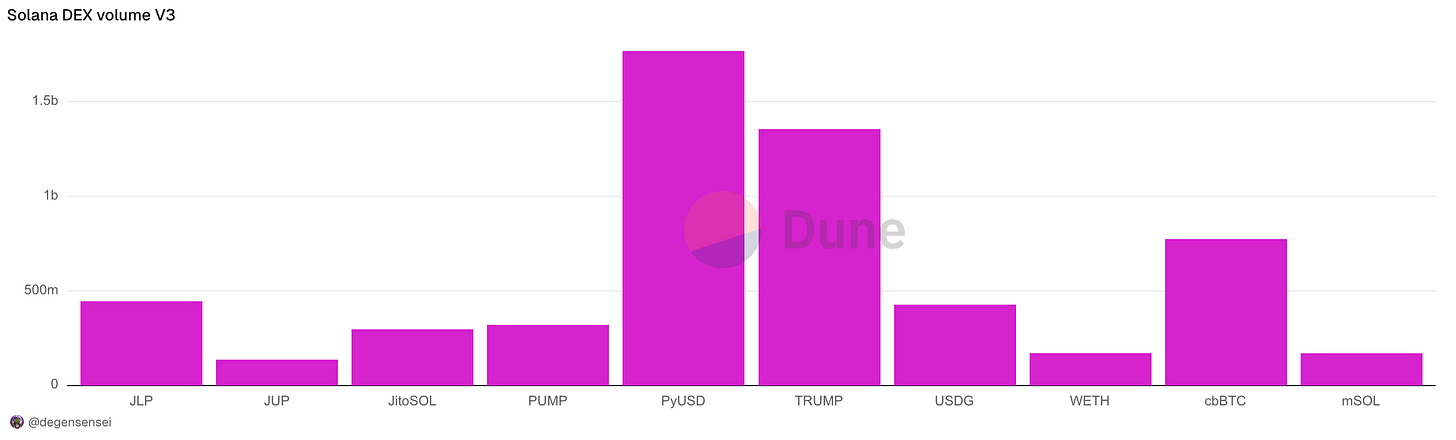

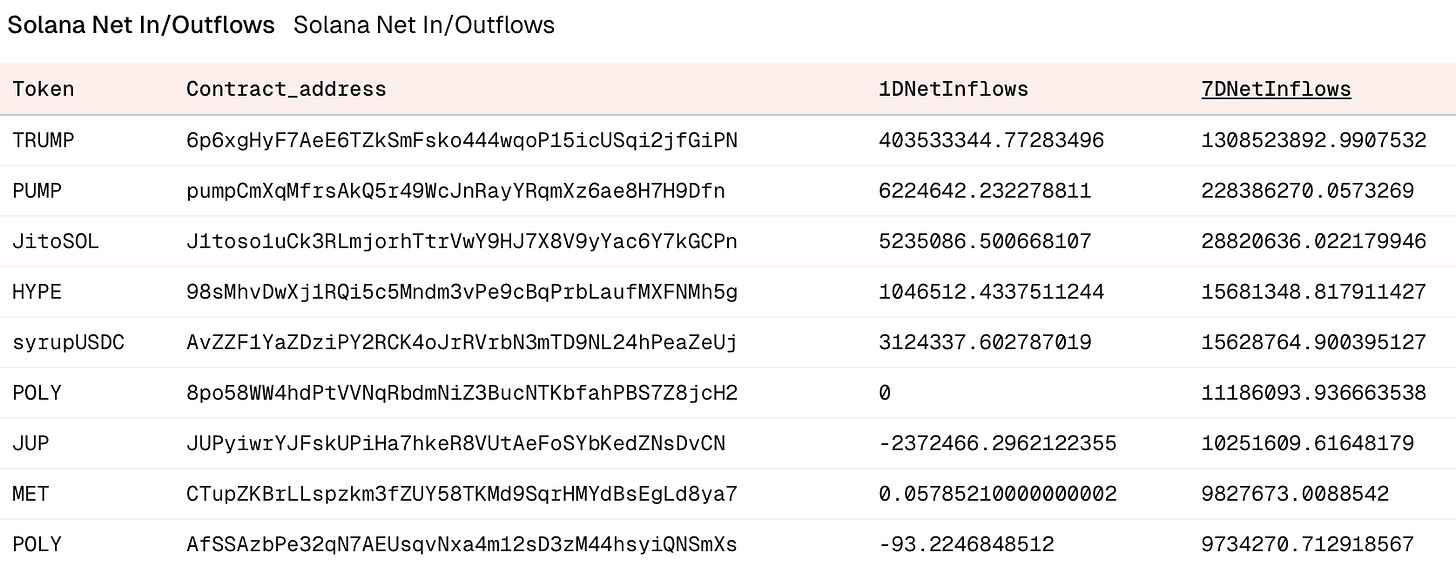

There were some insider trading prevalent on the TRUMP chart with the announcement of a TRUMP DAT that will be introduced to accumulate the TRUMP token. PUMP is starting to perform well and is in an uptrend again after the steep correction since 10/10 while x402 tokens not making the list such as PAYAI have been performing very well too.

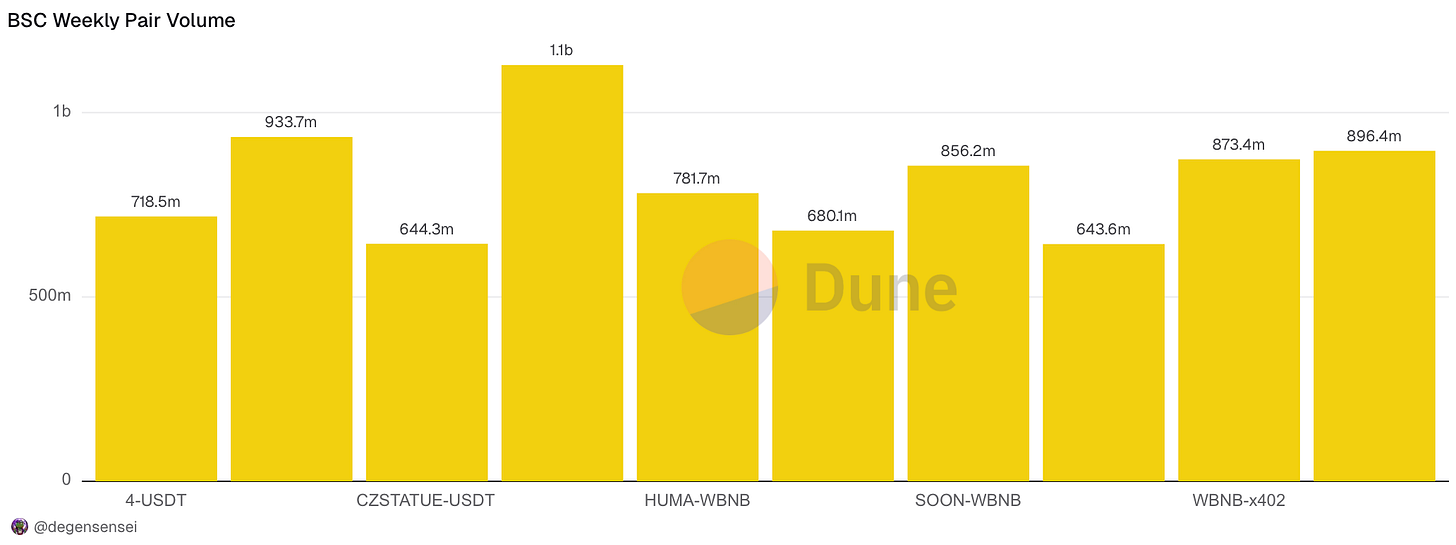

BNB volume might look obscenely high but it is Binance alpha traders at it again, the one that is relevant amongst these tokens is 4. Otherwise, the ecosystem have lost mindshare and interest for the time being while Base is growing in stature and rightly so.

NFT Trading

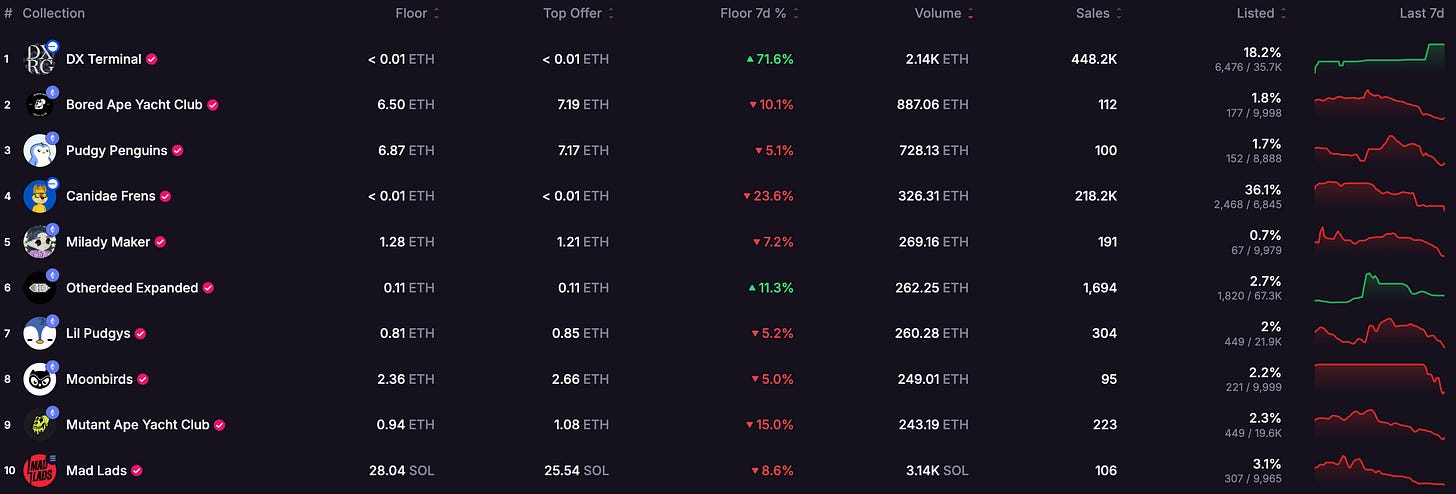

NFT continue to bleed and will likely do so for a while until something changes as there is no incentive to hold this asset class at all unless there is any special utility baked into it.

Bear market.

The Warplets - Farcaster NFTs that are becoming the official mascot of the ecosystem and have thus been a very successful mint for once in a blue moon.

However, people are frustrated that the mint went beyond 10k as initially promised so it’s unclear how much staying power they have.

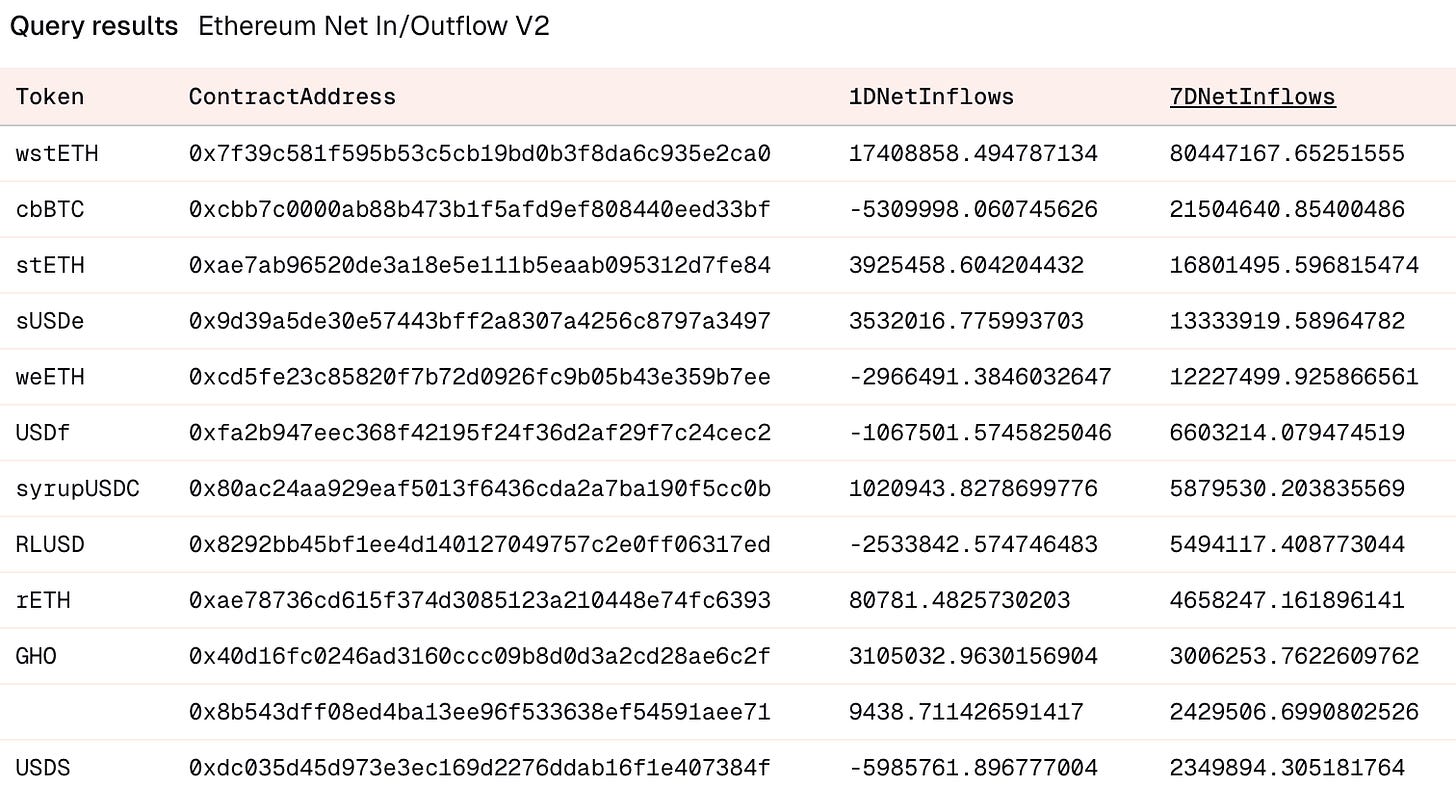

Net Inflow

As you can see, dead alt interest here and it will not change until Ethereum convicingly breaks and holds new all-time-highs. However, it is a good place to park ETH and stablecoins for yield if that is of interest to you.

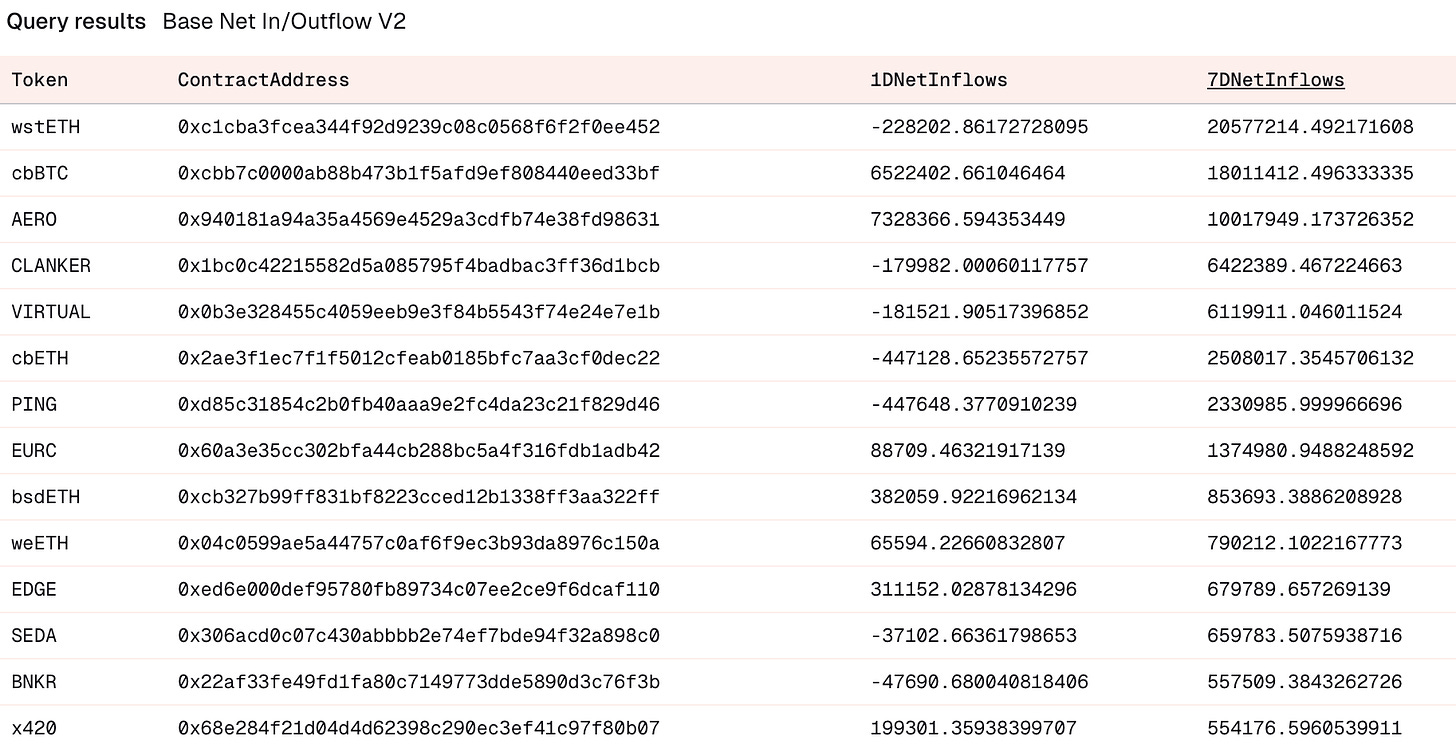

It’s the complete inverse on Base with very strong altcoin accumulation across the board with AERO leading the race as it will see increased locks going forward. CLANKER saw heavy on-chain interest after the Farcaster acquisition and strong buybacks to power the flywheel as well and I think it is far from done. VIRTUAL ecosystem is thriving and it was only a matter of time before the main token would see that value being reflected in token price as people want to hold it again. PING kickstarted the x402 on-chain run on Base while EDGE is starting to ignite as they have recently activated buybacks as well. SEDA is the oracle provider for HIP-3 that is powrring equity perps on Hyperliquid and it is no surprise to see it being heavily accumulated as well. *Phew* that was a lot but very exciting times.

TRUMP was heavily accumulated going into the DAT announcement as every token that have had association with the Trump familiy has had heavy insider front-running every time there have been news impending. PUMP is being accumulated as the go to on-chain proxy on Solana. HYPE has been bridged to Solana so people can be accumulate it there even if the volumes are off on the table. MET launch was relatively underwhelming, not because it was bad price action but because it arguably launched at fair value so nothing much has happened since even if the team has done a great job.

Sleuthing

This is probably worth paying attention to as it is one of the most profitable protocols on Base starting to buyback their own token. It’s a platform I am a fan of myself for on-chain trading.

If you want to track the buyback wallet you can track this address: 0xB115124f277215BF85b710F0137EfaCAC09CbAAF

Token Unlocks

PRIME - 0.86% of supply worth $483.67K on October 31st

FLOCK - 1.02% of supply worth $591.30K on October 31st

OP - 1.71% of supply worth $13.72M on October 31st

W - 1.04% of supply worth $3.54M on October 31st

DYDX - 0.58% of supply worth $1.38M on October 1st

SUI - 1.21% of supply worth $109.46M on October 1st

EIGEN - 12.10% of supply worth $38.70M on October 1st

ENA - 0.60% of supply worth $18.52M on October 2nd

SPEC - 11.24% of supply worth $916.44K on October 3rd

MEME - 5.98% of supply worth $5.51M on October 3rd

I think we are getting closer to the period of crypto underperforming stocks coming to a close and when it shifts best believe it will happen fast. Make sure you are positioned before then and be thankful for the gift you have been given. Patience will be rewarded and we are at the right place at the right time. Affirm.

I hope you enjoyed the post. Don’t forget that you are more than welcome to leave feedback or drop any questions in the comment section.

Get 10% off on the fees when you start trading on TryFomo here.

Join me on BloFin: no KYC, 1,000+ pairs, top-tier security, and zero downtime, start trading here.

Steer clear of security compromises and safeguard your assets reliably with Trezor - the premier hardware wallet available on the market here.

Bypass the complexities of crypto tax calculations effortlessly with the best-in-class tax calculator app – quick, precise, and at your fingertips here.

Wallet security overview for beginners here.

Earn free subscription months when you refer a friend who subscribes.

Disclaimer: All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. I am just sharing my opinion. This post may contain affiliate links.